Signet Jewelers Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Signet Jewelers Bundle

What is included in the product

Analysis of Signet's units via BCG Matrix, identifying investment, hold, or divest strategies.

Clean, distraction-free view optimized for C-level presentation, providing concise strategic insights.

Delivered as Shown

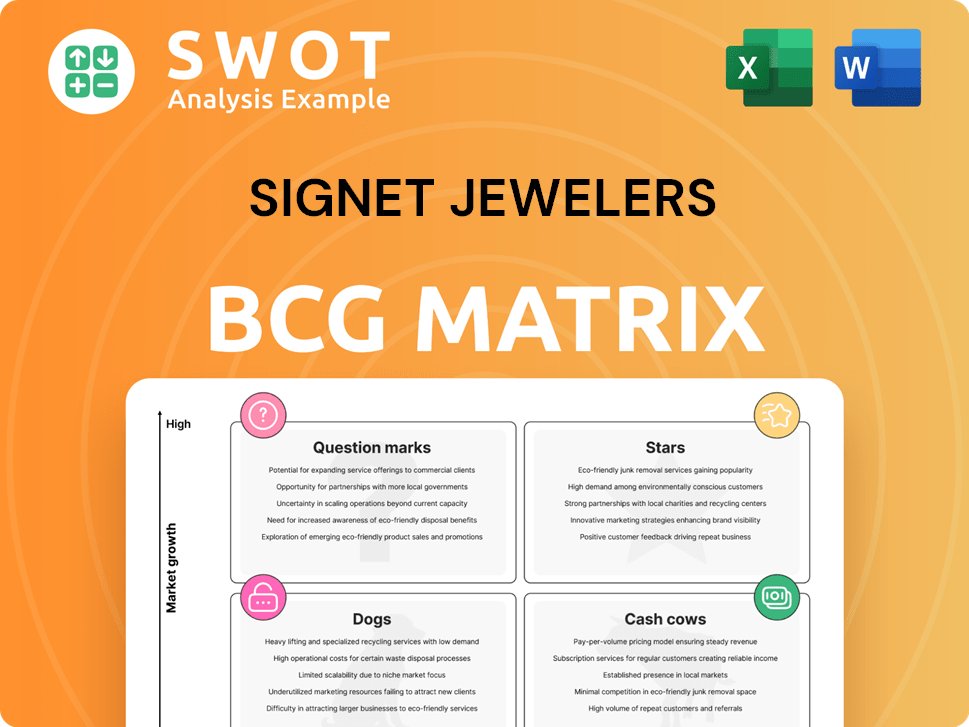

Signet Jewelers BCG Matrix

The BCG Matrix you're viewing is the same document you'll receive. Get the full analysis and strategic insights instantly—no hidden content, just a ready-to-use report.

BCG Matrix Template

Signet Jewelers, with its diverse portfolio of brands, presents a fascinating case study for the BCG Matrix. Understanding the dynamics of its "Stars," "Cash Cows," "Dogs," and "Question Marks" is key. This preliminary view provides a glimpse into product portfolio strategies. A deeper dive unlocks actionable insights for strategic decision-making.

The complete BCG Matrix reveals exactly how this company is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Kay Jewelers, a cornerstone brand within Signet Jewelers, shines as a star. Its robust brand presence and focus on the bridal market fuel its strong performance. In 2024, Signet reported strong same-store sales growth, with Kay contributing significantly. The bridal segment continues to be a key driver.

Jared, a luxury brand within Signet Jewelers, is likely categorized as a Star in the BCG Matrix. In fiscal year 2024, Signet Jewelers reported a total revenue of $6.9 billion. Jared's strong brand recognition and high-end focus contribute significantly to this figure. Its continued success and premium market positioning affirm its status as a key growth driver.

Diamonds Direct, a direct diamond importer, could be a star. Signet Jewelers reported a 2.7% same-store sales decrease in Q3 2024. Diamonds Direct's customer-focused approach might drive growth. Its position could shift based on market dynamics and Signet's overall performance.

Online Sales Growth

Signet Jewelers' online sales, a key growth area, are considered stars in its BCG matrix. The company focuses on improving digital sales through innovation and omnichannel strategies. In fiscal year 2024, digital sales accounted for 18.1% of total sales. Signet aims to boost online presence and sales further. This focus aligns with consumer trends favoring online shopping and omnichannel experiences.

- Digital sales represented 18.1% of total sales in fiscal year 2024.

- Signet emphasizes innovation and omnichannel retailing to drive online sales.

- The company is investing in digital platforms for growth.

- Online channels are a significant focus area for Signet's future.

Lab-Grown Diamond Fashion

Lab-grown diamond fashion jewelry is a star for Signet Jewelers, with rising sales in its major brands. This segment is a high-growth opportunity, expected to improve retail prices and margins. It also helps attract new customers, boosting overall financial performance. In 2024, lab-grown diamond sales grew significantly, contributing to Signet's revenue.

- Sales of lab-grown diamonds are growing rapidly.

- Expected to increase average unit retail.

- Attracts new customers.

- Helps improve profit margins.

Stars in Signet Jewelers' BCG Matrix show strong growth. Digital sales, representing 18.1% of total 2024 sales, are a key focus. Lab-grown diamonds, driving sales growth, also enhance margins.

| Brand/Segment | Description | 2024 Performance |

|---|---|---|

| Kay Jewelers | Bridal market focus | Strong same-store sales growth |

| Jared | Luxury brand, high-end focus | Contributed significantly to $6.9B revenue |

| Online Sales | Digital and omnichannel focus | 18.1% of total sales |

Cash Cows

Zales, under Signet Jewelers, is a cash cow due to its consistent revenue from a broad customer base. In 2024, Signet reported strong sales, with Zales contributing significantly. This brand's focus on accessible price points ensures steady demand, generating stable cash flow. Its established market position solidifies its cash cow status within Signet's portfolio.

Peoples Jewellers, a Signet Jewelers brand, is a Cash Cow. It is the largest specialty jewelry brand in Canada. Peoples caters to sentimental gifting and mid-market bridal customers. In 2024, Signet reported strong sales across its North America segment, including Canada. This indicates Peoples Jewellers’ consistent revenue generation.

H. Samuel, a key brand for Signet Jewelers in the UK, focuses on affordable jewelry for fashion-conscious consumers. In 2024, Signet's UK segment, which includes H. Samuel, saw sales impacted by economic pressures. H. Samuel's strategy revolves around value and trend-driven products.

Ernest Jones (UK)

Ernest Jones, a UK-based jewelry retailer, is a key part of Signet Jewelers. It's known for its range of diamonds and Swiss watches. In 2024, Signet Jewelers reported a total revenue of $6.9 billion. Ernest Jones contributes significantly to this revenue stream.

- Diamond and watch sales drive revenue.

- Part of a larger, successful group.

- Signet Jewelers' revenue in 2024 was $6.9B.

Services Business

Signet Jewelers' services business, encompassing jewelry repair and warranties, is a reliable revenue source. They are broadening service offerings to boost customer loyalty and generate recurring income. This strategy helps stabilize financial performance. In fiscal year 2024, service revenue contributed significantly.

- Service revenue growth contributes to overall revenue stability.

- Expansion of services enhances customer retention rates.

- Recurring revenue streams improve financial predictability.

- Services provide higher profit margins compared to product sales.

Signet Jewelers utilizes services like jewelry repair, contributing to revenue stability. Service revenue growth in 2024 was notable, improving financial predictability and profit margins. These services also boost customer loyalty, enhancing recurring income streams.

| Aspect | Details | Impact |

|---|---|---|

| Service Revenue | Significant growth in 2024 | Revenue Stability |

| Customer Loyalty | Expansion of services | Enhanced Retention |

| Profit Margins | Higher compared to product sales | Improved Financials |

Dogs

Rocksbox, Signet Jewelers' jewelry rental service, could be a dog. It likely has a small market share within the broader jewelry market. In 2024, the jewelry rental market's growth was modest, suggesting low growth rates for Rocksbox.

Signet Jewelers' divested UK prestige watch locations are now dogs. This move, due to the sale, has impacted the company's financial performance. The sale led to a decrease in Average Transaction Value (ATV). In 2024, this strategic shift needs careful monitoring for its long-term effects.

Underperforming mall locations can be classified as dogs in Signet Jewelers' BCG matrix. Signet plans to transition over 10% of mall stores in the next three years. This strategic shift aims to improve profitability. In Q3 2024, same-store sales decreased by 8.3%, indicating the need for change.

Traditional Watches

In Signet Jewelers' BCG matrix, traditional watches could be classified as dogs. The company primarily sells jewelry, watches, and services. Consumer preferences are shifting, potentially impacting sales of traditional watches. Signet's 2024 sales data will provide a clearer picture of this segment's performance.

- Signet Jewelers' revenue in 2023 was approximately $6.9 billion.

- The watch category's contribution to overall sales is a key indicator.

- Changing consumer tastes influence market positioning.

- The company's strategies may affect the watch segment.

Products with Low Fashion Mix

Products with a low fashion mix, especially those dependent on promotions, can be classified as dogs in Signet Jewelers' BCG matrix. This category experienced challenges during the 2023 holiday season. Signet's holiday sales were negatively impacted by the low fashion mix and increased customer demand for promotional items. These items often yield lower profit margins.

- Signet's Q3 2023 sales decreased by 8.4% due to a shift towards promotional items.

- Promotional items generally have lower profit margins than core fashion products.

- The low fashion mix reflects reduced consumer interest in full-price, trend-driven jewelry.

Dogs in Signet's BCG matrix include underperforming segments. These face low market share and growth. Strategic shifts, like divesting watch locations, are being monitored for their impact.

Low fashion mix products, reliant on promotions, also fall into this category. These items have faced challenges, particularly during the holiday season. Q3 2023 sales decreased by 8.4% due to this.

Traditional watches and Rocksbox jewelry rental service are potential dogs too. The shift in consumer preferences towards promotional items needs to be considered.

| Category | Characteristics | 2024 Status |

|---|---|---|

| Rocksbox | Low market share, modest growth | Ongoing evaluation |

| UK watch locations | Divested, impacting ATV | Needs monitoring |

| Underperforming mall stores | Transitioning, sales decline | Strategic shift |

| Traditional watches | Shifting consumer preferences | Sales data analysis |

| Low fashion mix | Promotion-dependent, lower margins | Facing challenges |

Question Marks

Blue Nile, acquired by Signet Jewelers, fits the "Question Mark" quadrant in the BCG Matrix due to integration challenges. Signet reported a total sales decrease in 2024. This reflects issues integrating Blue Nile with James Allen, plus the market's competitive nature. The integration presents hurdles.

James Allen, like Blue Nile, is in a challenging position within Signet Jewelers' portfolio. The company needs investments to boost market share. Signet's total sales declined, indicating difficulties in integrating James Allen and Blue Nile. In Q3 2024, Signet's same-store sales decreased by 7.1%.

Banter by Piercing Pagoda, a question mark in Signet's portfolio, focuses on younger consumers. It offers affordable jewelry and piercing services, aiming for rapid growth. In 2024, Signet's same-store sales decreased by 4.3%, reflecting challenges in the jewelry market. Banter's performance is crucial for Signet's future growth.

Expansion into Self-Purchase and Gifting

Signet Jewelers' foray into self-purchase and gifting is a question mark, indicating high market growth potential with uncertain market share. To fuel this expansion, the company is restructuring its operations, prioritizing a brand-centric approach. This shift involves centralizing key functions to enhance efficiency, leverage economies of scale, and foster organic growth. In 2024, Signet reported a 2.3% increase in same-store sales, reflecting ongoing efforts to tap into these evolving consumer segments.

- Brand-centric strategy to drive growth.

- Centralized capabilities for efficiency.

- Focus on self-purchase and gifting categories.

- 2.3% increase in same-store sales in 2024.

New Product Designs

New product designs at Signet Jewelers currently fit the "Question Mark" category within the BCG Matrix. While these designs show promise, evidenced by increased sales, their long-term market share and profitability are still uncertain. The company is experiencing positive trends, including a 120 basis points merchandise margin expansion and an increase in average transaction value compared to the previous year. These factors suggest potential, but further evaluation is needed to determine if these new designs will become Stars or ultimately fade.

- Increased sales indicate initial success.

- Uncertainty remains regarding long-term market share.

- Merchandise margin expansion of 120 basis points.

- Increase in average transaction value.

Question Marks at Signet, like new designs, face uncertainty despite initial success. They require investment to gain market share. In 2024, Signet's same-store sales saw fluctuations, with a 2.3% increase overall. Their future depends on successful growth strategies.

| Category | 2024 Performance | Strategic Focus |

|---|---|---|

| New Designs | Initial Sales Growth | Market share expansion |

| Blue Nile/James Allen | Integration Challenges | Market share gains via synergy |

| Banter | Competitive Market | Targeting younger consumers |

| Self-Purchase/Gifting | Positive Trends | Brand-centric approach |

BCG Matrix Data Sources

The Signet BCG Matrix leverages company financials, market analysis, and industry reports for data-backed assessments. This includes company reports and competitor performance benchmarks.