Silgan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Silgan Bundle

What is included in the product

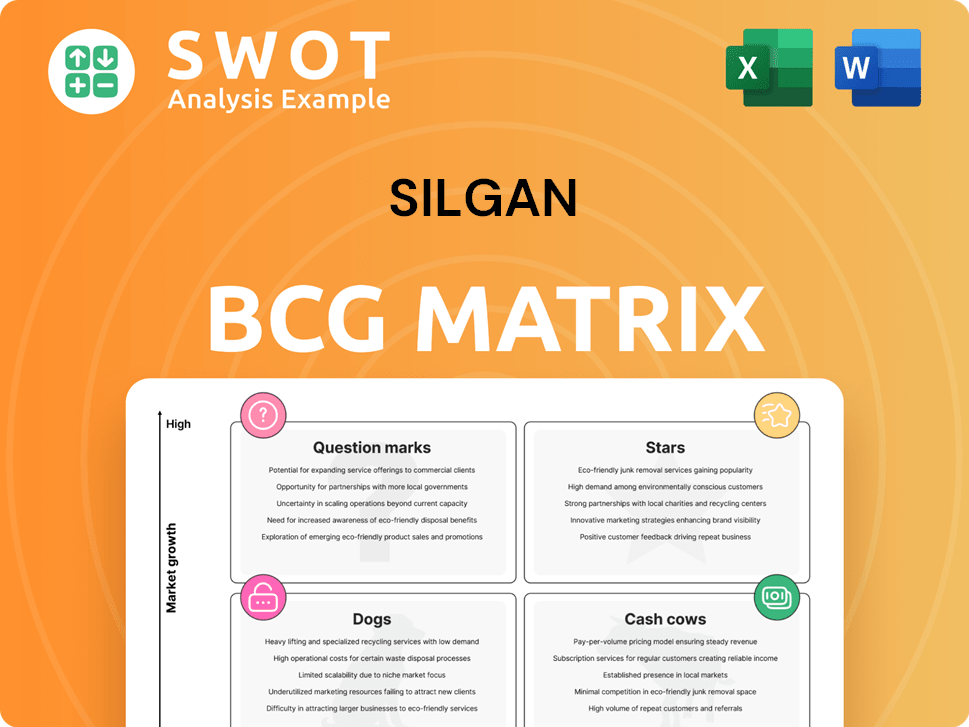

Silgan's portfolio evaluated across BCG Matrix quadrants.

Clean and optimized layout for sharing or printing, providing a clear and concise view of Silgan's portfolio.

What You See Is What You Get

Silgan BCG Matrix

The Silgan BCG Matrix you're viewing is identical to the one you'll receive after purchase. This comprehensive document is professionally crafted, offering immediate strategic insights without any modifications. Expect a ready-to-use tool, perfect for enhancing your business analysis and decision-making processes. The complete, downloadable file provides instant access.

BCG Matrix Template

Silgan's BCG Matrix offers a glimpse into its product portfolio's competitive landscape. See how its offerings rank: Stars, Cash Cows, Dogs, or Question Marks. This preliminary analysis sets the stage for strategic assessment. Understanding these placements is crucial for informed decision-making. The full matrix report reveals deeper insights and actionable recommendations. It's your key to strategic clarity and maximizing Silgan's potential. Purchase now for a comprehensive analysis and strategic advantage.

Stars

Silgan's Dispensing and Specialty Closures segment, boosted by Weener Packaging, is a star performer. This area thrives on rising demand, particularly in health and beauty. Continued innovation and strategic acquisitions are crucial for sustained growth. In 2024, this segment's revenue reached $2.5 billion, up 8% year-over-year.

Silgan's Metal Containers for pet food is a star, showing strong performance. The segment saw double-digit volume growth in 2024. This reflects rising demand for durable and sustainable pet food packaging. Focusing on this area is key for Silgan's growth.

Custom Containers are a "Star" in Silgan's portfolio, demonstrating strong commercial success. This segment benefits from increased market demand and new business wins. Silgan's custom design and manufacturing capabilities offer a competitive edge. In 2024, Silgan's net sales reached approximately $6.3 billion, with the custom containers division contributing significantly to this figure.

Sustainability Initiatives

Silgan's sustainability drive, targeting waste reduction, makes them industry leaders. They aim for significant environmental goals by 2030. This focus aligns with growing demand for green packaging, boosting their market position. Investing in sustainability strengthens their brand and attracts eco-minded consumers.

- Silgan’s 2023 Sustainability Report highlights waste reduction efforts.

- They aim to increase recycled content in packaging.

- Silgan invests in eco-friendly material research.

- Their initiatives boost brand reputation.

Weener Packaging Integration

Silgan's acquisition of Weener Packaging is a "Star" in its BCG matrix, indicating high market share in a high-growth market. This integration strategically bolsters Silgan's dispensing business. The deal is projected to boost earnings, with procurement and manufacturing synergies.

- In 2023, Silgan's net sales were approximately $6.1 billion.

- Weener's integration is expected to generate significant cost savings.

- Silgan's focus remains on leveraging Weener's strengths for further growth.

Silgan's "Stars" include Dispensing, Metal Containers, and Custom Containers. These segments show high market share in growing markets. Key drivers include innovation, strategic acquisitions, and sustainability initiatives. 2024 revenue from Custom Containers reached a substantial $6.3B.

| Segment | Market Share | Growth Rate (2024) |

|---|---|---|

| Dispensing & Specialty Closures | High | 8% Revenue Growth |

| Metal Containers (Pet Food) | High | Double-Digit Volume Growth |

| Custom Containers | High | Significant Contribution to $6.3B |

Cash Cows

Silgan's metal container segment in North America and Europe is a cash cow, benefiting from its leading market position. This segment is characterized by stable revenue streams and long-term customer contracts. In 2024, Silgan's net sales were approximately $5.7 billion, highlighting its financial stability. The strong cash flow generation supports investments and shareholder returns.

Silgan's metal food container business is a cash cow, dominating North America with about 50% market share. This strong position generates consistent revenue. In 2024, Silgan's net sales were around $5.7 billion, demonstrating its market strength. Operational efficiency and cost control are key to boosting profits in this stable market.

Silgan's closures business, producing metal and plastic lids, is a dependable revenue source. They offer various closure types and modern capping equipment, ensuring their supplier role. In 2023, Silgan's closures segment generated approximately $1.7 billion in net sales. Maintaining strong ties with food and beverage clients is essential for this cash cow's sustainability.

Long-Term Customer Contracts

Silgan benefits from long-term customer contracts, ensuring a stable revenue flow. This is highlighted by an extension with its biggest metal container client. These contracts provide predictability, which is key for Silgan's financial health. Securing and renewing these agreements is vital for Silgan's future.

- In 2024, Silgan's revenue was approximately $6.1 billion.

- Long-term contracts help stabilize revenue.

- Customer retention is essential for sustained performance.

- Stable revenue supports strategic initiatives.

Operational Efficiency

Silgan's strong focus on operational efficiency and strict cost management is a key driver of its profitability. Continuous improvements in manufacturing processes and supply chain optimization can further enhance its cash flow generation capabilities. Investing in infrastructure and technology supports operational efficiency and boosts cash flow. In 2024, Silgan reported a gross profit of $760.2 million, indicating strong operational performance.

- Cost Management: Silgan's efficiency initiatives aim to reduce operational expenses.

- Supply Chain Optimization: Streamlining logistics improves cash flow.

- Technology Investments: Upgrades enhance efficiency and productivity.

- 2024 Performance: Gross profit of $760.2 million reflects operational effectiveness.

Silgan's cash cows, like metal containers, generate substantial cash due to their leading market positions and long-term contracts. These segments consistently produce stable revenue streams, exemplified by the $5.7 billion in net sales in 2024. The company prioritizes operational efficiency and cost management to maximize profitability.

| Metric | 2024 Value |

|---|---|

| Net Sales | $6.1 Billion |

| Gross Profit | $760.2 Million |

| Market Share (Metal Food Containers) | ~50% (North America) |

Dogs

Silgan's Metal Containers saw reduced volumes in fruit and vegetable markets in 2024, partly due to challenging weather and customer shifts. In Q3 2024, the company reported a slight dip in overall metal container volumes. Considering this, Silgan might find greater success by emphasizing faster-growing sectors within Metal Containers, like pet food, which saw increased demand. Focusing on these areas could boost performance.

Silgan's specialty closures for food and beverage faced volume declines due to customer destocking and inflation impacting consumer spending. In 2024, the Dispensing and Specialty Closures segment experienced a decrease in volumes. Focusing on higher-growth areas like dispensing systems could improve performance. The company's strategic shift aims to mitigate the effects of economic pressures.

The Custom Containers segment, while growing, has pockets of underperformance. Divesting underperforming products could boost profits. Focus on niches with higher growth, aligning with market trends. In 2024, Silgan's custom containers represented a significant portion of its revenue, with specific areas showing slower growth rates compared to others. This strategic shift aims to optimize resource allocation.

Underperforming Acquisitions

Underperforming acquisitions in Silgan's portfolio, if any, are categorized as dogs, dragging down overall performance. These acquisitions might not be meeting revenue or profit targets. Silgan needs to assess these underperformers and consider divestiture. Focusing on integrating and optimizing successful acquisitions is key.

- Silgan's 2023 revenue was $6.2 billion, showing the impact of acquisitions.

- Underperforming acquisitions can lead to lower margins and reduced shareholder value.

- Divesting underperforming assets can free up capital for better investments.

- Integration challenges often lead to acquisition underperformance.

Commoditized Products

Within Silgan's portfolio, products facing tough competition and low profit margins are potential "dogs." Divesting these can shift resources to more profitable, unique offerings. Silgan's focus should be on innovation to stand out from commoditization. In 2024, Silgan reported a net sales decrease, suggesting the need to analyze and improve its product mix.

- Commoditized products experience tough competition.

- Divestment can free up resources.

- Innovation and differentiation are key.

- Silgan's 2024 sales data is crucial.

Silgan's "Dogs" include underperforming acquisitions and commoditized products with low margins. These assets drag down overall financial performance. In 2024, divesting them could free up capital. Silgan should focus on higher-growth and innovative areas to boost profitability.

| Characteristic | Impact | Action |

|---|---|---|

| Low Growth/Share | Reduced Profit | Divest/Restructure |

| Commoditized | Intense Competition | Innovation |

| Underperforming | Decreased Value | Strategic Review |

Question Marks

Silgan is venturing into sustainable packaging, using more recycled materials. Currently, the impact of these innovations is uncertain, reflecting their place as a question mark. Silgan's 2024 sustainability report highlights a 15% increase in the use of recycled content. Successfully integrating these solutions is key to future growth. The company's investments in sustainability reached $50 million in 2024.

Expansion into emerging markets, like India and Brazil, presents high growth potential. However, it also involves considerable risks. In 2024, these markets showed volatile economic growth. Strategically investing requires thorough research and adaptation. For example, in 2024, the Indian market grew by 7.5%

Silgan's healthcare expansion includes intranasal solutions, a "Question Mark" in its BCG matrix. This area has high growth potential, driven by rising demand for advanced drug delivery. In 2024, the global nasal drug delivery market was valued at $6.87 billion. Success hinges on R&D investments and regulatory approvals.

Refillable Packaging Systems

Silgan Dispensing's Replay™ Connector exemplifies refillable packaging, a move toward sustainability. However, the market's acceptance remains unclear. Driving growth requires highlighting refillable benefits and brand partnerships. The global refillable packaging market was valued at $84.6 billion in 2023.

- Market adoption uncertainty poses a challenge.

- Sustainability trends offer a growth opportunity.

- Partnerships and promotion are crucial for success.

- Refillable packaging is worth $84.6 billion (2023).

Advanced Manufacturing Technologies

Advanced manufacturing technologies, including clean room capabilities, represent a Question Mark in Silgan's BCG matrix. These technologies could provide a competitive edge, potentially leading to higher-margin products. However, the investment's return and market demand remain uncertain, making strategic evaluation critical. Careful consideration of potential benefits and a phased investment approach will be important.

- Clean room technology is a key enabler for industries like pharmaceuticals and electronics.

- Market demand is growing, yet the adoption pace varies by sector.

- ROI depends on specific applications and market conditions.

- Strategic investments should consider long-term market trends.

Silgan faces uncertainty in new ventures, categorized as question marks. Sustainable packaging, despite a 15% rise in recycled content in 2024, has an unclear impact. Emerging markets like India (7.5% growth in 2024) and Brazil pose high-risk, high-reward scenarios. Healthcare expansion and advanced manufacturing also fall into this category.

| Aspect | Description | Data (2024) |

|---|---|---|

| Sustainability | Recycled content use | 15% increase |

| Emerging Markets | Indian market growth | 7.5% |

| Nasal Drug Delivery | Global market value | $6.87 billion |

BCG Matrix Data Sources

The Silgan BCG Matrix leverages public financial statements, market analysis, and competitor reports, all carefully vetted for dependability.