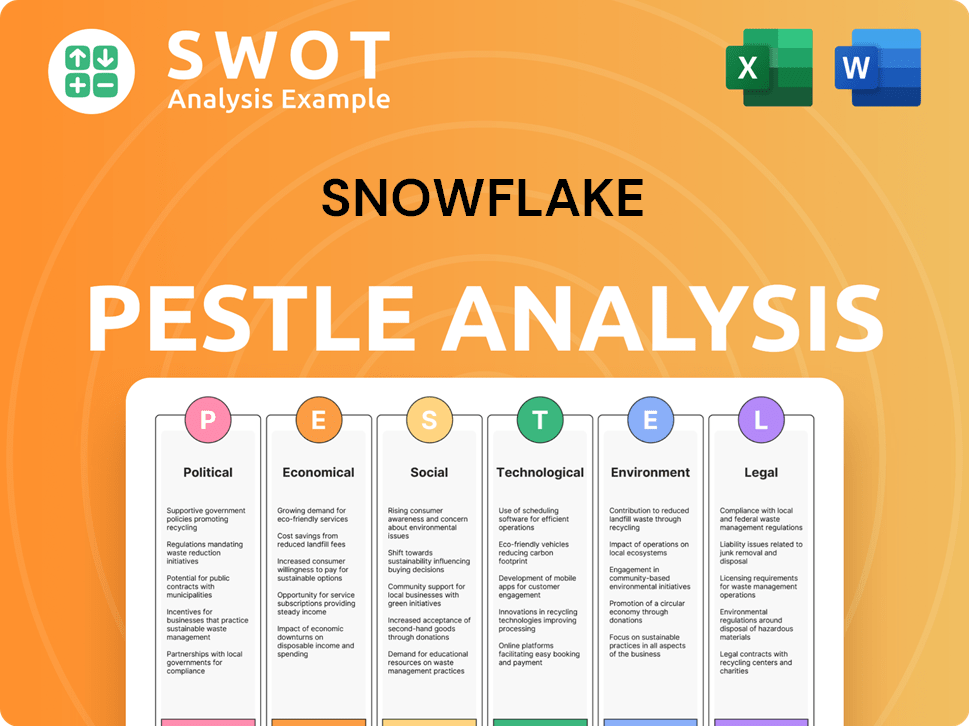

Snowflake PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Snowflake Bundle

What is included in the product

Examines how external factors influence Snowflake across Political, Economic, Social, etc. dimensions.

The Snowflake PESTLE's summarized format aids fast analysis for board or exec summaries.

Same Document Delivered

Snowflake PESTLE Analysis

What you're previewing here is the actual file—fully formatted and professionally structured. This Snowflake PESTLE analysis details the key Political, Economic, Social, Technological, Legal, and Environmental factors. You can use it right away, after your purchase.

PESTLE Analysis Template

Discover the external forces shaping Snowflake's trajectory with our PESTLE analysis. We dissect the political landscape, from regulations to trade policies. Economic factors, including market trends, are also examined. Technological advancements driving innovation are explored. Dive into social and environmental influences affecting its operations. Don't miss this crucial intelligence. Buy the full analysis today.

Political factors

Snowflake faces a complex web of government regulations globally, especially regarding data privacy and sovereignty. Data protection laws like GDPR and CCPA necessitate careful data handling across borders. Snowflake must comply with varied legal frameworks, impacting data storage and transfer strategies. For instance, in 2024, GDPR fines reached €1.1 billion, emphasizing compliance importance.

Evolving government cybersecurity mandates directly impact Snowflake. Compliance with standards like NIST and FedRAMP is crucial. Achieving and maintaining these certifications requires significant investment. For example, in 2024, companies spent an average of $1.2 million on FedRAMP compliance. This increases operational costs and resource allocation.

International trade policies and geopolitical risks significantly impact Snowflake. The EU's Digital Markets Act and similar regulations globally introduce challenges. Data localization requirements and trade restrictions can limit expansion. Snowflake's ability to navigate these complexities is crucial for its global strategy. In 2024, geopolitical tensions affected tech trade, influencing market access.

Government Support for Cloud Adoption

Government policies and initiatives significantly influence Snowflake's growth. Public sector investments in digital transformation create opportunities for Snowflake to secure contracts and boost revenue. For instance, the U.S. government's cloud-first strategy, as of late 2024, continues to drive cloud adoption across federal agencies. This trend is further supported by various state-level initiatives.

- Cloud spending by the U.S. federal government is projected to reach $14.5 billion in 2025.

- Snowflake's government revenue grew by over 50% in fiscal year 2024, reflecting its increasing presence in this sector.

- Compliance with FedRAMP and other security standards is crucial for accessing these government contracts.

Political Stability and its Impact on Business Operations

Political stability is crucial for Snowflake's operations. Unstable regions can disrupt business continuity and expansion plans. Political risks, such as policy changes or conflicts, could affect Snowflake's customer base and revenue. For instance, the war in Ukraine has led to a 15% decrease in IT spending in some sectors, impacting global tech companies.

- Geopolitical tensions can cause delays and increase costs.

- Changes in data privacy laws globally can affect Snowflake's compliance requirements.

- Political instability may lead to market volatility, influencing investment decisions.

Snowflake navigates global data privacy laws like GDPR and CCPA, with GDPR fines reaching €1.1 billion in 2024, affecting data handling. Cybersecurity mandates and standards, such as FedRAMP, require substantial investment; companies spent an average of $1.2 million on FedRAMP compliance in 2024. Government spending on cloud services and political stability also significantly shape Snowflake's trajectory.

| Aspect | Details | Impact |

|---|---|---|

| Data Privacy Laws | GDPR, CCPA, etc. | Compliance costs; data handling across borders |

| Cybersecurity Mandates | FedRAMP, NIST, etc. | $1.2M avg. cost; resource allocation |

| Cloud Spending (US Gov) | $14.5B projected (2025) | Revenue opportunity for Snowflake |

Economic factors

Snowflake's revenue is sensitive to global economic health and IT spending trends. As of Q4 2024, IT spending is projected to increase, with cloud services growing over 20% annually, driving demand for Snowflake. Economic downturns can lead to budget cuts, potentially impacting subscription renewals and new customer acquisition. In 2024, the global cloud market is valued at $600 billion, highlighting its importance.

Inflation and exchange rate shifts directly influence Snowflake. High inflation might raise operational costs, affecting profitability. Currency fluctuations can change revenue from international markets. For example, the US inflation rate was 3.5% in March 2024. These factors demand careful financial planning.

The market demand for data analytics solutions significantly impacts Snowflake. The increasing reliance on data-driven decisions fuels demand for platforms like Snowflake. The global data analytics market is projected to reach $655 billion by 2029, with a CAGR of 18.3% from 2022. Snowflake's growth potential is directly tied to this expanding market.

Corporate Budget Rationalization and Cost Optimization

Economic instability often prompts companies to tighten their belts, focusing on cost-cutting and budget adjustments. This trend can affect how customers spend, potentially leading to shorter contract durations and impacting Snowflake's revenue. For example, in 2024, many tech firms reduced spending on non-essential services. This could result in delays or cancellations of cloud service expansions.

- Reduced IT budgets due to economic uncertainty.

- Shorter contract terms to manage cash flow.

- Focus on cost-effective cloud solutions.

- Potential delays in new cloud deployments.

Competition and Pricing Pressure

The cloud computing market is intensely competitive. Snowflake faces strong rivals like AWS, Microsoft Azure, and Google Cloud. This competition drives pricing pressures, impacting profitability. Snowflake must offer attractive pricing to stay competitive.

- AWS holds about 32% of the cloud market share as of early 2024.

- Microsoft Azure has roughly 23% of the market share.

- Snowflake's revenue grew by 32% in fiscal year 2024.

Economic factors are vital for Snowflake's success, with IT spending and cloud market growth being key. Cloud services are expanding over 20% yearly. However, downturns can limit budgets.

Inflation, exchange rates, and overall market demand significantly impact Snowflake. Currency shifts can change revenue. The data analytics market is predicted to reach $655B by 2029.

Economic uncertainty causes budget tightening, impacting contract lengths and deployments. Competition, led by AWS (32%), also affects profitability.

| Metric | Data | Source/Date |

|---|---|---|

| Cloud Market Growth (2024) | 20%+ annually | Industry Reports |

| US Inflation (March 2024) | 3.5% | BLS |

| Data Analytics Market Forecast (2029) | $655B | Industry Estimates |

Sociological factors

Growing data privacy concerns shape market demand for secure platforms like Snowflake. Snowflake's robust security features are crucial for attracting clients. In 2024, data breaches cost businesses an average of $4.45 million. Organizations prioritize data protection when selecting data platforms. This boosts Snowflake's appeal.

The digital transformation of the workforce and remote work trends boost demand for cloud-based solutions. This shift impacts Snowflake as organizations seek secure data platforms for distributed teams. In 2024, remote work increased, with about 30% of U.S. employees working remotely at least part-time. Snowflake's revenue grew 32% in fiscal year 2024, indicating strong market demand.

Consumer behaviors shift with tech adoption, impacting cloud service demand. In 2024, 73% of US adults used cloud storage. Snowflake must adapt to these trends. Societal attitudes toward data privacy and security are also critical. The global cloud market is projected to reach $1.6 trillion by 2025.

Diversity and Inclusion in the Tech Industry

Diversity and inclusion are critical social factors for Snowflake. The tech industry's focus on these values impacts workforce dynamics, talent acquisition, and public image. Snowflake must demonstrate commitment to these values to attract and retain top talent. Failure to do so can harm its reputation and ability to compete. The company's success depends on its ability to adapt.

- In 2024, tech companies with strong DEI programs saw a 15% increase in employee satisfaction.

- Snowflake's commitment to DEI can be measured by its ESG (Environmental, Social, and Governance) scores, which are increasingly important to investors.

- Studies show diverse teams are 35% more likely to outperform less diverse teams.

Addressing Global Data Inequality

Snowflake's commitment to tackling global data inequality is a crucial sociological factor. The company acknowledges how unequal data access and quality impede advancements in tackling social and environmental problems, especially within emerging markets. This initiative aligns with the growing global emphasis on digital inclusion and equitable access to technology. According to the World Bank, in 2023, 37% of the world's population still lacked internet access, highlighting the scale of this issue. Snowflake's efforts could improve data-driven decision-making globally.

- Focus on emerging markets for data access improvement.

- Enhance social and environmental progress through data.

- Address digital inclusion and technology equity.

- Improve global data-driven decision-making.

Societal attitudes on data privacy and security are pivotal. Consumer behaviors and workforce shifts impact cloud service demand, with digital transformation favoring cloud solutions. Diversity, inclusion, and tackling global data inequality shape Snowflake's success and its commitment to social responsibility is crucial.

| Sociological Factor | Impact on Snowflake | Supporting Data (2024-2025) |

|---|---|---|

| Data Privacy & Security | Influences platform adoption | Average data breach cost: $4.45M (2024) |

| Remote Work & Digital Transformation | Boosts demand for cloud solutions | 30% US employees work remotely (2024) |

| DEI & Global Data Equity | Attracts talent, shapes public image | Tech firms with strong DEI saw 15% employee satisfaction increase (2024) |

Technological factors

Continuous innovation in AI and Machine Learning is vital for Snowflake's success. AI and ML integration enables advanced analytics and data processing, boosting demand. Snowflake's revenue reached $828.6 million in Q1 2024, a 33% YoY increase, driven by AI-enhanced capabilities. The company's focus on AI helps it stay competitive.

The rise of big data and the need for real-time analytics significantly influence Snowflake. Snowflake must improve its platform to handle and analyze data rapidly. For instance, the global big data analytics market is projected to reach $684.12 billion by 2030. This includes supporting streaming data processing.

The rise of multi-cloud architectures is reshaping IT strategies, and Snowflake is well-positioned. Its ability to function across major cloud providers like AWS, Azure, and Google Cloud is a significant technological asset. This approach helps companies avoid vendor lock-in, offering flexibility. In 2024, over 70% of enterprises adopted a multi-cloud strategy, boosting demand for Snowflake's platform.

Cybersecurity Advancements and Threats

Cybersecurity advancements are crucial for Snowflake to protect its platform and customer data. The company must stay ahead of emerging threats and implement robust security measures to maintain customer trust and prevent breaches. In 2024, the global cybersecurity market is projected to reach $218.3 billion, showcasing the industry's growth. Snowflake's investment in security is vital.

- The global cybersecurity market is expected to reach $270 billion by 2026.

- Ransomware attacks increased by 13% in 2023.

- Snowflake's security spending is approximately 20% of its overall IT budget.

Development of Open Source Technologies

Open-source technologies significantly influence Snowflake's strategy. The rise of open-source data platforms, like Apache Iceberg, necessitates Snowflake's active participation for interoperability. This collaboration enhances innovation and expands market reach. Snowflake's investments in open-source integration are crucial for maintaining its competitive edge. In 2024, the open-source data market was valued at $25 billion, growing at 18% annually.

- Market growth in open-source data technologies.

- Snowflake's strategic response to open-source adoption.

Technological factors are crucial for Snowflake. Continuous advancements in AI/ML drive advanced analytics and demand; Snowflake's focus on AI is critical for staying competitive, and investments are approximately 20% of IT budget.

| Technological Aspect | Impact | Financial Data (2024/2025) |

|---|---|---|

| AI/ML Integration | Enhances analytics | Q1 2024 Revenue: $828.6M, 33% YoY |

| Cybersecurity | Protects data/platform | Cybersecurity market: $218.3B (2024) |

| Open-Source Technologies | Enhances interoperability | Open-source data market: $25B (2024) |

Legal factors

Snowflake faces intricate global data privacy regulations like GDPR and CCPA. These laws dictate how customer data is handled, impacting storage, processing, and security. Compliance requires significant investment; for example, GDPR fines can reach up to 4% of annual global turnover. In 2024, the global data privacy software market is projected to reach $8.9 billion.

Snowflake must adhere to government cybersecurity mandates, especially those from agencies like CISA. These mandates, such as mandatory multi-factor authentication, are legally binding. Failure to comply can result in significant penalties and legal repercussions. In 2024, CISA reported a 51% increase in cyberattacks against critical infrastructure.

International data transfer laws significantly affect Snowflake's global data operations. Snowflake must comply with legal frameworks like GDPR and CCPA, which govern data movement across borders. These regulations necessitate the use of mechanisms such as Standard Contractual Clauses. Failure to comply can lead to significant penalties, impacting Snowflake's financials. For instance, in 2024, GDPR fines totaled over €1.4 billion, highlighting the importance of compliance.

Intellectual Property Protection

Snowflake heavily relies on protecting its innovations and brand identity through legal means. Securing patents for its cloud data platform and trademarks for its brand is crucial. This legal strategy ensures Snowflake maintains its competitive edge in the market.

- Patents: Snowflake has been granted numerous patents, reflecting its commitment to innovation.

- Trademarks: The company actively protects its brand names and logos.

- Copyrights: Snowflake uses copyrights to safeguard its software code.

Contractual Obligations and Service Level Agreements

Snowflake's operations hinge on contractual agreements and service level agreements (SLAs). These legally binding documents dictate the terms of service, data security, and performance guarantees. Snowflake must rigorously adhere to these SLAs to maintain customer trust and avoid potential legal repercussions. Non-compliance can lead to financial penalties or damage to reputation. In Q1 2024, Snowflake reported a 33% year-over-year revenue increase, highlighting the importance of maintaining service quality.

- Adherence to SLAs is vital for customer retention.

- Legal disputes can arise from unmet contractual obligations.

- Financial penalties may result from SLA breaches.

- Reputational damage can occur due to non-compliance.

Snowflake navigates stringent global data privacy laws such as GDPR and CCPA. They require significant investments to ensure compliance, given potential hefty fines, with the data privacy software market projected to reach $8.9 billion in 2024.

Compliance with government cybersecurity mandates from agencies like CISA, is legally required, given a 51% increase in cyberattacks on critical infrastructure, necessitating strict adherence. The use of mechanisms like Standard Contractual Clauses is essential to follow international data transfer rules.

Safeguarding its cloud data platform and trademarks is essential for Snowflake's competitiveness. Protecting its innovations legally maintains its market position.

| Regulatory Aspect | Details | Impact on Snowflake |

|---|---|---|

| Data Privacy | GDPR, CCPA, data handling | Compliance costs, fines up to 4% global revenue |

| Cybersecurity | CISA mandates, multi-factor authentication | Penalties, operational disruptions |

| International Data Transfers | GDPR, CCPA compliance | Requires SCCs, potential fines in EU |

Environmental factors

Snowflake's reliance on cloud providers (AWS, Azure, GCP) means it's linked to high energy consumption from data centers. The increasing demand for cloud services directly correlates to higher energy use. Globally, data centers consumed an estimated 240-340 TWh of electricity in 2022. This consumption is expected to rise as cloud adoption continues.

Climate change regulations are becoming increasingly strict, affecting data center operations. Snowflake must address these regulations to ensure its infrastructure and partnerships comply. For example, the EU's Carbon Border Adjustment Mechanism (CBAM) will start phasing in from 2026. This could influence Snowflake's energy costs and its partners' operations. These regulations will drive the need for sustainable energy sources and efficient data center designs.

Snowflake's cloud operations indirectly contribute to e-waste from hardware lifecycles. The global e-waste volume reached 62 million tons in 2022, a 82% increase since 2010. While Snowflake doesn't manage the disposal, it's part of the IT sector's environmental impact. This includes servers and networking gear.

Shift Towards Sustainable Technology Solutions

The tech industry is increasingly focused on sustainable solutions, which presents both challenges and opportunities for companies like Snowflake. Snowflake's dedication to environmental sustainability in its operations and architecture can be a strong selling point for clients who prioritize eco-friendly practices. This focus aligns with broader market trends and could attract new customers. For instance, the global green technology and sustainability market is projected to reach $61.5 billion by 2027, growing at a CAGR of 9.4% from 2020.

- The global green technology and sustainability market is projected to reach $61.5 billion by 2027.

- Snowflake can leverage its sustainable practices to attract environmentally conscious customers.

Partnering with Cloud Providers Committed to Renewable Energy

Snowflake's commitment to environmental sustainability is evident in its partnerships with cloud providers prioritizing renewable energy. This collaboration directly reduces the carbon footprint linked to Snowflake's operations. In 2024, the tech industry's energy consumption increased by 10%, highlighting the importance of such initiatives. Snowflake's strategy aligns with growing investor and customer demands for eco-friendly practices.

- Snowflake's cloud partners use renewable energy.

- Reduces the carbon footprint of Snowflake's services.

- Tech industry's energy use grew in 2024.

- Supports customer and investor environmental goals.

Snowflake's cloud operations impact energy use, and e-waste. Data center energy consumption was 240-340 TWh in 2022, a concern as cloud demand grows. Sustainability practices can boost client attraction in a market projected to hit $61.5B by 2027.

| Environmental Aspect | Impact | Data Point |

|---|---|---|

| Energy Consumption | Data centers require massive energy, mostly in cloud infrastructure | Global data center electricity use 2022: 240-340 TWh |

| E-waste | IT hardware disposal poses an environmental concern. | Global e-waste in 2022: 62 million tons |

| Sustainability Focus | Prioritizing renewable energy is crucial for mitigating effects and customer's environmental concerns. | Green tech market by 2027: $61.5 billion |

PESTLE Analysis Data Sources

Our Snowflake PESTLE Analysis uses government databases, industry reports, and financial publications to analyze the external factors influencing the company.