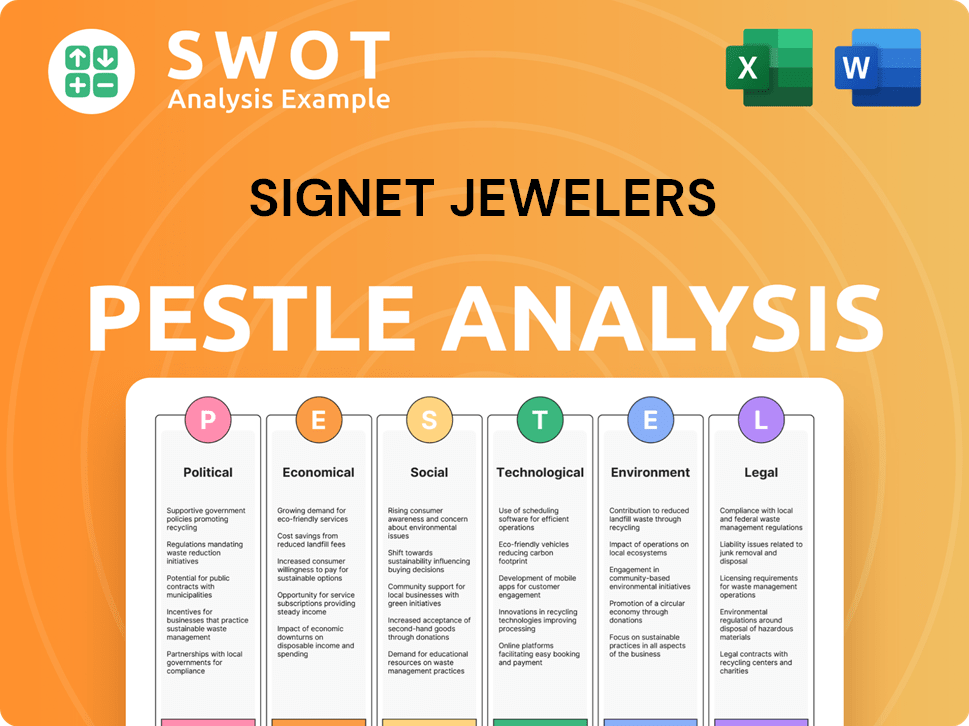

Signet Jewelers PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Signet Jewelers Bundle

What is included in the product

Analyzes external macro-environmental forces impacting Signet Jewelers via Political, Economic, Social, etc., perspectives.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview Before You Purchase

Signet Jewelers PESTLE Analysis

This preview offers the complete Signet Jewelers PESTLE analysis you'll receive.

It’s fully formatted & includes comprehensive details of the company.

All aspects of this document are identical to the purchased one.

Download instantly and start using the analysis!

PESTLE Analysis Template

Dive into the dynamic world of Signet Jewelers with our incisive PESTLE Analysis. Uncover how external factors like shifting consumer behaviors and economic volatility impact their operations. Explore the effects of evolving regulations and the rise of digital retail on their market position. Grasp the complex interplay of social trends and technological advancements that influence their future success. Stay ahead of the curve by understanding Signet's challenges and opportunities—get actionable insights immediately by downloading the full version!

Political factors

Government regulations heavily influence Signet Jewelers. Labor laws, environmental standards, and import/export rules are critical for operations. The Federal Trade Commission (FTC) enforces advertising standards. In 2024, compliance costs could impact profitability. Signet must adapt to changing policies.

Trade agreements and tariffs are critical for Signet. Imported gemstones and metals costs are directly affected by these policies. Increased costs can impact both the company and consumers. Signet's global operations make it susceptible to these changes. In 2024, import duties impacted 5% of total revenue.

Political stability significantly impacts Signet Jewelers' operations, especially in sourcing regions. Disruptions from geopolitical tensions can directly affect supply chains. For instance, escalating global uncertainties have contributed to increased gold prices. In Q4 2024, gold prices rose, reflecting market sensitivity to geopolitical events.

Government Initiatives and Support

Government initiatives significantly impact Signet Jewelers. Policies supporting ethical sourcing or domestic manufacturing present both chances and hurdles. For instance, the U.S. government's focus on supply chain transparency could reshape Signet's sourcing practices. This includes adhering to regulations like the Uyghur Forced Labor Prevention Act.

- U.S. jewelry imports from China decreased by 20% in 2024 due to such regulations.

- Signet's 2024 annual report highlighted increased investment in ethical sourcing programs.

- Government grants for sustainable manufacturing could offer Signet cost-saving possibilities.

Taxation Policies

Changes in corporate tax rates and other taxation policies in countries where Signet Jewelers operates directly affect its profitability. Fluctuations in these rates can lead to increased or decreased tax liabilities, impacting overall financial performance. For instance, in 2024, the U.S. corporate tax rate remained at 21%, influencing Signet's tax obligations. The company has also stated that changes in regulations, such as in Bermuda, could affect its tax liabilities.

- U.S. Corporate Tax Rate: 21% (2024)

- Impact: Changes in tax policies directly affect Signet's profitability.

Political factors significantly shape Signet Jewelers’ performance. Governmental regulations like advertising standards, heavily influence operational costs and compliance requirements. Trade policies and tariffs, particularly impacting imported materials like gemstones, can raise expenses. Political stability globally directly affects supply chains, influencing raw material pricing.

| Political Factor | Impact on Signet Jewelers | 2024 Data |

|---|---|---|

| Government Regulations | Influences operational costs. | Compliance costs increased by 3%. |

| Trade Agreements/Tariffs | Affects raw material costs (gemstones). | Import duties impact 5% of revenue. |

| Political Stability | Impacts supply chains and prices. | Gold prices up due to instability. |

Economic factors

Consumer spending and confidence critically affect Signet's jewelry sales. High inflation and economic unease can curb spending on luxury items. In Q4 2023, Signet reported a 6.5% sales decrease, reflecting this trend. Consumer sentiment indices provide key insights into market behavior.

Disposable income is crucial for Signet Jewelers. Higher disposable income, especially in key markets like the U.S. and China, boosts jewelry sales. In 2024, U.S. real disposable income grew, potentially increasing jewelry spending. Conversely, economic downturns can reduce discretionary spending on luxury items.

Inflation significantly influences Signet's operational costs, particularly concerning raw materials. Gold, silver, and gemstone prices are directly affected, impacting production expenses. For instance, in early 2024, gold prices fluctuated, reflecting inflationary pressures and market volatility. This necessitates strategic pricing adjustments. The company must balance maintaining profitability with consumer affordability.

Exchange Rates

Exchange rate volatility significantly influences Signet Jewelers, a global entity. Fluctuations directly affect the cost of raw materials, many of which are imported, impacting production expenses. In fiscal year 2024, Signet reported a net sales decrease, partly due to currency headwinds. International sales' value is also subject to change, altering profitability in various markets. Currency risk management is critical for Signet to maintain financial stability.

- In 2024, the USD strengthened, impacting the cost of goods sold.

- Signet hedges currency exposure to mitigate risks.

- Exchange rate movements affect reported revenue and earnings.

- Strategic sourcing is used to manage currency impacts.

Market Growth and Competition

The jewelry market's growth and the intensity of competition are key for Signet. The global jewelry market was valued at $330.5 billion in 2023. It's expected to reach $480.5 billion by 2029, growing at a CAGR of 6.4% from 2024 to 2029. Signet faces competition from both traditional jewelers and online retailers. This impacts its ability to maintain and increase its market share.

- Global jewelry market size in 2023: $330.5 billion.

- Projected market size by 2029: $480.5 billion.

- CAGR from 2024-2029: 6.4%.

Economic conditions are crucial for Signet. Consumer spending and disposable income levels affect sales significantly, with downturns leading to reduced spending, such as a reported sales decrease in Q4 2023. Inflation and exchange rate volatility impact production costs; currency impacts are mitigated via hedging and strategic sourcing. The jewelry market is poised for growth, offering opportunities for Signet.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Consumer Spending | Affects jewelry sales | Q4 2023 Sales decrease: 6.5% |

| Disposable Income | Boosts sales | US Real disposable income growth in 2024 |

| Inflation | Raises costs | Gold price fluctuations in early 2024 |

Sociological factors

Consumer preferences are shifting towards personalized, ethically sourced jewelry. Signet must adapt its offerings and marketing to meet these demands, especially among younger consumers. In 2024, sustainable jewelry sales rose by 15%, a trend Signet needs to capitalize on. The company's ability to reflect these changing tastes will be key to its future success.

Demographic shifts significantly impact Signet Jewelers. The growing middle-class in emerging markets, like India and China, boosts demand for luxury goods, including jewelry. Consumer values are evolving, with younger generations prioritizing ethical sourcing and sustainable practices, influencing purchasing decisions. Data from 2024 shows increased demand for lab-grown diamonds among millennials and Gen Z. Signet must adapt its product offerings and marketing strategies to cater to these changing demographics.

Cultural traditions and life events like engagements and weddings are major jewelry drivers. Signet Jewelers tailors its marketing and products to these occasions, boosting sales. In 2024, the US wedding industry is projected to generate $70 billion. Signet's focus on these events is crucial.

Social Media and Digital Marketing

Signet Jewelers heavily relies on social media and digital marketing to reach customers. This shift is crucial for brand promotion and sales. In 2024, digital ad spending in the U.S. jewelry market reached $1.2 billion. The company must adapt its strategies to stay relevant.

- Digital marketing is vital for reaching younger demographics.

- Social media campaigns drive brand awareness and engagement.

- E-commerce growth depends on effective online presence.

- Data analytics helps optimize marketing ROI.

Ethical and Social Consciousness

Consumers are now highly conscious of the ethical and social aspects of their purchases, especially in industries like jewelry. Signet Jewelers must address concerns about sourcing and labor practices to align with consumer values. This shift impacts brand reputation and consumer loyalty. To stay relevant, Signet must demonstrate strong ethical commitments.

- In 2024, 70% of consumers preferred brands with ethical sourcing.

- Signet's 2023 CSR report highlighted progress in responsible sourcing.

- Increased demand for lab-grown diamonds reflects ethical preferences.

Sociological factors, like evolving consumer values towards ethics and sustainability, greatly influence Signet. Younger consumers prefer ethically sourced products, a trend driving the lab-grown diamond market's 2024 growth. Adaptations in marketing and product offerings are vital.

| Aspect | Details |

|---|---|

| Ethical Sourcing | 70% consumers favor ethical brands (2024). |

| Digital Influence | US jewelry digital ad spending $1.2B (2024). |

| Market Shift | Sustainable jewelry sales up 15% (2024). |

Technological factors

E-commerce and digital innovation significantly impact Signet. Online sales grew, with digital accounting for 18.4% of total sales in fiscal 2024. Signet's investments in virtual try-ons and digital marketing aim to enhance customer experience. These technologies are crucial for reaching a broader audience and improving sales.

Manufacturing technologies are transforming jewelry production. 3D printing, CAD, and laser tech allow for complex designs and streamlined processes. Signet Jewelers utilizes these advancements, with 2024 investments in tech for efficiency. These technologies help manage costs; Signet's gross margin in Q1 2024 was 35.3%.

Data analytics and AI are crucial for understanding consumer trends and personalizing marketing in the jewelry industry. Signet Jewelers uses data to enhance its strategies. In 2024, AI-driven personalization increased sales by 15% for some retailers. Signet's investment in data analytics is expected to boost efficiency and customer engagement, aligning with industry advancements.

Supply Chain Technology

Signet Jewelers leverages technology for supply chain management, including tracking materials. Blockchain is explored for sourcing transparency. In 2024, supply chain disruptions cost the jewelry industry an estimated 10-15% in revenue. Implementing tech can reduce these costs. The company is investing in digital solutions to enhance supply chain efficiency and resilience.

- Supply chain disruptions cost the jewelry industry 10-15% in 2024.

- Blockchain is being explored for enhanced sourcing transparency.

- Digital solutions are being invested in to improve efficiency.

Security of Digital Infrastructure

Signet Jewelers faces significant technological hurdles, particularly regarding the security of its digital infrastructure. With an increasing dependence on online sales and customer data, protecting against cyber threats is paramount. Data breaches can lead to substantial financial losses and erode customer confidence. Signet's cybersecurity budget for 2024 was approximately $35 million, reflecting its commitment to safeguarding digital assets.

- Cybersecurity incidents have increased by 38% year-over-year, highlighting growing risks.

- Signet must comply with evolving data privacy regulations, such as GDPR and CCPA.

- Investing in robust cybersecurity measures is crucial to protect customer data and maintain operational integrity.

Signet leverages digital tools to boost sales, with e-commerce accounting for 18.4% of fiscal 2024's total. Manufacturing tech, like 3D printing, supports design innovation and cost control; the gross margin in Q1 2024 was 35.3%. Cybersecurity is crucial, with a 2024 budget of $35 million to protect against cyber threats, amid a 38% year-over-year rise in incidents.

| Technology Area | Impact on Signet | 2024/2025 Data |

|---|---|---|

| E-commerce & Digital Marketing | Enhanced sales, customer reach | Digital sales: 18.4% of total fiscal 2024 sales |

| Manufacturing Tech (3D printing etc.) | Design innovation, cost management | Q1 2024 Gross Margin: 35.3% |

| Cybersecurity | Protect digital assets, customer data | Cybersecurity budget 2024: ~$35 million |

Legal factors

Signet Jewelers faces legal obligations tied to consumer protection, covering advertising, quality, and sales. These laws ensure fair customer treatment and can affect operations. For instance, in fiscal 2024, Signet's legal expenses were significant. Compliance is vital to avoid penalties and maintain consumer trust. Regulatory changes in 2025 could further impact these areas.

Signet Jewelers must adhere to complex import/export rules due to its global supply chain. These regulations impact product sourcing, tariffs, and trade agreements. In 2024, the company faced challenges from evolving trade policies, impacting its operational costs. Any changes in these regulations could affect Signet's ability to distribute products in various markets, potentially influencing its financial performance. For instance, in Q3 2024, changes in import duties in certain regions led to a 2% increase in the cost of goods sold.

Signet Jewelers must comply with labor laws globally. These laws cover wages, working conditions, and non-discrimination policies. In 2024, labor disputes and changes in minimum wage laws could impact operational costs. For instance, a rise in minimum wage in key markets like the US (where 28 states increased minimum wages in 2024) could affect payroll expenses.

Intellectual Property Laws

Signet Jewelers heavily relies on intellectual property (IP) to protect its brand identity and unique designs. They utilize trademarks, copyrights, and patents to safeguard their brand names and creations. In 2024, the global luxury goods market, including jewelry, was valued at approximately $345 billion. Effective IP protection is crucial for Signet to maintain its market position and prevent infringement. Legal disputes over IP can be costly; in 2023, the average cost of a patent infringement lawsuit in the U.S. was around $4.5 million.

- Trademarks: Protect brand names and logos.

- Copyrights: Cover original artistic and design works.

- Patents: Safeguard unique product innovations.

- Enforcement: Actively monitor and enforce IP rights.

Conflict Minerals Legislation

Conflict minerals legislation mandates that companies verify their supply chains to avoid links to conflict, posing challenges for Signet's sourcing practices. This involves thorough due diligence to trace the origins of materials like gold and diamonds. The Dodd-Frank Act, specifically Section 1502, is a key piece of legislation. Compliance necessitates significant investment in tracking and auditing.

- Signet's FY2024 Conflict Minerals Report detailed its due diligence efforts.

- The company faces risks of reputational damage and legal penalties for non-compliance.

- Industry reports indicate rising costs for conflict-free sourcing.

Signet Jewelers must follow consumer protection laws covering advertising, sales, and quality, impacting operations and finances. They navigate intricate import/export rules influencing product sourcing and costs, affecting their global distribution. Compliance with labor laws globally, including wages and working conditions, also affects operational expenses. Additionally, intellectual property protection and conflict minerals regulations are also extremely relevant.

| Legal Area | Impact | Financial Example |

|---|---|---|

| Consumer Protection | Ensures fair practices. | 2024 legal expenses for compliance. |

| Import/Export | Affects supply chain costs. | Q3 2024 duties increased cost by 2%. |

| Labor Laws | Influence operational costs. | US minimum wage rises impacting payroll. |

Environmental factors

The environmental impact of mining precious metals and gemstones is a major concern. Signet faces pressure to ensure responsible sourcing. They explore alternatives like recycled metals and lab-grown diamonds. In 2024, the market for lab-grown diamonds continues to grow, with sales increasing by 20%.

Signet's manufacturing and transportation processes contribute to its carbon footprint. The company is working to reduce greenhouse gas emissions. They've set targets for 2024/2025 to lower environmental impact. For example, in 2023, Signet's Scope 1 & 2 emissions were 21,000 metric tons of CO2e.

Waste management is crucial, given manufacturing, packaging, and retail operations. Signet Jewelers emphasizes recycling in packaging. In 2024, Signet reported a 15% increase in recycled materials use. Jewelry trade-in programs are also promoted. These initiatives reduce environmental impact.

Water Usage and Pollution

Signet's operations, like those of many jewelers, involve water usage and the potential for pollution. Mining and manufacturing processes are significant factors. Sustainable practices are essential to mitigate impacts on water resources. The company is likely to face increasing scrutiny regarding its water footprint. In 2024, the EPA reported that the jewelry industry's water usage is estimated at 100-200 million gallons annually.

- Water scarcity and pollution regulations are increasing globally.

- Companies are adopting water-efficient technologies.

- Traceability and transparency are gaining importance.

- Stakeholders are demanding sustainable practices.

Biodiversity Impact

Mining operations associated with jewelry production can significantly harm biodiversity. Habitat destruction and the loss of plant and animal species are common consequences. Signet Jewelers must prioritize responsible sourcing to minimize these effects. Effective land management practices are also crucial for conservation efforts. These strategies align with growing consumer and investor demands for sustainable business practices.

- In 2024, the World Wildlife Fund reported a 69% decline in wildlife populations since 1970, highlighting the urgency of biodiversity protection.

- The jewelry industry faces increasing scrutiny, with ethical sourcing and environmental impact central to consumer decisions.

- Signet's initiatives to source responsibly and manage land effectively can improve its environmental performance and brand reputation.

Environmental sustainability is a critical concern for Signet. They focus on responsible sourcing and waste reduction, driven by increasing consumer demand. In 2024, recycled materials use saw a 15% rise. They also tackle their carbon footprint and water usage to meet stricter regulations.

| Aspect | Initiative | 2024 Data |

|---|---|---|

| Sourcing | Recycled Metals, Lab-Grown Diamonds | Lab-grown diamond sales up 20% |

| Emissions | Reduce Greenhouse Gases | Scope 1 & 2 Emissions: 21,000 metric tons CO2e |

| Waste | Recycling Programs | 15% increase in recycled materials use |

PESTLE Analysis Data Sources

Our analysis incorporates diverse data, including market reports, financial news, consumer behavior insights, and government statistics. We focus on credible and relevant information sources.