Scania AB Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Scania AB Bundle

What is included in the product

Scania's BCG Matrix analysis revealing portfolio's growth and market share.

Printable summary optimized for A4 and mobile PDFs. Get a clear, concise snapshot of Scania's portfolio for quick reference.

Delivered as Shown

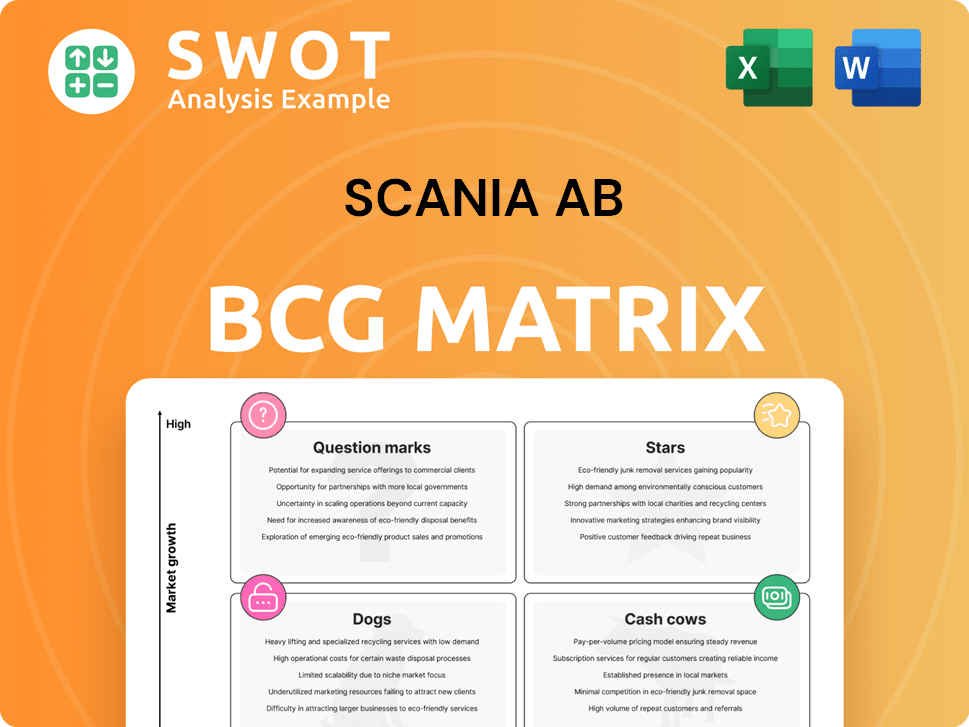

Scania AB BCG Matrix

The preview showcases the complete Scania AB BCG Matrix, identical to the purchased file. Download the fully formatted, ready-to-analyze report immediately after buying. No hidden extras or changes will be applied post-purchase.

BCG Matrix Template

Scania AB's BCG Matrix reveals its diverse product portfolio's market dynamics. This snapshot offers a glimpse into the company's strategic positioning. Stars, Cash Cows, Dogs, and Question Marks – each quadrant holds a piece of Scania's story. Understanding these classifications is key to grasping Scania's overall health. Uncover the complete picture by purchasing the full BCG Matrix for actionable strategies.

Stars

Scania's Super driveline is a Star, showing impressive fuel efficiency gains. This boosts both Scania's and customer profits. It led to a European market share increase, reaching 17.8% in 2024. Continued investment is key to maintaining its leading market position.

Scania's Latin American operations shine, securing a strong position. Market share rose to 17.3% in 2024, notably in Brazil. This illustrates Scania's resilience amid regional shifts. Future investments will likely bolster its leading status.

Scania's decarbonization efforts are a "Star" in its BCG matrix. The company cut operational emissions by 47%, nearing its 2025 goal. This was achieved via green electricity, decarbonized logistics, and lower energy consumption. Investments in sustainable transport boost its brand, attracting eco-minded clients.

Autonomous Mining Trucks

Scania's autonomous mining trucks represent a "Star" in its BCG matrix, spearheaded by Scania Australia. They are at the forefront globally for autonomous heavy trucks in mining, covering both haul roads and in-pit applications. This innovation solidifies Scania's position as a leader in autonomous vehicle technology. Continuous development and deployment will boost its innovative image.

- In 2024, Scania's investments in R&D reached approximately SEK 10.5 billion, fueling such innovations.

- The global autonomous truck market is projected to reach $1.6 billion by 2025.

- Scania's focus on autonomous solutions aligns with the industry's move towards enhanced safety and efficiency.

New Software Platform

Scania's new software platform is a "Star" in its BCG Matrix, focusing on future customer needs and functionality. Despite implementation delays, the company is actively resolving these challenges. This investment aims to boost customer satisfaction and loyalty, crucial for market leadership. Scania's 2024 investments in software and R&D totaled SEK 6.7 billion.

- Software platform enhances customer experience.

- Implementation delays are being actively addressed.

- Investment drives customer satisfaction and loyalty.

- 2024 R&D investment was SEK 6.7 billion.

Scania’s R&D investments, around SEK 10.5 billion in 2024, fuel several "Stars." The autonomous truck market is set to hit $1.6B by 2025. These areas drive Scania's innovation, including the new software platform.

| Innovation Area | Investment (2024) | Market Projection (2025) |

|---|---|---|

| R&D | SEK 10.5 Billion | N/A |

| Autonomous Trucks | Included in R&D | $1.6 Billion |

| Software Platform | SEK 6.7 Billion | N/A |

Cash Cows

Scania's heavy trucks are a cash cow, generating consistent revenue due to their strong global market presence. In 2024, Scania's net sales reached approximately SEK 200 billion, reflecting robust demand. Maintaining high quality and reliability is crucial to sustain this revenue stream. This ensures customer loyalty and repeat business.

Scania's service contracts are a cash cow, providing steady, predictable revenue. These contracts cover maintenance and repairs, enhancing customer loyalty. In 2024, service revenue significantly contributed to Scania's financial stability. Expanding these contracts is key for sustained financial performance.

Scania's financial services, like financing and insurance, boost revenue and customer loyalty. In 2024, these services contributed significantly to Scania's overall financial performance. Investing further in financial services strengthens customer bonds. This strategy boosts profitability, as seen in recent financial reports.

Global Production System

Scania's global production system acts as a cash cow, particularly with hubs in Europe and Latin America. This system is designed to effectively balance regional market fluctuations. It consistently supplies vehicles to meet customer demand. Optimizing and expanding this system will improve efficiency and reduce costs.

- In 2024, Scania increased its vehicle deliveries by 12% year-over-year, showing strong demand.

- Scania's net sales in 2024 were up by 18%, indicating robust financial performance.

- The company's operating margin in 2024 remained solid at 10.7%, showcasing efficient operations.

- Scania invested heavily in production and logistics in 2024 to enhance its global footprint.

Premium Brand

Scania's premium brand status allows it to charge higher prices and secure strong profit margins. This is a key element of its "Cash Cow" status within the BCG matrix. Maintaining this premium image through quality and service is vital for continued success. Innovation and sustainability efforts are key to attracting and retaining customers in the long term.

- In 2024, Scania's operating margin was approximately 12.7%.

- Scania invested heavily in R&D, with expenditures reaching SEK 10.5 billion in 2024.

- Sustainability initiatives include a growing range of electric and biofuel-powered trucks.

Scania's diverse cash cows, including trucks, services, and financial offerings, consistently generate strong revenue. Financial services contributed significantly to Scania's 2024 profits. Maintaining a premium brand and global production hubs are essential for sustained profitability.

| Cash Cow | 2024 Key Metric | Impact |

|---|---|---|

| Heavy Trucks | 12% YoY Delivery Growth | Strong demand, revenue |

| Service Contracts | Increased Service Revenue | Predictable Income |

| Financial Services | Significant Profit Contribution | Boosts customer loyalty |

Dogs

Stricter environmental rules and the rise of electric vehicles could lower demand for Scania's diesel engines. To adapt, Scania must shift to electric and alternative fuels. In 2024, diesel sales decreased by 15% in some areas due to these changes. Scania should phase out older tech and invest in eco-friendly options to keep up.

Non-core markets for Scania, where the company has a limited presence or low market share, are categorized as such within the BCG Matrix. These markets often need substantial investment to grow or might be better off sold. A detailed analysis to assess growth potential is crucial. In 2024, Scania's sales in non-core markets represented around 10% of total revenue, prompting strategic reviews.

Scania's 4% order intake decrease in 2024, totaling 81,012 vehicles, suggests weakening demand. This downturn requires investigation to understand underlying causes. Analyzing these factors is essential for Scania to adjust strategies effectively. Addressing the demand drop is vital for future performance.

Limited ZEV Deliveries

Scania's ZEV deliveries are a "dog" in the BCG matrix due to low market share in a growing market. Only 266 ZEVs were delivered in 2024, indicating slow progress. This sluggish performance contrasts with increasing ZEV demand, requiring urgent action. Scania needs to accelerate its EV transition to capitalize on market opportunities.

- 266 ZEVs delivered in 2024.

- Growing ZEV market demand.

- Need for faster EV transition.

- Low market share, high growth.

Dependence on Diesel Technology

Scania's heavy dependence on diesel engines positions it as a "Dog" in the BCG matrix due to the industry's move towards electric and sustainable fuels. The company needs to urgently invest in research and development to stay competitive in the changing market. To adapt, Scania must significantly boost its investments in electric and alternative fuel vehicle production.

- In 2023, Scania's sales of alternative fuel vehicles represented a small percentage of total sales.

- The shift to electric vehicles is accelerating, with Volvo Trucks, a major competitor, increasing its electric truck sales by 250% in 2023.

- Scania's R&D spending in 2023 was approximately 8% of its revenue.

- Scania's market share in the European heavy-duty truck market was around 17% in 2023.

Scania's ZEVs are "Dogs," with low market share in a growing ZEV market. Only 266 ZEVs were delivered in 2024, signaling slow progress. Diesel dependence further solidifies this status due to industry shifts. Scania must aggressively boost its EV investments to transform this segment.

| Metric | 2023 | 2024 |

|---|---|---|

| ZEV Deliveries | Data not provided | 266 |

| R&D as % of Revenue | 8% | Data not provided |

| Diesel Sales Decrease (in some areas) | Data not provided | 15% |

Question Marks

The electric vehicle (EV) market represents a high-growth opportunity for Scania, despite its current low market share. Scania is actively growing its supplier network to boost resilience and speed up deliveries. Significant investment in EVs could drive considerable growth, though risks are involved. Therefore, Scania should increase its investment in EV development and production. In 2024, the global EV market is projected to reach $800 billion.

Autonomous vehicle tech is a question mark for Scania. The market's growth is uncertain. Scania's autonomous mining trucks show promise. Continuing investment is crucial, despite market development. In 2024, the autonomous truck market was valued at $1.6 billion, projected to reach $9.4 billion by 2030.

The market for sustainable transport is expanding, driven by environmental concerns. Scania's focus on eco-friendly solutions aligns with this trend. In 2024, Scania saw increased demand for its electric trucks. Investment boosts Scania's brand and attracts customers. Scania should keep investing in sustainable transport.

New Industrial Hub in China

Scania's new industrial hub in China represents a Question Mark in its BCG matrix. This move aims to tap into China's vast and expanding market, offering significant growth potential. Despite the allure, the Chinese market is fiercely competitive, demanding strategic agility. Investing in this hub presents both high-return opportunities and considerable risks that Scania must carefully navigate.

- Market size: China's automotive market is the world's largest, with over 26 million vehicles sold in 2023.

- Competition: Numerous domestic and international brands compete in China.

- Investment risks: Potential for overcapacity and changing regulatory environments.

- Growth potential: A growing middle class and infrastructure development drive demand.

Alternative Fuels

Alternative fuels represent a growing market for Scania, driven by the increasing demand for sustainable transport solutions. Biodiesel and HVO are key examples, allowing companies to reduce their carbon footprint. Investing in these technologies could attract environmentally conscious customers and boost Scania's market share.

- The global biofuel market was valued at USD 139.3 billion in 2023.

- The market is projected to reach USD 206.3 billion by 2030.

- Scania's focus on alternative fuels aligns with the EU's push for decarbonization.

Scania's China hub is a Question Mark, offering high growth potential in the massive automotive market. The company faces intense competition and regulatory risks in China. Strategic investment is crucial. In 2024, China's automotive market exceeded 26 million vehicles sold.

| Aspect | Details | 2024 Data |

|---|---|---|

| Market Size | China's auto market is the world's largest | Over 26 million vehicles sold |

| Competition | Intense competition from domestic/global brands | Varies by segment, but significant |

| Investment Risks | Overcapacity, changing regulations | Ongoing, requires constant monitoring |

BCG Matrix Data Sources

The Scania BCG Matrix leverages comprehensive sources such as financial statements, market analysis, and expert industry evaluations.