Silgan Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Silgan Bundle

What is included in the product

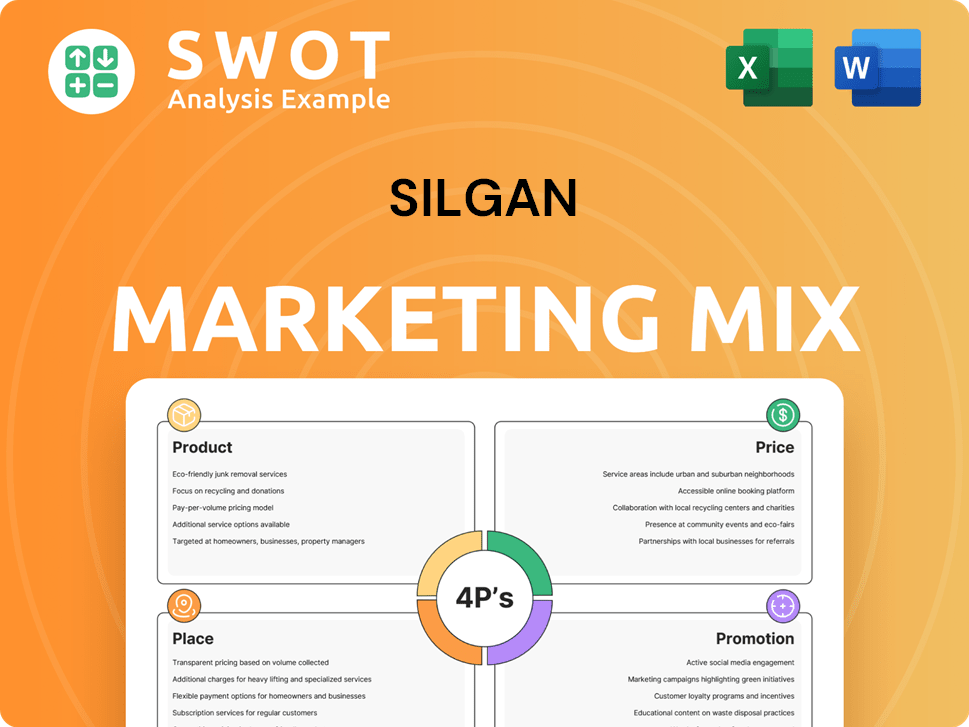

An in-depth analysis of Silgan's Product, Price, Place, and Promotion strategies, using real-world examples and strategic insights.

Silgan's 4P's analysis gives an at-a-glance marketing overview to accelerate understanding.

Preview the Actual Deliverable

Silgan 4P's Marketing Mix Analysis

The Silgan 4P's Marketing Mix Analysis preview mirrors the final, complete document. This is the same in-depth analysis you'll download right after your purchase. Access the full details without hidden surprises. Start your analysis today with instant access.

4P's Marketing Mix Analysis Template

Silgan, a packaging powerhouse, dominates its industry. They employ a complex marketing strategy. Analyzing their approach reveals intriguing insights. This preview offers a glimpse. Learn about Silgan's product offerings. Explore their pricing structures, distribution, & promotions.

The full 4Ps Marketing Mix Analysis uncovers the complete picture. Gain a deep understanding of Silgan's competitive edge. Download now for actionable insights, formatted and ready to go.

Product

Silgan is a major metal container supplier in North America and Europe. These containers package diverse food items like pet food and human food, plus general line products. Silgan, as of Q1 2024, reported net sales of $1.4 billion. The company is the top producer of steel and aluminum food cans in North America.

Silgan's closures, spanning metal, plastic, and composite types, are a core product. They are a global leader, critical for preserving food and beverages. Closures' revenue contributed significantly to Silgan's $6.3 billion in net sales in 2024. This ensures product safety and upholds quality standards.

Silgan's dispensing systems are key, serving diverse markets. They excel in fragrance, beauty, and health care. The company offers consumer insights and tech expertise. In 2024, the dispensing systems segment generated approximately $1.8 billion in revenue, showcasing its significance. The focus is on innovation and market-driven solutions.

Custom Containers

Silgan's custom containers are a key part of its product strategy. As a major North American supplier, Silgan caters to diverse sectors. These containers serve personal care, healthcare, food, and industrial chemicals. Silgan's revenue in 2024 was approximately $6.1 billion.

- Diverse Applications: Containers for various industries.

- Thermoformed Products: Bowls, trays, and tubs are also produced.

- Market Leader: Silgan holds a significant market position.

- Revenue: Approximately $6.1 billion in 2024.

Plastic Packaging

Silgan's plastic packaging is a key part of its marketing mix, excelling in blow and injection molding for sectors like food and healthcare. It provides high-barrier plastic containers, including retortable options, vital for shelf-stable food. Silgan Specialty Packaging drives innovation across various industries with its plastic solutions. In 2024, the global plastic packaging market was valued at approximately $310 billion, with forecasts predicting continued growth.

- Blow and injection molding expertise across key sectors.

- Leading supplier of high-barrier and retortable containers.

- Focus on innovation within Silgan Specialty Packaging.

- Significant player in the $310 billion plastic packaging market (2024).

Silgan's diverse product portfolio, from metal containers to plastic packaging, caters to various industries with high-barrier and retortable options. Blow and injection molding expertise is significant for sectors like food and healthcare. The company is a leading supplier within the global plastic packaging market, valued at about $310 billion in 2024.

| Product | Description | 2024 Revenue |

|---|---|---|

| Metal Containers | Food, pet food, and general line products. | Included in overall company net sales ($6.3B) |

| Closures | Metal, plastic, and composite closures for various products. | Significant contribution to overall net sales |

| Dispensing Systems | Systems for fragrance, beauty, and healthcare sectors. | Approximately $1.8B |

| Custom Containers | Serving personal care, healthcare, food, & industrial sectors. | Approximately $6.1B |

| Plastic Packaging | Blow & injection molded containers; high barrier & retortable. | Significant part of total sales |

Place

Silgan's global manufacturing network includes 124 facilities. These are strategically located across the Americas, Europe, and Asia. This broad presence enables Silgan to serve customers in over 100 countries. In 2024, Silgan reported net sales of approximately $6.1 billion, reflecting the impact of its global reach.

Silgan's custom containers rely on a direct sales force for customer interaction. This strategy fosters strong client relationships. In 2023, Silgan's sales reached approximately $6.1 billion. This direct approach is vital for their marketing, focusing on enduring customer connections. This strategy helps Silgan maintain a competitive edge in the packaging industry.

Silgan's distributor network complements its direct sales, boosting market coverage. This is especially beneficial for clients needing lower volumes. Silgan Plastics utilizes certified contract distributors in North America. This strategy helps increase the company's footprint and sales efficiency. Silgan's 2024 revenue was approximately $6.0 billion, reflecting the impact of its distribution strategy.

Proximity to Customers

Silgan's metal container business focuses on customers within a 300-mile radius of its plants, driven by the high cost of transporting empty containers. This localized approach minimizes transportation expenses and supports a streamlined supply chain. In 2024, Silgan's transportation costs represented approximately 5% of its total revenue. This strategic proximity enhances service efficiency and responsiveness to customer needs.

- Transportation costs are a key factor in profitability.

- Local manufacturing supports quicker delivery times.

- Proximity enhances customer relationship management.

Strategic Acquisitions

Silgan's strategic acquisitions, like the 2020 purchase of Weener Packaging, are crucial for growth. These moves broaden Silgan's geographic reach, boosting its presence in important markets. Such acquisitions enhance its manufacturing capabilities and customer base. For example, Silgan's revenue in 2023 was approximately $6.2 billion, showing the impact of these expansions.

- Geographic Expansion: Acquisitions like Weener Packaging expand Silgan's global footprint.

- Market Presence: Strengthening position in key regions.

- Manufacturing Footprint: Adding to production capabilities.

- Customer Base: Expanding by integrating new clients.

Silgan's "Place" strategy involves global and local approaches. A global network with 124 facilities across continents ensures broad market access. Local strategies, such as metal container plants, cut costs.

| Aspect | Strategy | Impact |

|---|---|---|

| Global Presence | 124 facilities worldwide | Serves clients in over 100 countries; 2024 sales $6.1B |

| Localized Production | Metal containers within 300-mile radius | Reduces transport costs (5% of 2024 revenue) |

| Strategic Acquisitions | Weener Packaging (2020) | Expanded geographic reach, customer base; 2023 sales $6.2B |

Promotion

Silgan prioritizes long-term customer relationships, a key aspect of its marketing mix. They secure stable demand through multi-year supply agreements, especially in the U.S. market. This approach enables predictable production schedules and reduces market volatility. In 2024, Silgan reported that 75% of its revenue came from customers with whom they have had relationships for over a decade.

Silgan strategically positions itself as a top provider of rigid packaging. They underscore leadership in key areas, like being North America's largest food packaging supplier. This strong position builds trust, crucial for attracting clients in 2024/2025. Silgan's market cap was about $6.5 billion as of late 2024, reflecting its industry prominence.

Silgan's marketing strategy highlights sustainable packaging. They meet the increasing demand for eco-friendly options. This boosts their brand reputation. Silgan's 2024 sustainability report details these initiatives. In 2024, the sustainable packaging market grew by 8%.

Innovation and Technology

Silgan emphasizes its innovation and tech prowess in packaging. They showcase expertise in blow molding, injection molding, and thermoforming. Silgan's X-CUP™ demonstrates its innovative spirit. In 2024, Silgan invested $175 million in capital expenditures, including tech upgrades. This focus boosts efficiency and product quality.

- Silgan's tech focus includes blow molding, injection molding, and thermoforming.

- X-CUP™ highlights Silgan's commitment to innovation.

- 2024 capital expenditures were $175 million.

Earnings Releases and Investor Communications

Silgan promotes itself through earnings releases and investor communications, keeping stakeholders informed. These communications are vital for transparency, showcasing financial health, growth, and future plans. This helps build trust with investors. In 2024, Silgan's revenue was approximately $5.8 billion. This shows their commitment to keeping the financial community informed.

- Investor calls provide opportunities for Q&A, clarifying strategy.

- Earnings reports include detailed financial performance metrics.

- These communications are vital for maintaining investor confidence.

- Silgan's approach supports a positive market perception.

Silgan uses earnings releases and investor communications for promotion. They aim for transparency with stakeholders, presenting financials and plans. Silgan's approach aims to build trust. In 2024, they reported revenue of about $5.8B.

| Aspect | Details | 2024 Data |

|---|---|---|

| Communication | Earnings Releases, Investor Calls | $5.8B Revenue |

| Objective | Transparency & Trust | Investor Confidence |

| Focus | Financial Health, Growth | Positive Market Perception |

Price

Silgan's pricing hinges on competitive cost structures, ensuring affordability. Operational efficiency is key, allowing them to offer attractive prices. They target yearly cost reductions, boosting their pricing edge. In 2024, Silgan's focus on cost management supported its profitability, with a gross profit margin of 20.1%.

Silgan's metal container contracts often feature a pass-through of raw material costs. This strategy protects them from metal price volatility. Consequently, the final price for customers adjusts with material expenses. For 2024, metal prices saw fluctuations, impacting contract pricing.

Silgan's pricing strategy focuses on value, mirroring its market stance. Pricing adapts to demand and economic realities. In Q1 2024, Silgan's net sales were $1.38 billion. They aim to balance value with profitability.

Impact of Acquisitions on Pricing

Silgan's strategic acquisitions, like Weener, are designed to boost margins, impacting pricing. This margin expansion allows for competitive pricing or higher per-unit profits. Silgan's Q1 2024 earnings showed a 3.7% increase in net sales, partly from acquisitions. These moves influence pricing strategies to maximize profitability.

- Acquisitions drive margin improvements.

- Pricing strategies adapt to enhanced profitability.

- Competitive advantages may arise.

- Q1 2024 sales reflect acquisition impact.

Volume and Mix Influence on Pricing

Silgan's pricing strategy is significantly impacted by sales volume and product mix. A better price/cost ratio, influenced by these factors, has boosted Adjusted EBIT in certain areas. This indicates that selling more products or shifting towards higher-margin items enhances profitability. For instance, a 2024 report highlighted a 3.5% increase in net sales due to favorable mix.

- Volume discounts and bulk purchase incentives can lower average costs.

- Selling more of high-margin products improves profitability.

- Strategic pricing can maximize revenue.

Silgan's pricing is built on competitive costs, aided by efficiency, and adjusted for raw material costs and demand. Acquisitions and product mix greatly influence profitability, enabling strategic price setting. In 2024, the gross profit margin was 20.1%, demonstrating effective cost management.

| Pricing Factor | Impact | 2024 Data |

|---|---|---|

| Cost Structure | Determines affordability and competitiveness | Gross Profit Margin: 20.1% |

| Raw Material Costs | Pass-through impacts pricing | Metal price fluctuations |

| Acquisitions/Mix | Boosts margins & affects pricing | 3.5% sales increase due to mix |

4P's Marketing Mix Analysis Data Sources

Silgan's 4P's analysis is rooted in credible sources: public filings, industry reports, and direct company communications. We analyze product offerings, pricing strategies, and distribution to understand Silgan's market approach.