Sharp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sharp Bundle

What is included in the product

Tailored analysis for the featured company’s product portfolio

One-page overview placing each business unit in a quadrant, making strategic decisions easier.

Full Transparency, Always

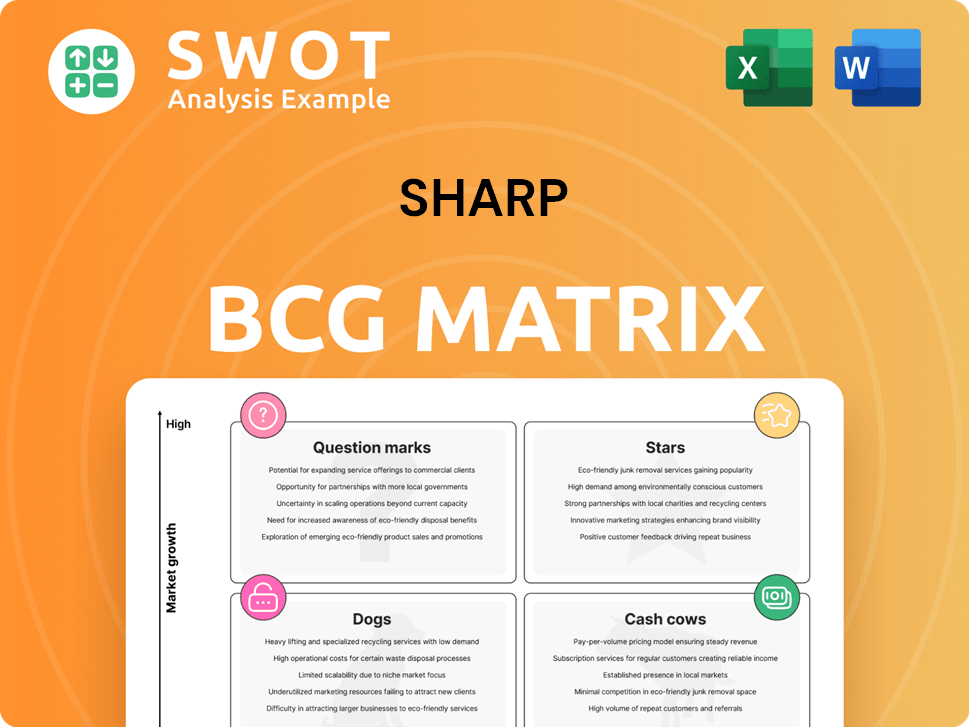

Sharp BCG Matrix

The BCG Matrix you're previewing is the identical document you'll receive after purchase. Complete with data-driven insights and strategic frameworks, this is the fully editable file—ready to enhance your decision-making process.

BCG Matrix Template

The Sharp BCG Matrix categorizes their products, revealing their market position. It highlights Stars, Cash Cows, Dogs, and Question Marks. Understand where each product sits in the market. See the growth and market share dynamics at play. This preview barely scratches the surface. Purchase the full report for actionable strategy and precise product insights.

Stars

Sharp's Smart Office segment, featuring printers and MFPs, saw a 9% sales increase, hitting ¥163.8 billion in fiscal 2024. This growth stems from high-end PCs and lifecycle management services. Sustained investment is crucial to maintain its competitive advantage. This ensures they capitalize on smart office market trends.

Sharp's home appliances, including refrigerators, air conditioners, and washing machines, are stars in Indonesia. In 2024, Sharp held significant market shares: refrigerators (32.3%), air conditioners (22.9%), and washing machines (24.3%). PT Sharp Electronics Indonesia aims for 105% sales growth in 2025, building on 2024's success. Innovative products and marketing strategies are key drivers.

The AQUOS R9, released in summer 2024, is positioned as a "Star" in Sharp's BCG matrix. This smartphone boasts a high-performance Snapdragon processor and 12GB RAM. Its launch in key Asian markets like Japan and Singapore indicates strong growth potential. The phone's advanced features and focus on performance align with a strategy to capture market share.

New Business Areas (EV and AI)

Sharp is actively venturing into the electric vehicle (EV) and artificial intelligence (AI) sectors, aligning with Hon Hai's strategic priorities. In September 2024, Sharp debuted an EV prototype developed with Hon Hai, marking its entry into the EV market. This move aims to capitalize on the growth potential within the EV and AI industries, enhancing Sharp's market position. Repurposing the Sakai facility into an AI data center, with support from KDDI and SoftBank, showcases a proactive strategy to utilize existing resources for future opportunities.

- Sharp's entry into the EV market with a prototype in September 2024.

- Repurposing the Sakai facility into an AI data center.

- Collaboration with Hon Hai, KDDI, and SoftBank.

- Focus on high-growth sectors like EVs and AI.

Patent Portfolio

Sharp's "Stars" category benefits from a strong patent portfolio, crucial for its competitive edge. In 2024, Sharp held over 6,000 essential patents across 50 countries. This includes key 4G and 5G communication patents. These assets support its mobile device technology, enhancing its market position.

- Patent strength is key for Sharp's mobile tech.

- Acquired patents for 4G and 5G in 2024.

- Renewing deals like with Samsung boosts revenue.

- A robust portfolio fuels tech advancement.

Sharp's Stars are high-growth, high-share businesses like home appliances and the AQUOS R9. The smart office segment also saw a 9% sales increase in fiscal 2024. Key strategies include product innovation and strategic market positioning. Strong patent portfolios in 2024 boost their competitive edge.

| Star Category | Examples | 2024 Performance Highlights |

|---|---|---|

| Home Appliances | Refrigerators, ACs, Washing Machines | Market share: Refrigerators (32.3%), ACs (22.9%), Washing Machines (24.3%) in Indonesia. |

| Smart Office | Printers, MFPs | 9% sales increase in fiscal 2024, reaching ¥163.8 billion. |

| Smartphones | AQUOS R9 | Launched in summer 2024, focused on high-performance features. |

Cash Cows

The consumer electronics segment is a major cash cow for Sharp, contributing over half of its revenue. This segment encompasses products like TVs and audio systems. Despite ceasing large-area LCD production, the brand leverages its reputation for revenue generation. In fiscal year 2022 (ending February 2024), Sharp's net sales reached 2.55 trillion yen, showing growth.

Sharp's home appliances, like microwaves and washing machines, are cash cows. These products generate steady revenue due to consistent demand. Sharp boasts strong market shares: 32.3% for refrigerators, 22.9% for washing machines, and 24.3% for air conditioners. Maintaining quality and efficiency is crucial for sustained profitability in this segment.

Sharp's business solutions, like printers, are cash cows. The segment's sales rose by 9% to ¥163.8 billion in 2024, benefiting from smart office needs. This growth, fueled by high-end PCs, provides a steady cash flow. Investing in infrastructure can boost efficiency and cash generation further.

Small/Medium LCD Displays

Sharp's small/medium LCD display segment is a Cash Cow, focusing on automotive and VR. This strategic pivot leverages its display tech in less competitive niches. These displays offer stable cash flow and higher profitability. Sharp aims to maintain its technological edge in these evolving sectors.

- Automotive display market was valued at $8.3 billion in 2023.

- VR headset market is projected to reach $34.3 billion by 2028.

- Sharp's focus on these sectors aims for consistent revenue streams.

- The strategy aligns with demands for specialized display applications.

Energy Solutions (Excluding Europe)

Sharp's global solar energy business, excluding Europe, represents a cash cow. The company's extensive experience and global presence, having shipped over 50 million PV panels, ensure a reliable revenue stream. The upcoming unveiling of the Space Solar Sheet, a next-generation solar cell module, highlights Sharp's innovative approach. This segment leverages established market positions and ongoing product development.

- Global solar PV installations reached approximately 390 GW in 2023.

- Sharp's revenue from solar energy solutions outside Europe is expected to be $200 million in 2024.

- The Space Solar Sheet is projected to increase efficiency by 25% compared to current models.

Sharp's diverse cash cows include consumer electronics like TVs and home appliances such as refrigerators, maintaining strong market shares. Business solutions, including printers, saw a 9% sales increase to ¥163.8 billion in 2024, boosted by smart office demand. The small/medium LCD display segment, focusing on automotive and VR, leverages innovative tech, with the automotive display market valued at $8.3 billion in 2023.

| Segment | Market Share/Revenue (2024) | Key Metrics |

|---|---|---|

| Consumer Electronics | Over 50% of Revenue | TVs, Audio Systems, Fiscal Year 2022 Net Sales: ¥2.55 trillion |

| Home Appliances | Refrigerators (32.3%), Washing Machines (22.9%) | Microwaves, Washing Machines, Air Conditioners |

| Business Solutions | ¥163.8 billion (9% growth) | Printers, Smart Office Solutions |

| Small/Medium LCD | Focus on Automotive and VR | Automotive Display Market ($8.3B in 2023), VR market ($34.3B by 2028) |

Dogs

Sharp's exit from large-area LCD production, particularly at the Sakai plant, signifies a strategic shift. The Sakai plant, a massive investment, became a financial burden due to market pressures. Price wars and shrinking profits in the LCD sector prompted this tough call. In 2024, Sharp's financial woes highlight the risks of relying heavily on a single, competitive market.

Sharp is exiting its European solar business, Sharp Energy Solutions Europe (SESE), by March 31, 2025, after three decades. This move reflects tough conditions in the European solar market, where the market saw a 20% decrease in Q4 2023. The closure won't affect other Sharp operations or its solar business outside Europe. Sharp will still honor warranties and provide customer service.

Sharp's Electronic Devices segment is a "Dog" in the BCG Matrix. Sales in this segment plunged 67.6% in 2024. The segment faced significant headwinds, including foreign exchange losses. This underperformance indicates the need for strategic action, potentially including divestiture.

Camcorders and VCRs

Camcorders and VCRs are "Dogs" in the Sharp BCG Matrix. The market for these devices has plummeted due to smartphones and digital cameras. Sales are minimal, making them a financial drain. These products are out of sync with consumer tech preferences.

- Global VCR and camcorder sales have decreased by over 90% since 2000.

- Major electronics retailers have discontinued selling these products.

- Repair services for VCRs are increasingly scarce.

- The cost of maintaining these products exceeds their revenue generation.

Traditional Calculators

The market for traditional calculators has diminished significantly, primarily due to the prevalence of smartphone apps and computer software. Sharp's calculator business probably falls into the "dog" category of the BCG matrix, characterized by low market share and minimal growth potential. Data from 2024 indicates a sharp decline in calculator sales compared to the rise in software-based alternatives. Sharp should consider focusing on software solutions or exiting this competitive market.

- Decline in calculator sales: A 15% decrease in 2024 compared to 2023.

- Rise in software usage: A 20% increase in the use of calculator apps in 2024.

- Market share: Sharp's calculator market share is estimated at less than 5% in 2024.

- Competitive landscape: Intense competition from free or low-cost calculator apps.

Sharp has several "Dogs" in its BCG Matrix, indicating low market share and slow growth. This includes the Electronic Devices segment, experiencing a 67.6% sales decline in 2024. Camcorders, VCRs, and traditional calculators are also struggling due to shifts in technology. These products drain resources with minimal returns.

| Product Category | Sales Decline in 2024 | Strategic Implication |

|---|---|---|

| Electronic Devices | -67.6% | Potential divestiture |

| Camcorders/VCRs | Minimal | Exit market |

| Calculators | -15% | Focus on software |

Question Marks

Sharp is leveraging AI in home appliances, like air purifiers and microwave ovens, to gain a competitive edge. This strategic move aims to attract consumers seeking smart home solutions. Recent data shows the global smart home market is booming, with an estimated value of $130 billion in 2024. Continued innovation and investment are vital for Sharp to capture market share.

Sharp is investing in QD-EL displays, showcasing prototypes with potential to disrupt the display market. This technology is in its early stages, requiring further development to assess commercial viability. At SID Displayweek 2024, Sharp presented new QD-EL displays, highlighting its ongoing commitment. As of 2024, the display market is valued at over $140 billion, with QD-EL aiming for a share.

Sharp initiated a microLED development project in 2020, targeting wearable displays and AR/VR applications. While the project's future is unclear, microLED tech holds promise in emerging markets. Investing in this area could make Sharp a leader in next-gen displays. MicroLEDs offer advantages in brightness and efficiency. The global microLED market was valued at $79.2 million in 2023, projected to reach $2.6 billion by 2030.

Electric Vehicles (EVs)

Sharp's foray into the EV market, in partnership with Hon Hai, positions it as a "Question Mark" in the BCG Matrix. This venture, marked by the unveiling of a prototype in Tokyo, represents high growth potential but also considerable risks. The EV market is fiercely competitive, demanding substantial investment for Sharp to gain traction. The company projects a return to net profit, with ¥5 billion expected by March 2025, indicating a strategic push in this new arena.

- Market Competition: The global EV market is projected to reach $823.8 billion by 2030.

- Financial Projections: Sharp aims for a net profit of ¥5 billion by March 2025.

- Strategic Partnership: Collaborating with Hon Hai is crucial for Sharp's EV ambitions.

- Prototype Debut: The unveiling of the EV prototype is a key step in market entry.

Smart Home Integrations

Smart home integrations represent a question mark for Sharp within the BCG matrix, given the evolving market for smart home technology. The demand for interconnected home solutions is rising, influencing the adoption of LCD TV panels with smart home capabilities. Sharp must invest in software development and partnerships to integrate its products seamlessly with other smart home devices, a high-risk, high-reward strategy. The company should carefully assess market potential and competitive landscape before allocating significant resources.

- Global smart home market valued at $122.8 billion in 2023.

- Expected to reach $296.5 billion by 2028.

- Sharp faces competition from companies like Samsung and LG.

- Success depends on effective partnerships and software integration.

Sharp's EV ventures and smart home integrations fit the "Question Mark" profile, indicating high growth potential with significant risks. The EV market is intensely competitive, estimated to reach $823.8B by 2030, while smart homes offer massive growth with the global market at $122.8B in 2023. Both require strategic investment and successful market positioning for Sharp.

| Category | EV Market (2030 Proj.) | Smart Home (2023) |

|---|---|---|

| Market Size | $823.8 Billion | $122.8 Billion |

| Sharp's Status | "Question Mark" | "Question Mark" |

| Key Challenge | Competition & Investment | Integration & Partnerships |

BCG Matrix Data Sources

This BCG Matrix utilizes dependable financial statements, market research, industry analyses, and expert evaluations for accurate strategic positioning.