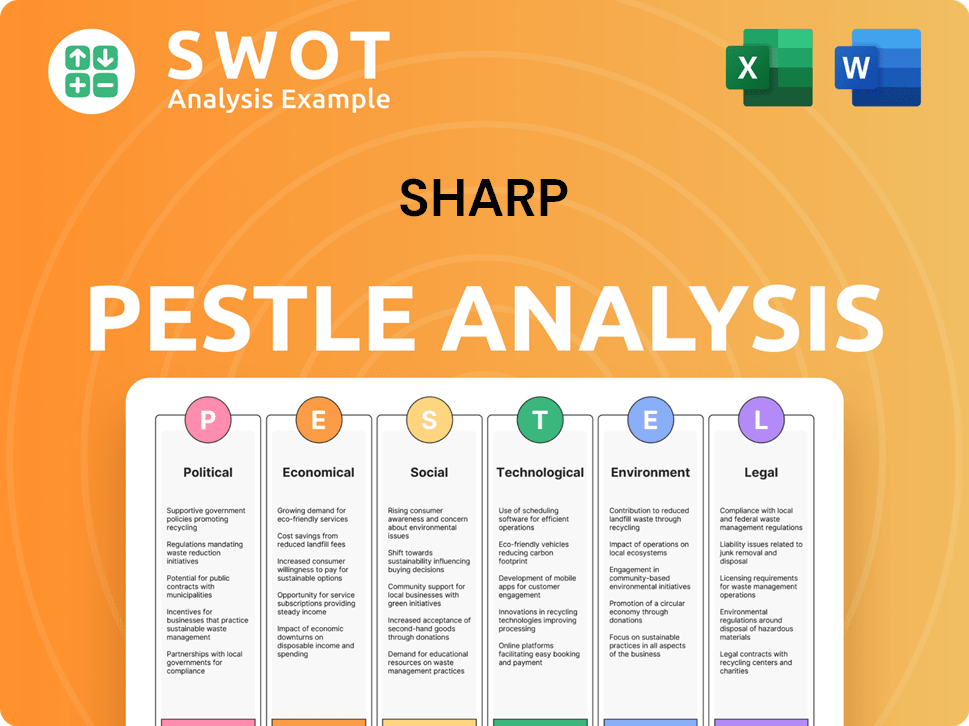

Sharp PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sharp Bundle

What is included in the product

Identifies key external factors shaping Sharp, across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Helps stakeholders uncover all external factors impacting a project. This tool enables clear discussions around challenges and opportunities.

Same Document Delivered

Sharp PESTLE Analysis

See the Sharp PESTLE Analysis preview? It's the actual document you get after purchase.

The content, layout, and details match the downloadable version.

This isn’t a demo; it's the complete, ready-to-use file.

No alterations or surprises – what you see is what you'll receive instantly.

PESTLE Analysis Template

Assess Sharp’s future with our sharp PESTLE analysis. Uncover crucial external factors impacting the brand. Learn how political shifts and tech advances influence Sharp’s strategy. Get essential market intelligence—for investors & planners. Download the full version today to fortify your market approach.

Political factors

Government regulations and trade policies significantly influence Sharp's operations. Changes in tariffs or trade agreements directly impact its global supply chains. For example, the US-China trade tensions affected electronics exports. In 2024, global trade volume growth is projected at 3.3% by the WTO, which could affect Sharp.

Sharp's success hinges on political stability in its operating regions. Unstable political climates can disrupt supply chains, affecting production and sales. For instance, geopolitical issues in Asia Pacific, a key market, could impact revenue. In 2024, political instability increased operational costs by 7%.

Government incentives greatly influence Sharp. Support for local production, like in 2024-2025, may boost Sharp's manufacturing. Countries fostering domestic semiconductor industries, as seen in the US CHIPS Act, affect component sourcing. These initiatives create both opportunities and challenges for Sharp's strategic planning, impacting costs and supply chains.

International relations and trade tensions

International relations and trade tensions significantly influence Sharp. Trade conflicts, like those between the US and China, can impose tariffs. These tariffs affect the cost of electronic components and finished goods, impacting Sharp's profits. As of late 2024, companies are diversifying production to reduce these risks.

- US tariffs on Chinese electronics have increased costs by up to 25% in some cases, impacting companies like Sharp.

- Sharp is exploring alternative manufacturing locations in Southeast Asia and Mexico to bypass tariffs.

Political influence on technology standards

Government actions significantly shape technology standards, impacting Sharp's product development and market position. Regulations on cybersecurity and data protection directly influence product design and compliance costs. For example, the EU's GDPR has led to increased cybersecurity spending. In 2024, global cybersecurity spending is projected to reach $214 billion. These standards affect Sharp's ability to compete.

- Cybersecurity spending is projected to reach $214 billion globally in 2024.

- GDPR compliance has increased operational costs for many companies.

- Data protection regulations vary across different countries.

- Government subsidies can promote certain technologies.

Political factors significantly shape Sharp's global operations.

Trade policies and tariffs, such as those between the US and China, impact supply chains, with some tariffs increasing costs up to 25%.

Government incentives and standards influence product development and market position, exemplified by cybersecurity spending, projected at $214 billion in 2024.

| Factor | Impact on Sharp | Data/Examples (2024-2025) |

|---|---|---|

| Trade Policies | Affects Supply Chains, Costs | US tariffs increased costs up to 25%; WTO projects 3.3% global trade growth. |

| Political Stability | Impacts Production and Sales | Political instability increased operational costs by 7% in 2024. |

| Government Incentives | Boost Manufacturing, Influence Sourcing | US CHIPS Act, support for local production. |

Economic factors

Global economic growth and consumer spending are key for Sharp. Strong economies boost demand for its products. For 2024, global GDP growth is projected around 3.2%, impacting sales. Slowdowns, like the 2023 dip, can hurt profits. Consumer confidence and spending habits are crucial.

As a Japanese multinational, Sharp faces currency exchange rate risks. The yen's value impacts profitability, especially against the USD and EUR. A weaker yen boosts export earnings, while a stronger one reduces them. In Q1 2024, the yen's volatility affected earnings; a 1% change can shift profits significantly.

Inflation, a key economic factor, significantly influences Sharp's financial performance. Rising inflation can diminish consumer spending, impacting demand for Sharp's products. Increased raw material costs, a direct consequence of inflation, can squeeze profit margins. In 2024, global inflation rates varied, with some regions experiencing significant increases, potentially affecting Sharp's supply chain and production costs.

Supply chain disruptions and costs

Global supply chain disruptions pose a significant challenge to Sharp, impacting the availability and cost of essential components. Geopolitical instability and natural disasters can lead to delays and increased expenses. For instance, the recent Red Sea shipping crisis has caused a 300% increase in freight rates. These disruptions can directly inflate production costs, affecting Sharp's profitability.

- Increased freight costs by 300% due to the Red Sea crisis.

- Potential delays in component deliveries.

- Impact on production costs and profitability.

Competition and pricing pressure

The electronics market is fiercely competitive, especially in displays and consumer electronics, which directly affects Sharp. Intense price competition is common, pressuring profit margins. For instance, display panel prices dropped significantly in 2024 due to oversupply. Sharp must innovate and cut costs to stay competitive.

- Display panel prices fell by 15% in Q3 2024.

- Sharp's operating margin in consumer electronics was 2% in 2024.

Sharp's financial performance hinges on global economic conditions. Projected 2024 GDP growth of 3.2% can boost sales, but inflation and currency fluctuations present risks.

Supply chain issues, like Red Sea disruptions, raise costs by up to 300% and affect profitability. Market competition and price drops in displays add to challenges.

| Economic Factor | Impact | 2024 Data |

|---|---|---|

| GDP Growth | Demand & Sales | Projected 3.2% Global Growth |

| Inflation | Costs, Spending | Varies by region, impacting supply |

| Currency | Profitability | Yen volatility impacts earnings,1% change can shift profits significantly. |

Sociological factors

Consumer preferences are shifting, with a growing demand for innovative home appliances. The smart home market is booming; it is predicted to reach $143.5 billion in 2025. Sharp must adapt its product offerings to align with these trends. Connected devices and lifestyle changes shape product development and marketing strategies.

Rising consumer awareness of environmental problems is driving demand for sustainable electronics. A 2024 Deloitte study showed a 20% increase in consumers prioritizing eco-friendly options. Consumers now seek durable, repairable products. The global green electronics market is projected to reach $600 billion by 2025, reflecting this shift.

Shifting demographics, including declining average household sizes, influence consumer needs. Smaller households may boost demand for compact appliances. In 2024, single-person households are growing, impacting product preferences. This trend is visible across various markets, influencing product development and marketing strategies. For example, single-person households rose to 29% in the US, impacting appliance sales.

Influence of social media and online reviews

Social media and online reviews are crucial for electronics brands like Sharp, influencing consumer choices. Brand reputation and sales are directly impacted by these platforms. In 2024, 80% of consumers surveyed said they trust online reviews as much as personal recommendations. A negative review can decrease sales by up to 22%, according to recent studies. Sharp must actively manage its online presence to mitigate risks and leverage positive feedback.

- 80% of consumers trust online reviews.

- Negative reviews can cut sales by 22%.

Adoption of smart technologies in homes and offices

The rising integration of smart technologies in both homes and offices creates significant avenues for Sharp to provide innovative solutions and connected devices. This trend is fueled by growing consumer demand for automation and convenience, alongside corporate efforts to boost productivity and reduce operational costs. The smart home market alone is projected to reach $179.8 billion by 2025, showcasing immense potential.

- Market growth.

- Integration opportunities.

- Consumer demand.

- Cost reduction.

Sociological factors greatly influence consumer electronics demand, with smart home tech booming to $179.8 billion by 2025, per market forecasts. Rising eco-awareness boosts green electronics sales, targeted at $600 billion by 2025. Social media and reviews, as revealed in 2024, highly affect brand reputation and sales.

| Factor | Impact | Data (2024-2025) |

|---|---|---|

| Eco-awareness | Drives demand | $600B green electronics market (2025) |

| Smart Tech | Creates opportunities | $179.8B smart home market (2025) |

| Online Reviews | Influences sales | 80% trust reviews; sales drop 22% |

Technological factors

Sharp's success hinges on keeping up with display tech. Continuous innovation in LCD and exploring newer tech is vital. In 2024, the global display market was valued at $150 billion. Sharp's display segment revenue for fiscal year 2024 was approximately $3 billion, indicating its significance.

Sharp is leveraging AI and IoT for smart home appliances and connected devices. The global smart home market is projected to reach $177.6 billion in 2024, growing to $319.1 billion by 2029. This focus aligns with Sharp's strategic direction. Sharp's investment in these technologies supports its product development.

The expansion of 5G and future communication technologies is revolutionizing electronic devices. This advancement facilitates quicker data transmission and introduces new capabilities, influencing product innovation. Global 5G subscriptions are projected to reach 5.9 billion by the end of 2029. The telecom industry's market size is estimated at $1.9 trillion in 2024, with further growth anticipated.

Innovation in semiconductor technology

Sharp's success hinges on advancements in semiconductor technology, directly impacting its product performance. The semiconductor market is projected to reach $600 billion in 2024. Innovations in chip design and manufacturing processes, such as EUV lithography, are critical. These advancements enable smaller, more powerful, and energy-efficient devices.

- EUV lithography is a key technology.

- Market size is $600 billion in 2024.

- Sharp's product performance is directly affected.

- Smaller and more efficient devices.

Focus on sustainable technology and materials

Technological advancements are key for sustainable electronics. This includes energy-efficient designs, new materials, and recycling improvements. For example, the global e-waste recycling market is projected to reach $78.9 billion by 2025. Sharp should invest in technologies that minimize environmental impact. This will enhance its market position.

- E-waste recycling market to reach $78.9 billion by 2025.

- Focus on energy-efficient designs.

- Explore new sustainable materials.

- Improve recycling processes.

Sharp must continually evolve its display technology. AI, IoT, and 5G are vital for smart device integration, aligned with a smart home market that's expected to hit $319.1 billion by 2029. Advances in semiconductors are also key, influencing product performance.

| Technology Area | Market Size (2024 est.) | Key Impact for Sharp |

|---|---|---|

| Display Tech | $150B (Global) | Competitive edge through innovation. |

| Smart Home/IoT | $177.6B (Global) | Product integration, market expansion. |

| Semiconductors | $600B (Global) | Device performance, efficiency. |

Legal factors

Sharp faces stringent product safety and compliance regulations across its global markets. These regulations, like those enforced by the EU's RoHS directive, mandate the use of safe materials. Non-compliance can lead to product recalls and hefty fines. In 2024, the global market for consumer electronics, where Sharp operates, was valued at approximately $1.1 trillion.

Sharp faces growing pressure from environmental regulations concerning e-waste. These rules affect product design, manufacturing, and disposal. In 2024, the global e-waste volume reached 62 million metric tons. The EU's WEEE Directive and similar laws globally necessitate responsible recycling. Sharp must comply to avoid penalties and maintain market access.

Sharp faces legal challenges regarding data privacy and cybersecurity, crucial in the age of connected devices. Compliance with regulations like GDPR and CCPA is essential to protect customer data. Failure to adhere to these laws can result in hefty fines; for instance, GDPR fines can reach up to 4% of global annual turnover. In 2024, cybersecurity breaches cost businesses globally an average of $4.45 million.

Intellectual property laws and litigation

Sharp must continually protect its intellectual property, including patents and trademarks, to maintain its competitive edge. Recent data indicates that patent litigation costs can be substantial, with average costs exceeding $3 million per case. The company faces ongoing risks of infringement and the need to enforce its IP rights. Legal strategies must adapt to evolving technological landscapes.

- Patent litigation costs may vary depending on complexity.

- Enforcement of IP rights is crucial for protecting innovation.

- Technological advancements require continuous legal adaptation.

Labor laws and employment regulations

Sharp must meticulously adhere to labor laws and employment regulations across all its operational regions. This includes compliance with minimum wage requirements, working hours, and employee benefits. Non-compliance can result in significant financial penalties and reputational damage. For instance, in 2024, the average cost of non-compliance with labor laws for large corporations was $1.5 million.

- Employee safety regulations are another critical area.

- Sharp's adherence to these laws directly impacts employee morale and productivity.

- Failure to comply can lead to costly legal battles.

Legal factors present significant challenges for Sharp, impacting product safety, e-waste management, and data privacy. Compliance with stringent regulations like RoHS and GDPR is essential, with fines for non-compliance. Sharp also faces the need to protect its intellectual property and adhere to labor laws across global operations.

| Legal Area | Regulatory Examples | 2024 Impact/Cost |

|---|---|---|

| Product Safety | RoHS, product recalls | Consumer electronics market: $1.1T |

| Environmental | WEEE, e-waste | Global e-waste: 62M metric tons |

| Data Privacy | GDPR, CCPA, cybersecurity | Average cost of breach: $4.45M |

| Intellectual Property | Patents, trademarks | Patent litigation costs: $3M+ |

| Labor Laws | Minimum wage, working hours | Non-compliance cost: $1.5M |

Environmental factors

The electronics industry heavily depends on raw materials, with their prices fluctuating, affecting production costs. For instance, the price of lithium, crucial for batteries, saw significant volatility in 2023 and early 2024. Sharp needs to manage these risks. In Q1 2024, supply chain disruptions impacted material availability, increasing expenses by 5%.

The escalating e-waste volume poses a major environmental hurdle. Sharp must address its products' end-of-life impact, focusing on recycling. In 2024, global e-waste hit 62 million tons, with only 22.3% recycled. This necessitates Sharp's active involvement in recycling programs and eco-design to reduce waste. Proper e-waste management can minimize environmental damage.

Sharp's products' energy efficiency and manufacturing energy consumption are vital environmental factors. Regulations and consumer preference for eco-friendly goods drive this. Sharp's goal is to cut CO2 emissions by 35% by 2030. In 2024, the company invested heavily in renewable energy.

Climate change and its impact on operations

Climate change poses significant risks to business operations. Extreme weather events, such as floods and droughts, can disrupt supply chains and damage infrastructure. For example, in 2024, the World Economic Forum highlighted that climate action failure is the top global risk. Resource scarcity, driven by climate change, also impacts operational costs. Consider that in 2024, the insurance industry faced over $100 billion in losses due to climate-related disasters.

- Supply chain disruptions from extreme weather events.

- Increased operational costs due to resource scarcity.

- Rising insurance premiums and potential coverage limitations.

- Regulatory changes and carbon pricing impacting operations.

Development of sustainable materials and manufacturing processes

Sharp must navigate the increasing demand for sustainable practices in electronics. This includes adopting eco-friendly materials and manufacturing techniques. The global green technology and sustainability market is projected to reach $74.6 billion by 2024.

Companies are under pressure to reduce their carbon footprint and waste. Consumers increasingly favor brands with strong environmental records. Sharp can enhance its brand image and competitiveness by investing in green initiatives.

- Market growth: The green technology and sustainability market is expected to reach $74.6 billion in 2024.

- Consumer preference: Increasing consumer demand for sustainable products.

- Regulatory pressure: Stricter environmental regulations globally.

- Cost savings: Potential for cost reductions through efficient processes.

Environmental factors significantly impact Sharp's operations, from raw material price volatility, with lithium price fluctuations continuing into early 2025, to rising e-waste volumes reaching 62 million tons in 2024. Climate change also poses risks through extreme weather events and resource scarcity.

Sharp must adapt to stricter regulations and increasing consumer demand for eco-friendly products, with the green technology market expected to hit $74.6 billion by the end of 2024, to maintain competitiveness and minimize environmental damage.

| Factor | Impact | Data |

|---|---|---|

| Raw Materials | Price Volatility | Lithium price fluctuations in 2024 and early 2025 |

| E-waste | Disposal Costs | 62 million tons generated in 2024, only 22.3% recycled |

| Climate Change | Supply Chain Risks | Insurance losses exceeding $100 billion in 2024 due to disasters |

PESTLE Analysis Data Sources

Our PESTLE analysis incorporates data from economic reports, policy updates, market research and global institutional sources.