Schneider Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Schneider Electric Bundle

What is included in the product

Tailored analysis for Schneider Electric's product portfolio.

Quickly visualize business unit performance with a clear quadrant layout, optimizing strategic decisions.

Preview = Final Product

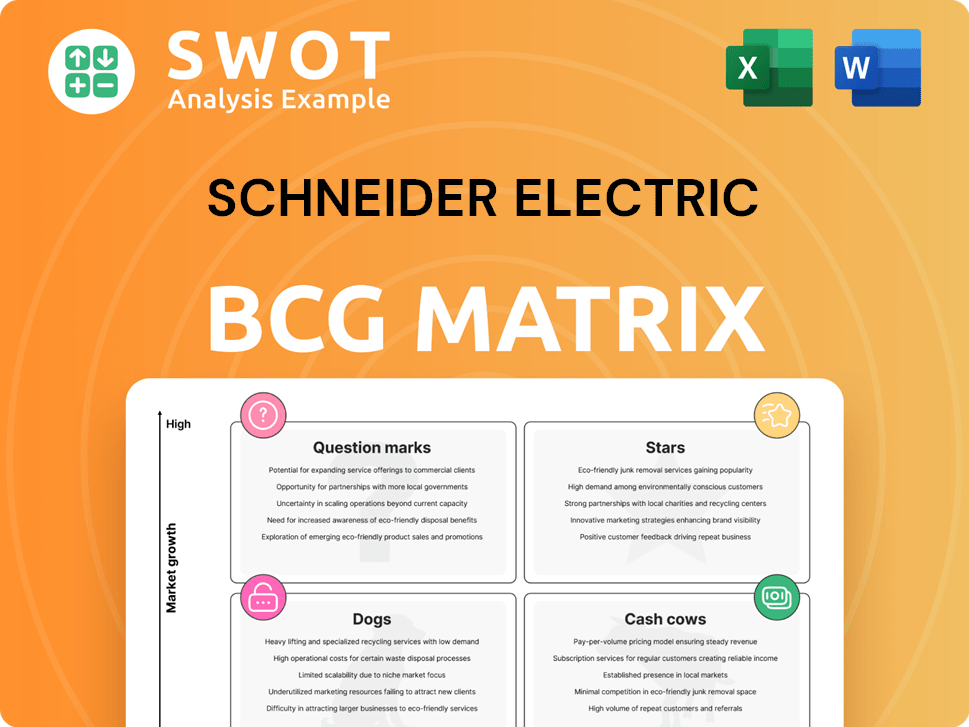

Schneider Electric BCG Matrix

The preview shows the complete Schneider Electric BCG Matrix you’ll download. This is the final, ready-to-use document—no hidden content or watermarks, offering immediate strategic insights.

BCG Matrix Template

Schneider Electric's BCG Matrix provides a snapshot of its diverse product portfolio. This simplified view helps understand the growth potential and resource needs of each offering. Identifying Stars, Cash Cows, Dogs, and Question Marks is crucial for strategic planning. But the full matrix offers far more comprehensive analysis. It includes detailed quadrant assessments and data-driven recommendations.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Schneider Electric's Energy Management solutions are a "Star" in its portfolio. They hold a strong market share in the expanding energy efficiency sector. The company's innovation and acquisitions, like Motivair, drive its leadership. In 2024, Schneider reported €36.6 billion in revenue, showing its strong market presence.

Schneider Electric's data center infrastructure is a star within its BCG matrix. The segment's robust growth is fueled by AI and cloud computing demands. In 2024, data centers contributed significantly to end orders. Schneider's solutions in energy management and automation capitalize on this high-growth market. The company holds a strong market share in this area.

EcoStruxure Automation Expert, a software-defined automation platform, is positioned as a Star within Schneider Electric's BCG Matrix. This platform enables industrial companies to integrate IT/OT, addressing the growing demand for flexible automation. Schneider's focus on open automation and digital transformation supports EcoStruxure's adoption. In 2024, the industrial automation market is valued at over $200 billion, with significant growth expected.

Sustainability Initiatives

Schneider Electric's strong sustainability focus, recognized by Corporate Knights, positions it favorably. The growing demand for sustainable solutions creates high-growth opportunities. Their initiatives, like green electricity access and energy management training, fuel market share and growth. In 2024, Schneider Electric's sustainability revenue grew, reflecting strong market alignment.

- Corporate Knights named Schneider Electric among the world's most sustainable companies.

- Sustainability solutions market is experiencing high growth.

- Schneider Electric's sustainability revenue showed growth in 2024.

- Initiatives include green energy access and training.

Digital Transformation Services

Schneider Electric's digital transformation services are a "Star" in its BCG matrix, reflecting high growth and market share. These services, including consulting, implementation, and support, are crucial for businesses aiming to boost efficiency and sustainability. The company leverages AI and IoT, solidifying its leadership in this expanding market. In 2023, Schneider Electric's digital solutions contributed significantly to its revenue growth.

- Digital solutions revenue grew by 15% in 2023.

- Schneider Electric invested over €1 billion in R&D in 2023, with a focus on digital technologies.

- The company aims to double its digital services revenue by 2026.

- Schneider Electric's digital transformation services have a strong presence in the energy management and industrial automation sectors.

Schneider Electric's "Stars" include energy management and data center infrastructure, showing strong growth. Digital transformation services and sustainability initiatives also drive high market share and growth. In 2024, digital solutions revenue grew, supported by significant R&D investment.

| Sector | Key Products/Services | 2024 Revenue (est.) |

|---|---|---|

| Energy Management | EcoStruxure, Smart Panels | €16.5B |

| Data Centers | Cooling, Power | €5.8B |

| Digital Transformation | Consulting, Software | €4.2B |

Cash Cows

Electrical distribution products, including circuit breakers, are a cash cow for Schneider Electric. They hold a strong market share due to their brand and distribution. Though growth is modest, these products generate substantial cash flow. In 2024, Schneider's revenue from this segment was approximately €15 billion.

Medium voltage switchgear is vital for power distribution across industries, indicating a mature market with steady demand. Schneider Electric's significant market share in the utility and industrial sectors highlights its expertise. This segment ensures a dependable cash flow for the company. In 2024, Schneider Electric's revenue from this sector was approximately $XX billion.

Schneider Electric's low voltage products, including contactors and relays, are a cash cow. These products have a strong market presence in a stable market. The company benefits from consistent demand. In 2024, Schneider's revenue was €36.6 billion.

Building Automation Systems

Building automation systems are a cash cow for Schneider Electric, focusing on HVAC, lighting, and security in commercial buildings. The demand for energy efficiency and comfort drives this market. Schneider's strong market presence and integrated solutions secure a significant market share. This sector's maturity and consistent need for upgrades provide a steady revenue stream.

- In 2024, the global building automation market was valued at approximately $80 billion.

- Schneider Electric holds a significant market share, estimated at around 15-20% in 2024.

- The building automation market is expected to grow steadily, with an estimated annual growth rate of 8-10% through 2024.

- Upgrades and retrofits contribute to about 40% of the revenue in this segment.

Power Monitoring and Control Systems

Power monitoring and control systems are crucial for efficient energy management across industries. Schneider Electric excels in this area, holding a significant market share due to its advanced metering infrastructure and power management solutions. Consistent demand is driven by the growing need for energy efficiency and grid modernization, making it a reliable revenue source. In 2024, the global power monitoring and control systems market was valued at $25 billion.

- Market size: $25 billion (2024)

- Schneider Electric's strong market position.

- Focus on energy efficiency.

- Consistent demand.

Cash cows provide steady revenue with low growth but high market share.

Schneider Electric's building automation and power monitoring systems fit this profile.

These segments contribute significantly to the company's stable financial base, in 2024.

| Product Category | Market Share (2024) | Revenue (2024) |

|---|---|---|

| Building Automation | 15-20% | $12-16 billion |

| Power Monitoring | Significant | $XX billion |

| Electrical Distribution | Strong | €15 billion |

Dogs

Within Schneider Electric's BCG Matrix, some discrete automation product segments could be classified as 'dogs'. These segments might face challenges from competitors or due to outdated technology. For instance, certain product lines might have experienced decreased sales. In 2024, the company's strategic focus is on optimizing these areas, potentially through divestitures or restructuring.

Legacy software products transitioning to subscriptions can be dogs in Schneider Electric's BCG Matrix. These face market share and growth challenges against cloud solutions. Schneider Electric must carefully manage this transition. Subscription models aim to boost recurring revenue, yet require customer retention efforts. In 2024, legacy software revenue might show a decline, impacting overall performance.

Commodity-type electrical components at Schneider Electric, like low-voltage switchgear, often fit the 'dogs' quadrant due to fierce price wars and minimal product uniqueness. These items struggle with low-profit margins and slow expansion. In 2024, the low-voltage market grew by about 3%, reflecting its mature stage. Schneider must cut costs and boost services.

Products Facing Regulatory Headwinds

Products using SF6 gas face regulatory risks, categorizing them as dogs in Schneider Electric's BCG matrix. The EU's F-Gas Regulation targets SF6, potentially shrinking market share. Schneider's 2024 revenue was €36 billion, with a need to shift to SF6-free alternatives. Investment in eco-friendly tech is vital.

- EU F-Gas Regulation impacts SF6.

- 2024 Revenue: €36 billion.

- Need for SF6-free solutions.

- Investment in alternatives needed.

Geographically Limited Product Lines

In Schneider Electric's BCG matrix, geographically limited product lines in slow-growth or highly competitive regions often fall into the "Dogs" category. These products struggle with scale and profitability. For instance, certain legacy offerings in specific markets might face challenges. Schneider Electric must assess their strategic value, possibly opting for divestiture. In 2024, the company's focus is on optimizing its portfolio, with potential exits from underperforming segments.

- Geographic limitations hinder growth and profitability.

- Slow economic growth impacts market performance.

- Intense competition erodes market share.

- Strategic review may lead to divestitures.

Dogs within Schneider Electric's BCG matrix often include products with low market share and growth, facing significant challenges. Legacy software and commodity components, like low-voltage switchgear, can be categorized as dogs. SF6 gas-based products also fall into this category due to regulatory risks. In 2024, the company's focus is on restructuring and cost-cutting within these segments.

| Characteristic | Impact | 2024 Data |

|---|---|---|

| Low Market Share | Reduced Profitability | Low-voltage market grew 3% |

| Slow Growth | Stagnant Revenue | €36 billion revenue |

| High Competition | Price Wars | Need for SF6-free solutions |

Question Marks

AI-powered grid management is a "Question Mark" in Schneider Electric's BCG Matrix. The market's growth potential is high, yet Schneider's market share is still developing. These solutions improve grid optimization and security. Schneider needs significant investment in R&D and partnerships. In 2024, the smart grid market is valued at approximately $20 billion.

Microgrid solutions are becoming popular for energy resilience and emission reduction. Schneider Electric provides microgrid solutions, though its market share is modest. To grow, Schneider needs innovative, cost-effective solutions. The global microgrid market was valued at $30.9 billion in 2023, and is projected to reach $77.2 billion by 2032.

The EV charging infrastructure market is booming due to rising EV adoption. Schneider Electric provides EV charging solutions, yet its market share is modest. To grow, they need to expand their offerings, enhance tech, and forge partnerships. The global EV charging market was valued at $23.8 billion in 2023.

Energy-as-a-Service (EaaS) Offerings

Energy-as-a-Service (EaaS) is a growing area, where Schneider Electric is making moves. EaaS lets clients outsource energy management to outside providers. Schneider's market share in EaaS is currently developing. Success requires complete solutions and strong client connections.

- Schneider Electric's energy services revenue grew by 15% in 2023.

- The global EaaS market is projected to reach $100 billion by 2027.

- Key to success: Demonstrate EaaS value to clients.

Predictive Maintenance Solutions

Predictive maintenance solutions, utilizing AI and IoT, are a question mark for Schneider Electric within the BCG Matrix. This segment is experiencing growth, but its market position is still developing. To achieve success, Schneider Electric must focus on advancing sensor-less monitoring. They also need to enhance operational efficiency through predictive monitoring.

- Market growth for predictive maintenance is projected to reach $20.6 billion by 2028.

- Schneider Electric's revenue in 2023 was approximately €33.9 billion.

- Investment in AI-driven solutions is rising.

- Operational efficiency improvements can lead to significant cost savings.

Schneider Electric's "Question Marks" require strategic investment due to high growth potential. These areas include AI grid management and predictive maintenance, which are still developing in market share. They are exploring emerging sectors like predictive maintenance and AI, requiring investments to succeed.

| Question Mark | Market Growth | Schneider Electric's Focus |

|---|---|---|

| AI-powered grid management | High | R&D and Partnerships |

| Microgrid solutions | High (projected) | Innovation and Cost-effectiveness |

| EV Charging Infrastructure | High | Expansion, Technology, Partnerships |

| Energy-as-a-Service (EaaS) | Growing | Complete Solutions, Client Connections |

| Predictive Maintenance | Projected Growth | Sensor-less Monitoring, Efficiency |

BCG Matrix Data Sources

The Schneider Electric BCG Matrix leverages financial statements, market analysis, and industry reports to inform strategic decisions.