Solo Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Solo Brands Bundle

What is included in the product

Analyzes Solo Brands' competitive landscape, including market risks and influences on profitability.

Instantly pinpoint where Solo Brands faces the most competitive stress, enabling faster strategic adjustments.

Preview Before You Purchase

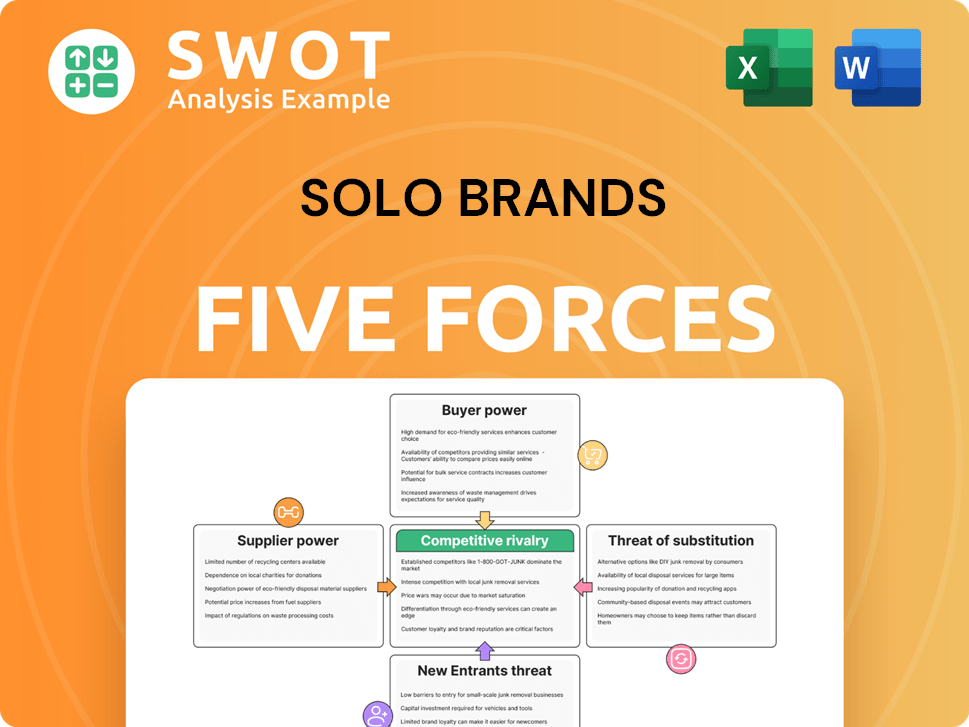

Solo Brands Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This Solo Brands Porter's Five Forces analysis examines competitive rivalry, bargaining power of buyers/suppliers, threat of substitutes, and new entrants. It provides insights into the company's position within the outdoor lifestyle market, considering its competitors and consumer behaviors. The comprehensive analysis offers a clear understanding of the industry dynamics affecting Solo Brands. The complete document is professionally formatted for your immediate use.

Porter's Five Forces Analysis Template

Solo Brands faces a competitive landscape shaped by brand loyalty and diverse product offerings, impacting its pricing power.

Threat of substitutes, like other outdoor and lifestyle brands, necessitates continuous innovation.

Buyer power is moderate, influenced by consumer choice and online retailers.

Supplier power is relatively low, with varied material sources available.

Rivalry is high, with strong competitors in the outdoor gear market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Solo Brands’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Solo Brands depends on third-party manufacturers, increasing their reliance on suppliers. This dependence could empower suppliers, particularly if few alternatives exist. In 2024, supply chain disruptions impacted many retailers. Diversifying the supplier base is a key mitigation strategy. Solo Brands' ability to negotiate is crucial for profitability.

Raw material availability significantly influences supplier power. For Solo Brands, sourcing steel or specialized fabrics is crucial. If these materials are scarce or controlled by a few suppliers, costs rise, reducing Solo Brands' bargaining power. Steel prices, for example, fluctuated in 2024, impacting manufacturing costs. Monitoring these market dynamics is essential for strategic planning.

Solo Brands' reliance on few suppliers grants them leverage. If suppliers offer unique components, this increases their power over Solo Brands. Analyzing supplier concentration is vital. For instance, if 80% of Solo Brands' materials come from 3 suppliers, their power rises. This impacts cost and operational flexibility in 2024.

Impact of Tariffs

Tariffs, particularly new or increased ones, can significantly impact Solo Brands. According to their reports, tariffs can raise the cost of goods sold. This can empower suppliers, potentially allowing them to increase prices. To mitigate this, Solo Brands must monitor trade policies and diversify its sourcing strategies.

- Tariffs can directly inflate the cost of raw materials and components.

- Increased costs might force Solo Brands to raise prices, affecting consumer demand.

- Diversifying suppliers helps reduce reliance on any single source.

- Trade policy changes require continuous monitoring.

Supplier Switching Costs

Solo Brands' ability to switch suppliers significantly impacts supplier power. High switching costs, stemming from specialized materials or lengthy lead times, can increase supplier influence. For instance, if a key component has only a few suppliers, those suppliers gain leverage. Strategic sourcing is crucial to mitigate these costs, enhancing Solo Brands' negotiating position. In 2024, companies focused on diversifying their supply chains to minimize dependency on any single supplier, which aligns with reducing switching costs.

- Diversifying suppliers reduces dependency, lowering switching costs.

- Specialized components can increase supplier power.

- Long lead times can amplify supplier influence.

- Strategic sourcing is a key mitigation strategy.

Solo Brands' reliance on suppliers, particularly third-party manufacturers, affects its profitability and operational flexibility. Raw material scarcity or supplier concentration can elevate costs and reduce bargaining power. In 2024, tariffs and trade policies added to supplier influence, impacting the cost of goods sold.

| Factor | Impact | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | Increases supplier power | 80% materials from 3 suppliers |

| Raw Material Scarcity | Raises costs | Steel price fluctuations |

| Tariffs | Inflate costs | Increased cost of goods sold |

Customers Bargaining Power

Customers' price sensitivity significantly shapes their bargaining power. If prices rise, price-sensitive customers may quickly switch to competitors. In a cautious consumer spending climate, understanding price elasticity is vital. For example, in 2024, sporting goods sales saw a moderate increase, reflecting consumer price awareness. This sensitivity impacts Solo Brands' pricing strategies.

Strong brand loyalty significantly diminishes the bargaining power of customers. When customers are deeply loyal to Solo Brands and its brands like Solo Stove and Chubbies, they are less inclined to switch due to price fluctuations or minor product variations. In 2024, Solo Brands reported a net revenue of $380.6 million. Building and maintaining strong brand loyalty is, therefore, a critical strategic imperative. Solo Stove, for instance, enjoys high brand affinity, excellent customer loyalty, and impressive net promoter scores, which help insulate it from customer price sensitivity.

Customers can easily find product details, prices, and competitors, boosting their bargaining power. Online platforms, like Amazon, offer extensive comparisons, influencing choices. Solo Brands, like many, need to manage online reviews, as seen with negative feedback impacting sales. In 2024, Solo Brands' online presence and reputation management are key to maintaining their market position and sales.

Switching Costs for Buyers

Low switching costs significantly amplify buyer power, pressuring Solo Brands to maintain competitive pricing and superior product offerings. If customers can effortlessly choose alternatives, Solo Brands faces increased vulnerability to price wars and diminished margins. Understanding the ease with which customers can switch is crucial for strategic planning. A 2024 report by Statista indicates that online retail sales reached $3.4 trillion, highlighting the ease of switching between brands.

- Ease of Switching: Customers can easily switch brands.

- Price Sensitivity: Customers are highly sensitive to price changes.

- Competitive Landscape: Many similar products are available.

- Brand Loyalty: Low brand loyalty among customers.

Product Differentiation

The degree of product differentiation significantly impacts customer power within Solo Brands. Highly differentiated products with unique value propositions reduce customer willingness to switch. Solo Brands emphasizes continuous innovation and product development to maintain this advantage. This strategy supports portfolio extensions and premiumization, as seen with their recent launches.

- Solo Brands' gross margin increased to 56.8% in Q3 2024 due to premiumization efforts.

- New product launches contributed to 12% of total revenue in Q3 2024.

- The company's investments in innovation totaled $20 million in 2024.

Customer bargaining power at Solo Brands is influenced by price sensitivity and ease of switching. High price sensitivity and low switching costs empower customers. Brand loyalty and product differentiation help mitigate this power. In 2024, these factors shaped Solo Brands' strategies.

| Factor | Impact on Customer Power | 2024 Data/Examples |

|---|---|---|

| Price Sensitivity | High = Increased Power | Sporting goods sales saw a moderate increase. |

| Brand Loyalty | High = Decreased Power | Solo Brands reported $380.6M in net revenue. |

| Switching Costs | Low = Increased Power | Online retail sales reached $3.4T. |

Rivalry Among Competitors

The outdoor and lifestyle market is intensely competitive, featuring numerous well-known brands. This fragmented market structure intensifies rivalry among companies. Solo Brands faces the challenge of differentiating itself to succeed. In 2024, the outdoor recreation market was valued at $887 billion.

The growth rate significantly influences competitive rivalry within the outdoor and apparel sectors. Slower growth often intensifies competition as firms vie for market share. The projected compound annual growth rate (CAGR) for the global apparel market from 2024 to 2029 is approximately 6% per year, impacting Solo Brands' competitive environment. This moderate growth rate suggests a potentially heightened battle for market dominance in the coming years.

Established brands with strong recognition create competitive challenges for Solo Brands. To compete, Solo Brands must focus on building and sustaining brand awareness. Solo Stove, a leader, benefits from high brand affinity and customer loyalty. In 2024, Solo Stove's net promoter score (NPS) was a key metric for customer satisfaction.

Product Innovation

Continuous product innovation intensifies competitive rivalry. Businesses constantly strive to introduce new products to gain market advantages. Solo Brands, recognized for its innovative approach, was ranked second in Fast Company's 2024 list of the world's most innovative companies in the consumer goods category. This recognition highlights the company's efforts to stay ahead in a competitive landscape. Such innovation can lead to rapid shifts in market share as rivals react.

- Solo Brands' innovative spirit is a key factor in competitive dynamics.

- The company's ranking in Fast Company's list is a testament to its product development efforts.

- Innovation drives the need for competitors to also improve and adapt.

- Competitive rivalry is heightened by the constant pursuit of new and better products.

Exit Barriers

High exit barriers can intensify competitive rivalry. Solo Brands, facing challenges, may struggle to exit the market. The company's warning about its ability to continue as a going concern indicates these challenges. This situation can lead to overcapacity and price wars.

- Refinancing its existing debt is a critical strategy.

- Substantial doubt about its ability to continue indicates potential exit barriers.

- Overcapacity and price wars can impact profitability.

Competitive rivalry in Solo Brands' market is high, influenced by innovation and market growth. The apparel market's CAGR from 2024 to 2029 is 6%. Solo Brands innovates, ranking second in its category. This drives competitors to adapt, affecting market share.

| Factor | Impact | Data |

|---|---|---|

| Market Growth | Moderate growth intensifies rivalry | 6% CAGR (2024-2029) |

| Innovation | Key driver of competition | Fast Company ranking (2024) |

| Exit Barriers | High barriers increase competition | Going concern doubts |

SSubstitutes Threaten

Solo Brands faces threats from substitutes like general outdoor gear. These alternatives, including established brands and generic products, provide options for consumers. In 2024, the outdoor recreation market, which includes substitutes, was valued at over $50 billion. Addressing these alternatives is key to maintaining market share.

The price-performance ratio significantly impacts the appeal of substitutes. If alternatives provide similar benefits at a lower cost, they become a bigger threat. Considering the high inflation rates, consumers are increasingly price-conscious. For example, in 2024, Solo Brands faced challenges as consumers sought cheaper alternatives in a tighter economic climate.

Low switching costs heighten the threat of substitutes for Solo Brands. Customers can easily choose competitors without significant financial or logistical hurdles. This necessitates Solo Brands to continuously offer compelling value to retain customers. In 2024, the direct-to-consumer (DTC) market, where Solo Brands operates, saw intensified competition, emphasizing the need for a strong brand and customer loyalty. Low switching costs also amplify buyer power.

Consumer Preferences

Consumer preferences significantly impact the threat of substitutes. Changing tastes can boost demand for alternatives, like the rise in minimalist outdoor gear potentially impacting Solo Brands' fire pits. Brands must deeply understand their target audience to stay relevant. In 2024, the outdoor recreation market showed a 7.7% growth, highlighting the importance of adapting to trends.

- Market shifts can erode demand for existing products.

- Understanding customer needs is crucial for product development.

- Brands must innovate to compete with new alternatives.

- Focusing on a core customer base helps maintain relevance.

Technological Advancements

Technological advancements continually introduce new substitutes, impacting Solo Brands. Portable solar stoves, for instance, present an alternative to traditional camp stoves, potentially affecting Solo Brands' stove sales. Technological innovations are also transforming outdoor apparel, with smart clothing and wearable tech gaining traction. This shift creates new competitive pressures.

- The global smart clothing market was valued at $5.2 billion in 2023 and is projected to reach $15.8 billion by 2030.

- Solo Brands' net sales decreased 10.9% to $296.1 million in Q3 2023, showing the impact of market shifts.

- Competitors like Lululemon are investing heavily in wearable technology.

Substitutes like generic outdoor gear, threaten Solo Brands. Price-performance ratios are crucial; cheaper alternatives gain traction. Low switching costs intensify the threat; understanding changing consumer tastes is vital.

| Factor | Impact on Solo Brands | 2024 Data |

|---|---|---|

| Outdoor Recreation Market | Increased competition | Over $50 billion |

| Inflation | Consumer price sensitivity | Continued pressures |

| DTC Market | Intensified competition | Growing but crowded |

Entrants Threaten

High barriers to entry, including capital needs and scale, protect Solo Brands. The company, with its established brand, can deter new rivals. Starting a fashion retail business requires considerable capital, like real estate and marketing. In 2024, Solo Brands reported a revenue of $1.04 billion.

Strong brand loyalty significantly raises the barrier for new competitors. Solo Brands, with its established brands like Solo Stove, leverages this advantage. Solo Stove's high brand affinity and loyalty, reflected in strong Net Promoter Scores, protect its market position. In 2024, Solo Stove's robust customer base continues to be a key asset against new entrants.

New entrants face challenges accessing distribution channels. Solo Brands' existing partnerships offer a significant advantage. For example, in Q1 2024, Dick's increased Solo Stove presence from 350 to 700 stores. Tractor Supply expanded from 100 to over 1,500 doors, showcasing established market access.

Government Regulations

Government regulations significantly influence new entrants. Favorable policies can attract, while restrictive ones can deter them. Potential tariff increases in 2024 could affect the sporting goods sector, impacting pricing and supply chains. This creates both opportunities and challenges for Solo Brands. For example, the U.S. imposed tariffs on certain Chinese goods, potentially affecting companies like Solo Brands.

- Tariffs on athletic footwear from China were about 20% in 2024.

- The sporting goods market size was approximately $100 billion in 2024.

- Compliance costs for new entrants can be substantial.

- Regulatory changes can create uncertainty.

Economies of Scale

The threat of new entrants is moderate for Solo Brands. Existing companies with economies of scale can produce goods at a lower cost, creating a barrier for new competitors. Solo Brands benefits from its operational scale, especially in its ability to manage its diverse brand portfolio effectively. The company's expertise in scaling digitally-native brands, exemplified by the rapid growth of Chubbies, is a key advantage.

- Economies of scale enable lower production costs.

- Solo Brands leverages its scale across brands.

- Chubbies' growth showcases scaling expertise.

The threat from new entrants is moderate. Capital requirements and brand loyalty act as barriers. Regulatory hurdles and existing distribution networks also play a role. Solo Brands leverages its scale and brand recognition to deter new competition.

| Factor | Impact on Threat | Data Point (2024) |

|---|---|---|

| Capital Needs | High Barrier | Retail startup costs: $500K-$2M+ |

| Brand Loyalty | High Barrier | Solo Stove NPS: High; Chubbies sales growth. |

| Distribution | Moderate Barrier | Dick's: 700 stores; Tractor Supply: 1,500+ doors. |

Porter's Five Forces Analysis Data Sources

This analysis synthesizes information from Solo Brands' SEC filings, industry reports, and competitor analysis.