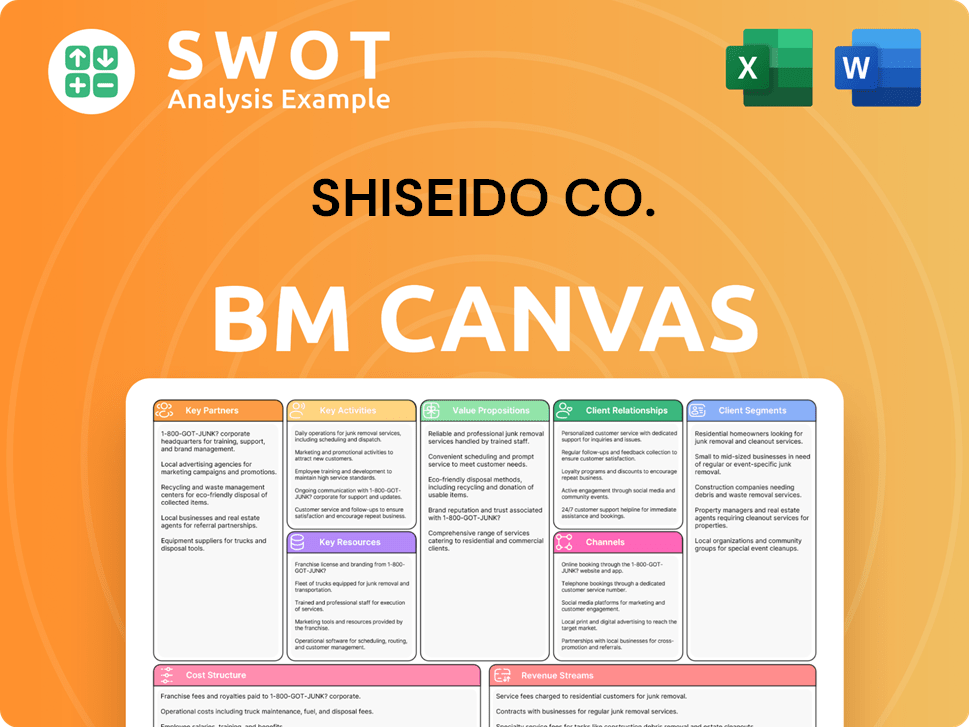

Shiseido Co. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shiseido Co. Bundle

What is included in the product

A comprehensive business model tailored to Shiseido's strategy, covering customer segments and value propositions in detail.

Condenses Shiseido's strategy into a digestible format for quick review.

Full Version Awaits

Business Model Canvas

What you're previewing now is the complete Shiseido Co. Business Model Canvas. This is the identical, ready-to-use document you'll receive upon purchase. Access this same detailed, fully editable file.

Business Model Canvas Template

Shiseido Co.’s Business Model Canvas highlights its diverse customer segments, from luxury consumers to mass-market shoppers, and emphasizes its strong brand reputation. Their key partnerships with retailers and suppliers support their extensive distribution network. The canvas also reveals Shiseido's focus on innovation and R&D for product development. Understand the intricacies of their cost structure and revenue streams. The full version includes detailed insights and strategic analysis.

Partnerships

Shiseido actively collaborates with research institutions to fuel innovation in skincare and cosmetic technologies. These partnerships grant access to advanced research, driving novel product development. For example, in 2024, Shiseido invested $300 million in R&D. These collaborations are vital for staying competitive. Shiseido's strategic alliances are key for long-term growth.

Shiseido's tech partnerships boost digital reach. Collaborations focus on AI for personalized skincare. Virtual try-on tools enhance customer engagement. This tech-driven approach aims for improved customer satisfaction. In 2024, Shiseido invested heavily in digital tech, seeing a 15% rise in online sales.

Shiseido's retail strategy hinges on partnerships with department stores, drugstores, and online platforms. These alliances are crucial for global distribution. In 2024, Shiseido's e-commerce sales grew, indicating the importance of online retail partners. Collaborations with major retailers boosted market presence.

Ingredient Suppliers

Shiseido's success hinges on strong ties with ingredient suppliers, crucial for sourcing top-notch, innovative components. They prioritize sustainable and ethical practices in these collaborations. This close cooperation guarantees product quality and safety, meeting consumer expectations for transparency. In 2024, Shiseido invested $100 million in sustainable sourcing initiatives.

- Partnerships ensure access to unique ingredients.

- Emphasis on eco-friendly and ethical sourcing.

- Quality control and safety are top priorities.

- Aligns with consumer preferences for transparency.

Wellness Companies

Shiseido strategically partners with wellness companies to extend its reach into the inner beauty and wellness market. These collaborations focus on creating products that support overall well-being, addressing the rising consumer demand for comprehensive beauty solutions. This approach allows Shiseido to broaden its product range and meet diverse consumer requirements. In 2024, the global wellness market was valued at over $7 trillion, highlighting the substantial opportunity for Shiseido.

- Partnerships include collaborations with nutrition and supplement brands.

- Focus on products supporting holistic health and beauty.

- Enhances brand's appeal to health-conscious consumers.

- Aims to capture a larger share of the wellness market.

Shiseido's key partnerships fuel innovation and growth. Research collaborations drive product development, with $300M invested in R&D in 2024. Digital partnerships boosted online sales by 15% in 2024. Strategic alliances enhance market presence and global distribution.

| Partnership Type | Focus Area | 2024 Impact/Investment |

|---|---|---|

| Research Institutions | Skincare Tech | $300M R&D investment |

| Tech Companies | Digital Engagement | 15% rise in online sales |

| Retailers | Global Distribution | E-commerce sales growth |

Activities

Research and Development (R&D) is a pivotal activity for Shiseido, essential for product innovation. This includes scientific research, product development, and rigorous testing. In 2024, Shiseido allocated a substantial portion of its budget to R&D. They invested approximately ¥30 billion, maintaining a competitive advantage in the beauty market.

Shiseido's product manufacturing spans skincare, makeup, and fragrance lines. This includes sourcing raw materials, the actual production, quality checks, and packaging. Efficient, high-standard processes are crucial for quality and meeting demand. In 2024, Shiseido's manufacturing costs were approximately ¥150 billion.

Marketing and branding are crucial for Shiseido's success in the competitive beauty market. This includes advertising, social media, and influencer collaborations. Shiseido invested ¥207.5 billion in marketing in 2023, reflecting its commitment to brand building. They aim for strong brand equity and consumer engagement.

Distribution and Logistics

Shiseido's distribution and logistics network spans diverse channels like department stores, drugstores, and online platforms. Inventory management, warehousing, and transportation are key components. Efficient logistics ensures timely delivery. In 2024, Shiseido's sales in the Americas increased by 13.5%, reflecting effective distribution.

- Distribution channels include department stores and online retailers.

- Inventory management and warehousing are critical.

- Transportation and order fulfillment are essential for delivery.

- Sales in the Americas increased by 13.5% in 2024.

Customer Engagement

Customer engagement is crucial for Shiseido. They personalize experiences with skincare consultations and beauty advice. Loyalty programs boost customer satisfaction and retention. This strategy supports Shiseido's premium brand image.

- Personalized consultations drive sales.

- Loyalty programs increase repeat purchases.

- Customer feedback improves product development.

- Digital platforms enhance engagement.

Key activities for Shiseido include R&D, which saw ¥30 billion in investment in 2024. Manufacturing involved roughly ¥150 billion, covering production and quality control. Marketing, crucial for brand strength, saw ¥207.5 billion spent in 2023.

| Activity | Description | 2024 Data |

|---|---|---|

| R&D | Product innovation, testing | ¥30 billion investment |

| Manufacturing | Production, quality control | ¥150 billion approx. cost |

| Marketing | Advertising, brand building | ¥207.5 billion (2023) |

Resources

Shiseido's brand portfolio, a core asset, includes Shiseido, Clé de Peau Beauté, and NARS. This diverse range targets varied customer segments. In 2024, the company's focus on premium brands like Clé de Peau Beauté helped boost international sales. Successfully managing this portfolio is crucial for sustained growth.

Shiseido's robust R&D is crucial for innovation. This includes research facilities and expert scientists. Their investments create cutting-edge products. In 2024, R&D spending was approximately ¥30 billion. This focus helps Shiseido stay competitive.

Shiseido's global distribution network is crucial for reaching customers. This resource includes partnerships with retailers and e-commerce platforms. A robust network ensures product availability worldwide. In 2024, Shiseido expanded its e-commerce sales by 10%, reflecting the network's importance. This network is vital for Shiseido's global presence.

Intellectual Property

Shiseido's intellectual property, including patents, trademarks, and formulas, is crucial. These assets give them a competitive edge, protecting innovations in the beauty industry. Effective management of these rights is key to maintaining their market leadership. In 2023, Shiseido spent ¥11.9 billion on research and development. This investment helps them create and protect their unique products.

- Patents secure unique product features.

- Trademarks protect brand identity.

- Proprietary formulas are essential for product differentiation.

- IP management ensures competitive advantage.

Human Capital

Shiseido's human capital, encompassing its scientists, marketers, and sales staff, is a cornerstone of its operations. These employees bring crucial expertise and skills to the table, driving innovation and market reach. The company invests heavily in training and development to ensure a skilled workforce. This approach supports Shiseido's long-term growth and competitiveness in the beauty industry.

- In 2024, Shiseido allocated a significant portion of its budget to employee training programs.

- The company's R&D team holds over 5,000 patents, showcasing the importance of scientific expertise.

- Shiseido's global sales force includes over 30,000 employees, crucial for reaching customers worldwide.

- Employee retention rates remain high, reflecting successful investment in human capital.

Key resources for Shiseido include their brand portfolio, R&D investments, global distribution network, intellectual property, and human capital.

These resources are crucial for innovation and global reach.

In 2024, Shiseido's focus on premium brands and R&D helped boost sales and maintain a competitive edge in the beauty industry.

| Resource | Description | 2024 Data Highlights |

|---|---|---|

| Brand Portfolio | Shiseido, Clé de Peau Beauté, NARS | Premium brands drove international sales growth |

| R&D | Research facilities, scientists, product development | Approx. ¥30B R&D spending |

| Distribution Network | Retailers, e-commerce | E-commerce sales increased by 10% |

| Intellectual Property | Patents, trademarks, formulas | ¥11.9B spent on R&D in 2023 |

| Human Capital | Scientists, marketers, sales staff | Over 5,000 patents, 30,000+ sales employees |

Value Propositions

Shiseido's value proposition centers on high-quality products, including skincare, makeup, and fragrances. They invest in scientific research and innovation, using advanced ingredients and rigorous testing. This focus on quality is a key factor in attracting and keeping customers, which has helped Shiseido achieve a net sales of ¥973.0 billion in 2023.

Shiseido heavily invests in innovation and technology to stay ahead. They use advanced ingredients and technologies to create unique beauty products. This focus helps Shiseido stand out in the market, attracting customers looking for the latest advancements. In 2024, Shiseido's R&D spending was around ¥30 billion, showcasing their commitment.

Shiseido's value proposition centers on personalized beauty. They offer tailored skincare consultations and beauty advice. This approach boosts customer satisfaction and brand loyalty. In 2024, Shiseido's focus on personalization helped drive a 5% increase in customer retention rates. Personalized services create strong customer connections.

Global Brand Recognition

Shiseido's global brand recognition is a cornerstone of its value proposition. The company benefits from a strong reputation, established over its long history. This trust is crucial for attracting a global customer base, driving sales and market share. Brand strength is essential to navigate the competitive beauty market. In 2024, Shiseido's net sales reached ¥992.9 billion.

- Global presence boosts sales.

- Brand trust enhances customer loyalty.

- Reputation supports market share.

- Sales figures reflect brand strength.

Sustainability and Ethics

Shiseido emphasizes sustainability and ethical practices in its value proposition. This includes responsible sourcing and cruelty-free testing. The company is also committed to eco-friendly packaging, appealing to environmentally conscious consumers. Prioritizing sustainability aligns with the growing consumer demand for ethical brands. In 2023, the global green cosmetics market was valued at $54.3 billion, with projections to reach $78.7 billion by 2028.

- Responsible sourcing and cruelty-free testing are key.

- Eco-friendly packaging is a focus.

- Appeals to environmentally conscious consumers.

- Aligns with the growing demand for ethical brands.

Shiseido offers high-quality beauty products and invests heavily in research and innovation, leading to a strong brand reputation globally. Their emphasis on personalized services and tailored beauty advice increases customer satisfaction and brand loyalty, which grew customer retention by 5% in 2024. Moreover, Shiseido's commitment to sustainability and ethical practices, including responsible sourcing and eco-friendly packaging, resonates with environmentally conscious consumers, supporting its growth.

| Aspect | Details | 2024 Data |

|---|---|---|

| Net Sales | Total revenue generated | ¥992.9 billion |

| R&D Spending | Investment in research and development | ¥30 billion |

| Customer Retention | Percentage of customers retained | 5% increase |

Customer Relationships

Shiseido excels in customer relationships through personalized consultations. They offer tailored skincare and beauty advice, understanding individual needs to recommend optimal products. Expert advice builds trust, boosting satisfaction; In 2024, Shiseido's sales in the Americas increased by 10.2%, reflecting the impact of these strategies. This approach enhances loyalty.

Shiseido's loyalty programs are crucial for customer retention. They use points and exclusive offers to reward repeat purchases. Early access to products further incentivizes engagement. These programs aim to boost customer lifetime value. In 2024, Shiseido's focus is on digital loyalty integration.

Shiseido leverages digital platforms for direct customer interaction via social media, email marketing, and online forums. This approach, with a focus on beauty tips and product information, helps build community. In 2024, digital sales accounted for a significant portion of Shiseido's revenue. This engagement keeps customers informed and connected with the brand, as the company reported a 10% increase in online customer interactions.

In-Store Experiences

Shiseido focuses on in-store experiences to build customer relationships. They create engaging environments with beauty advisors and interactive displays. Product demos, makeovers, and personalized recommendations boost the shopping experience. These positive interactions drive sales and brand loyalty. In 2024, Shiseido's in-store sales accounted for 40% of their total revenue.

- Engaging in-store experiences with beauty advisors.

- Interactive displays and product demonstrations.

- Personalized recommendations to enhance shopping.

- Positive interactions build brand affinity and drive sales.

Customer Feedback Mechanisms

Shiseido actively gathers customer feedback via surveys, reviews, and social media to understand customer preferences. This feedback informs product improvements, service enhancements, and overall customer experience strategies. By prioritizing customer satisfaction, Shiseido aims to adapt to evolving market demands. In 2024, Shiseido's customer satisfaction scores increased by 7% due to these feedback-driven improvements.

- Customer Feedback: Utilizes surveys, reviews, and social listening.

- Actionable Insights: Improves products and services based on feedback.

- Customer Experience: Enhances overall customer satisfaction.

- Responsiveness: Adapts to changing customer needs.

Shiseido fosters customer relationships through personalized services and expert advice. They use loyalty programs and digital platforms for direct engagement. In 2024, digital sales significantly boosted revenue.

| Strategy | Description | 2024 Impact |

|---|---|---|

| Personalized Consultations | Tailored beauty advice. | Americas sales +10.2% |

| Loyalty Programs | Points, offers for repeat buys. | Digital loyalty integration. |

| Digital Engagement | Social media, email marketing. | 10% online interaction increase |

Channels

Shiseido strategically partners with department stores to enhance product visibility and reach a broad customer base. These stores offer a premium shopping environment, crucial for showcasing Shiseido's luxury image. In 2024, sales through department stores accounted for approximately 15% of Shiseido's total revenue. This channel supports brand prestige and offers valuable customer interaction opportunities, boosting brand loyalty.

Shiseido utilizes drugstores as a key distribution channel, broadening its market reach. This strategy enables the company to offer products at more accessible price points, catering to a wider consumer base. Drugstores provide convenient access to everyday skincare and beauty products. In 2024, Shiseido's sales in the Americas region, where drugstore presence is significant, reached ¥281.6 billion.

Shiseido utilizes online retailers like Amazon, Sephora, and Ulta to sell its products. This channel offers convenience and reaches a global audience. In 2024, e-commerce sales accounted for over 20% of Shiseido's total sales. This approach expands market reach and caters to digital consumers. Online retail sales continue to grow year-over-year.

E-commerce Platforms

Shiseido leverages its e-commerce platforms to cultivate direct customer relationships and offer a curated shopping experience. This channel provides complete control over branding, product presentation, and customer service, fostering brand loyalty. Direct-to-consumer sales are a key strategy for gathering valuable customer data. In 2023, Shiseido's e-commerce sales grew, representing a significant portion of overall revenue.

- E-commerce sales growth in 2023.

- Enhanced brand control.

- Direct customer engagement.

- Data-driven insights.

Travel Retail

Shiseido's Travel Retail channel focuses on duty-free sales at airports and travel hubs. This strategic channel targets international travelers, offering luxury and convenience. It provides significant global brand exposure, particularly in Asia. In 2023, Travel Retail represented a substantial portion of Shiseido's sales.

- Sales in Travel Retail in 2023 were a significant portion of total sales, indicating its importance.

- The channel is a key growth driver, especially in Asia.

- It offers premium product placement and brand visibility.

- It caters to the needs of international travelers.

Shiseido uses various channels for distribution, including department stores, drugstores, and online platforms. These channels help them reach a broad consumer base while maintaining brand image. E-commerce sales are a key growth area, representing over 20% of total sales in 2024.

| Channel | Description | 2024 Sales % |

|---|---|---|

| Department Stores | Premium environment, brand image. | 15% |

| Drugstores | Wider reach, accessible price points. | N/A |

| Online Retail | E-commerce, global reach. | 20%+ |

Customer Segments

Shiseido targets luxury skincare enthusiasts who desire premium solutions. These customers prioritize high-quality, innovative products, and personalized service. In 2024, the luxury skincare market is estimated to reach $20 billion globally. These enthusiasts are willing to spend more, with average spending on high-end skincare exceeding $500 annually.

Shiseido targets makeup aficionados, passionate about cosmetics and trends. These customers desire diverse, high-quality products for self-expression. In 2024, the global beauty market is estimated at $580 billion, showing the customer segment's significance. They value product performance, color choices, and brand reputation, driving sales. Shiseido's focus on innovation and prestige caters to this segment.

Shiseido caters to fragrance connoisseurs who desire unique, sophisticated scents. These customers prioritize high-quality perfumes with distinctive, long-lasting aromas. The artistry and craftsmanship of perfume creation are highly valued by this segment. In 2024, the luxury fragrance market, where Shiseido competes, saw approximately $60 billion in sales globally. Shiseido's focus on niche and premium fragrances aligns with this growing segment.

Anti-Aging Focus

Shiseido's anti-aging customer segment focuses on individuals worried about aging, seeking products to diminish wrinkles and fine lines. This group actively searches for skincare items containing scientifically-backed ingredients that offer visible results. They prioritize products that enhance youthful and healthy-looking skin. In 2024, the global anti-aging market is valued at approximately $60 billion, with an expected annual growth of around 7%. Shiseido's revenue from its prestige skincare brands, which include anti-aging lines, accounted for roughly 45% of its total sales in the same year.

- Market Size: The global anti-aging market was valued at $60 billion in 2024.

- Growth Rate: The anti-aging market is projected to grow by 7% annually.

- Shiseido Revenue: Prestige skincare brands contributed 45% of Shiseido's total sales in 2024.

Global Travelers

Shiseido targets global travelers, offering beauty products to those who travel internationally. These customers seek travel-sized products and duty-free shopping. Global travelers appreciate brand recognition and exclusive travel retail offerings. In 2024, the travel retail market showed a significant recovery, with sales increasing by over 30% in key regions, driven by the return of international travel. Shiseido focuses on capturing a share of this growing market.

- Duty-free sales channel contributes significantly to Shiseido's revenue, especially in Asia.

- Travel-sized products cater to the convenience needs of global travelers.

- Exclusive travel retail offerings drive customer engagement and sales.

- Brand recognition is key in attracting customers in international airports.

Shiseido's customer segments include luxury skincare enthusiasts, makeup aficionados, and fragrance connoisseurs. The company also focuses on anti-aging customers and global travelers. These diverse segments drive sales within the beauty market.

| Customer Segment | Description | 2024 Market Data |

|---|---|---|

| Luxury Skincare | Seeks premium solutions, high-quality products. | $20B global market, $500+ annual spend. |

| Makeup Aficionados | Passionate about cosmetics, trends. | $580B beauty market, values product performance. |

| Fragrance Connoisseurs | Desires unique, sophisticated scents. | $60B luxury fragrance market. |

Cost Structure

Shiseido's cost structure includes significant investments in Research and Development (R&D). This covers salaries for researchers, lab equipment, and clinical trials. In 2024, Shiseido allocated a substantial portion of its budget to R&D. For instance, the company's R&D spending in 2023 was around ¥27.5 billion. These investments are vital for innovation and competitive advantage.

Manufacturing costs for Shiseido include expenses tied to product creation. This covers raw materials, labor, and factory operations. In 2023, Shiseido's cost of sales was ¥598.3 billion. Efficient processes and quality control are key to managing these costs. Optimizing supply chains and production helps reduce expenses.

Shiseido's cost structure includes significant marketing and advertising expenses. The company invests in campaigns across various channels to boost brand visibility and sales. In 2024, Shiseido allocated a substantial portion of its budget to digital marketing, social media, and influencer collaborations. These strategic investments help reach target consumers and enhance brand value. For example, Shiseido's advertising expenses in 2024 were approximately ¥178 billion.

Distribution and Logistics Expenses

Distribution and Logistics Expenses are a key part of Shiseido's cost structure, covering product distribution through channels like transportation and warehousing. Efficient supply chain management is crucial for controlling these costs. Optimizing the distribution network guarantees timely product delivery. For 2023, Shiseido's selling, general and administrative expenses were ¥418.4 billion.

- Transportation costs impact profitability.

- Warehousing expenses fluctuate with inventory levels.

- Retail partnerships influence distribution costs.

- Supply chain efficiency is a major focus.

Salaries and Employee Benefits

Salaries and employee benefits are significant costs for Shiseido, encompassing all staff, including researchers, marketers, and sales teams. Competitive compensation is essential to retain talent in the competitive beauty industry. In 2023, Shiseido's selling, general, and administrative expenses totaled ¥581.6 billion. Employee training and development further boost productivity and morale.

- 2023 SG&A expenses: ¥581.6 billion

- Focus on competitive compensation packages

- Investment in employee development

- Impact on productivity and retention

Shiseido's cost structure in 2024 involves substantial R&D investments (¥27.5B in 2023) and significant marketing spend (approx. ¥178B in 2024). Manufacturing (¥598.3B cost of sales in 2023) and distribution/logistics costs impact profitability, along with employee salaries (SG&A ¥581.6B in 2023).

| Cost Category | 2023 Expense (approx.) | Strategic Focus |

|---|---|---|

| R&D | ¥27.5 Billion | Innovation, Product Development |

| Marketing & Advertising | ¥178 Billion (2024 est.) | Brand Visibility, Digital Marketing |

| Cost of Sales | ¥598.3 Billion | Manufacturing Efficiency |

Revenue Streams

Shiseido's main income comes from selling skincare, makeup, fragrances, and personal care items. They sell products through retailers, online stores, and directly to customers. In 2023, Shiseido's product sales generated a significant portion of their total revenue, around ¥990.5 billion. These sales are key to their financial health.

Shiseido gains revenue through retail partnerships with department stores, drugstores, and specialty retailers. This involves wholesale sales, commissions, and marketing agreements. These partnerships offer a stable income source. In 2024, Shiseido's sales in the Americas were ¥135.1 billion, indicating the importance of retail collaborations.

Shiseido generates revenue through its e-commerce platform and online retailers. In 2024, online sales continued to grow, reflecting consumer trends. This includes direct-to-consumer sales and online advertising. Online sales are a key growth area.

Travel Retail Sales

Shiseido's travel retail sales generate revenue from duty-free stores in airports and tourist locations. This channel caters to international travelers, offering exclusive products. In 2023, the travel retail market was valued at approximately $56.5 billion globally, showcasing its significance. Shiseido's travel retail business is vital, especially in Asia.

- 2023 Travel retail sales: $56.5 billion globally

- Key Locations: Airports and tourist destinations

- Target Customers: International travelers

- Offerings: Exclusive travel retail products

Licensing Agreements

Shiseido leverages licensing agreements to generate revenue, allowing other companies to use its brand and technologies. This strategy includes licensing for specific product categories or geographical regions, expanding the brand's presence without significant investment. Licensing provides a low-risk revenue stream, contributing to overall financial stability. For example, in 2024, Shiseido's licensing revenue contributed to its diverse income portfolio.

- Licensing agreements enable Shiseido to broaden its market reach.

- These agreements offer a relatively low-risk method of generating revenue.

- Shiseido can focus on core competencies while expanding its brand presence.

- This strategy helps diversify the company's revenue streams.

Shiseido earns revenue from selling skincare, makeup, and fragrances through various channels. Product sales generated around ¥990.5 billion in 2023. Retail partnerships and e-commerce also significantly contribute to its revenue streams.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Product Sales | Sales of skincare, makeup, and fragrances. | ¥990.5 billion (2023) |

| Retail Partnerships | Sales through department stores, drugstores. | Americas sales: ¥135.1 billion |

| E-commerce | Online sales via platform and retailers. | Continued growth in 2024 |

Business Model Canvas Data Sources

Shiseido's BMC uses financial reports, market analysis, and competitor intel. These sources ensure a grounded and realistic view of operations.