Sheetz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sheetz Bundle

What is included in the product

Evaluates control held by suppliers and buyers, and their influence on pricing and profitability.

Instantly see strategic pressure with a powerful spider/radar chart—no more guesswork!

Preview Before You Purchase

Sheetz Porter's Five Forces Analysis

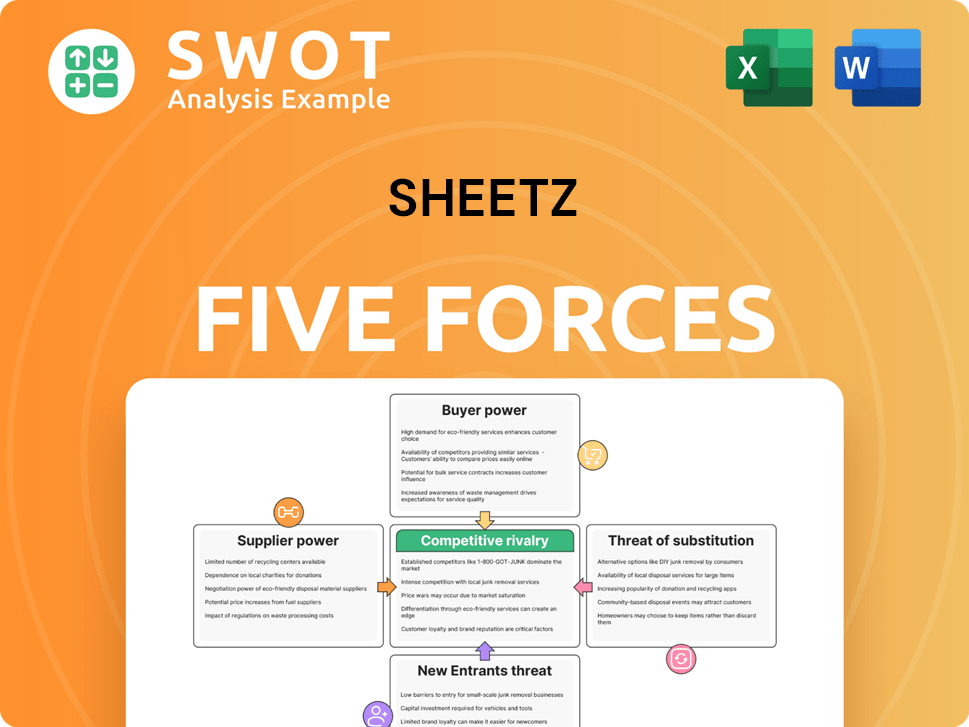

This preview details Sheetz's Porter's Five Forces analysis, covering competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants. You're viewing the complete document—exactly what you'll download immediately after purchase.

Porter's Five Forces Analysis Template

Sheetz navigates a complex convenience store landscape. Analyzing its competitive environment via Porter's Five Forces helps uncover key vulnerabilities and strengths. Buyer power, like the impact of consumer preferences, shapes its strategy. Understand the threat of new entrants, such as emerging competitors, as well as substitute products like quick-service restaurants. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Sheetz’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Sheetz faces supplier power challenges due to a limited number of major suppliers. A concentrated supplier base for gasoline, food, and beverages reduces Sheetz's switching options. This dependence allows suppliers to potentially increase prices. In 2024, rising supply costs affected Sheetz's operational margins.

For commodity products like gasoline, suppliers hold considerable power due to market dynamics and price volatility. Sheetz's profits are sensitive to fluctuating gasoline prices set by suppliers. In 2024, gasoline prices have seen notable swings, impacting retailers. Sheetz must carefully manage inventory and pricing to mitigate risks.

Sheetz's regional focus potentially increases supplier power due to concentrated supply networks. Established regional suppliers often possess advantages, including existing infrastructure and relationships. This can make switching costly for Sheetz, enhancing supplier leverage. In 2024, regional food distributors saw a 5% rise in prices, impacting chains like Sheetz. This highlights the impact of supplier concentration.

Differentiation in specialty items

Sheetz's reliance on unique suppliers is a key factor in its operations. Suppliers of specialty food and beverages, which often differentiate Sheetz from competitors, can wield significant power. These suppliers' control over exclusive items can impact Sheetz's product offerings and pricing strategies. For instance, in 2024, Sheetz expanded its proprietary food offerings, increasing its dependence on these specialized suppliers.

- Exclusive product lines like Sheetz Bros. Coffee and made-to-order foods rely on specific suppliers.

- The scarcity of alternatives for these unique items enhances supplier leverage.

- Supplier power can influence Sheetz's cost of goods sold and profit margins.

- Successful differentiation hinges on managing these supplier relationships effectively.

Contract negotiation effectiveness

Sheetz's success hinges on its ability to negotiate favorable contracts with suppliers, which is crucial for mitigating supplier power. Strong negotiation skills and purchasing volume allow Sheetz to secure better terms. Effective contract management ensures a competitive cost structure and a stable supply chain. In 2024, Sheetz's cost of goods sold represented approximately 65% of its revenue.

- Negotiating lower prices reduces costs.

- Volume discounts are key to profitability.

- Stable supply chains prevent disruptions.

- Effective contract management is essential.

Sheetz contends with supplier power, particularly from concentrated gasoline, food, and beverage providers. This concentration limits Sheetz's ability to switch suppliers and potentially raises costs. In 2024, rising supply costs, including regional food distributor price hikes, impacted profitability, as cost of goods sold reached approximately 65% of revenue. Strategic negotiation is key.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supplier Concentration | Reduced Switching Options | Gasoline price volatility |

| Commodity Suppliers | Price Sensitivity | Regional food price rise of 5% |

| Specialty Suppliers | Impact on Product Offerings | COGS ~65% of Revenue |

Customers Bargaining Power

Customers are often price-sensitive, particularly for gasoline, boosting their bargaining power. Sheetz needs competitive pricing to keep customers. Competitors' price wars or promotions can significantly affect Sheetz's sales. In 2024, gasoline prices fluctuated, impacting Sheetz's profitability. Lower prices at competitors can drive customers away.

Customers of convenience stores like Sheetz face low switching costs. This means they can easily choose competitors. To compete, Sheetz must offer great value.

Sheetz needs to innovate constantly. They must provide excellent service. This helps build customer loyalty. In 2024, the convenience store market saw intense competition, with margins under pressure.

Sheetz faces strong customer bargaining power due to the availability of alternatives. Customers can easily switch to competitors, including Wawa, 7-Eleven, and local options. This competitive landscape forces Sheetz to offer competitive pricing and promotions. In 2024, the convenience store market is estimated to be worth over $700 billion in the US, highlighting the abundance of choices.

Information transparency

Customers wield significant power due to information transparency. They can easily access pricing data through apps and online tools, enabling informed choices. Price comparison tools pressure Sheetz to keep prices competitive. To stay ahead, Sheetz must use tech and data analytics to understand customer preferences and refine pricing.

- Digital tools provide instant price comparisons.

- Sheetz faces pressure to match competitor pricing.

- Data analytics help Sheetz understand customer behavior.

- This leads to optimized pricing strategies.

Brand loyalty influence

Strong brand loyalty diminishes customer bargaining power because loyal customers are less sensitive to price changes. Sheetz has successfully built a strong brand through its high-quality offerings and excellent customer service. This loyalty allows Sheetz to maintain pricing strategies without significant customer loss. Maintaining this loyalty is crucial for Sheetz to withstand price wars and keep a steady customer base.

- Sheetz's customer satisfaction scores consistently rank high, reflecting strong brand loyalty.

- Loyal customers are less likely to switch to competitors, even with minor price differences.

- Sheetz's focus on quality helps foster this loyalty, protecting it from price-based competition.

Customers' bargaining power impacts Sheetz significantly. They have numerous choices, including gas stations and convenience stores. Sheetz must offer competitive prices and promotions to retain customers. Brand loyalty helps mitigate customer power.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Price Sensitivity | High | Gas prices fluctuated, affecting profitability. |

| Switching Costs | Low | Customers can easily switch to competitors. |

| Brand Loyalty | Mitigating | Sheetz satisfaction scores remain high. |

Rivalry Among Competitors

The convenience store and gas station sector is fiercely competitive. Sheetz competes with major players like Wawa, 7-Eleven, and Speedway. This rivalry pushes Sheetz to innovate. In 2024, the market saw increased consolidation and promotional wars. Sheetz must adapt to maintain its competitive edge.

Price wars, especially in gasoline, can greatly affect profits. Competitors often use aggressive pricing to draw customers. Sheetz needs careful pricing to stay competitive and keep profit margins, a tough balance in a price-focused market. In 2024, gas price fluctuations saw significant regional differences, with some areas experiencing intense price competition impacting retailer profitability.

Sheetz, like other convenience stores, battles rivals by differentiating its offerings. They use MTO food and customer-focused service. This strategy helps them stand out. Sheetz must innovate to stay ahead. For instance, in 2024, Sheetz reported revenues of $11.8 billion, showing the importance of these efforts.

Market saturation

Sheetz faces intense competition due to market saturation, particularly in areas with many convenience stores and gas stations. The high density of competitors means customers have many choices nearby. For instance, in 2024, the average distance between gas stations in urban areas was just 0.7 miles. To thrive, Sheetz must prioritize strategic location choices, as seen in their expansion into less saturated markets, and focus on superior store design. This design includes offering unique products and services to draw customers away from rivals in crowded markets.

- High competition in urban areas.

- Strategic location is key for success.

- Superior store design helps attract customers.

- Focus on unique offerings.

Expansion strategies

Aggressive expansion by rivals, like Wawa, intensifies competition for Sheetz. New store openings in Sheetz's areas can chip away at its market share. Sheetz must strategically plan its growth to defend its position against competitors. In 2024, Sheetz has faced increased competition, with Wawa's expansion into new markets. This has led to a slight dip in Sheetz's same-store sales growth compared to the previous year.

- Wawa has been expanding aggressively, with plans to open numerous new stores in direct competition with Sheetz.

- Sheetz's market share has faced pressure in areas where competitors have increased their presence.

- Sheetz needs to carefully select new locations and innovate its offerings to stay ahead.

Competitive rivalry in the convenience store sector is fierce. Sheetz battles Wawa, 7-Eleven, and others, leading to innovation. Price wars and market saturation add to the pressure. Expansion by rivals, like Wawa, increases the challenges.

| Aspect | Impact on Sheetz | 2024 Data |

|---|---|---|

| Price Wars | Reduced profit margins | Gas price volatility; margins tightened by 2-3% |

| Market Saturation | Increased competition for customers | Avg. distance between gas stations: 0.7 miles in urban areas |

| Rival Expansion | Market share pressure | Wawa opened 30+ stores near Sheetz locations; Sheetz's sales dipped |

SSubstitutes Threaten

Restaurants, fast-food chains, and grocery stores are direct substitutes, lessening demand for Sheetz's made-to-order (MTO) items. Consumers have countless meal and snack options beyond convenience stores. In 2024, restaurant sales in the U.S. are projected to reach $1.1 trillion, highlighting the vast competition. Sheetz must offer competitive quality, pricing, and convenience to retain customers.

Other gas stations are direct substitutes for Sheetz's gasoline, affecting revenue if prices aren't competitive. The abundance of options allows customers to switch based on price and location. In 2024, the average gas price fluctuated, so Sheetz needed to stay competitive. Maintaining competitive pricing and convenient locations is crucial for Sheetz to retain customers. Gas prices in 2024 varied, impacting consumer choices.

Coffee shops and cafes present a threat as they offer alternative beverages. Starbucks and Dunkin' are major competitors. Sheetz needs to differentiate its drinks. In 2024, Starbucks' revenue was over $36 billion, showcasing the competitive landscape. Sheetz must offer unique promotions.

Vending machines

Vending machines and automated kiosks pose a threat to Sheetz by offering convenient alternatives for quick snacks and drinks. These options provide immediate gratification for customers, especially in locations with limited alternatives. To compete, Sheetz needs to focus on enhancing its in-store experience to attract customers. For example, the global vending machine market was valued at $21.2 billion in 2023.

- Convenience: Vending machines offer 24/7 access.

- Price: Often lower prices on some items.

- Location: Readily available in various locations.

- Speed: Quick transactions.

Delivery services

Delivery services pose a significant threat to Sheetz. Platforms like DoorDash and Uber Eats enable customers to easily order food and groceries. These services offer convenience, potentially diverting customers from visiting Sheetz stores. To counter this, Sheetz needs to invest in its own delivery capabilities.

- DoorDash's revenue in 2023 was $8.6 billion.

- Uber Eats generated $11.1 billion in revenue in 2023.

- Sheetz has been expanding its delivery partnerships.

- Convenience is a key driver for consumers.

Alternative payment methods like mobile wallets and digital currencies threaten traditional payment systems, including those used by Sheetz. Consumers have more payment choices. In 2024, mobile payment transactions surged, with a 20% increase.

| Threat | Impact | 2024 Data |

|---|---|---|

| Mobile Wallets | Reduced card use | Mobile payments up 20% |

| Digital Currencies | Potential for volatility | Bitcoin market cap fluctuating |

| Online Payment Services | Increased Competition | PayPal's 2024 revenue $30B+ |

Entrants Threaten

The convenience store and gas station sector demands considerable upfront capital, acting as a significant hurdle for new businesses. Real estate, construction, and equipment expenses are substantial, often reaching millions of dollars. For instance, starting a new gas station can cost upwards of $3 million. This high initial investment limits the pool of potential competitors, as smaller businesses often struggle with such financial demands.

Established brands like Sheetz, Wawa, and 7-Eleven present a significant barrier to new competitors. These companies possess strong brand recognition and customer loyalty, developed over many years. New entrants face the challenge of building brand awareness and trust, requiring substantial investments in marketing. For instance, in 2024, Sheetz reported revenues exceeding $13 billion, showcasing their market dominance.

Stringent regulations and compliance requirements present significant challenges for new entrants. Securing permits and licenses, alongside navigating environmental regulations, can be intricate and time-intensive. These regulatory hurdles significantly elevate the costs and complexity of market entry, deterring potential competitors. For example, in 2024, the average time to obtain necessary permits in the U.S. for a new business was 6-12 months.

Economies of scale

Existing companies, like Sheetz, have cost advantages due to economies of scale in areas like purchasing, distribution, and marketing. They can secure better deals with suppliers and spread marketing expenses across a larger sales volume. New entrants often find it hard to compete with these established cost structures. For example, in 2024, Sheetz's revenue was approximately $14.5 billion, highlighting their scale.

- Large chains negotiate favorable supplier terms.

- Marketing costs are spread over more sales.

- New entrants face higher initial costs.

- Established players have a pricing edge.

Real estate availability

Securing real estate is a significant hurdle for new convenience store entrants, especially in competitive markets. Prime locations are often already taken by established brands. This scarcity limits newcomers' ability to establish a strong presence, impacting their market entry. The availability of desirable spots directly affects expansion plans and market share gains.

- Sheetz, with its aggressive expansion strategy, constantly seeks new locations, facing competition from existing players.

- In 2024, the top convenience store chains, like 7-Eleven and Circle K, control a large portion of the market, making it harder for new entrants to find suitable sites [3].

- Real estate costs and availability vary significantly by region, influencing where new stores can realistically open [8].

- The competition for locations drives up real estate prices, increasing the initial investment for new convenience stores [2].

The convenience store sector's high initial capital requirements, including real estate and construction, pose a barrier. Established brands like Sheetz have strong brand recognition and customer loyalty, making it hard for newcomers. Stringent regulations and the need for permits add to the complexity of market entry.

| Factor | Impact on New Entrants | 2024 Data |

|---|---|---|

| Capital Costs | High initial investment | Gas station startup: ~$3M+ |

| Brand Loyalty | Challenges building awareness | Sheetz revenue: ~$14.5B |

| Regulations | Time-consuming & costly | Permit time: 6-12 months |

Porter's Five Forces Analysis Data Sources

Sheetz's analysis leverages market share reports, financial statements, and industry publications.