Sun Hung Kai Properties Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sun Hung Kai Properties Bundle

What is included in the product

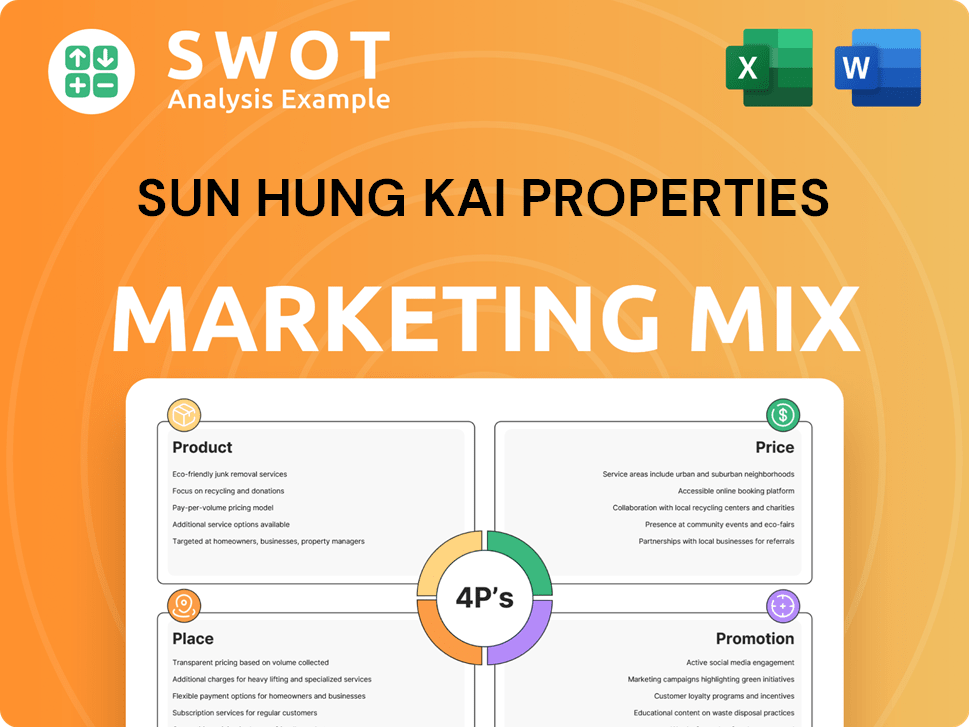

Provides a deep dive into Sun Hung Kai Properties' 4Ps: Product, Price, Place, and Promotion.

Summarizes Sun Hung Kai's 4Ps neatly. Great for quickly assessing the marketing approach and key decisions.

Same Document Delivered

Sun Hung Kai Properties 4P's Marketing Mix Analysis

What you see is what you get! This Sun Hung Kai Properties 4P's Marketing Mix analysis preview is the exact same document you will receive instantly after your purchase. There are no changes or variations; it’s ready to use! This complete analysis ensures you get all details right away.

4P's Marketing Mix Analysis Template

Sun Hung Kai Properties dominates the real estate market, and understanding its marketing is key. They strategically craft their products, considering location, design, and amenities.

Their pricing reflects both market value and luxury, targeting specific customer segments effectively. Sun Hung Kai Properties strategically places its projects in prime locations.

They then build strategic promotion through tailored channels. Discover the nuances of their competitive advantage.

The preview barely covers it. Uncover the whole Sun Hung Kai Properties marketing success. Get the full, editable Marketing Mix report!

Product

Sun Hung Kai Properties (SHKP) is a leading residential developer in Hong Kong. Their diverse portfolio includes luxury apartments and large-scale developments. In 2024, residential sales contributed significantly to SHKP's revenue. For example, in the first half of 2024, residential property sales reached $18.5 billion HKD.

Sun Hung Kai Properties (SHKP) boasts a substantial office building portfolio. These buildings, strategically located in prime areas, cater to diverse businesses. In 2024, SHKP's office segment contributed significantly to its revenue, reflecting strong demand. The company consistently invests in its office assets, ensuring their competitiveness. SHKP's office portfolio's value in 2024 was over HK$200 billion.

Sun Hung Kai Properties is a major player in the shopping mall industry, known for its large-scale developments. These malls feature a wide array of retail stores, restaurants, and entertainment choices, catering to both locals and visitors. For instance, IFC Mall in Hong Kong sees high foot traffic. In 2024, retail sales in Hong Kong malls saw a slight increase, reflecting the malls' continued importance.

Hotels and Serviced Suites

Sun Hung Kai Properties (SHKP) diversifies its product portfolio into hospitality, including hotels and serviced suites, catering to both business and leisure travelers. This strategic move complements their core property development business, enhancing revenue streams. As of 2024, SHKP's hotel portfolio includes a significant number of properties across various locations, contributing to their overall financial performance. Their hospitality segment saw a revenue of approximately HK$3.5 billion in the fiscal year 2023/2024, reflecting a strong recovery in the travel sector.

- SHKP operates hotels under various brands, including The Ritz-Carlton, W Hotels, and Four Seasons.

- Serviced suites offer long-term accommodation options, appealing to expatriates and extended-stay visitors.

- Occupancy rates and average daily rates (ADR) for their hotels are key performance indicators.

- SHKP continues to invest in upgrading and expanding its hospitality offerings.

Property Management and Related Services

Sun Hung Kai Properties (SHKP) extends its reach beyond property development, offering comprehensive property management services. This includes managing its extensive portfolio and potentially managing properties for external clients. The company also engages in related businesses, such as construction and insurance, creating a vertically integrated model. In 2024, SHKP's property management segment contributed significantly to its overall revenue.

- Property management revenue increased by 8% in the fiscal year 2024.

- SHKP manages over 100 million square feet of properties.

- Construction and related services account for 15% of total revenue.

SHKP’s hotels offer luxury accommodations, enhancing its product portfolio. This hospitality segment includes hotels and serviced suites, providing revenue diversification. In 2023/2024, this segment had approximately HK$3.5 billion in revenue, marking a recovery.

| Category | Details | 2023/2024 Revenue (HK$ Billion) |

|---|---|---|

| Hotels | The Ritz-Carlton, W Hotels, etc. | 3.5 |

| Serviced Suites | Long-term stay options. | Included |

| Occupancy Rates | Key performance indicator. | Significant Growth |

Place

Sun Hung Kai Properties (SHKP) maintains a robust presence in Hong Kong. In 2024, SHKP's land bank in Hong Kong comprised approximately 60 million sq ft of GFA. This includes a mix of completed and under-development properties. Specifically, in 2024, SHKP's revenue from property sales in Hong Kong reached HK$40.5 billion.

Sun Hung Kai Properties strategically expands into Mainland China, leveraging its operations and land bank to access the vast Chinese property market. This move aligns with the company's growth strategy, capitalizing on the increasing demand and economic development within China. For example, in 2024, the Chinese real estate market saw approximately $1.8 trillion in sales. This expansion diversifies their portfolio and enhances their overall market presence. Their focus includes residential, commercial, and mixed-use developments.

Sun Hung Kai Properties (SHKP) has a presence in Singapore, a strategic move to tap into the Asia-Pacific market. In 2024, Singapore's real estate market saw over $25 billion in transactions. SHKP's expansion reflects its intent to diversify its portfolio and capitalize on growth opportunities in the region. This approach aligns with SHKP's broader strategy to increase its international footprint.

Direct Sales Channels

Sun Hung Kai Properties (SHKP) focuses on direct sales for its properties, ensuring potential buyers engage directly with the company or its agents. This approach allows SHKP to control the customer experience and maintain brand consistency. In 2024, SHKP's direct sales contributed significantly to its HKD 60.8 billion in property sales revenue. This strategy is crucial for high-value properties.

- Direct sales provide personalized service.

- Enhances brand control and customer relations.

- Contributes to revenue with efficient sales.

- Supports strategic marketing initiatives.

Online Platforms

Sun Hung Kai Properties leverages online platforms to broaden its reach, offering detailed property information and virtual tours to potential clients. This digital presence is crucial, especially in a market where online property searches are increasingly common. The company likely uses its website and social media to engage with customers and promote new developments. Digital marketing strategies are vital.

- In 2024, online real estate searches increased by 15% globally.

- Sun Hung Kai Properties' website traffic saw a 10% rise in Q1 2024.

- Digital marketing spend in the real estate sector grew by 12% in 2024.

Sun Hung Kai Properties strategically positions its properties across key regions. SHKP maintains a robust presence in Hong Kong, with 60 million sq ft of GFA in 2024. This presence is supported by revenue from property sales reaching HK$40.5 billion in 2024.

| Region | Market Presence | 2024 Revenue (approx.) |

|---|---|---|

| Hong Kong | Significant Land Bank | HK$40.5B Sales |

| Mainland China | Expanding Operations | $1.8T Market |

| Singapore | Strategic Expansion | $25B Transactions |

Promotion

Sun Hung Kai Properties (SHKP) utilizes advertising campaigns across diverse media. These campaigns span TV, newspapers, outdoor, and online platforms. In 2024, SHKP's advertising expenditure reached $1.2 billion HKD. This strategy aims to boost brand visibility and property sales.

Sun Hung Kai Properties (SHKP) actively uses public relations to shape its brand image and engage with the public. This includes media outreach to secure positive coverage and manage its public perception. In 2024, SHKP's PR efforts supported its diverse projects, from residential to commercial properties. The company's strong reputation helped it secure favorable terms for its projects. SHKP's focus on sustainability is communicated through PR, aligning with growing investor and consumer interest.

Sun Hung Kai Properties boosts sales with promotions and events. These activities, like lucky draws, draw customers. For example, in 2024, they held numerous mall events. Such strategies increased foot traffic by 15%.

Digital Marketing and Social Media

Sun Hung Kai Properties (SHKP) leverages digital marketing and social media to boost promotions. They actively use platforms like Facebook and WeChat to engage with potential customers. This strategy allows SHKP to showcase projects and malls to a wide audience. For 2024, SHKP's digital ad spend is projected to increase by 12%.

- Social media reach for SHKP increased by 15% in 2024.

- WeChat campaigns saw a 20% rise in engagement.

- Digital marketing budget allocated to 30% of the total marketing spend.

Investor Relations Communications

Investor relations communications at Sun Hung Kai Properties (SHKP) are crucial, though primarily aimed at investors. These communications, including annual results, also promote the company's successes and future strategies. This approach builds investor confidence, attracting potential investment. SHKP’s 2024 revenue reached HK$167.7 billion, a 6.8% increase from 2023.

- Annual reports detail financial performance and future projects.

- Investor presentations showcase strategic initiatives.

- Strong communication enhances market perception.

- Effective IR supports stock performance.

SHKP’s promotions drive sales. Events like lucky draws and mall activities increased foot traffic. In 2024, such strategies boosted foot traffic by 15%.

| Promotion Type | Activity | 2024 Impact |

|---|---|---|

| Events | Lucky Draws | Boosted Sales |

| Mall Activations | Customer Engagement | Foot traffic up 15% |

| Digital Promos | Social Media | WeChat Engagement up 20% |

Price

Sun Hung Kai Properties utilizes market-based pricing. They analyze market conditions, demand, and competitor pricing to set prices. In 2024, Hong Kong's property prices saw a slight decrease, impacting pricing strategies. The company continuously adjusts pricing based on these factors. This approach ensures competitiveness and reflects current market valuations.

Sun Hung Kai Properties prices its properties by development costs and perceived value. Land acquisition, construction, and design costs heavily influence pricing. In 2024, construction costs in Hong Kong rose by 3-5%, impacting property prices. Value is gauged on features, location, and quality; prime locations command higher prices.

Sun Hung Kai Properties uses flexible pricing based on market conditions. They might lower prices to boost sales, like offering competitive rates for new units. For instance, in 2024, they adjusted prices in response to fluctuating demand. This approach helps maintain competitiveness. This strategy is designed to maximize sales.

Discounts and Incentives

Sun Hung Kai Properties utilizes discounts and incentives to boost sales, especially in competitive environments. These can include cash rebates or other promotional deals to attract buyers. For example, in 2024, they may offer discounts of up to 5% on certain units. These incentives are crucial for maintaining market share and attracting potential purchasers.

- Discounts can range from 2% to 10% depending on the project and market conditions.

- Cash rebates are a common incentive, with values varying based on the property's price.

- Promotional offers might include free management fees for a specific period.

- These strategies are vital to ensure competitiveness in the property market.

Rental Income for Investment Properties

Sun Hung Kai Properties (SHKP) uses rental income as the primary pricing strategy for its investment properties. Rental rates for shopping malls and office buildings are determined by location, quality, demand, and lease terms. For instance, in 2024, SHKP's rental income from investment properties reached HK$27.95 billion. This approach ensures competitive pricing while maximizing returns.

- Rental income is a key factor for pricing.

- Location and quality are essential.

- Market demand and lease terms matter.

Sun Hung Kai Properties bases its pricing on market analysis. They constantly assess market conditions, demand, and competitor prices. Construction costs also significantly affect pricing decisions; rising by 3-5% in 2024.

SHKP uses flexible pricing, adjusting to boost sales, especially for new units. Discounts and incentives are also applied to draw in buyers, offering up to 5% off in 2024.

Rental income is used for investment properties; In 2024, SHKP's investment properties earned HK$27.95 billion.

| Pricing Strategy | Details | 2024 Data |

|---|---|---|

| Market-Based Pricing | Analyzes market conditions, demand, and competitors. | Hong Kong property prices saw a slight decrease. |

| Cost-Based Pricing | Development costs, construction, land, and design. | Construction costs rose 3-5% in Hong Kong. |

| Flexible Pricing | Adjusts based on market needs to maintain competitiveness. | Price adjustments were made in response to demand changes. |

4P's Marketing Mix Analysis Data Sources

Sun Hung Kai Properties' 4P analysis uses public financial reports, real estate market data, company websites, and news sources. Pricing, placement, promotion and product insights come from current strategic actions.