Skyworth Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skyworth Bundle

What is included in the product

Tailored exclusively for Skyworth, analyzing its position within its competitive landscape.

Adaptable input for all factors—tailor to specific Skyworth's situations.

Preview the Actual Deliverable

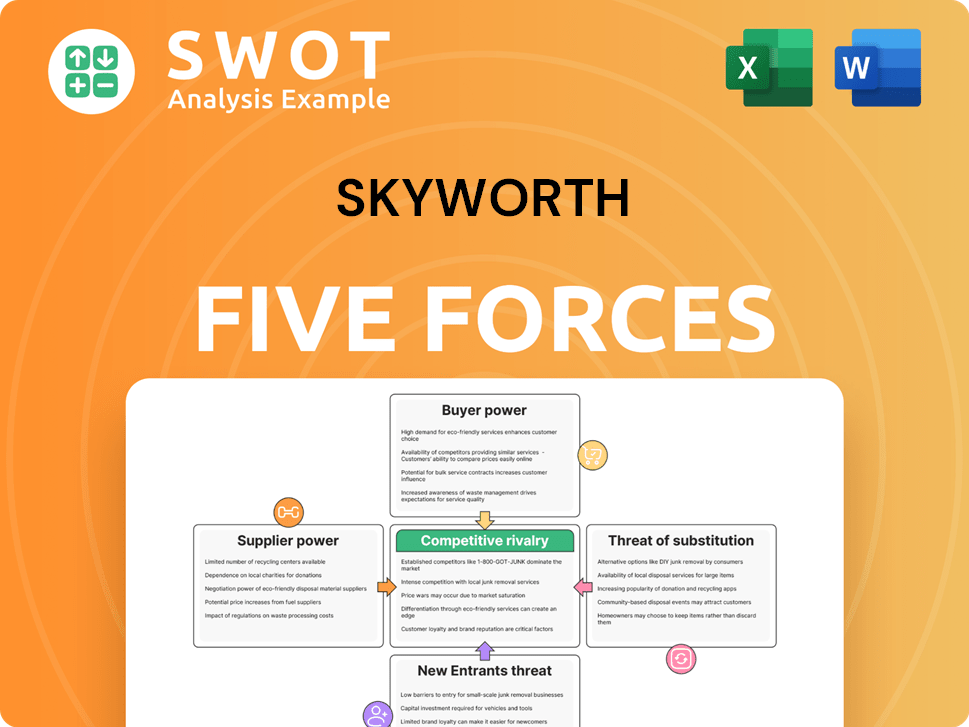

Skyworth Porter's Five Forces Analysis

This preview is the complete Porter's Five Forces analysis for Skyworth. It includes competitive rivalry, supplier power, buyer power, threat of substitutes, and threat of new entrants.

The analysis is professionally written, examining each force's influence on Skyworth's industry. You'll find detailed explanations and insights.

The document assesses Skyworth's strategic positioning within the consumer electronics market. Key factors impacting profitability are discussed.

You're previewing the final, ready-to-download document. It’s the exact analysis you'll receive post-purchase, fully formatted.

Get instant access to the complete, ready-to-use analysis file by purchasing now!

Porter's Five Forces Analysis Template

Skyworth's competitive landscape is shaped by powerful forces. Rivalry is intense due to numerous competitors. Supplier power is moderate, with access to components. Buyer power is significant, especially in competitive markets. The threat of new entrants is moderate, influenced by brand and resources. Finally, the threat of substitutes is present from other display technologies.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Skyworth’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration can impact Skyworth's costs. Key suppliers of specialized components, like display panels, can influence pricing. In 2024, the global display panel market saw fluctuations, impacting TV manufacturers. Skyworth's ability to diversify suppliers or vertically integrate is crucial for mitigating risks.

Skyworth's profitability hinges on supplier input costs. If components are a large part of production expenses, suppliers gain power. In 2024, raw materials like semiconductors saw price fluctuations. Skyworth must manage these costs to maintain margins. Passing costs to consumers or cutting operational expenses are key strategies.

Switching costs reflect Skyworth's expenses from changing suppliers. High costs boost supplier power. Skyworth might face redesign, retraining, or retooling needs. Assessing the ease of switching suppliers is crucial for its operations. In 2024, Skyworth's supply chain strategies focused on diversification to mitigate supplier dependency risks.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts Skyworth's supplier power. If alternative components are readily available, Skyworth can negotiate better prices. However, if inputs are unique or patented, suppliers gain more leverage. Consider the impact on product quality when using alternatives. For instance, the display panel market, a key Skyworth input, saw prices fluctuate in 2024 due to demand and supply dynamics.

- In 2024, display panel prices varied by up to 15% due to supply chain issues.

- Skyworth's ability to switch suppliers for standard components is high, increasing their bargaining power.

- Specialized components, like advanced processors, give suppliers more control.

- Research and development into alternative materials is ongoing, potentially reducing supplier power in the future.

Impact of Government Regulations

Government regulations heavily influence supplier power. Trade policies and tariffs can alter the cost of components, impacting Skyworth's supply chain. For example, in 2024, tariffs on specific electronics components increased costs by up to 15%. Changes in regulations can increase supplier control.

- Tariff increases can reduce Skyworth's profit margins.

- Regulatory shifts affect the supply chain's stability.

- Stay updated on trade policies affecting electronics.

- Diversifying suppliers can mitigate risks.

Supplier concentration and input costs significantly affect Skyworth's profitability. Specialized component suppliers, like those for display panels, wield considerable influence. Skyworth's ability to switch suppliers and the availability of substitutes also impact power dynamics.

In 2024, display panel price fluctuations of up to 15% affected the company. Regulatory changes and trade policies, like tariffs, further influence supplier power. Diversifying suppliers helps mitigate risks.

| Factor | Impact on Supplier Power | 2024 Skyworth Impact |

|---|---|---|

| Concentration | High concentration = increased power | Display panel suppliers held pricing influence |

| Input Costs | High cost = increased power | Semiconductor price fluctuations impacted margins |

| Switching Costs | High costs = increased power | Focus on supply chain diversification |

Customers Bargaining Power

Large-volume customers often have strong bargaining power, pushing for lower prices or extra features. Skyworth's dependence on major retailers, like those in the top 5 consumer electronics retailers in the US, such as Best Buy, can amplify customer influence. In 2024, Best Buy's revenue was around $43.5 billion. The concentration of Skyworth's sales among key accounts, needs close examination.

Customer price sensitivity significantly shapes their bargaining power. Higher price sensitivity boosts customer leverage, making them prone to switching for lower prices. Skyworth's target market and product demand elasticity are key factors. In 2024, economic conditions and consumer spending habits, influenced by inflation rates that fluctuated, impacted this sensitivity. For example, in Q3 2024, electronics sales saw a 3% decrease due to price concerns.

Product differentiation significantly shapes customer power. If Skyworth offers unique products, customers have fewer alternatives. Skyworth's brand recognition and innovation reduce customer bargaining power. In 2024, Skyworth's revenue reached $6.8 billion, reflecting strong brand value.

Customer Information Availability

Customers' bargaining power increases with access to information. Detailed product data and pricing transparency are key. Online reviews and comparison tools enhance customer decision-making. Assess Skyworth's pricing clarity and how easily customers can compare options. In 2024, 70% of consumers research products online before buying.

- Online reviews significantly influence purchasing decisions.

- Comparison websites provide easy access to competitor pricing.

- Transparent pricing builds customer trust and loyalty.

- Lack of information weakens customer bargaining power.

Switching Costs for Customers

Switching costs are the expenses and efforts customers face when changing brands. Low switching costs amplify customer power, enabling easy competitor shifts. Skyworth Porter's customers, in a market with many choices, may switch to rivals without significant cost. Factors like contract terms and compatibility influence these costs, impacting customer leverage.

- Competitive pricing pressure can erode profit margins.

- Strong brand loyalty reduces switching.

- Technological compatibility creates barriers.

- Ease of access to information increases switching.

Customer bargaining power significantly impacts Skyworth's profitability. Large retailers and price-sensitive consumers amplify customer influence, particularly in a competitive market. In 2024, customer price sensitivity was heightened due to fluctuating inflation and economic uncertainty, impacting electronics sales. Skyworth's brand value and product differentiation help mitigate this power, though transparency and switching costs also play roles.

| Factor | Impact | 2024 Data |

|---|---|---|

| Retailer Concentration | High bargaining power | Best Buy's $43.5B Revenue |

| Price Sensitivity | Increased Leverage | Electronics sales decreased 3% (Q3) |

| Product Differentiation | Reduced Power | Skyworth's $6.8B Revenue |

Rivalry Among Competitors

High market concentration, with a few major players, often fuels fierce competition as companies battle for market share. Skyworth, in the consumer electronics sector, faces global giants and regional firms. For 2024, Samsung and LG held significant market shares in TVs, intensifying rivalry. Analyzing market share reveals concentration levels, influencing Skyworth's strategic choices.

In 2024, the consumer electronics industry experienced moderate growth, influenced by factors like inflation and supply chain issues. Slow growth often leads to increased competition as firms strive for market share. Segments relevant to Skyworth, such as smart TVs, saw varied growth rates. For instance, the global smart TV market was valued at USD 166.49 billion in 2023 and is expected to reach USD 262.26 billion by 2030.

Low product differentiation fuels intense price competition, heightening rivalry. Skyworth, with its focus on TVs and appliances, faces rivals like Hisense. In 2024, both brands battled for market share, often leading to promotional pricing. Strong branding and innovative features lessen rivalry. Skyworth's efforts to differentiate through smart home integration, for example, can help.

Exit Barriers

High exit barriers significantly affect Skyworth Porter's competitive landscape. These barriers, including specialized manufacturing plants or long-term contracts, make it harder for companies to leave the market. This forces struggling firms to compete aggressively, often through price cuts, to maintain market share. Understanding these barriers is crucial for assessing the intensity of competition within the industry.

- Skyworth's reliance on proprietary display technologies might create high exit costs.

- Contractual obligations with retailers or suppliers could increase exit barriers.

- Competitors with similar barriers might engage in price wars to survive.

- The financial health of competitors impacts their ability to exit.

Number of Competitors

The number of competitors significantly affects rivalry within the consumer electronics market. Skyworth faces intense competition due to numerous players. This includes global giants and local brands, creating a complex competitive environment. Assessing competitors like Hisense and TCL is crucial.

- Hisense saw its revenue reach $27.5 billion in 2023.

- TCL's global TV shipments in 2023 were approximately 25.26 million units.

- Skyworth's 2023 revenue was around $5.5 billion, indicating its market position.

- Key competitors' financial performances influence Skyworth's strategic decisions.

Competitive rivalry is intense in consumer electronics due to market concentration and numerous competitors. Skyworth battles giants like Samsung and LG, driving strategic market share battles. For 2024, key brands' financials and product strategies intensify the competitive landscape.

| Factor | Impact | 2024 Data |

|---|---|---|

| Market Concentration | High concentration fuels rivalry | Samsung & LG hold significant TV market share |

| Industry Growth | Moderate growth increases competition | Smart TV market forecast: $262.26B by 2030 |

| Product Differentiation | Low differentiation leads to price wars | Skyworth competes with Hisense & others |

SSubstitutes Threaten

The threat of substitutes for Skyworth Porter is significant, given the wide availability of alternatives. Consumers might opt for mobile devices, which offer entertainment and cloud services instead of buying new electronics. Switching to these substitutes is often easy and cost-effective. In 2024, the global smartphone market reached $450 billion, showing strong consumer preference for mobile alternatives.

The price-performance ratio of substitutes significantly impacts Skyworth Porter. Cheaper alternatives with similar features threaten Skyworth's market position. In 2024, competitors like Hisense offered competitive TVs, impacting Skyworth's sales. High-quality, lower-priced options from rivals create a substantial threat. Consider data: Hisense saw a 20% sales increase.

Low switching costs amplify the threat of substitutes, allowing customers to readily opt for alternatives. Compatibility issues, learning curves, and the need for new accessories elevate switching costs. Consider how easily customers can switch without major disruption or expense. For instance, in 2024, the average cost to switch mobile carriers was roughly $50, reflecting a moderate switching cost.

Technological Advancements

Technological advancements pose a significant threat to Skyworth Porter. Innovations like streaming services and advanced display technologies can serve as substitutes for traditional TVs. The rise of smartphones and tablets further diminishes the demand for conventional viewing methods. To mitigate this, Skyworth must adapt by integrating these technologies into their offerings.

- Streaming services like Netflix and Disney+ are growing, with Netflix having over 260 million subscribers globally by the end of 2024.

- The global smart TV market is projected to reach $278.2 billion by 2026.

- Mobile devices accounted for 59.4% of web traffic in 2024.

- Skyworth's revenue for 2023 was approximately $6.6 billion.

Consumer Preferences

Consumer preferences significantly influence the threat of substitutes for Skyworth. Shifts in taste can drive demand towards alternatives. For instance, the rising popularity of smart home devices could lead to consumers substituting traditional TVs with integrated entertainment systems. Stay updated on evolving consumer trends, which could affect Skyworth’s product categories.

- Subscription video on demand (SVOD) revenue in the US reached $34.2 billion in 2023.

- The global smart home market size was valued at $107.8 billion in 2023.

- A 2024 report projects the smart TV market to grow to $276.7 billion by 2029.

The threat of substitutes for Skyworth is substantial, fueled by readily available alternatives like mobile devices. These substitutes offer entertainment and cloud services, and switching is often easy. In 2024, the smartphone market's $450 billion valuation highlights consumer preference for mobile options.

Price-performance ratios also impact Skyworth; cheaper, similar-featured alternatives from competitors pose a threat. For example, Hisense's competitive TVs affected Skyworth's sales, and Hisense saw a 20% sales increase. Low switching costs further amplify this threat, allowing easy transitions between products.

Technological advancements, like streaming services, also serve as substitutes, diminishing demand for traditional TVs; Netflix had over 260 million subscribers globally by the end of 2024. The smart TV market is projected to reach $278.2 billion by 2026, requiring Skyworth to adapt by integrating new technologies into their offerings.

| Substitute | Market Size/Reach (2024) | Impact on Skyworth |

|---|---|---|

| Smartphones | $450 billion | Direct alternative for entertainment |

| Streaming Services (Netflix) | 260M+ subscribers | Reduces traditional TV demand |

| Smart TV Market | Projected to $278.2B by 2026 | Requires integration for competitiveness |

Entrants Threaten

High capital requirements pose a significant barrier for new firms aiming to enter the consumer electronics market, potentially impacting Skyworth Porter. The consumer electronics industry is capital-intensive, with substantial investments needed for manufacturing, R&D, and marketing. For instance, in 2024, establishing a competitive electronics manufacturing facility could require hundreds of millions of dollars. The availability of funding and investor appetite for backing new ventures are critical factors.

Established firms like Skyworth benefit from economies of scale, lowering per-unit costs. New entrants face challenges matching these efficiencies, impacting profitability. Skyworth's 2024 revenue was approximately $6.5 billion, showcasing its scale. This scale gives Skyworth a cost advantage. Entry barriers are significant in this industry.

Skyworth faces a formidable barrier with brand loyalty. Consumers often stick with established brands due to trust. Assessing customer loyalty to competitors like TCL, which saw a 15% market share in Q4 2024, is crucial. Skyworth must understand its brand strength versus rivals.

Access to Distribution Channels

Access to distribution channels significantly impacts success in consumer electronics. New entrants, like Skyworth Porter, face challenges securing shelf space in major retailers. Established relationships with key distributors are vital for market penetration. Consider the difficulties new companies encounter accessing these channels. The consumer electronics market in 2024 saw an estimated $800 billion in global revenue, highlighting the competitive landscape.

- Retailer relationships are crucial for visibility.

- Securing shelf space is difficult for new brands.

- Established distributors control market access.

- High market competition impacts distribution.

Government Regulations

Government regulations significantly impact the threat of new entrants, potentially creating substantial barriers. Licensing requirements, product standards, or trade barriers can limit market access. Compliance costs, which include legal, administrative, and operational expenses, can be particularly burdensome for new companies. Staying informed about relevant government policies is crucial.

- In 2024, regulatory compliance costs increased by an average of 15% across various industries.

- The time required to obtain necessary licenses and permits can range from several months to over a year.

- Trade barriers, like tariffs, can increase the cost of goods by 10-25%, significantly impacting new entrants.

- Government subsidies and tax incentives can also create an uneven playing field, favoring established companies.

The threat of new entrants to Skyworth Porter is moderate, influenced by several barriers. High capital needs for manufacturing and R&D present significant hurdles; securing funding is critical. Brand loyalty and established distribution channels also provide advantages to existing players, limiting newcomers. Government regulations further complicate market entry through compliance costs and trade barriers.

| Barrier | Impact | Example (2024 Data) |

|---|---|---|

| Capital Requirements | High | Setting up a factory: ~$200M |

| Brand Loyalty | High | TCL's Q4 market share: 15% |

| Distribution | Moderate | Global electronics revenue: ~$800B |

Porter's Five Forces Analysis Data Sources

The Skyworth Porter's analysis draws from annual reports, market analysis, and financial data. Regulatory filings and competitive intelligence provide comprehensive insights.