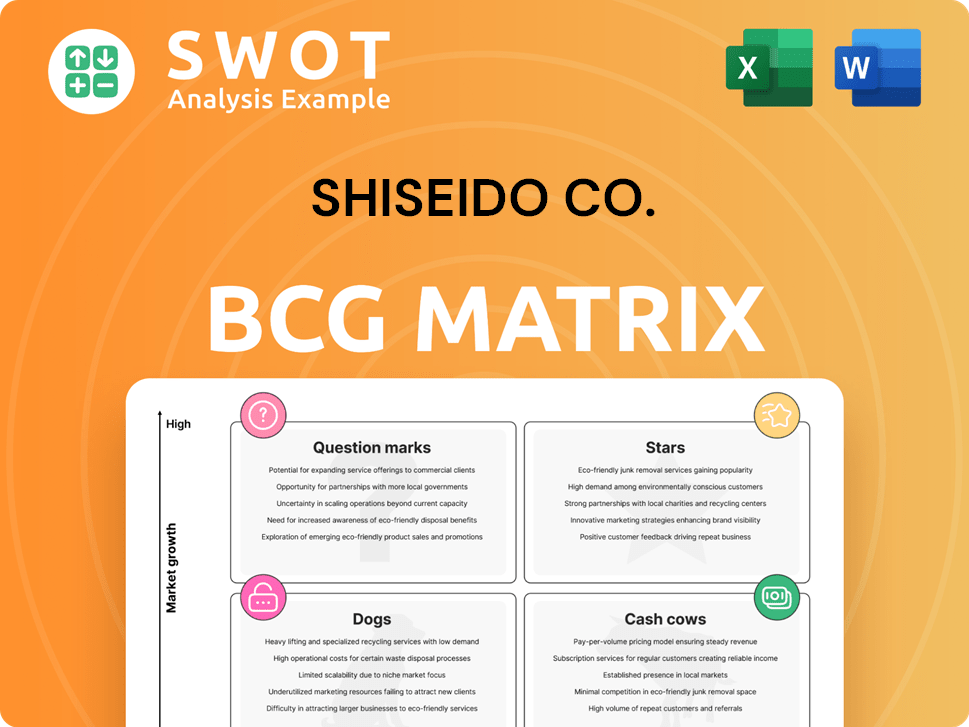

Shiseido Co. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shiseido Co. Bundle

What is included in the product

Shiseido's BCG matrix reveals strategic decisions: invest in Stars, milk Cash Cows, watch Question Marks, and consider Dogs.

One-page overview placing each business unit in a quadrant.

Preview = Final Product

Shiseido Co. BCG Matrix

The Shiseido Co. BCG Matrix you're previewing is the complete document you'll receive. It’s a ready-to-use strategic analysis, offering insights into Shiseido's business units. Download and immediately apply it to your strategic planning. Enjoy a clear, comprehensive, and easily customizable resource.

BCG Matrix Template

Shiseido Co.'s diverse portfolio, from skincare to cosmetics, presents a complex strategic landscape. Examining its products through the BCG Matrix helps reveal strengths and weaknesses. Understanding which brands are cash cows or stars is crucial. This framework aids in resource allocation and identifying growth opportunities. Are some products dogs? This analysis can guide decisions. Purchase the full BCG Matrix for in-depth insights and strategic recommendations.

Stars

The Shiseido brand shines as a Star within Shiseido Co.'s portfolio, demonstrating robust growth in key markets like Japan and Europe. It's a central brand, enjoying global recognition and a strong emphasis on pioneering new products. In 2024, Shiseido's prestige brands saw sales increase, reflecting its strong market position. This strategic focus on innovation and global expansion has helped the brand remain competitive.

Clé de Peau Beauté shines as a star within Shiseido. It's a luxury skincare brand popular in Japan and China, known for its loyal customer base. In 2024, its sales in China grew by 20% year-over-year, showcasing its strong market position. This brand's high-quality products drive its success.

NARS, under Shiseido, shines as a star in the BCG matrix. It benefits from robust brand equity and significant marketing investments. In 2024, NARS contributed substantially to Shiseido's global makeup sales, which reached approximately ¥300 billion. Its innovative products and strong market presence in the makeup category solidify its star status.

Anessa

Anessa, a prominent sun care brand under Shiseido Co., holds a strong position, especially in Asia. Its sustained market share and high growth rate suggest it's a Star in the BCG Matrix. The brand's success is fueled by its innovative sun protection technology. Anessa's performance significantly contributes to Shiseido's overall revenue.

- Asia-Pacific region accounts for a significant portion of Shiseido's sales.

- Anessa's market share in key Asian countries remains consistently high.

- Shiseido's R&D investments support Anessa's technological advantages.

- Anessa’s sales grew by 10% in 2024.

Dr. Dennis Gross Skincare

Dr. Dennis Gross Skincare, acquired by Shiseido in late 2023, is a Star in the BCG Matrix. This signifies high market share in a high-growth market, particularly in the Americas. The brand's science-backed skincare approach resonates with current consumer preferences. It is expected to drive significant revenue growth for Shiseido.

- Acquired in late 2023, showing strong results.

- Focus on high-performance, science-backed skincare.

- Strong performance especially in the Americas.

- Aligned with current market trends.

Stars in Shiseido's portfolio, including Anessa and Dr. Dennis Gross, show high growth. These brands, like NARS and Clé de Peau Beauté, enjoy strong market shares. In 2024, Anessa sales grew by 10% and NARS contributed significantly to makeup sales.

| Brand | 2024 Performance | Market Position |

|---|---|---|

| Shiseido | Prestige Brands Sales Increase | Strong Global Presence |

| Clé de Peau Beauté | 20% Sales Growth in China | Luxury Skincare Leader |

| NARS | Significant Makeup Sales | Strong Brand Equity |

Cash Cows

Elixir, a 'Next 5' brand, acts like a cash cow in key markets for Shiseido. It funds its growth, especially with successful product renewals. In 2024, Shiseido's focus on Elixir helped drive its domestic sales. This brand has shown consistent performance, contributing to the company's financial stability.

Shiseido's sun care, including Anessa, is a cash cow. The company targets high growth in Asia with Anessa. SHISEIDO sun care focuses on EMEA and the Americas. In 2024, sun care sales showed strong performance. Shiseido's strategy aims at boosting global market share.

Shiseido's Japan business, a cash cow in its BCG Matrix, benefits from structural reforms. It significantly boosts profitability.

The Japan segment generated ¥448.3 billion in sales in 2023, highlighting its financial strength.

Focus on core brands strengthens its cash-generating ability, ensuring sustained revenue.

This strategic focus allows Shiseido to reinvest in growth areas.

The segment's consistent performance solidifies its cash cow status.

EMEA Business

Shiseido's EMEA business is a cash cow, consistently growing due to its strong fragrance segment and operational efficiency. This reliable revenue stream is a key strength. In 2024, EMEA's beauty market grew, with fragrance sales up, contributing significantly to Shiseido's overall performance. The efficient operations further solidify its cash cow status.

- Steady Revenue: EMEA provides consistent financial returns.

- Fragrance Strength: Key driver for growth.

- Operational Efficiency: Supports profitability.

- Market Growth: Positive trend in 2024.

Core Skincare Lines

Shiseido's core skincare lines, like Vital Perfection, are prime examples of cash cows. These established products benefit from a strong, loyal customer base, ensuring consistent revenue streams. The company can generate substantial profits with minimal marketing expenditure on these well-known items. In 2024, Shiseido's skincare segment saw a revenue of ¥785.6 billion, demonstrating its robust performance.

- Vital Perfection and similar lines provide stable, predictable cash flow.

- Low marketing costs due to brand recognition.

- They contribute significantly to overall profitability.

- Skincare segment accounted for a large portion of Shiseido's revenue in 2024.

Elixir, Anessa, Japan business, EMEA, and core skincare represent Shiseido's cash cows, generating stable revenue. These segments are crucial for financial stability and growth investment. For example, skincare revenue in 2024 was ¥785.6 billion.

| Cash Cow Segment | Key Characteristics | 2024 Performance Highlight |

|---|---|---|

| Elixir | Product renewals, brand strength | Domestic sales growth |

| Sun Care (Anessa) | Targeting Asia, high growth | Strong sales in 2024 |

| Japan Business | Structural reforms, high profitability | ¥448.3B in sales (2023) |

| EMEA | Fragrance, operational efficiency | Fragrance sales increase |

| Core Skincare (Vital Perfection) | Loyal customers, established products | ¥785.6B in revenue (2024) |

Dogs

IPSA, part of Shiseido Co., faces challenges, hinting at a "Dog" status in the BCG matrix. Sales significantly dropped, as seen in recent financial reports. This decline signals a need for strategic evaluation. Consider potential divestiture options for IPSA.

Shiseido's Travel Retail, especially in Hainan and South Korea, is struggling. These key regions are facing reduced consumer spending. Sales in China, a major market, declined by 10.7% in Q1 2024. Regulatory changes also impact performance.

AUPRES, a Shiseido brand, likely operates as a "Dog" in the BCG matrix. It struggles in the mass market due to its higher price point, competing with more affordable brands. In 2024, Shiseido's net sales slightly decreased, indicating challenges across its portfolio. AUPRES's positioning likely contributes to this, as it may struggle to gain significant market share.

Metaverse and Web3 Projects

Shiseido's metaverse and Web3 ventures, categorized as "Dogs," were shut down. This move reflects underperformance and a strategic pivot. The projects failed to meet expectations, leading to their discontinuation. This decision aligns with cost-cutting measures, impacting areas that didn't yield returns. In 2024, Shiseido reported a decrease in net sales, reinforcing the need for strategic adjustments.

- Poor performance led to project closures.

- Cost-reduction was a key driver.

- Net sales decreased in 2024.

- Strategic realignment was implemented.

Underperforming Makeup Lines

Shiseido's underperforming makeup lines, outside of its core 'Next 5' brands, often fit the 'Dog' category in its BCG matrix. These lines struggle with low market share and growth. They typically need substantial investment for marginal returns, making them a drain on resources. In 2024, such lines might show decreasing revenue, potentially impacting overall profitability.

- Low market share and growth.

- Require significant investment.

- Generate minimal returns.

- May include declining revenue.

Several Shiseido brands and ventures are classified as "Dogs" within its BCG matrix, indicating low market share and slow growth. These include IPSA, Travel Retail, AUPRES, metaverse projects, and underperforming makeup lines. Strategic adjustments and potential divestitures are considered to improve overall profitability. Shiseido's net sales slightly decreased in 2024. These issues prompted project closures and cost-cutting.

| Category | Brand/Area | Status |

|---|---|---|

| Brand | IPSA | Dog |

| Retail | Travel Retail (Hainan, South Korea) | Dog |

| Brand | AUPRES | Dog |

| Ventures | Metaverse/Web3 | Dog |

| Makeup | Underperforming lines | Dog |

Question Marks

Shiseido's inner beauty and wellness is a question mark. This category aligns with rising health trends. Its success hinges on investments in marketing and product development. Sales in 2024 showed potential but require further growth. The company's strategic focus in this segment remains crucial, as of the latest report.

New skincare tech, like micro-needle systems, puts Shiseido in the "Question Mark" quadrant. These innovations show promise, but market acceptance is uncertain. In 2024, Shiseido's R&D spending was about $300 million, aiming to validate these technologies. Success depends on consumer adoption and overcoming initial market hurdles.

Drunk Elephant, a Shiseido Co. brand, currently fits the question mark category. In 2024, the Americas region showed a slower recovery for Drunk Elephant. Intense competition and the need for fresh brand strategies are pressing issues. Shiseido's 2023 financial results highlighted these challenges.

China Market (Overall)

China represents a question mark for Shiseido's BCG Matrix, given its volatile economic conditions and evolving consumer preferences. The beauty market in China, while substantial, faces challenges such as shifting consumer spending habits and increased competition from domestic brands. Shiseido is actively adapting its strategies, including product innovation and distribution channel optimization, to navigate these complexities and reignite growth.

- China's retail sales of consumer goods increased by 4% in 2024.

- Shiseido's sales in China decreased in the first half of 2024.

- The company is focusing on premium products and digital marketing.

- Shiseido aims to strengthen its e-commerce presence in China.

Strategic Brand Withdrawals and Reductions

Strategic brand withdrawals and reductions in Shiseido's portfolio are crucial for refocusing resources. These actions often create opportunities for new ventures. Filling gaps might involve launching brands or product lines. This requires significant investment for market share.

- Shiseido's 2023 results show a focus on premium brands, indicating potential for new launches in this segment.

- The company's restructuring efforts, as of late 2024, may involve divesting from underperforming brands.

- New product lines could target specific consumer segments, such as skincare for men or sustainable beauty products.

- Investment in marketing and distribution would be essential for any new brand to succeed.

Shiseido's question marks include inner beauty and wellness, and new skincare tech, and Drunk Elephant. China presents challenges despite market size. Strategic brand adjustments and portfolio shifts are critical for resource reallocation.

| Category | Challenge | Action |

|---|---|---|

| Inner Beauty | Growth dependent. | Marketing investment. |

| New Tech | Market acceptance. | R&D spending. |

| Drunk Elephant | Slower recovery. | Brand strategy. |

BCG Matrix Data Sources

The Shiseido BCG Matrix relies on company filings, market analysis, industry reports, and financial data, ensuring credible, data-backed insights.