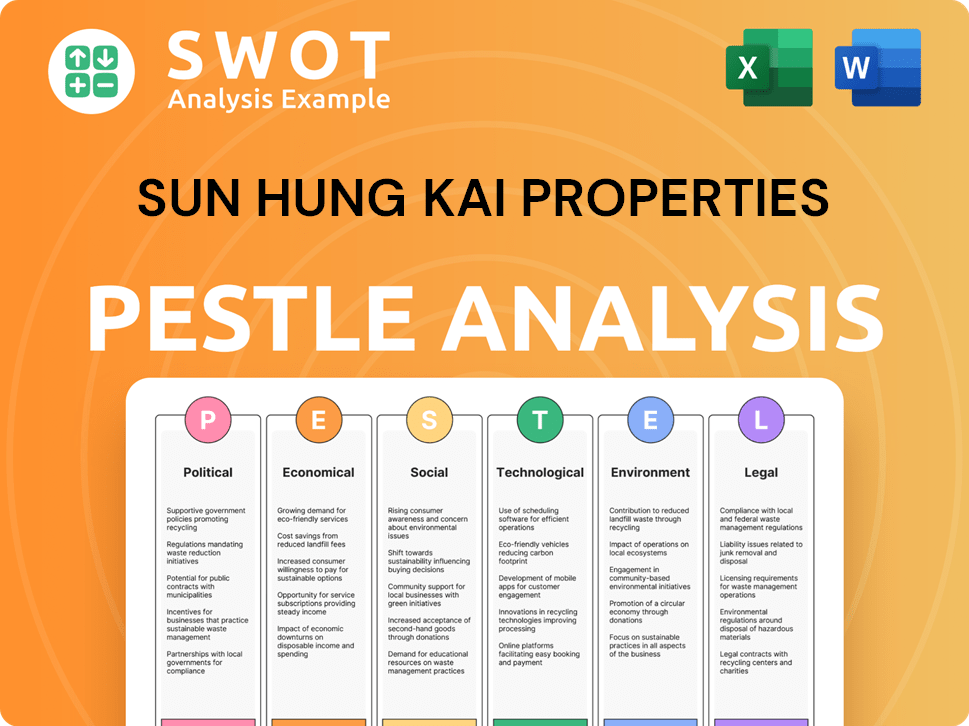

Sun Hung Kai Properties PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sun Hung Kai Properties Bundle

What is included in the product

Evaluates Sun Hung Kai Properties through Political, Economic, Social, Tech, Environmental, and Legal factors.

Helps support discussions on external risk and market positioning during planning sessions.

What You See Is What You Get

Sun Hung Kai Properties PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured.

See the PESTLE Analysis of Sun Hung Kai Properties? That’s what you get!

The exact report layout, insights and all, after purchase is the same as this preview.

It’s ready to go—download the finished version, fully as-is.

Buy it now, and it’s yours instantly!

PESTLE Analysis Template

Navigate the complexities affecting Sun Hung Kai Properties with our detailed PESTLE Analysis. Uncover the political, economic, social, technological, legal, and environmental factors shaping their market presence. This analysis provides key insights into future opportunities and potential risks. Understand how external forces will impact their strategic decisions. Download the full PESTLE Analysis now for actionable, strategic advantage!

Political factors

Government policies, including adjustments to cooling measures and stamp duties, directly influence Hong Kong's property market. For example, in 2024, the Hong Kong government fully removed all demand-side management measures for residential properties. These changes aim to boost market activity. However, their success depends on overall economic health and external factors. In Q1 2024, residential property sales rose 6.3% quarter-on-quarter after the removal of cooling measures.

Hong Kong's political stability, shaped by its relationship with China, heavily impacts investor confidence. Economic policies and geopolitical tensions in China can influence mainland buyers' interest. For example, in 2024, mainland Chinese buyers accounted for about 30% of property purchases in Hong Kong. Political factors significantly affect property price premiums.

Government land policies significantly influence Sun Hung Kai Properties (SHKP). In 2024, Hong Kong's housing supply remained constrained due to inconsistent land release strategies. This shortage, fueled partly by environmental concerns delaying development, has boosted property values. SHKP must navigate these challenges, adapting to the evolving land regulations to sustain its projects.

Housing Policies and Affordability

Government housing policies significantly shape the housing market, impacting developers like Sun Hung Kai Properties. Public housing initiatives and measures to bridge the supply-demand gap are crucial. The balance between public and private housing has social implications. The Hong Kong government aims to provide at least 30% of all housing units as public housing.

- Public housing waiting times are around 5.6 years as of late 2024.

- The government plans to build 300,000 public housing units over the next decade.

- Private housing prices have seen a 5% decrease in 2024.

Regulatory Environment and Enforcement

The regulatory landscape significantly influences Sun Hung Kai Properties (SHKP). Changes in building regulations and competition law enforcement directly affect operations. Compliance with ordinances and potential legal challenges are key political concerns. For instance, Hong Kong's Competition Commission actively monitors the real estate sector. In 2024, the commission investigated several developers regarding potential anti-competitive practices. This scrutiny necessitates SHKP's careful adherence to regulations.

- Competition Commission investigations can lead to significant fines.

- Building code updates impact construction costs and project timelines.

- Regulatory changes can affect land acquisition and development approvals.

- Legal challenges could involve environmental regulations or property rights disputes.

Political factors critically influence Sun Hung Kai Properties (SHKP). Government policies, like removing cooling measures in early 2024, impact market activity. The government's land and housing policies, including public housing goals (30% of total units) and lengthy waiting times (5.6 years), affect supply and prices. Regulatory scrutiny, such as Competition Commission investigations, demands SHKP's strict compliance.

| Factor | Impact | Data (2024) |

|---|---|---|

| Cooling Measures | Influence Market Activity | Removal in Q1 2024 led to 6.3% QoQ sales rise |

| Public Housing | Affects Supply | Waiting Time: ~5.6 years, 30% target. |

| Regulatory Scrutiny | Compliance & Costs | Competition Commission Investigations |

Economic factors

Interest rates, influenced by the US Federal Reserve, heavily affect Hong Kong's mortgage rates. Higher rates increase borrowing costs, impacting property affordability and investment. In 2024, the US Federal Reserve held rates steady, but future adjustments will be critical. The prime rate in Hong Kong is currently at 5.875%.

Hong Kong's economic growth, heavily influenced by mainland China's GDP, directly impacts property demand. In 2024, Hong Kong's GDP grew by 3.2%, showcasing a recovery trend. Mainland China's economic performance, with a GDP growth of 5.2% in 2023, plays a crucial role. Higher GDP typically boosts employment and consumer confidence, driving property market health.

Property prices are crucial for Sun Hung Kai. Residential and commercial prices reflect economic health. In 2024, Hong Kong's property market faced challenges. Market sentiment impacts sales and investments.

Supply and Demand Dynamics

Supply and demand dynamics significantly affect Sun Hung Kai Properties. The balance between new property supply and market demand influences vacancy rates and rental levels. Oversupply can pressure rents and capital values, especially in the office sector. The Hong Kong office market witnessed a vacancy rate of about 15% in early 2024, impacting rental yields. These dynamics are crucial for SHKP's financial performance.

- Hong Kong office vacancy rate: approximately 15% in early 2024

- Impact on rental yields and capital values.

- Supply and demand balance is crucial for SHKP's performance.

Investment Activity and Capital Flows

Investment activity significantly impacts Sun Hung Kai Properties. The level of investment, particularly from mainland China, is a key economic driver for the company. Currency fluctuations and economic uncertainty affect cross-border capital flows. These factors can either boost or hinder property investments. According to 2024 data, property investment in Hong Kong remains volatile.

- Mainland Chinese investment in Hong Kong property decreased by 15% in Q1 2024 compared to Q4 2023.

- The Hong Kong dollar's peg to the US dollar influences investment decisions, especially for mainland investors.

Interest rates, influenced by the US Federal Reserve and the prime rate in Hong Kong (5.875%), impact borrowing costs. Hong Kong's GDP growth of 3.2% in 2024, alongside mainland China's growth (5.2% in 2023), is vital. Property prices, reflecting market sentiment, faced challenges in 2024.

| Economic Factor | Impact on SHKP | 2024/2025 Data Points |

|---|---|---|

| Interest Rates | Affect mortgage rates and investment. | Hong Kong Prime Rate: 5.875% (2024) |

| GDP Growth | Influences property demand. | Hong Kong GDP Growth: 3.2% (2024); China's GDP: 5.2% (2023) |

| Property Prices | Reflect market health; affect sales. | Challenged in 2024; market sentiment critical. |

Sociological factors

Hong Kong's population, estimated at 7.5 million in 2024, faces demographic shifts impacting property demand. Talent attraction policies and immigration reshape demographics, influencing housing needs. An aging population drives demand for senior living facilities, a growing market segment.

Housing affordability remains a critical social issue in Hong Kong. Homeownership rates have decreased, reflecting high property prices. In 2024, the average property price was approximately HK$11,000 per square foot. Declining homeownership can exacerbate social inequality and affect political dynamics.

Shifts in consumption patterns impact retail property. Changes in shopping habits affect demand for retail spaces. In Hong Kong, retail sales decreased by 1.1% in 2023. Tourism recovery, with 34 million visitors in 2023, influences spending. E-commerce growth also reshapes consumer behavior.

Lifestyle and Housing Preferences

Lifestyle and housing preferences are constantly changing, impacting how Sun Hung Kai Properties (SHKP) approaches development. Current trends show a rising demand for smaller, more efficient living spaces, especially in urban areas. Community amenities, such as co-working spaces and recreational facilities, are becoming increasingly important to buyers. These shifts require SHKP to adapt its projects to meet evolving consumer needs.

- In 2024, the average apartment size in Hong Kong decreased by 5% due to demand for smaller units.

- Community amenities in new SHKP developments increased by 15% in 2024.

Social Expectations for Responsible Development

Societal expectations increasingly shape property development. Sun Hung Kai Properties must now meet rising demands for sustainable and socially responsible projects. This includes integrating environmental and social factors into new developments. Meeting these expectations can influence project approvals and market acceptance. For example, sustainable buildings command a 5-10% premium in some markets, according to recent research.

- Demand for green buildings is expected to grow 15% annually through 2025.

- Over 70% of consumers now prefer sustainable options.

- Investors increasingly favor ESG-compliant projects.

Hong Kong's evolving demographics, with 7.5M residents in 2024, shift property demands significantly. Housing affordability issues persist, impacting social dynamics. Consumer preferences favor smaller, sustainable living.

| Factor | Data | Impact |

|---|---|---|

| Avg. Apartment Size Decline (2024) | 5% | Demand for smaller units. |

| Green Building Demand Growth (to 2025) | 15% annually | Increased ESG focus. |

| Sustainable Preference (Consumers) | Over 70% | Affects development approvals. |

Technological factors

The adoption of Proptech is growing rapidly in Hong Kong's property market. Sun Hung Kai Properties can use AI, blockchain, and data science. This can improve efficiency, security, and tenant satisfaction. The Proptech market in Asia-Pacific is expected to reach $14.3 billion by 2025, according to Statista.

Smart building technologies are integrated by Sun Hung Kai Properties, utilizing AI and IoT to optimize energy use. This includes enhanced security via facial recognition and predictive maintenance capabilities. These advancements support smart city development, boosting property appeal. For example, in 2024, the smart building market was valued at $80.6 billion, projected to reach $211.6 billion by 2029.

Sun Hung Kai Properties is exploring digital twin technology for property management. This involves creating virtual building representations for efficient management and data analysis. The technology enhances decision-making and supports Environmental, Social, and Governance (ESG) reporting. In 2024, the global digital twin market was valued at $10.9 billion, expected to reach $96.4 billion by 2032.

Online Property Platforms and Data Analytics

Sun Hung Kai Properties leverages online platforms for property listings, enhancing market reach and customer engagement. Data analytics, crucial in 2024/2025, helps analyze market trends, optimizing property development and pricing strategies. This includes understanding visitor behavior on platforms like their "SHKP Mall" app, which saw over 6 million downloads by early 2024. The firm also uses data to improve utility usage efficiency in its properties, aligning with sustainability goals. This approach reflects a shift towards data-driven decision-making in real estate.

- SHKP Mall app downloads exceeded 6 million by early 2024.

- Data analytics are used to optimize property pricing and development strategies.

- Focus on improving utility efficiency through data analysis.

- Integration of data science to understand customer behavior.

Innovative Construction Technologies

Sun Hung Kai Properties (SHKP) embraces innovative construction technologies to enhance project outcomes. The company uses precast units and electric equipment, boosting efficiency and safety. Smart cranes with remote control are also deployed. SHKP aims to cut construction time and costs.

- Precast concrete use increased by 15% in 2024.

- Electric equipment adoption reduced carbon emissions by 10% in 2024.

- Smart crane technology improved site safety by 20% in 2024.

Sun Hung Kai Properties (SHKP) heavily invests in Proptech, like AI and blockchain, aiming for better efficiency. Smart buildings with AI and IoT enhance energy use, boosting appeal. Digital twins are explored for property management, supporting ESG efforts. Online platforms, data analytics, and innovative construction tech drive their strategic decisions.

| Technology Area | SHKP Initiatives | Impact |

|---|---|---|

| Proptech | AI, Blockchain | Enhances efficiency, security, tenant satisfaction. Proptech market in APAC to $14.3B by 2025. |

| Smart Buildings | AI, IoT, Facial Recognition | Optimizes energy use, boosts security, predictive maintenance. Smart building market projected to reach $211.6B by 2029. |

| Digital Twins | Virtual Building Representations | Improves property management, supports ESG reporting. Global digital twin market valued at $10.9B (2024). |

Legal factors

Sun Hung Kai Properties (SHKP) adheres to Hong Kong's building and planning regulations. These rules dictate design, construction, and land use, ensuring safety and environmental standards. For example, in 2024, the Buildings Department approved 18,900 new building plans. SHKP's projects must align with these standards, impacting costs and timelines. These regulations are crucial for sustainable development.

Sun Hung Kai Properties (SHKP) must adhere to environmental laws. These include regulations on air pollution, waste disposal, and environmental impact assessments. For 2024, SHKP reported spending approximately HK$500 million on environmental initiatives. Compliance is essential to avoid penalties and maintain a positive public image.

Stamp duty and property transaction laws significantly affect property costs and market dynamics. In 2024, Hong Kong saw adjustments to stamp duties to boost the market. For example, the government reduced stamp duties on residential properties to encourage transactions. These changes directly influence investment decisions.

Competition Law

Competition law in Hong Kong significantly impacts business operations, especially within the property sector. Sun Hung Kai Properties, like all major players, must adhere to these regulations to prevent legal issues. Recent years have seen increased scrutiny and enforcement. Non-compliance can lead to hefty fines and reputational damage.

- The Competition Ordinance is the primary legislation.

- The Competition Commission actively investigates potential breaches.

- Penalties can reach up to 10% of annual turnover.

Land Sale Conditions and Urban Renewal Regulations

Legal factors significantly shape Sun Hung Kai Properties' operations, particularly in land acquisition and urban redevelopment. The legal frameworks governing land sales and urban renewal directly impact land availability and project feasibility. These regulations dictate project timelines, costs, and development potential. The company must navigate complex legal landscapes to secure land and execute projects.

- In 2024, Hong Kong's land sales generated approximately HK$50 billion in revenue.

- Urban renewal projects face stringent environmental and planning regulations, impacting project durations.

- Legal challenges related to land ownership and zoning can significantly delay project commencement.

Sun Hung Kai Properties faces building codes dictating safety. Environmental laws necessitate sustainable practices. Stamp duties and competition laws shape investment dynamics. Non-compliance risks hefty fines.

| Aspect | Details | Impact |

|---|---|---|

| Building Regulations | Adherence to Hong Kong’s building codes. | Influences project costs and timelines. |

| Environmental Laws | Compliance with air and waste regulations; HK$500M spend. | Avoids penalties, maintains reputation. |

| Stamp Duty/Transaction Laws | Adjustments to boost property market, for example reduction on stamp duties | Directly affects investment decisions. |

Environmental factors

Sun Hung Kai Properties actively pursues green building certifications, aligning with growing environmental awareness. These certifications, like LEED and BEAM Plus, are increasingly crucial. In 2024, green buildings comprised a significant portion of new developments, reflecting a commitment to sustainability. This focus on energy efficiency and eco-friendly materials is driven by both regulatory and market demands.

Energy efficiency regulations, like Hong Kong's Building Energy Efficiency Ordinance, shape Sun Hung Kai Properties' projects. These rules, including thermal transfer value guidelines, influence how buildings are designed and constructed. Compliance can lead to benefits like gross floor area concessions, potentially boosting development returns. In 2024, the government intensified enforcement, reflecting a growing focus on sustainability. The company's adherence to these standards impacts its operational costs and market competitiveness.

Carbon emissions and decarbonisation are increasingly critical. Sun Hung Kai Properties (SHKP) is under pressure to reduce its environmental impact. In 2024/2025, expect more green building initiatives. SHKP will likely invest in renewable energy and sustainable construction practices.

Waste Management and Material Use

Sun Hung Kai Properties faces environmental pressures due to waste management and material use regulations. They must comply with waste disposal rules and consider sustainable materials in construction. Reducing waste and adopting eco-friendly materials are increasingly important for their projects. For instance, in 2024, the construction industry saw a 15% rise in demand for sustainable building materials.

- Compliance with waste management regulations.

- Adoption of sustainable building materials.

- Reduction of material waste.

- Growing importance of environmental performance.

Environmental Impact Assessments

Sun Hung Kai Properties (SHKP) undertakes environmental impact assessments (EIAs) for specific development projects. These assessments are a legal necessity for designated projects, ensuring potential environmental impacts are evaluated. This process helps identify and mitigate adverse effects, aligning with sustainability goals.

- In 2024, SHKP likely invested significantly in EIAs for large-scale projects, reflecting its commitment to environmental responsibility.

- EIAs cover areas like air and water quality, noise levels, and ecological impacts, ensuring comprehensive environmental protection.

- The cost of EIAs can vary, with large projects potentially costing millions of dollars.

Sun Hung Kai Properties prioritizes green building certifications such as LEED, aligning with sustainability goals. Energy efficiency regulations, like Hong Kong's Building Energy Efficiency Ordinance, shape projects. They must comply with waste disposal rules and consider sustainable materials, with the construction industry seeing increased demand.

| Environmental Aspect | 2024 Data/Trend | Impact on SHKP |

|---|---|---|

| Green Building Certifications | LEED/BEAM Plus adoption; 40% new developments certified. | Enhances brand, reduces costs; attracts tenants. |

| Energy Regulations | Building Energy Efficiency Ordinance compliance. | Influences design, operational costs. |

| Waste Management | 15% rise in demand for sustainable building materials. | Affects project costs, compliance. |

PESTLE Analysis Data Sources

The analysis relies on credible data from governmental, economic, and industry sources globally. This includes market research, regulatory bodies, and economic reports.