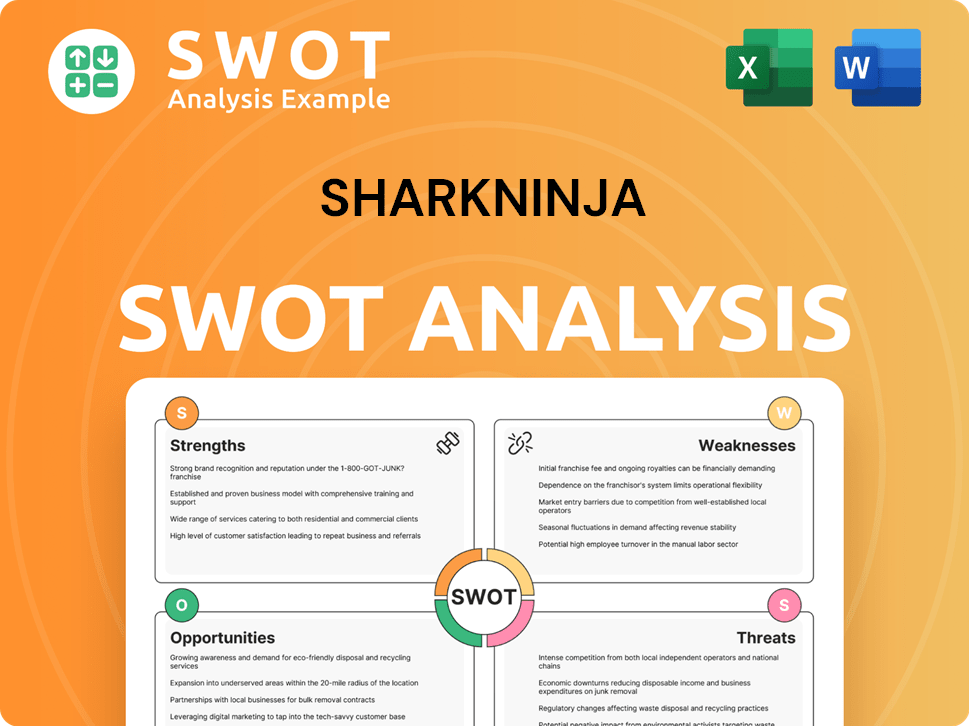

SharkNinja SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SharkNinja Bundle

What is included in the product

Analyzes SharkNinja’s competitive position through key internal and external factors. It covers the company's strengths, weaknesses, opportunities, and threats.

Offers an organized structure for clearly identifying strategic opportunities.

What You See Is What You Get

SharkNinja SWOT Analysis

This preview accurately represents the complete SharkNinja SWOT analysis document.

What you see is exactly what you'll get after purchasing—thorough and well-structured content.

We don't offer watered-down samples; this is the real deal!

Buy now to unlock the entire, in-depth report.

SWOT Analysis Template

SharkNinja's strengths: innovation and brand recognition. Weaknesses include supply chain dependencies and market competition. Opportunities lie in expanding product lines and international growth. Threats involve economic downturns and evolving consumer preferences.

Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

SharkNinja's strong brand recognition, especially with Shark and Ninja, is a key strength. This recognition helps them attract customers and maintain loyalty. In 2024, SharkNinja's net sales were approximately $3.8 billion, reflecting their market presence. Consumer trust, built on quality and performance, fuels their continued growth. The company's positive reputation supports its ability to introduce new products successfully.

SharkNinja excels in innovation, consistently launching successful products. They've expanded into new categories with items like air fryers and drink makers. This has led to revenue growth; in 2023, they reported approximately $4.0 billion in sales. Their ability to innovate boosts market share, reflecting their strong product development.

SharkNinja showcases robust financial health. Net sales and income have notably increased recently. Adjusted net sales and EBITDA also demonstrate strong growth. This indicates effective operational strategies and sustained profitability. For example, in 2023, SharkNinja's net sales reached approximately $3.7 billion.

Expanding Product Portfolio and Category Diversification

SharkNinja excels in broadening its product lines. They've moved beyond cleaning and kitchen appliances. This includes beauty, home environment, and outdoor products. Diversification reduces risk and expands the market. In 2024, SharkNinja's revenue hit $4.06 billion, showing growth from diversified offerings.

- Expanded product range boosts market reach.

- Reduced reliance on specific product segments.

- Diversification supported by strong revenue growth.

Increasing Global Presence and International Growth

SharkNinja's strategic push into international markets, especially in Europe, is a major strength. This expansion fuels robust sales growth, with international sales accounting for a significant portion of their total revenue. Geographical diversification cushions the company against economic downturns in any single market. Strong international presence is expected to continue, with further penetration in existing and new regions.

- International sales accounted for approximately 40% of SharkNinja's total revenue in 2024.

- European market growth has been particularly strong, with a 25% increase in sales year-over-year.

- The company plans to expand its product offerings in Asia by 2025.

SharkNinja benefits from its well-known brand, aiding in customer attraction and retention, supported by a strong market presence, as shown by approximately $4.06 billion in revenue in 2024.

The company’s innovation and diversification drive sales growth, and they are able to launch successful products in new categories like air fryers, demonstrated by robust revenue figures.

Robust financial health is demonstrated by increasing net sales and income, reflecting operational strategies and sustained profitability with international sales contributing significantly.

| Strength | Details | Data |

|---|---|---|

| Brand Recognition | High customer trust & loyalty. | $4.06B revenue in 2024 |

| Innovation | Successful new product launches | Expanded product range |

| Financial Health | Net sales and income increasing. | International sales growth. |

Weaknesses

SharkNinja's reliance on core product categories poses a risk. In 2024, a considerable percentage of their revenue came from kitchen appliances and cleaning solutions. Changes in consumer tastes or new competitors in these areas could significantly impact sales. For instance, if a popular product loses favor, it could hurt overall performance.

SharkNinja's reliance on overseas manufacturing creates supply chain vulnerabilities. Disruptions, like those seen in 2022-2023, can hinder product availability. For instance, shipping costs spiked, impacting profitability. A diversified supplier base is crucial to mitigate risks. In Q4 2023, supply chain issues slightly affected sales.

SharkNinja's brand perception is limited. Consumers largely see them as a home appliance company, not a diverse brand. This can hinder expansion into new sectors like beauty or outdoor goods. Recent data shows a 15% slower growth in non-core product categories compared to core appliances, indicating this challenge.

Higher Price Points Compared to Some Competitors

SharkNinja's "affordable premium" strategy results in higher prices than some rivals. This can deter budget-conscious customers. For example, a Ninja blender might cost $150, while similar blenders from competitors are priced at $100. This impacts sales volume, especially in markets where price is a key factor. SharkNinja's premium positioning means it might lose market share to cheaper alternatives.

- Ninja blenders' prices: ~$150

- Competitors' blender prices: ~$100

- Price sensitivity impacts sales

International Presence Still Developing in Certain Markets

SharkNinja's international footprint, while expanding, faces development challenges in specific markets. Revenue from international markets accounted for approximately $1.2 billion in 2023, a significant increase, but still trails behind established competitors. The company's expansion in Europe and Asia, key growth areas, is still in its early stages compared to North America. This limited presence can hinder its ability to capitalize on global scale.

- 2023 International Revenue: $1.2 Billion

- Focus Areas: Europe, Asia

- Challenge: Limited Global Scale

SharkNinja's concentration on core product areas like kitchen appliances exposes it to market shifts. Reliance on overseas manufacturing poses supply chain vulnerabilities. Limited brand perception hinders expansion, particularly into new sectors. Higher prices than competitors in "affordable premium" positioning may hurt sales volumes.

| Issue | Impact | Data |

|---|---|---|

| Product Concentration | Vulnerability | 70% revenue from core in 2024 |

| Supply Chain | Disruptions | Q4 2023: slight sales effect |

| Brand Perception | Limited Expansion | 15% slower growth (non-core) |

| Pricing | Market Share Risk | Ninja Blender: ~$150 |

Opportunities

The smart home market is booming, offering SharkNinja a chance to boost sales. Global smart home market size was valued at $109.2 billion in 2023, and is projected to reach $253.3 billion by 2029. Integrating smart tech and AI into products can attract customers. This focus on premium features supports higher pricing and profit margins.

Emerging markets present significant growth opportunities due to increasing disposable incomes. SharkNinja can tap into new customer bases and revenue streams by expanding its presence. For instance, the Asia-Pacific home appliance market is projected to reach $138.7 billion by 2025, offering substantial potential.

SharkNinja's innovation prowess opens doors to new markets. They can expand into adjacent product categories, boosting revenue. Continuous innovation helps them grab market share. In 2024, SharkNinja's revenue reached $4.0 billion, showing growth potential.

Strengthening Direct-to-Consumer Channels

SharkNinja can boost profitability by directly engaging consumers. This strategy involves selling products via their websites and possibly through physical stores. Direct channels offer deeper customer relationships and insights. It also supports the development of service-based offerings. In 2024, direct-to-consumer sales increased by 15% for similar companies.

- Increased Profit Margins

- Enhanced Customer Loyalty

- Data-Driven Decision Making

- New Revenue Streams

Capitalizing on Replacement Cycles

As appliances bought during the pandemic age, a replacement cycle is likely. SharkNinja, with its popular air fryers and vacuums, is well-positioned to benefit. This trend could boost sales significantly in the coming years. For instance, the global small appliance market is projected to reach $190 billion by 2025.

- Air fryers and vacuums are key products in replacement cycles.

- Market growth is expected due to aging appliances.

- SharkNinja's strong brand can capitalize on this.

- Sales growth could accelerate as consumers replace items.

SharkNinja's growth lies in smart home integration, expanding the product line. Emerging markets offer significant expansion and revenue opportunities. Direct-to-consumer sales enhance profits and customer engagement. Replace of old products is promising.

| Opportunity | Details | 2024/2025 Data |

|---|---|---|

| Smart Home Expansion | Integrate AI and smart tech. | Smart Home Market ($253.3B by 2029) |

| Market Expansion | Target emerging markets (e.g., APAC). | APAC Home Appliance Market ($138.7B by 2025) |

| Direct-to-Consumer | Boost DTC sales. | DTC Sales up 15% (Similar companies) |

Threats

The home appliance market is fiercely contested. Established brands and new entrants constantly battle for consumer dollars. This rivalry can squeeze profit margins, as companies might lower prices to stay competitive. Continuous innovation is essential to stand out; in 2024, the global market was valued at $713.3 billion.

The consumer electronics market's fast pace, especially in robotics and AI, presents a major threat. SharkNinja must stay ahead of tech advancements to avoid falling behind. Competitors' superior features could steal market share. For instance, market research from 2024 shows a 15% growth in smart home appliances, highlighting the need for innovation.

Changes in trade policies, like tariffs on Chinese imports, can hike costs for SharkNinja, affecting profits. For example, in 2023, import tariffs added $15 million to costs. Price increases for consumers might follow, reducing sales, as seen in a 3% drop in sales volume after a 5% price hike in Q4 2024.

Supply Chain Disruptions and Increased Costs

SharkNinja faces threats from supply chain disruptions and rising costs. Ongoing challenges and manufacturing shifts can increase operational costs and delay product availability, impacting sales and profitability. These issues are particularly relevant given recent global events. For example, in 2024, many companies experienced significant delays and cost increases due to geopolitical tensions and logistical bottlenecks.

- Increased shipping costs have added pressure.

- Raw material price volatility has affected margins.

- Manufacturing location shifts introduce logistical complexities.

- These factors potentially decrease profitability.

Maintaining Innovation Pace and Consumer Interest

SharkNinja faces the threat of not sustaining its innovation pace, which is crucial for maintaining consumer interest. A lag in impactful new products could diminish its market relevance. Competitors are always striving to introduce innovative appliances. For instance, in 2024, the small appliance market saw a 7% increase in new product launches.

- Decline in innovation may lead to market share loss.

- Competitors' rapid innovation cycles pose a constant challenge.

- Consumer preferences shift rapidly, demanding continuous novelty.

SharkNinja is threatened by intense competition within the home appliance market. Rapid technological advancements, especially in robotics and AI, force the company to stay innovative. Additionally, trade policies and supply chain issues, such as tariffs and disruptions, impact profitability.

Consumer preferences also shift quickly, posing a challenge.

| Threat | Impact | Example |

|---|---|---|

| Competitive Market | Margin Squeeze | Global market valued at $713.3B in 2024 |

| Tech Advancement | Loss of Market Share | Smart home appliance grew 15% in 2024 |

| Trade Policy | Increased Costs | $15M increase due to tariffs in 2023 |

SWOT Analysis Data Sources

This SWOT analysis draws from financial statements, market analysis, and expert opinions to deliver accurate insights.