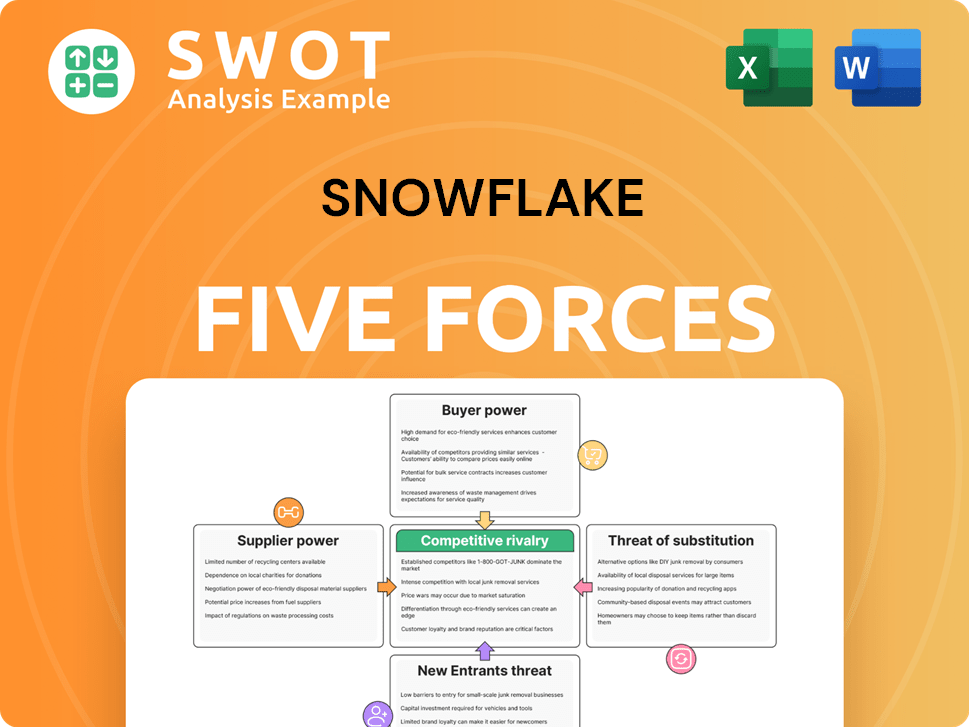

Snowflake Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Snowflake Bundle

What is included in the product

Analyzes Snowflake's competitive forces: rivalry, suppliers, buyers, substitutes, and new entrants.

Get a high-level, executive view instantly with a powerful and dynamic radar chart.

Preview the Actual Deliverable

Snowflake Porter's Five Forces Analysis

This preview reveals the complete Porter's Five Forces analysis of Snowflake. It's the exact same document you'll receive immediately after purchase, fully formatted and ready to use.

Porter's Five Forces Analysis Template

Snowflake's competitive landscape is shaped by the dynamic interplay of Porter's Five Forces. Intense rivalry among existing cloud data warehouse providers keeps pricing and innovation high. The threat of new entrants is moderate, with significant barriers to entry. Buyer power is substantial, as customers have multiple options. Substitute products, like other data analytics solutions, pose a considerable threat. Supplier power is less impactful, though infrastructure dependencies exist.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Snowflake’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Snowflake's dependence on major cloud providers like AWS, Azure, and Google Cloud concentrates supplier power. These suppliers can dictate pricing and service terms, influencing Snowflake's operational costs. In 2024, AWS, Azure, and Google Cloud control a significant portion of the cloud market. Any shifts in their pricing models or service agreements directly affect Snowflake's financials and service delivery, as seen in the 2023-2024 period.

Suppliers of specialized software, like data integration tools, have bargaining power. Snowflake relies on these for its platform's functionality. Switching costs are high, limiting Snowflake's ability to negotiate aggressively. In 2024, the cloud computing market, where Snowflake operates, was valued at over $670 billion.

Snowflake benefits from low supplier bargaining power for standardized hardware. Multiple vendors offer these components, fostering competition. Switching suppliers is easy, minimizing dependency on any single provider. This flexibility helps Snowflake negotiate favorable pricing. In 2024, the market for such components saw prices stabilize, benefiting companies like Snowflake.

Growing ecosystem of partners

Snowflake's expansive partner ecosystem, featuring tech providers, complements its services. These partners, offering similar solutions, face limited individual bargaining power. This competitive environment among partners reduces their ability to influence terms significantly. Snowflake's strategy to integrate with various solutions ensures its operational flexibility and cost-effectiveness. Therefore, the bargaining power of suppliers remains relatively low in this context.

- Snowflake's partnerships include over 700 technology partners as of late 2024.

- The data cloud company's revenue grew 36% year-over-year in Q3 2024, indicating strong demand.

- The partner ecosystem generated over 25% of Snowflake's revenue.

- This indicates a competitive landscape that limits supplier influence.

Data providers' influence

Data providers hold some sway, especially if they offer unique or in-demand datasets for Snowflake's marketplace. Maintaining strong relationships with these providers is crucial for Snowflake to ensure a valuable data marketplace. The exclusivity of certain datasets strengthens the data providers' bargaining power, impacting the overall dynamics. In 2024, Snowflake's data marketplace featured over 500 data providers, showing the importance of these relationships. This diversity is key to offering customers a wide array of options.

- Marketplace size: Over 500 data providers in 2024.

- Relationship importance: Maintaining strong partnerships is key.

- Exclusivity impact: Enhances data provider influence.

- Data diversity: Ensures a wide range of customer choices.

Snowflake faces high supplier bargaining power from cloud providers, who dictate pricing. Specialized software suppliers also hold power due to high switching costs. Standardized hardware suppliers have low bargaining power, fostering competition. Data providers’ power varies based on data exclusivity.

| Supplier Type | Bargaining Power | Impact on Snowflake |

|---|---|---|

| Cloud Providers | High | Influences costs, service terms |

| Software Suppliers | Medium | Limits negotiation, functionality |

| Hardware Suppliers | Low | Favorable pricing |

| Data Providers | Variable | Data marketplace value |

Customers Bargaining Power

Large enterprise clients significantly influence Snowflake's revenue, wielding substantial bargaining power. These clients negotiate pricing, service agreements, and custom features. In 2024, enterprise clients accounted for over 70% of Snowflake's total revenue. To retain these key accounts, Snowflake must meet their specific demands. This impacts profitability and resource allocation.

Snowflake's data migration complexity and costs influence customer bargaining power. Although switching is challenging, customers face lock-in, giving Snowflake some advantage. The cloud market evolves, with hybrid solutions gaining traction. Gartner projects global cloud spending to reach $678.8 billion in 2024, emphasizing the shift.

Customers have several options beyond Snowflake, boosting their leverage. Amazon Redshift, Google BigQuery, and Azure Synapse offer cloud data solutions. This competition means customers can negotiate better terms or switch. In 2024, the cloud data market is estimated at $80 billion, intensifying the competition.

Demand for transparent pricing

Customers increasingly seek transparent pricing. Snowflake's complex pricing models have faced criticism, prompting demands for clarity and cost control. This pressure heightens customer bargaining power. Snowflake must address these concerns to retain customer satisfaction. In 2024, customer churn rates were a key indicator of pricing dissatisfaction.

- Snowflake's revenue growth in 2024 was impacted by pricing concerns.

- Customer churn rates increased slightly due to pricing issues.

- Negotiations with large clients focused on pricing predictability.

- Transparency initiatives were launched to address customer feedback.

Growing data literacy

As businesses become more data-driven, data literacy is on the rise, enabling customers to make informed decisions. This increased understanding gives customers more negotiating power with vendors like Snowflake. They can better assess value and compare it against other options. This shift affects pricing and service agreements.

- Data literacy is increasing, empowering customers.

- Customers can now make more informed purchasing decisions.

- They can better assess the value proposition.

- This impacts negotiation power with vendors.

Snowflake's enterprise clients, constituting over 70% of 2024 revenue, have strong bargaining power. Switching costs and market competition affect customer leverage. Transparency initiatives aimed to address pricing concerns. Data literacy empowers customers, influencing negotiations.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Enterprise Clients | Negotiate terms | 70%+ revenue share |

| Market Competition | Influences leverage | $80B+ cloud data market |

| Pricing Transparency | Addresses concerns | Increased scrutiny |

Rivalry Among Competitors

The cloud data platform arena is fiercely contested, with AWS, Azure, and GCP as key rivals. This rivalry demands constant innovation and differentiation from Snowflake. For instance, in 2024, AWS held around 32% of the cloud infrastructure market, followed by Microsoft Azure with 25%, and Google Cloud with approximately 11%. Competition significantly influences pricing and marketing strategies.

Snowflake's rivals, like Databricks, frequently use aggressive pricing to gain market share. This forces Snowflake to compete on price, potentially squeezing its profitability. In 2024, the data cloud market saw significant price wars, especially for large enterprise clients. This price competition can impact Snowflake's gross margin, which was around 75% in 2024.

AWS, Azure, and GCP are constantly enhancing their data platforms with new features. Snowflake faces intense pressure to innovate to stay ahead. This necessitates substantial R&D investments. Snowflake's R&D expenses in 2024 were approximately $600 million, reflecting this commitment.

Focus on specific market segments

Snowflake faces competition from firms targeting specific market segments. These competitors, such as those focused on healthcare or finance, offer specialized data warehousing solutions. In 2024, niche players in healthcare saw a 15% increase in market share. Snowflake must adapt by either customizing its offerings or extending its industry reach to counter these specialized rivals.

- Specialized competitors target specific industries.

- Niche competitors offer tailored data solutions.

- Snowflake needs to adapt to compete effectively.

- In 2024, healthcare niche saw a 15% growth.

Open-source alternatives

Open-source data platforms, such as Hadoop and Spark, present a significant challenge to Snowflake's competitive position. These alternatives can be particularly appealing to cost-conscious businesses, potentially affecting Snowflake's market share. In 2024, the adoption of open-source data solutions increased, with a 15% rise in deployments. Snowflake must highlight its advantages to retain and attract customers. This involves showcasing its ease of use, scalability, and advanced features to justify its premium pricing.

- Cost: Open-source solutions often have lower upfront costs.

- Complexity: Require more technical expertise to manage.

- Value Proposition: Snowflake must demonstrate its superior value.

- Market Share: Open-source alternatives impact Snowflake's share.

Snowflake faces intense competition from major cloud providers like AWS, Azure, and GCP, which heavily influences pricing and innovation strategies. Aggressive pricing tactics by rivals such as Databricks compel Snowflake to compete on cost, potentially affecting profitability; Snowflake's gross margin in 2024 was approximately 75%. Specialized competitors and open-source platforms further challenge Snowflake's market position, requiring continuous adaptation and value demonstration.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Major Cloud Providers | Price wars & Innovation pressure | AWS: 32%, Azure: 25%, GCP: 11% market share |

| Pricing Pressure | Margin Squeeze | Databricks aggressive pricing |

| R&D Investment | Innovation & Differentiation | Snowflake's R&D: $600 million |

SSubstitutes Threaten

Traditional on-premise data warehouses, like Oracle and IBM, act as substitutes, particularly for entities prioritizing data governance or security. While on-premise solutions still exist, the market is trending towards cloud-based data warehouses due to their scalability and cost benefits. Snowflake faces the challenge of addressing security and control concerns to accelerate the shift from on-premise solutions; in 2024, the cloud data warehouse market is valued at $30 billion, with a projected CAGR of 20% by 2030, reflecting this trend.

Data lakes, like Amazon S3 and Azure Data Lake Storage, pose a threat as substitutes. They allow flexible storage of unstructured data, offering cost-effectiveness for some needs. Snowflake faces competition from data lakes, which are projected to reach a market size of $21.5 billion by 2024. To compete, Snowflake must enhance its analytics and data handling capabilities.

Hadoop and Spark present a threat to Snowflake due to their open-source, distributed data processing capabilities, enabling the creation of data warehouses and lakes. Despite needing technical proficiency, they offer a budget-friendly option, especially for technically adept organizations. Snowflake must emphasize its user-friendliness and managed services to stand out. In 2024, the global big data analytics market, where these solutions compete, was estimated at $280 billion, highlighting the scale of the competitive landscape.

Specialized analytics tools

Specialized analytics tools pose a threat to Snowflake. Data visualization and BI platforms can reduce the need for Snowflake. These tools allow direct data analysis from various sources. Snowflake must integrate seamlessly and offer compelling analytics capabilities. The global BI and analytics market was valued at $29.8 billion in 2023.

- Direct competition from specialized analytics tools.

- Integration is key for survival.

- Need for compelling in-platform analytics.

- Market size of BI and analytics is significant.

Serverless computing

Serverless computing, where data processing happens without server management, presents a threat to Snowflake. It can be a budget-friendly option for specific data tasks, potentially drawing users away. Snowflake must integrate well with serverless platforms to remain competitive. This includes offering attractive pricing models for these types of uses.

- By 2024, the serverless computing market is estimated to be worth over $7.5 billion, showing its growing importance.

- Snowflake's revenue in Q3 2024 was around $674 million, which could be affected by serverless alternatives.

- Amazon Web Services (AWS), a key player in cloud services, offers serverless options that compete with Snowflake.

Various substitutes challenge Snowflake. These include on-premise data warehouses, data lakes, and open-source solutions like Hadoop and Spark. Specialized analytics tools and serverless computing also pose threats. These alternatives compete with Snowflake in the data management and analytics space.

| Substitute | Description | Market Context (2024 est.) |

|---|---|---|

| On-Premise Data Warehouses | Traditional solutions like Oracle, IBM. | Cloud Data Warehouse Market: $30B, CAGR 20% by 2030. |

| Data Lakes | Flexible, cost-effective storage (e.g., Amazon S3). | Market size: $21.5B. |

| Hadoop/Spark | Open-source data processing. | Big Data Analytics Market: $280B. |

Entrants Threaten

Entering the cloud data platform market demands substantial capital for infrastructure, software, and marketing. This high initial investment acts as a major deterrent for new competitors. Snowflake, with its existing infrastructure and strong brand, has a significant advantage. In 2024, the cloud computing market is valued at over $600 billion globally, highlighting the scale of investment needed.

Building a cloud data platform like Snowflake demands significant technological expertise, including distributed computing and data analytics. This specialized knowledge is a considerable barrier to entry, protecting established firms. Snowflake’s experienced engineering team offers a distinct competitive edge. In 2024, the cloud computing market is projected to reach over $670 billion, highlighting the stakes.

Cloud data platforms thrive on network effects; more users and data enhance value. Snowflake's vast customer base and data ecosystem create a substantial barrier to entry. This makes it hard for new competitors to compete. Snowflake's revenue in Q4 2024 was $774.7 million, up 32% year-over-year. New entrants need exceptional value to succeed.

Regulatory compliance

Cloud data platforms face significant regulatory hurdles, especially concerning data privacy and security. Compliance can be a costly barrier, deterring new entrants. Snowflake's existing certifications, like those for HIPAA and GDPR, offer a competitive edge. These certifications demonstrate a commitment to meeting stringent standards. This reduces the perceived risk for customers.

- Compliance costs can range from $500,000 to over $2 million annually for large cloud providers.

- Snowflake holds over 20 compliance certifications.

- Data breaches cost companies an average of $4.45 million in 2023.

Established partnerships

Snowflake's established partnerships pose a significant barrier to new entrants. These alliances with major cloud providers and tech vendors broaden its platform's capabilities and market reach. Building such extensive partnerships takes considerable time and resources, putting new competitors at a disadvantage. To compete, new entrants must either forge their own robust partnerships or offer a significantly superior value proposition.

- Snowflake partners with AWS, Microsoft Azure, and Google Cloud, enhancing its platform's integration capabilities.

- These partnerships offer a competitive edge by providing access to a wider range of services and technologies.

- New entrants face the challenge of replicating Snowflake's established ecosystem of partners.

- The strength of these alliances makes it difficult for new companies to quickly gain market share.

High capital needs, technical expertise, and network effects make it tough for new cloud data platforms to compete. Regulatory hurdles and compliance costs further limit entry, costing up to $2 million annually. Established partnerships, like Snowflake's with major cloud providers, create additional barriers.

| Factor | Impact | Data Point (2024) |

|---|---|---|

| Capital Investment | High | Cloud market over $670B. |

| Technical Expertise | Significant barrier | Data analytics skills crucial. |

| Network Effects | Strong | Snowflake Q4 revenue $774.7M. |

Porter's Five Forces Analysis Data Sources

This analysis utilizes Snowflake's public data resources, market reports, financial filings, and competitor analysis for accurate and insightful evaluation.