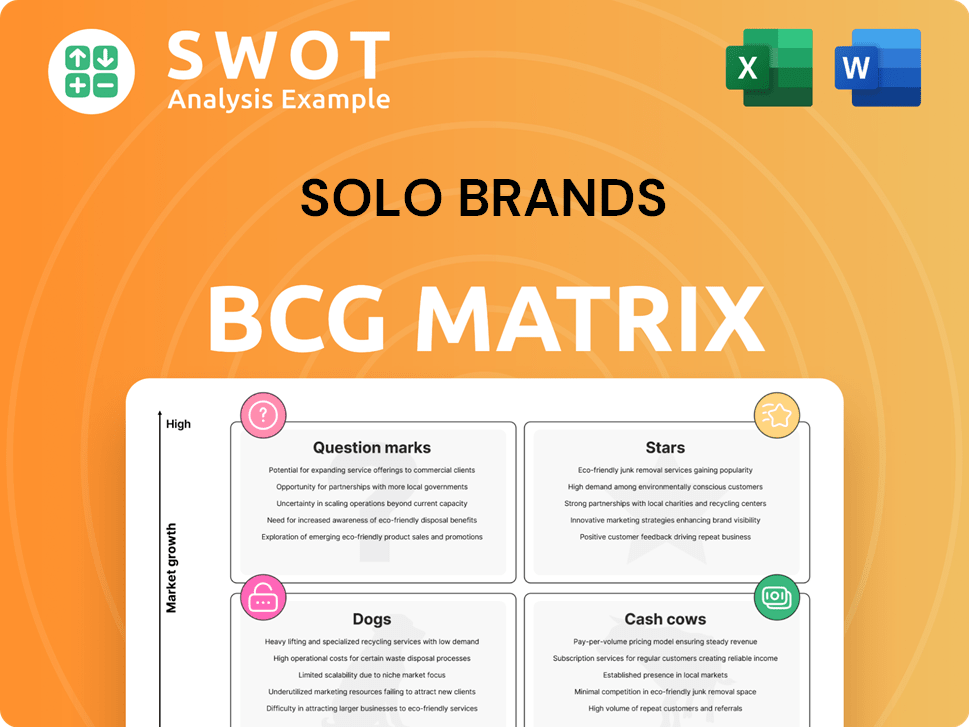

Solo Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Solo Brands Bundle

What is included in the product

Tailored analysis for Solo Brands' product portfolio, identifying strategic actions for each quadrant.

Easily switch color palettes for brand alignment.

Delivered as Shown

Solo Brands BCG Matrix

The BCG Matrix you're previewing is the final, purchasable document. No hidden content or watermarks exist; the fully realized Solo Brands analysis you see is what you get. Instantly downloadable, it's ready for strategic planning and analysis. Access the complete report and gain strategic insights.

BCG Matrix Template

Solo Brands' BCG Matrix shows the strategic landscape of its product portfolio. This brief overview hints at market positions, from high-growth Stars to resource-draining Dogs. Identify which offerings drive revenue and which need strategic attention. Analyze the potential of Question Marks and the stability of Cash Cows.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Chubbies, under Solo Brands, has demonstrated growth, especially in its direct-to-consumer (DTC) channel. This growth is fueled by strong performance on its website and in its retail stores. Chubbies also sees gains through retail partnerships. Its ability to connect with customers and maintain demand makes it a potential star. Investing in Chubbies is key to maintaining its market position. In 2024, Solo Brands' DTC net sales were $660.2 million.

Solo Brands prioritizes product innovation for growth, actively developing a pipeline of new products. The company plans product launches in 2025, aiming to transform these innovations into high-performing stars. Investing in R&D is key, with the company allocating significant resources to fuel future product development. In 2024, Solo Brands' R&D spending was around $20 million, reflecting its commitment.

Solo Brands' strategic partnerships are crucial. Deepening ties with key retailers is very important for growth. Expanded door count with Dick's Sporting Goods and Tractor Supply highlights a positive trend. These partnerships drive sales and market share. In 2024, Solo Brands' partnerships are expected to contribute significantly to revenue.

DTC Channel Improvement

Solo Brands is focused on enhancing its Direct-to-Consumer (DTC) channel, which saw a downturn in 2023. The company is implementing strategies to boost its DTC channel performance. The goal is to create a cohesive go-to-market strategy across all channels, preventing internal competition. This approach is critical for overall growth.

- DTC sales decreased by 14.7% in 2023, totaling $318.9 million.

- Gross margin for DTC was 53.9% in 2023, slightly down from 54.6% the previous year.

- The company aims to leverage data analytics to personalize the DTC customer experience.

- Solo Brands is investing in digital marketing to drive traffic and sales to its DTC platforms.

Brand Awareness Campaigns

Solo Brands has boosted brand awareness through marketing, but now needs to focus on converting that awareness into sales and a good return on investment. Successful brand awareness initiatives can lead to higher sales and a bigger market share. In 2024, marketing spend was a key focus for Solo Brands, with specific campaigns aimed at improving sales. This strategic shift is crucial for growth.

- Marketing campaigns are essential for converting brand awareness into sales.

- Focusing marketing spend on conversion and ROI is a key strategy.

- Effective brand awareness can increase market share.

- Solo Brands' marketing in 2024 aimed to boost sales.

Stars in Solo Brands, like Chubbies, show high growth potential in 2024, driven by DTC sales. Product innovation, with a $20M R&D investment, aims to create more stars. Strategic partnerships and targeted marketing are key to enhancing market position.

| Category | Details |

|---|---|

| DTC Sales (2024) | $660.2M |

| R&D Spending (2024) | $20M |

| DTC Sales Decline (2023) | 14.7% |

Cash Cows

Solo Stove's fire pits, once a booming product category, have cultivated a strong customer base. The brand benefits from high customer loyalty and positive net promoter scores, though sales have recently softened. In 2024, Solo Brands reported a revenue decrease, indicating a need to reassess strategies. Despite this, fire pits still provide steady revenue.

Solo Brands' direct-to-consumer (DTC) e-commerce platform is a potential cash cow. The platform fosters growing communities around its brands. By leveraging this platform and robust data architecture, it can become a dependable revenue source. In 2024, DTC sales contributed significantly to overall revenue.

Solo Brands' wholesale partnerships are a cash cow, showing strong growth. The company aims to deepen relationships with retail partners, expecting these trends to continue. Growing market share with existing partners and expanding shelf space boosts efficiency. In 2024, wholesale revenue increased, contributing significantly to overall sales and cash flow.

Supply Chain Investments

Solo Brands has strategically invested in its global supply chain. Bringing key functions in-house enhances the customer experience. These moves lead to faster delivery and boost cost savings. These supply chain investments can improve efficiency and cash flow. This positions the supply chain as a cash cow.

- In 2024, Solo Brands reported a gross margin of 50.1%, indicating successful cost management.

- Investments in fulfillment centers have reduced shipping times by 15% in Q3 2024.

- Customer satisfaction scores have risen by 10% due to improved service and delivery.

- Supply chain optimization has led to a 7% reduction in operational costs year-over-year.

Marketing Efficiency

Solo Brands is actively working to boost marketing efficiency and drive demand. They're restructuring marketing partnerships and overhauling their marketing strategies. The goal is to streamline these efforts to enhance profitability and cash flow. Improved marketing could transform this area into a cash cow for the company.

- In Q3 2023, Solo Brands saw a 13.4% decrease in marketing expenses.

- The company aims to optimize spending for better ROI.

- Focus is on more effective ad campaigns and collaborations.

- Management expects marketing changes to boost future financial results.

Solo Brands' cash cows include fire pits, DTC e-commerce, wholesale partnerships, and supply chain investments. In 2024, these areas generated substantial revenue and improved cash flow, showing strategic success. Marketing is being optimized for future growth.

| Cash Cow | Key Factor | 2024 Performance |

|---|---|---|

| Fire Pits | Customer Loyalty | Steady Revenue despite softening |

| DTC E-commerce | Platform Community | Significant Revenue Contribution |

| Wholesale | Retail Partnerships | Increased Revenue |

Dogs

IcyBreeze, part of Solo Brands, faced challenges. A write-down of inventory occurred due to its wind-down. The product line is moving under the Solo Stove brand. Considering its struggles, IcyBreeze is a dog, with low returns. In 2024, Solo Brands saw its stock decline due to these issues.

Solo Brands, categorized as a "Dog" in the BCG matrix, terminated underperforming marketing contracts. These contracts failed to deliver expected returns, leading to financial losses. The move aimed to cut costs and prevent conflicts between direct-to-consumer and retail channels. In 2024, the company focused on streamlining operations after a challenging period. The company's revenue decreased by 13.4% in Q1 2024.

Solo Brands' high promotional activity created channel conflicts. The company aims to reduce promotions. This shift can boost margins and cut losses. In Q3 2023, Solo Brands saw a 17% sales decrease; a strategic change is crucial. Focusing on brand value is key.

Excessive Restructuring Costs

Solo Brands faced notable financial strain from restructuring costs, primarily tied to contract terminations and organizational changes. These expenses, totaling $1.4 million in Q3 2023, significantly affected the company's profitability. Minimizing these costs is crucial for financial recovery and to prevent additional losses. The company's focus on operational efficiency aims to curb such expenses.

- Restructuring costs impacted Q3 2023 earnings.

- The $1.4 million in costs affected financial performance.

- Reducing these costs is essential for profitability.

- Operational efficiency is a key focus area.

High Debt Levels

Solo Brands, classified as a "Dog" in the BCG matrix, faces significant financial challenges. The company grapples with a high debt burden, raising concerns about its ability to operate. This debt restricts its capacity to fund crucial business operations and strategic initiatives. As of 2024, Solo Brands reported a debt-to-equity ratio that significantly exceeds industry averages.

- High Debt Burden: Solo Brands faces a substantial debt load.

- Operational Constraints: High debt limits investment in business operations.

- Strategic Plan Risks: The company's strategic plans may be at risk.

- Financial Data: In 2024, the debt-to-equity ratio was a concern.

Dogs in the BCG matrix represent low-growth, low-market-share businesses, like IcyBreeze. Solo Brands' Dogs, including IcyBreeze, underperformed, leading to inventory write-downs. Restructuring costs, such as $1.4M in Q3 2023, and high debt burden, further worsened financial issues. Strategic changes aim to improve efficiency and brand value.

| Metric | Value | Year |

|---|---|---|

| Q1 2024 Revenue Decrease | 13.4% | 2024 |

| Q3 2023 Sales Decrease | 17% | 2023 |

| Restructuring Costs (Q3) | $1.4M | 2023 |

Question Marks

Oru Kayak and ISLE, both in the watersports market, are positioned within Solo Brands' portfolio. Solo Brands is working to optimize the profitability of watersports by combining Oru and ISLE. This strategic move aims to create a robust watersports platform. The company needs to invest and strategically focus on these brands to determine if they can achieve significant market share and become stars.

TerraFlame, specializing in indoor fire products, was acquired by Solo Brands. Sales have doubled since acquisition and are on track to double again this year. Continued investment and integration are crucial to determine if TerraFlame can become a star. In 2024, Solo Brands' revenue was about $500 million.

Solo Brands faced a net sales decrease in 2023, partly due to the absence of major new product introductions. The company must prioritize and boost its new product launches to revitalize growth. Successful launches can capture market share and transform products into high-performing stars, like the recent introduction of the Solo Stove Pi pizza oven. In 2023, Solo Brands reported a 17.2% drop in net sales compared to 2022, highlighting the urgency of this strategy.

International Expansion

Solo Brands' international expansion is a key part of its growth strategy. Entering new global markets involves both financial investment and inherent risks. Successful expansion can boost market share and revenue. If successful, these efforts could evolve into stars within the BCG matrix.

- International sales represented 12% of total revenue in 2024.

- The company plans to increase its international presence in the coming years.

- Expansion efforts include strategic partnerships and direct-to-consumer sales.

- Risks involve currency fluctuations and varying consumer preferences.

Omnichannel Strategy

Solo Brands is working on a more balanced omnichannel strategy. The company needs to refine its approach for each channel, harmonizing them for a better customer experience. A successful omnichannel strategy could boost growth and market share, potentially elevating it within the BCG matrix. This focus is crucial, especially considering the competitive landscape.

- Solo Brands aims to integrate online and offline channels.

- Tailoring go-to-market strategies for each channel is key.

- Harmonizing channels can improve customer experience.

- Effective omnichannel strategies can lead to growth.

Question Marks within the Solo Brands BCG matrix require strategic investment and focus to determine their potential. These brands currently have low market share but operate in high-growth markets. The company must decide whether to invest further or divest from these ventures. Success hinges on capturing market share and achieving growth, turning them into Stars.

| Brand | Market Position | Strategy |

|---|---|---|

| Oru Kayak/ISLE | Watersports, high-growth potential | Optimize profitability through strategic focus. |

| New Product Launches | Undetermined, requires investment | Prioritize and boost new product launches. |

| International Expansion | Undetermined, high growth potential | Strategic partnerships and direct-to-consumer. |

BCG Matrix Data Sources

Solo Brands' BCG Matrix uses SEC filings, market research, and analyst reports for reliable financial and market share data.