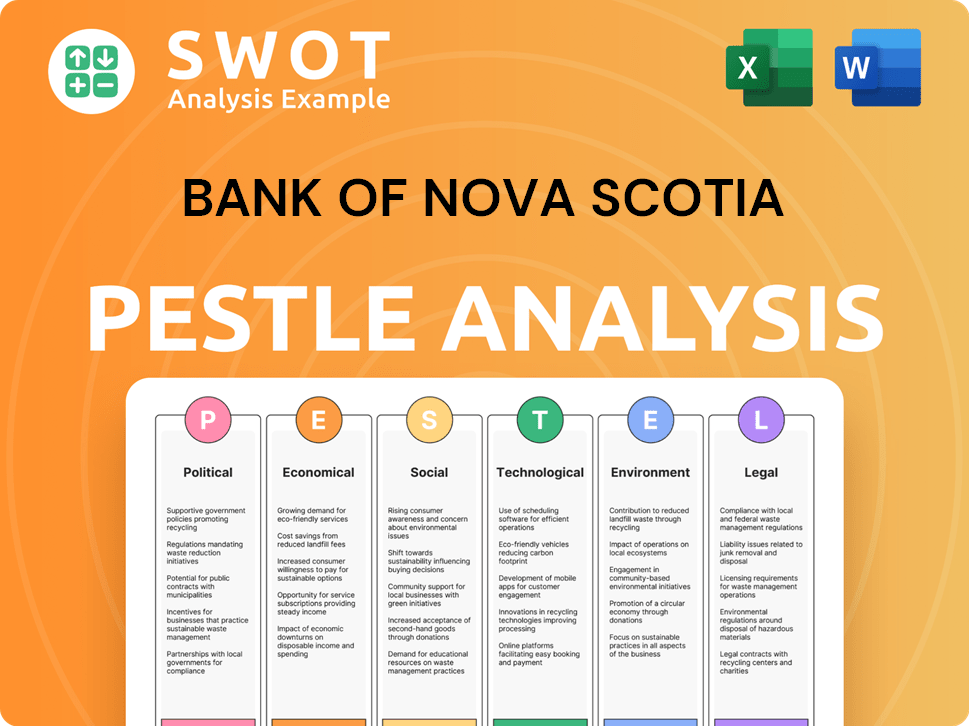

Bank of Nova Scotia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Nova Scotia Bundle

What is included in the product

Analyzes Scotiabank via Political, Economic, Social, Technological, Environmental & Legal factors. Reveals key insights for strategic planning.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview the Actual Deliverable

Bank of Nova Scotia PESTLE Analysis

The Bank of Nova Scotia PESTLE Analysis you see is the same document you'll download after buying. It's fully formatted and ready for your use.

PESTLE Analysis Template

Navigate the complex world of Bank of Nova Scotia with clarity. This PESTLE Analysis uncovers critical external factors impacting the bank's operations, from regulatory shifts to technological advancements. Understand how political instability, economic trends, and societal changes will affect its future. Perfect for investors, researchers, or anyone looking to understand Scotiabank's landscape, this analysis is crafted with real-world insights. Download the full version and gain a competitive advantage!

Political factors

Government policies and regulations significantly shape the banking sector. Scotiabank actively engages with the Canadian Bankers Association. This involvement helps the bank stay informed about policy changes. In 2024, the Canadian banking sector faced evolving regulations related to digital assets and cybersecurity. Scotiabank's proactive stance aids in adapting to these shifts.

Scotiabank's international presence exposes it to political instability risks. In 2024, geopolitical tensions in regions where Scotiabank operates, like Latin America, could impact its operations. Political instability can disrupt banking services and affect profitability. For example, currency fluctuations due to political events can erode profits.

Trade agreements and tariffs significantly shape Scotiabank's global strategy. Recent trade tensions, especially between Canada and the US, influence the bank's cross-border activities. For instance, in 2024, fluctuations in tariffs affected trade volumes, potentially impacting Scotiabank's revenue from international transactions. These shifts require the bank to adapt its financial strategies.

Government Fiscal Policy

Government fiscal policies significantly affect Scotiabank's operational environment. Increased government spending can stimulate economic activity, potentially boosting loan demand and investment opportunities for the bank. Conversely, fiscal austerity measures might slow economic growth, impacting Scotiabank's profitability and asset quality. The Canadian government's fiscal year 2024-2025 budget projects a deficit of $39.8 billion.

- Fiscal stimulus can increase consumer spending and business investment.

- Austerity measures may lead to reduced lending and investment by Scotiabank.

- The Bank of Canada's monetary policy also interacts with fiscal measures.

- Changes in tax policies can alter corporate profitability.

National Security and Financial System Integrity

The Canadian government is focused on national security and the financial system's integrity. They're providing the Minister of Finance with powers to protect this, including through initiatives like the Consumer-Driven Banking Framework. This framework is designed to mesh with current financial sector laws. The goal is to ensure the stability and security of the financial system. These measures are crucial for maintaining public trust and safeguarding economic interests.

- The Canadian government has allocated $3.3 billion over five years to enhance cybersecurity measures across various sectors, including finance, as of 2024.

- The Consumer-Driven Banking Framework is expected to be fully implemented by 2025, with ongoing consultations to ensure its effectiveness and alignment with evolving security threats.

- In 2024, the Bank of Canada reported that cyberattacks cost the Canadian financial sector an estimated $100 million annually.

Political factors impact Scotiabank through regulations and government policies. Cybersecurity, evolving digital asset regulations, and the Consumer-Driven Banking Framework shape its operations.

Geopolitical risks and trade tensions with the US also play a role.

The Canadian government's fiscal policies, with a projected deficit of $39.8 billion for 2024-2025, and its focus on financial security are key.

| Factor | Impact on Scotiabank | Data |

|---|---|---|

| Regulations | Adaptation to digital assets, cybersecurity | Consumer-Driven Banking Framework rollout by 2025. |

| Geopolitics/Trade | Risk to intl ops, cross-border activities | Cyberattacks cost the sector $100M annually (2024). |

| Fiscal Policy | Impacts loan demand & profit | 2024-2025 Deficit: $39.8B |

Economic factors

Fluctuations in interest rates, influenced by the Bank of Canada and the US Federal Reserve, are crucial for Scotiabank. These changes directly affect the bank's profitability, influencing lending margins and consumer loan demand. In 2024, the Bank of Canada maintained a key interest rate of 5%, impacting Scotiabank's financial performance. The Federal Reserve's actions also play a key role.

Global economic growth in 2024 is projected at around 3.2%, influencing Scotiabank's international operations. Domestic GDP growth in Canada is expected to be about 1.5% to 2% for 2024, impacting loan demand. The risk of a recession remains a concern, potentially affecting Scotiabank's credit quality. Consumer spending trends also play a crucial role.

Inflation rates are a crucial economic factor. High inflation erodes purchasing power, impacting loan repayment and product demand. Canada's inflation rate was 2.9% in March 2024, down from 4.3% in March 2023. The Bank of Canada targets a 2% inflation rate. This impacts BNS's lending and investment strategies.

Unemployment Rates

Elevated unemployment rates pose a significant risk to Scotiabank by potentially weakening the ability of borrowers to repay loans. This can increase the bank's credit risk profile. Reduced consumer spending, a common consequence of high unemployment, can directly impact Scotiabank's revenue streams, particularly within its retail banking sector. The Canadian unemployment rate stood at 6.1% as of May 2024, according to Statistics Canada. This data indicates a potential area of concern for Scotiabank's financial performance.

- Rising unemployment can lead to increased loan defaults.

- Decreased consumer spending affects retail banking revenues.

- The bank's credit risk increases during economic downturns.

Foreign Exchange Rate Volatility

The Bank of Nova Scotia, with its global presence, is significantly impacted by foreign exchange rate volatility. Fluctuations in currency values can directly influence the profitability of its international operations and the attractiveness of its services in different markets. For instance, a strengthening Canadian dollar can decrease the value of Scotiabank's earnings from its international divisions when converted back to Canadian dollars. According to the Bank of Canada, the Canadian dollar's exchange rate against the U.S. dollar has recently shown moderate volatility.

- Impact on Earnings: Currency fluctuations directly affect the translation of international earnings.

- Trade Activities: Changes in exchange rates influence international trade and the demand for financial services.

- Hedging Strategies: The bank employs hedging strategies to mitigate the risks of currency volatility.

- Market Performance: The bank's stock performance can be influenced by currency movements.

Economic factors heavily influence Scotiabank's performance, notably through interest rates. The Bank of Canada's 5% rate in 2024 and potential shifts by the US Federal Reserve are critical. Global and domestic GDP growth, forecasted around 3.2% and 1.5-2% respectively for 2024, also impacts Scotiabank.

Inflation and unemployment rates further affect BNS. Canada's inflation at 2.9% in March 2024 and unemployment at 6.1% in May 2024 pose risks to loan repayment and consumer spending, influencing the bank's credit profile. Foreign exchange rate volatility also plays a huge role.

| Economic Factor | Impact on Scotiabank | 2024/2025 Data |

|---|---|---|

| Interest Rates | Influences lending margins, consumer loan demand | Bank of Canada rate: 5% (2024) |

| GDP Growth | Impacts loan demand, international operations | Global: 3.2% (2024 est.) Canada: 1.5-2% (2024 est.) |

| Inflation Rate | Affects purchasing power, loan repayment | Canada: 2.9% (Mar 2024) |

Sociological factors

Digitalization has profoundly altered consumer behavior in retail banking. A substantial percentage of customers now use digital channels. In 2024, approximately 70% of Bank of Nova Scotia customers used digital banking. They expect personalized services and seamless digital experiences. The bank's digital strategy aims to meet these evolving demands.

Shifting demographics significantly impact The Bank of Nova Scotia. Canada's aging population, with a median age of 41.9 years in 2024, increases demand for retirement-focused financial products. The growing newcomer population, which reached over 1.2 million in 2023, creates demand for services like international money transfers and tailored banking solutions. These demographic shifts require Scotia to adapt its product offerings and marketing strategies to remain competitive.

Canada boasts high financial inclusion, yet underbanked populations remain. In 2024, 98% of Canadian adults had bank accounts. Financial literacy impacts product engagement; a 2024 study showed 40% struggle with basic financial concepts. Scotiabank can tailor services and education to boost inclusion and engagement.

Public Trust and Perception

Public trust is vital for Bank of Nova Scotia's success. Customer service and ethical behavior shape its image and customer loyalty. A 2024 study showed banks with high trust levels saw 15% more customer retention. Ethical lapses can lead to significant financial penalties and reputational damage. Public perception directly impacts the bank's ability to attract and retain customers.

- 2024: High trust banks saw 15% more customer retention.

- Ethical failures result in penalties and reputational harm.

- Public perception affects customer acquisition.

Diversity and Inclusion

Scotiabank faces increasing pressure to champion diversity and inclusion. Stakeholders expect tangible efforts to address racial inequality. This influences the bank's social responsibility programs. A diverse and inclusive workplace is now a key expectation.

- In 2024, Scotiabank increased its commitment to diversity and inclusion training for employees.

- The bank has set targets for representation of diverse groups in leadership roles.

- Scotiabank's community investment focuses on initiatives supporting underrepresented communities.

Digital banking adoption by Bank of Nova Scotia customers reached 70% in 2024, emphasizing the need for seamless digital experiences. Canada's aging and growing newcomer populations drive demand for specific financial products. High financial inclusion exists, with 98% of adults having bank accounts; ethical behavior and public trust remain crucial, influencing customer retention and perception.

| Factor | Impact | Data |

|---|---|---|

| Digitalization | Shapes consumer behavior | 70% digital banking use (2024) |

| Demographics | Influences product demand | 1.2M newcomers (2023), median age 41.9 (2024) |

| Social trust | Affects customer loyalty | 15% more retention for high-trust banks (2024) |

Technological factors

Technological factors significantly influence The Bank of Nova Scotia. AI, open banking, and digital onboarding are key. These advancements require substantial investment. They aim to boost customer experience and streamline operations. In 2024, BNS invested heavily in digital transformation, allocating $2.5 billion.

Fintech companies are revolutionizing financial services, creating both opportunities and challenges for Bank of Nova Scotia (BNS). These firms, such as Wealthsimple, offer innovative solutions, forcing BNS to adapt. In 2024, fintech investment reached $75 billion globally. BNS must compete or collaborate to stay relevant, accelerating its tech investments.

The Bank of Nova Scotia (Scotiabank) faces heightened cybersecurity risks due to its digital transformation. In 2024, global cyberattacks increased by 38%, impacting financial institutions significantly. Scotiabank invests heavily in data protection, allocating approximately $600 million annually to cybersecurity measures. Compliance with regulations like GDPR and CCPA is crucial, with potential penalties reaching up to 4% of global revenue for data breaches.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming banking. The Bank of Nova Scotia (BNS) uses AI for risk assessment and customer service, improving efficiency. In 2024, AI in banking saw a 20% increase in adoption. This trend offers targeted services and automation opportunities.

- BNS invested $1.2 billion in technology in 2023.

- AI-driven fraud detection reduced losses by 15%.

- Customer service chatbots handle 30% of inquiries.

Development of Payment Systems

The evolution of payment systems is reshaping banking. Real-time payments and digital wallets are becoming mainstream, prompting banks to innovate. Fintech companies are disrupting traditional payment methods. In 2024, mobile payment transactions are projected to reach $1.8 trillion in North America. The Bank of Nova Scotia must adapt to remain competitive.

- Mobile payment transactions in North America are projected to reach $1.8 trillion in 2024.

- The rise of e-wallets and fintech payment solutions increases competition.

- Real-time payment systems are becoming standard.

The Bank of Nova Scotia (BNS) navigates significant tech shifts. Investments in AI, open banking, and digital tools continue, with $2.5 billion in 2024. Cybersecurity is crucial, with $600 million yearly for protection amid rising cyberattacks. BNS adapts to fintech innovations and evolving payment systems, to remain competitive.

| Key Tech Area | Impact | 2024/2025 Data |

|---|---|---|

| Digital Transformation | Enhances customer experience; streamlines operations | $2.5B investment (2024) |

| Cybersecurity | Protects data; ensures regulatory compliance | $600M annual spend; 38% increase in cyberattacks |

| AI Adoption | Improves risk assessment and customer service | 20% increase in AI adoption in banking |

Legal factors

Scotiabank faces stringent Canadian banking regulations. These laws cover consumer protection, capital adequacy, and risk management. The bank must adhere to guidelines from the Office of the Superintendent of Financial Institutions (OSFI). In 2024, OSFI increased capital requirements for Canadian banks. This impacts Scotiabank's operational strategies.

The Financial Consumer Protection Framework in Canada, updated in 2024, strengthens customer rights, directly influencing Bank of Nova Scotia's operations. This legislation mandates transparent banking practices and efficient complaint resolution processes. Compliance requires significant investment in updated systems and staff training, potentially increasing operational costs. The bank must adapt its consumer-facing strategies to align with these evolving legal standards.

The Bank of Nova Scotia (Scotiabank) must comply with data protection laws like Canada's PIPEDA. This is vital given their digital tech and open banking efforts. Breaches can lead to hefty fines; in 2024, GDPR fines reached billions across the EU. Scotiabank's data handling practices directly impact customer trust and regulatory standing. They must invest in robust cybersecurity to protect consumer information.

Anti-Money Laundering and Anti-Terrorist Financing Regulations

Bank of Nova Scotia (BNS) must comply with stringent Anti-Money Laundering (AML) and Anti-Terrorist Financing (ATF) regulations. These laws necessitate robust internal controls, including customer due diligence and transaction monitoring. BNS faces significant penalties for non-compliance, potentially impacting its financial stability and reputation. In 2024, regulatory fines for AML breaches in the financial sector totaled over $2 billion globally.

- Compliance costs for AML/ATF can represent up to 10% of a bank's operating expenses.

- The Financial Action Task Force (FATF) sets global standards, with 200+ jurisdictions implementing these.

Open Banking Framework

The Bank of Nova Scotia (Scotiabank) navigates the evolving legal landscape of open banking in Canada. This framework, set to expand in 2024-2025, enables consumers to share financial data securely with third parties. Legal considerations are crucial, focusing on data privacy, consent management, and robust cybersecurity measures to protect consumer information. Scotiabank must ensure compliance with evolving regulations, such as those from the Financial Consumer Agency of Canada (FCAC), to avoid penalties.

- Data security breaches can lead to significant financial and reputational damage.

- The Canadian open banking framework's success hinges on consumer trust and data protection.

- Scotiabank is investing in cybersecurity and compliance to protect consumer data.

- The bank must adapt to changing legal requirements and maintain data integrity.

Scotiabank faces strict Canadian banking regulations, including capital adequacy and consumer protection. The bank must comply with OSFI guidelines; in 2024, capital requirements increased. AML/ATF compliance costs may hit up to 10% of operating expenses.

| Regulation | Impact | 2024/2025 Data |

|---|---|---|

| OSFI Guidelines | Capital requirements & risk management | Increased capital requirements in 2024 |

| Consumer Protection Framework | Strengthened customer rights | Requires transparent practices, updated systems. |

| Data Protection Laws (PIPEDA) | Data privacy & cybersecurity | GDPR fines reached billions across EU |

Environmental factors

Climate change presents significant risks. The Bank of Nova Scotia faces physical risks from extreme weather, and transition risks from policy shifts. The financial sector is increasingly exposed, with potential impacts on asset values and creditworthiness. In 2024, the bank is actively assessing and managing these climate-related risks. They are also working towards a net-zero economy.

Bank of Nova Scotia (BNS) must comply with environmental regulations, which influence its operations. Climate-related financial disclosures are increasingly mandatory. For example, in 2024, the Canadian government implemented stricter environmental standards. BNS faces risks from climate change, including potential loan defaults in affected sectors. The bank's sustainability initiatives are vital to address these challenges.

The demand for sustainable finance and ESG investments is rising. Investors and customers are increasingly focused on ESG factors, pushing financial institutions to adapt. For instance, in 2024, ESG assets under management globally reached approximately $40 trillion. This trend necessitates banks like Scotiabank to integrate ESG considerations into their operations. Furthermore, Scotiabank has committed $350 billion to climate-related financing by 2030.

Operational Environmental Impact

Scotiabank's operational footprint includes environmental impacts from its physical operations. These include greenhouse gas emissions, water usage, and waste production. The bank is actively measuring and aiming to cut down on these impacts. In 2023, Scotiabank's Scope 1 and 2 emissions totaled 59,000 tonnes of CO2e. They've also reduced paper consumption by 25% since 2017.

- Scope 1 and 2 emissions: 59,000 tonnes CO2e (2023)

- Paper consumption reduction: 25% since 2017

Reputational Risk related to Environmental Issues

The Bank of Nova Scotia (Scotiabank) faces reputational risks tied to environmental issues. Negative public perception or scrutiny of its environmental performance can damage its brand. This includes involvement in projects with significant environmental impacts. Such issues can lead to investor backlash and decreased customer trust. In 2024, environmental concerns continue to be a key factor for financial institutions.

- Scotiabank has faced criticism for financing projects in environmentally sensitive areas.

- Stakeholders increasingly demand transparency and sustainability.

- Reputational damage can affect stock value and business opportunities.

Environmental factors significantly impact the Bank of Nova Scotia's operations and financial performance.

Climate change poses physical and transition risks, requiring proactive risk management.

Increased focus on ESG and sustainability drives demand for green financing.

| Environmental Aspect | Impact | BNS Response/Data |

|---|---|---|

| Climate Risk | Asset value, creditworthiness. | Actively assessing, managing risks in 2024. |

| Regulations | Compliance costs, operational constraints. | Complying with Canadian environmental standards. |

| Sustainable Finance | Investor demand, ESG integration. | $350B climate-related financing by 2030. |

PESTLE Analysis Data Sources

Our Bank of Nova Scotia analysis integrates financial reports, regulatory databases, and economic forecasts.