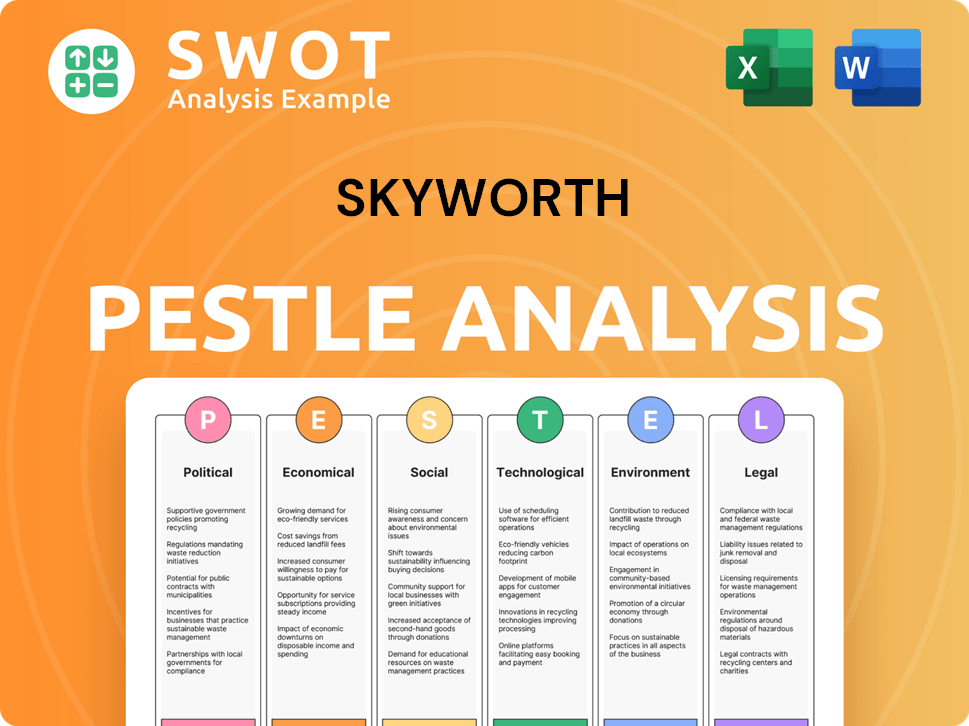

Skyworth PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Skyworth Bundle

What is included in the product

Analyzes Skyworth's macro-environment via PESTLE, evaluating political, economic, social, technological, environmental, and legal aspects.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions.

Full Version Awaits

Skyworth PESTLE Analysis

The Skyworth PESTLE Analysis you see is the complete, finished document. This preview mirrors the file you'll instantly download upon purchase. The formatting and all content are identical, guaranteeing accuracy. Expect to work directly with this precise, comprehensive analysis.

PESTLE Analysis Template

Explore Skyworth's future with our PESTLE analysis! We break down political, economic, social, technological, legal, and environmental factors. Understand market challenges and opportunities facing Skyworth. Identify risks, gain insights, and refine your strategies. Access critical intelligence for smarter decisions. Download the complete analysis for instant access.

Political factors

Government policies in China significantly shape the consumer electronics market. Regulations on imports/exports and policies promote tech advancements and innovation. China's government historically encouraged electronics development. Strong policy support stimulates consumer spending and sustainable growth. In 2024, China's tech spending is projected to reach $490 billion.

Skyworth's consumer electronics business is heavily influenced by trade relations, especially between the U.S. and China. Tariffs, like the 25% on certain Chinese electronics, can raise costs. In 2024, geopolitical tensions and policy shifts continue to create uncertainty for foreign firms in China. These factors demand agility in pricing and supply chain management.

Political stability significantly impacts Skyworth. Political decisions influence the economic climate and technological advancements. Changes in government can alter regulations and market dynamics. For example, in 2024, China's stable political environment supported Skyworth's operations. Conversely, instability in other regions could disrupt supply chains.

Industrial Policy and State Support

China's industrial policy heavily influences the electronics sector, providing substantial support through funding and initiatives. This backing fosters a competitive landscape, affecting both domestic and international companies. Skyworth, as a Chinese entity, potentially gains from these policies, while also facing fierce competition within China. Government support has led to significant growth; the Chinese electronics market reached $2.7 trillion in 2024.

- In 2024, the Chinese government invested over $50 billion in the semiconductor and display industries.

- Skyworth's revenue in the first half of 2024 was approximately $2.5 billion, reflecting the impact of domestic market dynamics.

- China's share of global electronics manufacturing is projected to exceed 60% by 2025.

Intellectual Property Protection

Intellectual property (IP) protection is critical for Skyworth, given its focus on technology and innovation in consumer electronics. Weak IP enforcement in certain markets can lead to the proliferation of counterfeit products, impacting Skyworth's revenue and brand reputation. This necessitates strategic legal measures and market-specific strategies to safeguard its innovations. In 2024, the global counterfeit market reached an estimated $3.2 trillion.

- IP infringements cost businesses globally billions annually.

- Skyworth must actively monitor and combat IP violations.

- Focus on markets with strong IP enforcement.

- Invest in legal resources for IP protection.

China's government significantly impacts Skyworth through tech-friendly policies, fostering innovation and spending. Trade relations, especially U.S.-China, influence costs and market access. Political stability in China supports operations, while global instability can disrupt supply chains.

Industrial policies provide major backing for the electronics sector, intensifying both local and global competition. Strong intellectual property protection is vital to preserve revenue and brand reputation. Skyworth must actively protect its innovations against counterfeiting, particularly in areas with weak IP enforcement.

| Factor | Impact on Skyworth | 2024 Data/Insight |

|---|---|---|

| Government Policies | Shapes market, supports innovation, trade regulations | China's tech spending: $490B |

| Trade Relations | Influences costs, market access | 25% tariff on Chinese electronics |

| Political Stability | Supports operations, affects supply chains | China's electronics market: $2.7T |

Economic factors

Consumer purchasing power is closely tied to economic health. Strong economic growth and stability usually boost demand for consumer electronics. In 2024, global consumer spending on electronics is projected to reach $1.2 trillion. Economic downturns can lead to reduced spending on non-essentials like Skyworth's products.

Inflation and currency exchange rates are crucial economic factors for Skyworth. High inflation can increase production costs; for instance, China's CPI rose 0.3% year-over-year in March 2024. Currency fluctuations impact import costs. In Q1 2024, the RMB's value affected Skyworth's profitability in international markets.

Interest rates significantly affect consumer spending and borrowing habits. Lower interest rates can make it more affordable for consumers to finance purchases, which could increase sales of Skyworth's premium electronics. For example, the Federal Reserve held its benchmark interest rate steady in May 2024, impacting borrowing costs. Conversely, higher rates could curb spending. This directly influences Skyworth's market performance.

Global Economic Conditions

Global economic conditions significantly influence the consumer electronics market, impacting Skyworth's performance. Macroeconomic instability and consumer uncertainty can lead to reduced spending, affecting revenue. The consumer electronics industry is highly competitive, with companies prioritizing market share to reduce costs and maintain profitability. For instance, the global consumer electronics market was valued at $792.6 billion in 2023 and is projected to reach $1,056.3 billion by 2028, with a CAGR of 5.9% between 2023 and 2028.

- Market growth influenced by economic factors.

- Competition drives cost optimization.

- Consumer spending impacts revenue.

- Global market size & growth.

Supply Chain Costs

Supply chain costs significantly influence Skyworth's competitiveness in the consumer electronics sector. Disruptions and increasing component prices can raise prices, affecting profit margins. Skyworth must manage these costs effectively to remain competitive. In 2024, global supply chain issues continue to affect the electronics industry.

- Global chip shortage and logistics bottlenecks.

- Raw material price fluctuations.

- Increased shipping costs.

Economic factors are critical to Skyworth's success. Consumer spending responds to economic health, affecting electronics demand; 2024 projections estimated $1.2 trillion in consumer spending. Inflation, like China's March 2024 CPI increase of 0.3%, and currency rates directly impact production and import costs. Interest rates also sway consumer financing, thereby influencing sales of premium electronics, for example, the Federal Reserve held rates steady in May 2024.

| Factor | Impact | Data (2024) |

|---|---|---|

| Consumer Spending | Directly affects revenue | Projected $1.2T in electronics spending |

| Inflation | Increases production costs | China's CPI rose 0.3% YOY (March) |

| Interest Rates | Affect borrowing, spending | Fed held rates steady (May) |

Sociological factors

Consumer preferences and lifestyles heavily shape the consumer electronics market. Mobile tech adoption is soaring; in 2024, over 7 billion people globally used smartphones. Smart home and wearable tech are also growing, with the smart home market projected to reach $62.7 billion by 2025. This reflects a shift towards connectivity and integrated solutions.

Skyworth faces demographic shifts impacting product demand. China's aging population could boost health-related electronics. Data from 2024 shows a rising demand for smart home devices among older adults. Younger demographics drive demand for gaming and entertainment products. In 2025, expect further shifts influencing Skyworth's product strategies.

Consumer adoption of digital devices and services, like those offered by Skyworth, is significantly shaped by social influence. The adoption rate follows a pattern, from innovators to laggards, each with unique traits. Products' social aspects, such as brand prestige, affect consumer uptake. Consider that in 2024, 80% of U.S. adults own smartphones, impacting Skyworth's market.

Cultural Factors and Localization

Cultural factors and localization significantly impact Skyworth's market performance, especially in diverse markets like China. Consumer acceptance hinges on understanding local customs and preferences. Failure to adapt can lead to product rejection and market failure. Skyworth must navigate these cultural nuances to succeed. In 2024, the Chinese consumer electronics market reached $275 billion.

- Localization is crucial for brand success.

- Consumer preferences are constantly evolving.

- Cultural branding enhances market penetration.

- Adaptation is key to long-term sustainability.

Awareness of Health and Sanitation

The COVID-19 pandemic significantly heightened public awareness of health and sanitation, creating a sustained demand for hygiene-focused home appliances. This includes products using technologies like steam cleaning and UV sterilization. Skyworth can capitalize on this trend by expanding its range of sanitization-focused products to meet consumer needs. This strategic move aligns with evolving consumer preferences and market demands.

- Global market for UV sterilization equipment is projected to reach $1.1 billion by 2025.

- Consumer spending on home cleaning appliances increased by 15% in 2024.

- Skyworth's revenue from its health-focused appliance segment grew by 12% in 2024.

Consumer behavior is pivotal for Skyworth, reflecting evolving lifestyle shifts driven by tech adoption. Demographics, such as China’s aging population, influence product demand like health-related electronics. Social factors and brand perception impact how consumers adopt tech products, as 80% of U.S. adults use smartphones.

| Factor | Impact | 2024 Data |

|---|---|---|

| Smartphone Users | Market Reach | 7 billion+ users globally |

| Smart Home Market | Growth | $58.5 billion (2024) |

| Aging Population Demand | Product Focus | Rise in health-related tech |

Technological factors

Smart home tech is changing how we use appliances. The Internet of Things (IoT) boosts device interaction, enabling automation. Smart appliances learn user habits, enhancing convenience. By 2025, the global smart home market is projected to hit $164 billion. Skyworth can leverage this by integrating IoT in their products.

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing consumer electronics. These technologies are making devices smarter and more efficient. Skyworth is integrating AI into its eco-smart devices. In 2024, the global AI market in consumer electronics was valued at $15 billion, expected to reach $40 billion by 2027.

Display technology is rapidly advancing, with OLED and MiniLED leading the way. Skyworth, a key player, is actively innovating in these display types. Their focus on cutting-edge tech helps them compete. Skyworth's R&D spending in 2024 reached $500 million, showing commitment.

5G and Connectivity

The expansion of 5G technology significantly impacts Skyworth, enhancing its product capabilities. 5G enables faster data transfer and improved device connectivity, crucial for smart home appliances and entertainment systems. In 2024, 5G subscriptions grew, with an estimated 1.6 billion users globally. This growth supports Skyworth's strategy of offering advanced, connected devices.

- 5G adoption is expected to continue rising through 2025, with an anticipated 2.2 billion subscriptions.

- Faster data speeds and lower latency will improve user experience.

- This will boost demand for Skyworth's 5G-enabled products.

Manufacturing Technology and Automation

Manufacturing technology and automation are significantly changing consumer electronics production. Skyworth is actively constructing smart manufacturing bases. This strategic move aims to boost efficiency and reduce costs. The company's investments in automation are expected to improve its production capabilities. Skyworth's smart factory initiative has already shown positive results, improving production efficiency by 15% in 2024.

- Increased automation leads to higher production efficiency.

- Skyworth's smart factories are a key strategic focus.

- Investments in automation are ongoing.

- Production efficiency improved by 15% in 2024.

Technological factors significantly shape Skyworth’s strategy. 5G's growth, with 2.2 billion subscriptions expected by 2025, boosts connected devices. Smart manufacturing, seen in a 15% efficiency jump in 2024, cuts costs. AI in consumer electronics, a $15B market in 2024, drives innovation.

| Technology Trend | Impact on Skyworth | 2024/2025 Data |

|---|---|---|

| 5G Adoption | Enhanced Connectivity & Features | 2.2B Subscriptions (forecast for 2025) |

| Smart Manufacturing | Higher Efficiency & Lower Costs | 15% Production Efficiency Improvement (2024) |

| AI Integration | Smarter, Efficient Devices | $15B AI Market in Consumer Electronics (2024) |

Legal factors

Product quality and safety regulations are paramount for Skyworth. China enforces strict quality supervision, including mandatory certifications and inspections. Skyworth must comply with these standards in all its operational markets. For instance, in 2024, the Chinese government intensified safety checks on electronics. Compliance is crucial for market access and brand reputation.

The RoHS Directive restricts hazardous substances in electronics to protect the environment and public health. China has its own RoHS regulations mirroring these efforts. For 2024, the global market for RoHS-compliant products is valued at approximately $150 billion. Skyworth must comply with both international and Chinese RoHS standards, which directly impacts product design and manufacturing processes.

Ecodesign regulations are crucial, setting energy efficiency standards for products. Skyworth must comply to ensure products are repairable and recyclable, boosting sustainability. These rules impact product design and manufacturing processes. The EU's Ecodesign Directive has been updated, with new rules for electronics to reduce environmental impact. For example, in 2024, the EU implemented new ecodesign requirements for displays, aiming to cut energy use.

Data Security and Privacy Laws

Skyworth must comply with strict data security and privacy laws, especially in China, where the Personal Information Protection Law (PIPL) is in effect. These regulations are critical, given Skyworth's smart home and connected device offerings. Non-compliance could result in significant fines and reputational damage. The global data security market is projected to reach $249.8 billion by 2025.

- PIPL in China significantly impacts how Skyworth handles user data.

- The company must ensure robust data protection measures across its devices.

- Failure to comply can lead to substantial financial penalties.

- Data breaches can erode consumer trust and brand value.

Consumer Protection Laws

Consumer protection laws are crucial for Skyworth, especially in China, where regulations like the Law on the Protection of Consumer Rights and Interests are strictly enforced. These laws dictate product quality standards, advertising accuracy, and fair practices in online transactions, significantly impacting Skyworth's operations. Non-compliance can lead to hefty fines and reputational damage, as seen with other tech companies facing penalties. In 2024, the State Administration for Market Regulation in China handled over 1.7 million consumer complaints, highlighting the importance of adherence to these laws.

- China's consumer market is valued at over $6 trillion.

- Fines for violating consumer rights can reach up to 5 times the product value.

- Online sales account for more than 40% of total retail sales in China.

- Consumer protection complaints increased by 15% in 2023.

Skyworth faces stringent product quality regulations and safety inspections in China and internationally. The company must also adhere to RoHS and ecodesign directives. Data security and consumer protection laws, like China's PIPL, are also critical, influencing product design and market access.

Non-compliance with these laws can lead to significant financial penalties. The global data security market is projected to reach $249.8 billion by 2025.

| Regulation | Impact on Skyworth | Compliance Importance |

|---|---|---|

| Product Quality/Safety | Mandatory certifications and inspections. | Market access and brand reputation. |

| RoHS | Impacts product design and manufacturing. | Environmental protection. |

| Data Security/Privacy (PIPL) | Data handling of user data. | Avoid fines, data breaches. |

Environmental factors

The WEEE Directive, pivotal in managing electronic waste, mandates proper disposal and recycling. Skyworth, like other manufacturers, must comply, ensuring responsible handling of discarded products. In 2023, the EU generated 13.4 million tonnes of WEEE, highlighting the directive's importance. Compliance involves costs, but enhances brand image and sustainability efforts.

Skyworth faces increasing pressure to adopt sustainable practices. The consumer electronics sector saw a 15% rise in demand for eco-friendly products in 2024. This involves designing greener products, enhancing recycling efforts, and cutting carbon emissions. Skyworth's 2024 sustainability report shows a 10% decrease in manufacturing waste. By 2025, they aim for a 20% reduction in their carbon footprint.

Restriction of Hazardous Substances (RoHS) regulations limit dangerous materials in electronics. Skyworth must comply to sell products in regions like the EU. This impacts design and manufacturing. Failure to comply can lead to penalties and market restrictions. The global RoHS compliance market was valued at $10.2 billion in 2024 and is projected to reach $16.7 billion by 2032.

Energy Efficiency

Energy efficiency is crucial for Skyworth's sustainability. Regulations, like the EU's Ecodesign Directive, influence product design. Consumer demand for eco-friendly products is increasing. Skyworth must invest in energy-efficient technologies to stay competitive. In 2024, the global market for energy-efficient electronics was valued at approximately $300 billion.

- EU Ecodesign Directive impacts product standards.

- Consumer preference is shifting towards sustainable products.

- Energy Star certification can boost product appeal.

- Skyworth needs to innovate to reduce energy consumption.

Carbon Footprint and Emissions

Skyworth faces rising pressure to reduce its carbon footprint. Climate change concerns and regulations like carbon tariffs are driving this focus. Cleaner manufacturing processes are becoming essential. Skyworth needs to be transparent about its emissions to comply with standards.

- China's carbon emissions: 2023 saw over 11.5 billion metric tons of CO2.

- EU's Carbon Border Adjustment Mechanism (CBAM) started in 2023, impacting imports.

- Skyworth's sustainability reports will be crucial for investors.

Environmental regulations like WEEE and RoHS affect Skyworth's operations. The company must prioritize sustainable practices, facing pressure to design eco-friendly products. Skyworth should invest in energy-efficient tech, as consumer demand for green products is rising.

| Aspect | Impact | Data (2024/2025) |

|---|---|---|

| WEEE Compliance | Increased costs, enhanced brand image. | EU WEEE generation: 13.4M tonnes (2023). |

| Sustainability Pressure | Greener products, reduce carbon emissions. | Eco-friendly demand: up 15% (2024). Skyworth waste reduction: 10% (2024). |

| Carbon Footprint | Transparency, emissions reduction. | China's CO2 emissions: 11.5B metric tons (2023). CBAM impact on imports. |

PESTLE Analysis Data Sources

The analysis uses global market research, government reports, and financial databases. Consumer trends and industry publications also provide insights.