Schneider Electric PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Schneider Electric Bundle

What is included in the product

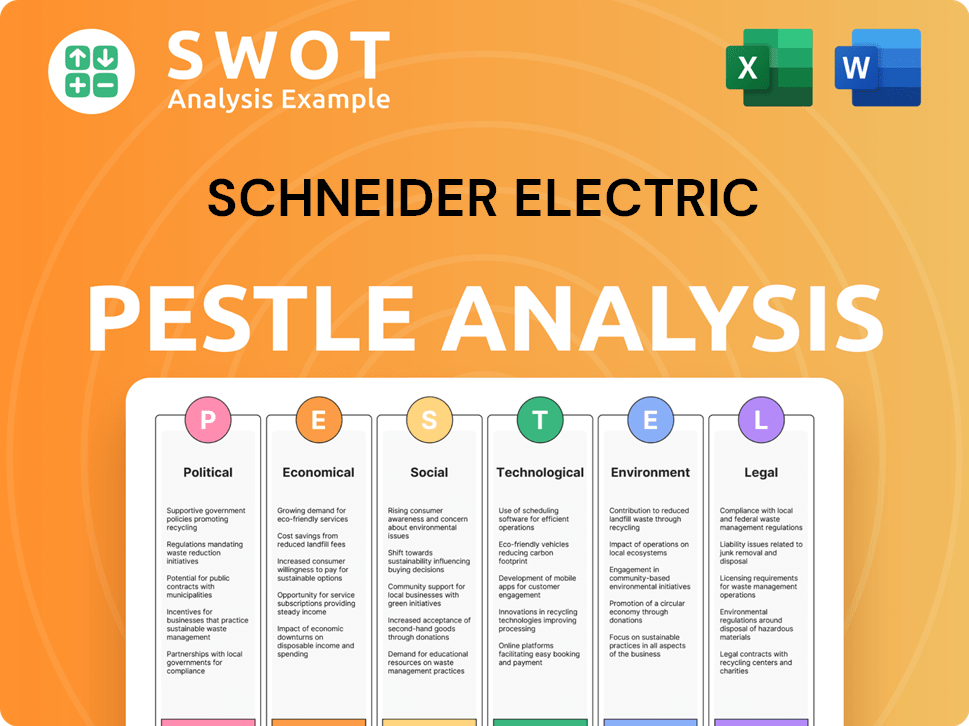

Provides a strategic overview of Schneider Electric considering Political, Economic, Social, Technological, Environmental, and Legal aspects.

Helps support discussions on external risk and market positioning during planning sessions.

Same Document Delivered

Schneider Electric PESTLE Analysis

The preview presents the actual Schneider Electric PESTLE analysis document. What you see now is the complete, ready-to-download file after purchase.

PESTLE Analysis Template

Uncover Schneider Electric's strategic landscape. Our PESTLE Analysis dissects key external factors. Explore the political, economic, social, technological, legal, and environmental forces. Gain vital insights to refine your strategies. Access the complete report for competitive advantages.

Political factors

Governments globally emphasize energy efficiency. Schneider Electric benefits from aligning with sustainability goals. Incentives and regulations for renewables and smart grids impact the market. For example, the global smart grid market is projected to reach $61.3 billion by 2025.

Schneider Electric's global footprint makes it vulnerable to political shifts. Stable markets such as Europe and North America, where Schneider generated 60% of its 2024 revenue, encourage investment. Conversely, political instability in regions like the Middle East and Africa, which accounted for roughly 5% of revenue in 2024, creates project delays and financial risks.

Trade agreements and tariffs are crucial for Schneider Electric. Positive agreements can cut costs, improving supply chains. Conversely, trade disputes increase costs for parts and manufacturing. For example, the U.S.-China trade war impacted component prices. In 2024, the company must navigate global trade dynamics carefully.

Government Support and Incentives

Government backing significantly impacts Schneider Electric's success. Support for big companies, especially in renewable energy and infrastructure, boosts its expansion. Initiatives like tax credits for eco-friendly projects create a beneficial market for their offerings. For instance, the Inflation Reduction Act in the U.S. offers substantial incentives. This law is providing over $369 billion for energy security and climate change programs.

- U.S. Inflation Reduction Act: $369B for energy and climate.

- EU Green Deal: Supports sustainable projects.

- Global renewable energy market: Expected to grow significantly.

Geopolitical Tensions and Supply Chain Regionalization

Geopolitical tensions, highlighted by the war in Ukraine, have significantly impacted Schneider Electric's supply chain strategy. The company is actively regionalizing and localizing its operations to mitigate risks. This shift is designed to enhance resilience and reduce reliance on distant suppliers.

This strategic pivot supports faster time-to-market and aligns with the company's sustainability objectives. By decreasing long-distance shipping, Schneider Electric aims to lower its carbon footprint. The company is investing in local manufacturing to support these goals.

- Schneider Electric has reported that 60% of its product sales are now localized.

- They have increased their local manufacturing footprint by 15% in the last two years.

- The company aims to have 80% of its supply chain regionalized by 2026.

Political factors significantly shape Schneider Electric’s performance, driving sustainability. Government policies like the Inflation Reduction Act impact operations. Geopolitical instability necessitates supply chain adaptation and regionalization, shown by a shift towards local manufacturing.

| Political Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Sustainability Focus | Aligns with energy efficiency goals. | Global smart grid market to $61.3B by 2025. |

| Geopolitical Risks | Supply chain disruptions. | 60% revenue from Europe, N. America in 2024. |

| Trade Policies | Affects costs, supply chains. | U.S.-China trade war impacted component prices. |

Economic factors

Fluctuations in foreign exchange rates affect Schneider Electric's global operations, impacting the cost of raw materials and the competitiveness of its products. Inflation rates, particularly in regions where Schneider Electric operates, can increase production costs and influence pricing strategies. In 2024, the Eurozone's inflation rate averaged around 2.4%, affecting the company's European operations.

The purchasing power of consumers and businesses directly impacts the demand for Schneider Electric's energy solutions. Rising consumer spending, as seen with a 2.5% increase in US retail sales in March 2024, suggests greater potential for adopting smart home technologies and energy management systems. Increased business investment, exemplified by a 4.2% rise in US non-residential fixed investment in Q1 2024, fuels demand for Schneider Electric's industrial automation and energy efficiency products. Higher purchasing power generally leads to increased investment in energy-efficient infrastructure and solutions.

High interest rates can hinder spending and investment, affecting sectors reliant on consumer demand, like some of Schneider Electric's. Elevated rates in 2024, with the Federal Reserve maintaining rates, could influence project financing. Business confidence also impacts demand for Schneider's solutions; a strong economy boosts infrastructure spending. As of late 2024, business confidence in Europe, a key market, showed mixed signals, affecting investment.

Investment in Infrastructure and Renewable Energy

Investment in infrastructure and renewable energy is a pivotal economic factor. Significant government and private investments drive modernization across electrical grids, ports, airports, water systems, and transportation, including EVs. This creates major opportunities for Schneider Electric. For instance, the U.S. Infrastructure Investment and Jobs Act allocates $62 billion for clean energy and grid modernization.

- Grid modernization spending is projected to reach $30 billion by 2026 in North America.

- Global renewable energy investment hit a record $358 billion in 2023.

- The EV market is forecasted to grow to $823.75 billion by 2030.

Economic Growth in Emerging Markets

Emerging markets present growth opportunities for Schneider Electric, despite potential political instability. These regions require energy management and automation solutions, aligning with Schneider Electric's offerings. Forecasts indicate continued economic expansion in these areas. For example, the World Bank projects that the East Asia and Pacific region will grow by 5% in 2024 and 4.8% in 2025. This growth fuels demand for infrastructure, where Schneider Electric's products are crucial.

- East Asia & Pacific growth: 5% (2024), 4.8% (2025)

- Schneider Electric provides energy solutions.

- Emerging markets offer expansion potential.

Economic factors significantly impact Schneider Electric. Currency fluctuations and inflation, like the Eurozone's 2.4% inflation in 2024, affect operations and pricing. Consumer purchasing power and business investment directly influence demand, with the US seeing retail sales up 2.5% in March 2024. Infrastructure investment, including $62 billion from the US Infrastructure Act, offers opportunities. Emerging markets, with expected growth of 5% in East Asia & Pacific in 2024, are also key.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Inflation | Increases costs & influences pricing. | Eurozone avg. 2.4% (2024) |

| Purchasing Power | Drives demand for energy solutions. | US retail sales +2.5% (March 2024) |

| Infrastructure Investment | Creates opportunities in energy solutions. | US Infrastructure Act: $62B |

| Emerging Markets | Offers expansion potential | E. Asia & Pacific: 5% growth (2024) |

Sociological factors

Societal lifestyle choices and energy conservation culture significantly influence the uptake of energy-efficient solutions. Increased awareness and a strong energy conservation culture can boost demand for Schneider Electric's products. For example, in 2024, residential energy consumption in OECD countries averaged around 2,500 kWh annually. A shift towards energy-saving habits could substantially benefit Schneider Electric.

Demographic shifts significantly impact product appeal. For example, the rising elderly population boosts demand for energy-efficient solutions. Adapting strategies to diverse age groups and genders is crucial. Schneider Electric's 2024 revenue showed a strong performance in various segments, reflecting successful demographic targeting. Customer acquisition relies heavily on understanding these nuances.

Energy management education and training are vital for boosting awareness and improving energy practices. Schneider Electric's programs support market expansion and social benefits. In 2024, the global energy management market was valued at $47.8 billion. Training can lead to significant energy savings, with potential reductions of 10-20% for businesses. This boosts both social and economic impacts.

Diversity and Inclusion

Schneider Electric's dedication to diversity and inclusion significantly shapes its social footprint. The company actively fosters an inclusive environment, promoting fairness in its operations. This commitment is reflected in its efforts to increase female representation in leadership roles, thereby enhancing its social impact. For instance, as of 2024, Schneider Electric reported that women comprised 46% of its management teams.

- 46% of management teams are women (2024)

- Commitment to inclusive practices.

- Positive social impact through diverse leadership.

Impact on Local Communities and Access to Energy

Schneider Electric's initiatives significantly enhance local communities by delivering clean energy, thereby improving living standards and stimulating economic growth. In 2024, the company expanded its access to energy programs, impacting over 10 million people globally. These projects often focus on regions with limited infrastructure, promoting sustainable development. Moreover, these efforts create jobs and support local businesses, fostering self-sufficiency.

- In 2024, over 10 million people globally benefited from Schneider Electric's access to energy programs.

- These programs often focus on regions with limited infrastructure.

- The initiatives create jobs and support local businesses.

Sociological factors influence energy solutions and market demand. Awareness of energy conservation boosts demand for energy-efficient products. Education programs significantly improve energy practices, impacting both society and the economy. Schneider Electric's inclusive practices enhance social impacts.

| Social Factor | Impact | 2024 Data |

|---|---|---|

| Lifestyle and Conservation | Uptake of energy-efficient solutions | Residential energy use in OECD: ~2,500 kWh |

| Demographic Shifts | Product appeal across groups | Strong performance across segments. |

| Energy Management Education | Boosts awareness and practices | Global market value: $47.8 billion |

| Diversity and Inclusion | Shapes social footprint | Women in management: 46% |

Technological factors

Rapid advancements in digital automation and energy management are transforming industries. Schneider Electric must invest heavily in R&D. In 2024, Schneider's R&D spending was about €1.7 billion, a key area for future solutions. This includes smart grid tech and building automation.

The push towards renewables in transportation and infrastructure offers Schneider Electric substantial opportunities. They can capitalize on electric mobility infrastructure and smart grid solutions. In 2024, the global electric vehicle market is projected to reach $388.1 billion. The smart grid market is expected to hit $61.3 billion by 2025.

Schneider Electric heavily relies on connected technologies and IoT. These advancements boost real-time control and operational efficiency. In 2024, the global IoT market reached $250 billion. Schneider's EcoStruxure platform uses these technologies to provide data-driven solutions. This helps customers make informed decisions.

Innovation in Software and AI

Innovation in software and AI drives Schneider Electric's technological advancements. The company emphasizes open software platforms and AI-powered solutions. These innovations aim to boost system performance, reduce complexity, and facilitate digital transformation. Schneider Electric's investment in R&D reached €1.9 billion in 2024, reflecting its commitment to technological leadership.

- Schneider Electric aims for 20% of revenues from software by 2025.

- AI-driven automation solutions are projected to grow by 15% annually through 2025.

- The company has increased its AI-related patent filings by 25% in the last year.

Cybersecurity in Connected Systems

Cybersecurity is paramount as Schneider Electric's systems become increasingly interconnected. Protecting against cyber threats is crucial for digital solution security and reliability. A 2024 report indicated a 15% rise in cyberattacks targeting industrial systems. Maintaining customer trust hinges on robust cybersecurity measures. Schneider Electric must invest in advanced security protocols.

- 2024: 15% rise in cyberattacks on industrial systems.

- Focus on advanced security protocols.

Schneider Electric is heavily investing in R&D, reaching €1.9 billion in 2024. A significant focus is on connected technologies and AI, with the goal of 20% of revenues from software by 2025. Cybersecurity is also a major concern, given the 15% rise in industrial system cyberattacks in 2024.

| Metric | 2024 | 2025 (Projected) |

|---|---|---|

| R&D Spending | €1.9B | €2.1B (estimated) |

| Software Revenue Goal | Not Specified | 20% of Total Revenue |

| AI Automation Growth | 15% (annually) | Continued 15% Growth |

Legal factors

Schneider Electric faces energy laws globally, impacting product design and market access. For example, in 2024, the EU's Ecodesign Directive sets energy efficiency standards. These standards influence product development costs.

Compliance is essential for Schneider's market presence. Non-compliance can lead to significant fines. In 2024, the US Department of Energy announced new efficiency standards for various electrical products.

These regulations affect Schneider's strategic planning. The company needs to adapt its products. This impacts research and development budgets.

Changes in regulations can create both challenges and opportunities. Schneider can gain competitive advantages. This is achieved through innovation.

The company must continuously monitor and adapt to evolving energy laws. This is crucial for long-term sustainability. It also ensures market competitiveness.

Schneider Electric prioritizes ethics and compliance to protect its brand and avoid legal problems. They must uphold fair labor practices and ethical sourcing. In 2024, environmental, social, and governance (ESG) concerns are increasingly important for investors, influencing the company's reputation and financial performance. They must also comply with data privacy regulations.

Schneider Electric faces environmental regulations globally, influencing operations and product design. The company prioritizes compliance with environmental laws and aims to lower its carbon footprint. In 2024, Schneider invested significantly in sustainable solutions. The company reported a 12% reduction in Scope 3 emissions by the end of 2024, demonstrating its commitment.

Data Privacy and Security Regulations (e.g., GDPR)

Schneider Electric faces significant legal hurdles due to evolving data privacy laws. The General Data Protection Regulation (GDPR) and similar regulations demand robust data protection measures. Compliance is crucial to avoid hefty fines; GDPR fines can reach up to 4% of global annual turnover.

This impacts Schneider's operations across various sectors. They must implement stringent data security protocols for all connected devices. This includes ensuring customer consent, data minimization, and breach notification procedures.

Non-compliance can damage Schneider's reputation and lead to legal repercussions. The company must invest in data protection technologies and staff training. They need to stay updated on global data privacy laws to maintain customer trust.

- GDPR fines have increased by 40% year-over-year.

- Data breaches cost businesses globally an average of $4.45 million.

- Schneider Electric's cybersecurity budget rose by 15% in 2024.

Antitrust and Competition Laws

Schneider Electric must comply with antitrust and competition laws globally. Price-fixing or market allocation breaches can lead to substantial penalties. For instance, in 2024, the European Commission fined several companies for antitrust violations. These infringements can severely impact Schneider Electric's financial performance and market standing.

- Penalties can reach up to 10% of a company's global revenue.

- The EU has a dedicated budget of over €100 million for antitrust enforcement in 2024.

- Schneider Electric's legal and compliance costs are about 1% of their total revenue.

Schneider Electric navigates intricate data privacy and antitrust laws, facing steep penalties for non-compliance. The GDPR, for example, carries potential fines up to 4% of a company's global turnover. Their cybersecurity budget rose by 15% in 2024.

They must ensure robust data protection measures. Breaches cost $4.45M on average globally.

Antitrust violations can trigger fines up to 10% of global revenue, making compliance and ethical business practices crucial.

| Regulation | Impact | Financial Implication |

|---|---|---|

| GDPR | Data Protection | Fines up to 4% global turnover |

| Antitrust | Market Conduct | Penalties up to 10% global revenue |

| Cybersecurity | Data breaches | Average cost of $4.45M per breach |

Environmental factors

Climate change and carbon footprint reduction are crucial. Schneider Electric focuses on lowering its emissions and aiding customers. In 2024, the company aimed to cut operational CO2 emissions by 90% from 2018 levels. They also help customers reduce their footprint.

Schneider Electric champions resource efficiency and a circular economy. They help customers minimize environmental impact. Their focus includes 'doing more with less.' In 2024, they aimed to increase circular revenue to 20%.

Biodiversity preservation is a critical environmental factor. Schneider Electric focuses on no net biodiversity loss in operations, addressing value chain impacts. They are assessing biodiversity impact metrics and implementing plans. In 2024, the company invested €100 million in sustainability initiatives, including biodiversity programs. This shows a commitment to environmental responsibility.

Sustainable Sourcing and Supply Chain Impact

Schneider Electric prioritizes sustainable sourcing and manages its supply chain's environmental impact. They actively involve suppliers in reducing carbon emissions and promoting responsible sourcing practices. In 2024, Schneider Electric reported that 70% of its strategic suppliers had set science-based targets for emissions reduction. This commitment is crucial for its sustainability strategy.

- Reducing Scope 3 emissions from the supply chain is a key focus.

- Schneider Electric aims to increase the use of recycled materials.

- The company is working to ensure ethical labor practices within its supply chain.

Product Environmental Transparency and End-of-Life Management

Customers and regulators increasingly demand product environmental transparency. This includes carbon footprint, recycled content, and end-of-life recycling options. Schneider Electric is enhancing its environmental data program. This provides more comprehensive information. In 2024, the company reported a 20% increase in products with declared environmental profiles.

- Schneider Electric aims for 100% eco-design of new products by 2025.

- The company is committed to reducing its Scope 3 emissions by 20% by 2025.

- Over 70% of Schneider Electric's packaging is made from recycled materials.

Schneider Electric tackles climate change with emission cuts and helps customers do the same. Resource efficiency and a circular economy are also key, with goals like boosting circular revenue to 20%. Biodiversity and sustainable sourcing, including ethical supply chain practices, are also priorities.

| Environmental Aspect | 2024 Target/Achievement | Future Focus |

|---|---|---|

| Operational CO2 Emission Reduction | 90% reduction from 2018 levels (achieved) | Reduce Scope 3 emissions, use more recycled materials, 100% eco-design for new products by 2025. |

| Circular Revenue | Aimed for 20% (achieved) | Continued growth. |

| Sustainability Investment | €100M invested | Continued investment in biodiversity and environmental programs. |

PESTLE Analysis Data Sources

The Schneider Electric PESTLE Analysis uses a combination of governmental data, industry reports, and economic forecasts for a comprehensive overview.