Sheetz Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sheetz Bundle

What is included in the product

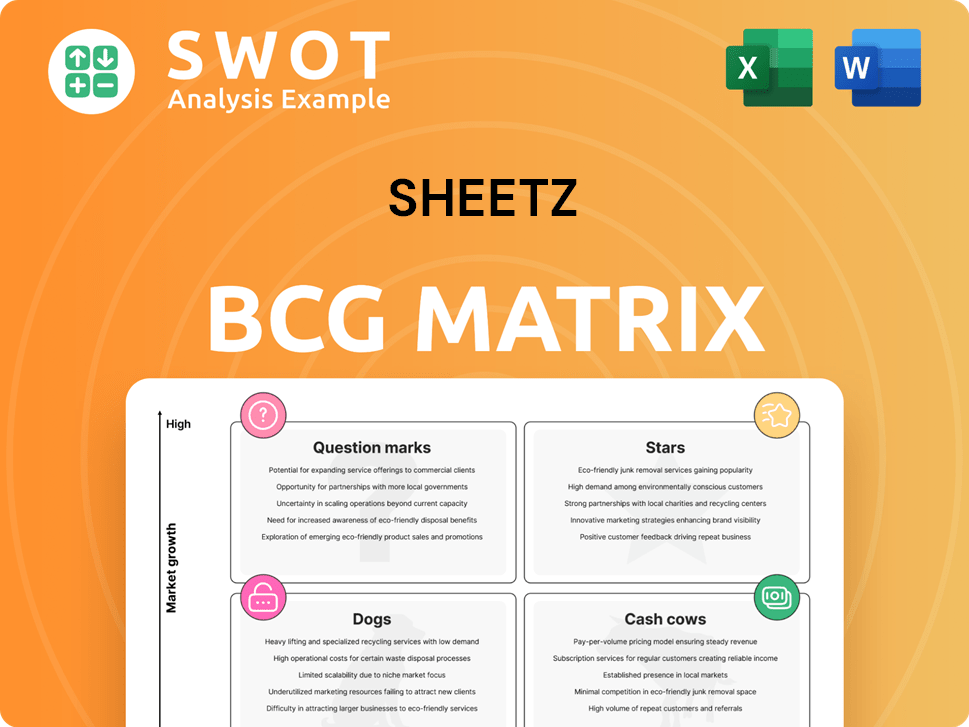

Analyzing Sheetz's diverse offerings with the BCG Matrix, pinpointing strategic actions across quadrants.

One-page overview placing each business unit in a quadrant.

What You’re Viewing Is Included

Sheetz BCG Matrix

The Sheetz BCG Matrix preview mirrors the complete document you'll receive. This strategic tool, fully realized upon purchase, offers clear insights for your analysis. Get immediate access to this refined, ready-to-use BCG Matrix, without hidden content. Download and utilize the same professional-grade report you're viewing now.

BCG Matrix Template

Sheetz, a beloved convenience store chain, likely has a diverse portfolio of products. Consider the competitive landscape: fuel, food, and loyalty programs. This analysis suggests potential 'Stars' like innovative food options. Also, some items could be 'Cash Cows', like consistent fuel sales.

Uncover Sheetz's strategic positioning with our in-depth BCG Matrix. Explore the complex relationships between its offerings and market share. Gain a clear view of where its products stand. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Sheetz is aggressively expanding into Michigan, a "Star" in its BCG matrix. Starting in 2024, Sheetz aims for 50-60 stores in southeastern Michigan over 5-6 years. This expansion creates jobs and boosts local economies. Sheetz's 2024 revenue was ~$11 billion, showing strong growth potential.

Sheetz's partnership with IONNA to install over 50 EV 'Rechargeries' by 2026 is a star in the BCG matrix, as it capitalizes on the expanding EV market. This collaboration boosts Sheetz's charging infrastructure, aligning with future-focused services. In 2024, EV sales increased, reflecting the growing demand. Loyalty programs and incentives, planned for 2025, will further engage customers with EV charging at Sheetz locations.

Sheetz's Made-to-Order (MTO) program remains a key competitive advantage, providing customizable food choices. This program's popularity is underscored by its 'Coolest Thing Made in PA' recognition. MTO boosts in-store sales and, consequently, fuel sales. In 2024, Sheetz reported a 6.2% increase in same-store sales, partly due to MTO's success.

Technology and Innovation Hub

Sheetz's tech hub in Pittsburgh is a strategic move to lead in innovation. This hub lets Sheetz create new offerings and improve customer experiences. The focus on innovation supports Sheetz's goal to be the go-to one-stop shop. Sheetz invested $70 million in 2024 for technological advancements.

- Investment in technology and innovation.

- Development and testing of new services.

- Meeting and exceeding customer expectations.

- $70 million invested in 2024.

Strong Brand Reputation

Sheetz's strong brand reputation is a key strength, consistently earning accolades. This positive image helps attract and keep top talent, which is vital for customer service. Happy employees usually lead to higher customer satisfaction, strengthening brand loyalty. In 2024, Sheetz's revenue was approximately $13.5 billion.

- Employee satisfaction scores consistently above industry averages.

- High customer loyalty rates, driven by positive brand perception.

- Strong social media presence, enhancing brand recognition.

- Sheetz's commitment to community involvement strengthens its image.

Sheetz's "Stars" include Michigan expansion and EV charging. These initiatives drive revenue growth and market share. MTO and tech investments also contribute to the "Stars."

| Strategy | Data (2024) | Impact |

|---|---|---|

| Michigan Expansion | $11B Revenue | Creates Jobs |

| EV Charging | Increased EV Sales | Customer Engagement |

| MTO | 6.2% Same-Store Sales | Boosts Sales |

Cash Cows

Sheetz excels in Pennsylvania, holding a strong market share, especially in Altoona, Pittsburgh, and Harrisburg. This widespread presence ensures steady revenue and brand recognition. Fuel and tobacco sales are significant revenue drivers. Sheetz's robust performance in Pennsylvania showcases its cash cow status. In 2024, the company's revenue reached $10 billion.

My Sheetz Rewardz is a major loyalty program, boosting customer retention. It uses points, monthly deals, and pump savings. The tiered structure (Fan, Friend, Freak) motivates higher brand interaction. Sheetz was recognized among America's Best Loyalty Programs. The program's success is reflected in its high customer engagement rates.

Sheetz's 24/7 operations are a cash cow, ensuring a steady income flow by serving customers anytime. This constant accessibility boosts its appeal over rivals with restricted hours. In 2024, Sheetz saw a 7% rise in same-store sales, showing how vital around-the-clock service is. It strengthens their image as a dependable, convenient choice for various needs.

Fuel Sales

Sheetz's fuel sales are a cornerstone of its cash cow status, significantly boosted by its successful in-store offerings. Strategically positioned near highways and busy areas, Sheetz captures high traffic volumes, increasing fuel sales. They cater to a broad clientele by providing various fuel choices, including E85 and E15. Fuel sales consistently contribute substantially to overall revenue, solidifying their position.

- Sheetz operates over 700 locations.

- Fuel sales represent a significant portion of total revenue.

- The company's strategy focuses on maximizing fuel sales alongside in-store purchases.

Tobacco Sales

Sheetz relies on tobacco sales, particularly cigarettes, for a steady revenue stream, often pricing them at state minimums. This generates consistent income, though regulatory pressures are growing. High tobacco sales regularly boost Sheetz's financial results. Tobacco sales continue to be a cash cow for Sheetz.

- Tobacco sales contribute significantly to Sheetz's revenue.

- Cigarettes are often sold at state minimum prices.

- This provides a stable, although potentially challenged, income stream.

- Sales are a consistent contributor to financial performance.

Sheetz's cash cow status is evident through steady revenue streams. Their presence in Pennsylvania and 24/7 operations drive consistent sales. Fuel and tobacco sales remain significant contributors.

| Aspect | Details | Financial Impact (2024) |

|---|---|---|

| Revenue | Over 700 stores | $10B |

| Loyalty Program | Sheetz Rewardz drives customer retention | High engagement rates |

| Operations | 24/7 availability boosts sales | 7% same-store sales increase |

Dogs

Sheetz's presence in major cities, such as Philadelphia, is notably limited. Wawa, a direct competitor, dominates these markets. This lack of presence restricts Sheetz's growth potential. Expanding into these areas demands substantial investment and strategic planning, especially considering the high costs.

The EEOC lawsuit against Sheetz concerning discriminatory hiring practices, particularly regarding criminal background checks, presents a significant threat. This legal challenge endangers Sheetz's reputation and financial standing. A resolution is critical to preserve its brand image, especially with consumers increasingly valuing ethical business practices. The lawsuit could force changes in hiring protocols and potentially result in substantial financial penalties; in 2024, similar cases have seen settlements ranging from $500,000 to several million dollars.

Sheetz's expansion plans have hit snags. Metro Detroit and Fraser, MI, residents voiced concerns about competition and environmental issues. Demolition of landmarks also fueled resistance. Addressing these worries is vital for Sheetz's growth. Engaging with locals can ease opposition.

Price Fluctuations

Sheetz, categorized as a "Dog" in the BCG Matrix, faces challenges from market price fluctuations. Rising fuel prices, for instance, directly impact their operational costs. These fluctuations can squeeze profit margins and influence customer spending habits, as seen in 2024 when gas prices varied significantly. Efficiently managing inventory and controlling costs are crucial strategies to lessen the impact of these market swings.

- Fuel prices directly influence Sheetz's profitability.

- Customer spending habits are affected by price changes.

- Inventory and cost management are critical for risk mitigation.

- Market fluctuations lead to unpredictable outcomes.

Competition

Sheetz operates in a highly competitive market, battling against major players like Wawa, QuikTrip, and Casey's. To stay ahead, Sheetz must stand out with unique offerings and superior customer service. Maintaining a competitive edge requires ongoing innovation and adaptation to changing consumer preferences. The convenience store market is crowded, and Sheetz must be agile to succeed.

- Wawa's 2023 revenue reached approximately $16.5 billion.

- QuikTrip's 2023 revenue was around $11.2 billion.

- Casey's reported $16.2 billion in revenue for fiscal year 2024.

Sheetz, as a "Dog," struggles with market volatility and intense competition, impacting its financial performance. Rising fuel costs directly affect profitability and customer behavior, as observed in 2024. Effective cost management and innovation are crucial for survival in a crowded market.

| Metric | Value (Approx.) |

|---|---|

| Estimated 2024 Fuel Cost Impact | 5-10% of Operating Costs |

| Convenience Store Market Growth (2024) | 2-4% |

| Average Customer Spend Change (2024) | -1% to +2% (depending on gas price) |

Question Marks

Sheetz's foray into states like Michigan and Ohio, as of 2024, is a high-growth, high-risk venture. These expansions demand considerable capital for construction, estimated at roughly $5-7 million per store. Successfully entering these markets hinges on understanding local consumer behavior and outmaneuvering rivals like Meijer or Speedway.

Sheetz's collaboration with IONNA for EV charging is a potential growth area, but faces uncertainties. The speed of EV uptake and the financial returns of charging stations are major question marks. In 2024, EV sales growth slowed, rising 2.7% in Q4, impacting infrastructure ROI. Continued investment and market analysis are crucial for success.

Introducing new food and beverage options, like gourmet doughnuts and customizable tater totz, can draw in new customers and boost sales. Success hinges on consumer interest and smart marketing. Sheetz's focus on innovation and testing is key. In 2024, Sheetz saw a 7% rise in overall food sales due to these strategies.

Gamification and Digital Engagement

Sheetz's moves, like entering Fortnite, show they're trying to grab younger crowds. Gamifying their loyalty program is another way to boost engagement. The real question is: will these digital efforts stick and pay off long-term? Keeping an eye on how well these strategies work and being ready to change with what customers want is key.

- Sheetz has over 600 stores across six states.

- Fortnite's user base includes millions of young people, a key demographic for Sheetz.

- Loyalty programs can boost sales by 10-20%, but success varies.

- Digital engagement strategies require constant monitoring and adaptation to consumer trends.

Sustainability Initiatives

Sheetz is increasingly focusing on sustainability, recognizing its importance to consumers. This includes initiatives like renewable energy agreements and waste reduction programs. While these efforts enhance brand image, their direct financial impact is still developing. Sheetz can attract environmentally conscious customers by investing in and promoting its sustainability efforts.

- Sheetz has been implementing solar energy projects at several store locations to reduce its carbon footprint.

- The company is also working on waste reduction strategies, including recycling programs and efforts to minimize packaging.

- These initiatives are part of a broader trend where consumers increasingly favor brands with strong sustainability commitments.

Sheetz's question marks involve high-risk, high-reward ventures with uncertain outcomes. These include new market entries and EV charging initiatives, demanding significant investment. Success depends on market analysis, consumer adoption rates, and strategic execution. Digital marketing and sustainability also fall into this category.

| Initiative | Risk | Reward |

|---|---|---|

| New Markets | High Investment, Competition | High Growth Potential |

| EV Charging | Slow EV Uptake, ROI Uncertain | Potential Revenue Stream |

| Digital Marketing | Engagement Challenges | Increased Customer Loyalty |

BCG Matrix Data Sources

Our Sheetz BCG Matrix draws upon internal sales data, competitor analysis, and market share research for strategic assessment.