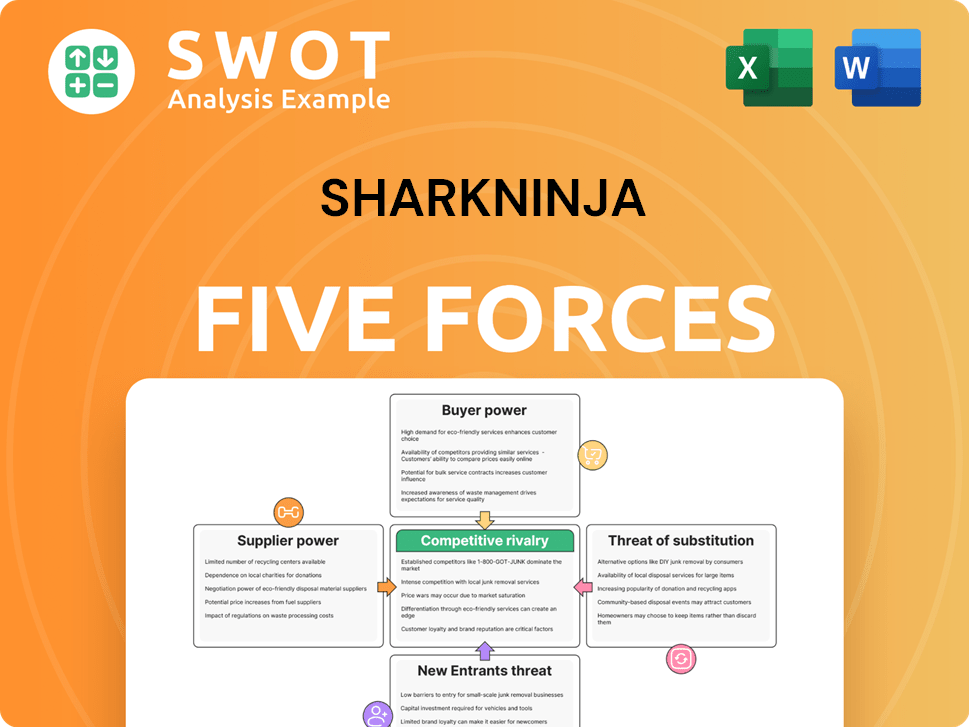

SharkNinja Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SharkNinja Bundle

What is included in the product

Analyzes SharkNinja's competitive position, considering rivalry, new entrants, and bargaining power.

Quickly pinpoint vulnerabilities and opportunities with dynamic force weighting.

Same Document Delivered

SharkNinja Porter's Five Forces Analysis

This preview presents SharkNinja's Porter's Five Forces analysis, covering key competitive aspects. It assesses industry rivalry, supplier power, buyer power, threats of substitutes, and new entrants. The displayed document is identical to the one you'll download immediately after purchasing. It's a complete, ready-to-use analysis.

Porter's Five Forces Analysis Template

SharkNinja's success hinges on navigating intense competitive pressures, shaped by powerful forces. Supplier bargaining power, especially for raw materials and components, significantly impacts their cost structure. Competition from established appliance brands and innovative startups constantly challenges SharkNinja's market share and pricing strategies. Buyer power is moderate as consumers have choices. The threat of new entrants is medium. The threat of substitutes, particularly from multi-functional appliances, also demands strategic agility.

Ready to move beyond the basics? Get a full strategic breakdown of SharkNinja’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

SharkNinja sources materials like plastics and electronics from a network of suppliers. The concentration of key suppliers is limited, potentially boosting their negotiation power. For example, reliance on specific chip manufacturers can impact production costs. In 2024, supply chain disruptions increased material costs by approximately 7% for similar consumer goods companies. Securing favorable terms is vital for managing costs.

SharkNinja's global sourcing strategy, especially in Southeast Asia (Malaysia, Singapore, Indonesia, Thailand, Vietnam, and China), diversifies its supplier network. This approach reduces dependency on any single supplier or region, mitigating supply chain risks. However, managing this complex global network presents challenges in coordination, logistics, and maintaining quality. In 2024, global supply chain disruptions have increased operational costs by 10-15% for many companies, including those with complex sourcing models.

SharkNinja's supplier bargaining power depends on concentration in materials and components. Despite global sourcing, a few suppliers might control vital inputs, impacting costs. For example, in 2024, the cost of specialized components rose by 7% due to limited suppliers. This can squeeze profit margins, especially for patented parts.

Impact of Tariffs

Trade policies, particularly tariffs, strongly affect supplier power, especially for companies like SharkNinja. For instance, increased tariffs on Chinese imports, where many suppliers are based, could raise costs. SharkNinja projects a 10% tariff impact in fiscal year 2025.

- Increased costs from tariffs can reduce SharkNinja's profit margins.

- Reliance on specific suppliers makes SharkNinja vulnerable to price hikes.

- Diversifying suppliers can mitigate some tariff risks.

- Strategic sourcing is crucial to manage supplier power effectively.

Strategic Partnerships

SharkNinja's strategic partnerships with suppliers are crucial for securing favorable terms and supply chain stability. These long-term contracts help in controlling costs, which is essential in a competitive market. These agreements can provide a competitive advantage by ensuring access to essential materials. However, this strategy also creates a dependency that could limit flexibility if a supplier relationship falters.

- In 2024, SharkNinja's cost of goods sold (COGS) was approximately 55% of revenue.

- Long-term contracts with suppliers helped stabilize raw material costs.

- Strategic partnerships are vital for maintaining profit margins.

- Dependency can restrict flexibility in switching suppliers.

SharkNinja's supplier power stems from material concentration and trade policies. Increased tariffs and reliance on key suppliers, such as chip manufacturers, impact costs. In 2024, specialized components' costs rose by 7% due to limited suppliers, affecting profit margins. Strategic sourcing and partnerships are crucial for managing these risks.

| Factor | Impact | 2024 Data |

|---|---|---|

| Tariffs | Increased Costs | Projected 10% impact in fiscal year 2025 |

| Supplier Concentration | Higher component costs | Specialized components up 7% |

| Strategic Partnerships | Cost stability | COGS approx. 55% of revenue |

Customers Bargaining Power

SharkNinja's strong brand recognition, fueled by innovation and quality, provides pricing power. This allows them to charge premiums, lessening customer price sensitivity. SharkNinja's strategic marketing helps maintain its market position. In 2024, their focus on innovative product lines and strategic partnerships increased brand value.

SharkNinja's reliance on major retailers like Amazon, Walmart, and Target grants these retailers substantial bargaining power. These retail giants, with their vast customer reach, can heavily influence the terms offered to suppliers. In 2024, Amazon's net sales reached approximately $575 billion, showcasing their significant market influence. SharkNinja must balance relationships with these retailers while preserving profit margins and brand recognition.

Consumers wield considerable power due to the vast selection of home appliances. They can readily opt for alternatives if SharkNinja's prices or products don't meet their needs. This consumer freedom necessitates continuous innovation and differentiation from SharkNinja to maintain market share. In 2024, the global home appliances market was valued at approximately $740 billion, highlighting the competitive landscape.

Price Sensitivity

SharkNinja faces price sensitivity from customers, despite its premium products. Consumers can easily switch to cheaper alternatives, like private label brands. This pressure necessitates competitive pricing strategies. In 2024, the home appliance market saw a 3% increase in demand for budget-friendly options. SharkNinja's innovation at a competitive price is vital.

- Price sensitivity impacts sales.

- Alternatives challenge pricing power.

- Competitive pricing is crucial.

- Innovation supports pricing strategy.

E-commerce Influence

The rise of e-commerce has significantly boosted customer bargaining power, giving them access to more information and price comparisons. Platforms like Amazon allow consumers to easily compare products and find better deals, intensifying competition. SharkNinja must adapt its online presence and pricing to succeed in this environment, leveraging e-commerce channels effectively. In 2024, e-commerce sales accounted for a substantial portion of retail, emphasizing the importance of online strategies.

- E-commerce sales in the U.S. reached approximately $1.1 trillion in 2023.

- Amazon's net sales increased by 12% to $143.1 billion in Q4 2023.

- SharkNinja's online sales are a significant part of its total revenue.

- Consumers now rely heavily on online reviews and ratings.

Customer bargaining power affects SharkNinja. Consumers can switch to alternatives. Competitive pricing and innovation are vital. E-commerce increases consumer power.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | Challenges pricing | 3% rise in budget-friendly appliance demand. |

| E-commerce | Boosts comparison | U.S. e-commerce sales approx. $1.1T (2023). |

| Alternatives | Pressure on sales | Global home appliance market valued at $740B. |

Rivalry Among Competitors

SharkNinja battles tough rivals like Dyson and KitchenAid, each with solid brands and customer loyalty. These competitors boast wide distribution networks, posing a direct challenge to SharkNinja. The company navigates separate competitive landscapes for its Shark and Ninja brands. For example, Dyson's 2023 revenue was about $7.1 billion, highlighting the scale of competition SharkNinja faces.

SharkNinja faces competition from emerging brands like Instant Pot and iRobot. These companies disrupt the market with innovative products. In 2024, iRobot's revenue was about $990 million. Such brands challenge SharkNinja's market share. To compete, SharkNinja must differentiate itself.

The home appliance market sees relentless innovation, with companies constantly launching new products. SharkNinja, a key player, must invest heavily in R&D to stay competitive. The company's innovation is reflected in its product launches; it introduces at least 25 new products yearly. This continuous push for cutting-edge features and performance is crucial for market share.

Pricing Strategies

Aggressive pricing and promotional offers are prevalent, fueling intense price competition. Companies frequently use discounts and bundled deals to attract customers and gain market share. SharkNinja needs to carefully manage pricing to remain competitive and profitable. Despite this, in 2024, SharkNinja demonstrated strong pricing power relative to competitors.

- SharkNinja's Q1 2024 net sales increased by 2.5% year-over-year.

- Promotional spending strategies impact margins.

- Competitors include Dyson, with varied pricing strategies.

- Price wars can lower profitability for all players.

Market Share

Competitive rivalry in the home appliance sector is intense, with companies battling for market share through aggressive marketing and product innovation. SharkNinja has demonstrated strong market share growth. This expansion indicates its ability to compete effectively.

- SharkNinja's revenue increased from $3.7 billion in 2022 to $4.0 billion in 2023.

- The company has expanded its global presence, with significant growth in North America and Europe.

- Market share gains are driven by successful product launches and brand recognition.

SharkNinja faces fierce competition from established brands like Dyson and KitchenAid. These rivals have strong brand recognition and extensive distribution. The market is also affected by emerging brands like Instant Pot, which challenges SharkNinja's market share.

Intense price competition and innovation are constant, with companies using promotions to gain market share. To stay competitive, SharkNinja needs robust R&D and effective pricing. SharkNinja's net sales grew by 2.5% year-over-year in Q1 2024.

| Metric | 2022 | 2023 |

|---|---|---|

| SharkNinja Revenue (USD Billions) | 3.7 | 4.0 |

| Dyson Revenue (USD Billions) | 6.5 | 7.1 |

| iRobot Revenue (USD Millions) | 1099 | 990 |

SSubstitutes Threaten

Traditional cleaning methods, like mops and brooms, present a threat to SharkNinja. These methods are cheaper and don't need electricity, offering a budget-friendly alternative. In 2024, the global market for manual cleaning tools was valued at around $15 billion. The cleaning services market also poses a threat, as consumers may prefer outsourcing cleaning. The cleaning services industry generated approximately $50 billion in revenue in the U.S. in 2024.

Generic appliances present a threat to SharkNinja, particularly for budget-conscious consumers. These store-brand alternatives often mimic the functionality of SharkNinja's products but at a lower cost. Private label brands, like those found at major retailers, compete directly by offering similar items at reduced prices. In 2024, the private label market grew, indicating an increased consumer interest in affordable options, which impacts companies like SharkNinja. This forces SharkNinja to highlight its product's unique value.

Multi-functional appliances are substitutes for SharkNinja's specialized products. A blender that also chops and makes smoothies can replace separate appliances. This trend addresses space and price concerns. In 2024, the market for multifunctional kitchen appliances grew by 7%, reflecting consumer preference for versatility and value.

DIY Solutions

DIY solutions pose a threat to SharkNinja's cleaning products. Homemade remedies using vinegar, baking soda, and lemon juice offer cleaning alternatives. Consumer preference for these natural ingredients can impact demand for commercial products. The DIY market's growth rate in 2024 was about 7%, indicating a notable shift.

- DIY cleaning solutions offer direct substitutes.

- Consumer preference impacts branded product demand.

- The DIY market is experiencing growth.

- Natural ingredients are increasingly popular.

Service-Based Alternatives

Service-based alternatives pose a threat to SharkNinja. Consumers may choose coffee subscriptions over coffee makers. Meal kits reduce the demand for kitchen appliances. These services offer convenience and variety. This substitution impacts SharkNinja's sales.

- Subscription coffee services grew, with companies like Trade Coffee reporting significant customer acquisition in 2024.

- Meal kit market, although competitive, still presents a challenge, with HelloFresh and Blue Apron maintaining a notable market share.

- The shift towards services is evident in consumer spending habits, with a growing portion of household budgets allocated to convenience-based solutions.

Substitutes like DIY cleaners and cleaning services challenge SharkNinja. Growth in these areas impacts demand for SharkNinja's products. Consumers' preference for budget-friendly or convenient alternatives poses risks. Diversification and innovation are key for navigating these threats.

| Substitute Type | 2024 Market Data | Impact on SharkNinja |

|---|---|---|

| DIY Cleaning | 7% growth | Reduced demand for cleaning products |

| Cleaning Services | $50B U.S. revenue | Competition for consumer spending |

| Generic Appliances | Private label market growth | Price pressure; need for value differentiation |

Entrants Threaten

Some areas of the home appliance market, like basic cleaning supplies, have low entry barriers. This means it's easier for new companies to start up. The cost to enter these segments is relatively low compared to more complex product areas. Recent data shows that the cleaning products market is highly competitive, with numerous small players. This increases the risk of new competitors.

Strong brand loyalty poses a significant threat to new entrants in the appliance market. Established brands like Dyson and KitchenAid have cultivated loyal customer bases. For example, in 2024, Dyson's brand value was estimated at over $7 billion. This customer preference creates a barrier, making it tough for new players to gain traction.

Building brand recognition and a solid market presence demands substantial marketing investments. Newcomers must be ready to invest heavily in advertising, promotions, and distribution to rival established firms. SharkNinja allocated approximately $100 million for advertising in 2023. This substantial marketing requirement functions as a barrier, particularly for smaller entrants.

Access to Distribution

Securing distribution is a significant hurdle for new entrants, particularly in competitive markets. Existing companies like SharkNinja often have established relationships with major retailers and online platforms. New competitors face challenges in gaining shelf space or visibility. This can lead to higher costs or reliance on less effective channels.

- SharkNinja products are available in major retailers such as Best Buy and Target.

- New entrants need to compete for these distribution channels.

- Established brands may have exclusive agreements.

- Logistics and supply chain are also a challenge.

Economies of Scale

SharkNinja, like other established firms, enjoys significant economies of scale in manufacturing, sourcing, and distribution, creating a formidable barrier to entry. These cost advantages allow SharkNinja to offer products at competitive prices, making it challenging for new competitors to match. For instance, in 2023, SharkNinja's net sales reached $3.7 billion, reflecting its strong market position due to its ability to leverage scale. This financial strength enables the company to invest in innovation and maintain its competitive edge. The company's success is, in part, due to its ability to offer both innovative and high-quality products at competitive prices.

- Manufacturing efficiency: Large-scale production lowers per-unit costs.

- Sourcing power: Bulk purchasing reduces material expenses.

- Distribution networks: Efficient logistics minimize transportation costs.

- Competitive pricing: Economies of scale support aggressive pricing strategies.

The ease of entry varies, with basic cleaning supplies being more accessible due to lower costs, heightening competition. Strong brand loyalty of established firms like Dyson, valued at over $7 billion in 2024, creates a barrier for new entrants. Significant marketing investments, such as SharkNinja's $100 million in advertising in 2023, are crucial but challenging for newcomers.

| Aspect | Impact | Example |

|---|---|---|

| Entry Barriers | Varying, some low | Cleaning products |

| Brand Loyalty | High barrier | Dyson ($7B+ 2024 value) |

| Marketing Costs | Significant | SharkNinja ($100M, 2023) |

Porter's Five Forces Analysis Data Sources

This analysis leverages data from company filings, market research, and industry publications for insights. We also incorporate competitor analyses and financial data for a comprehensive view.