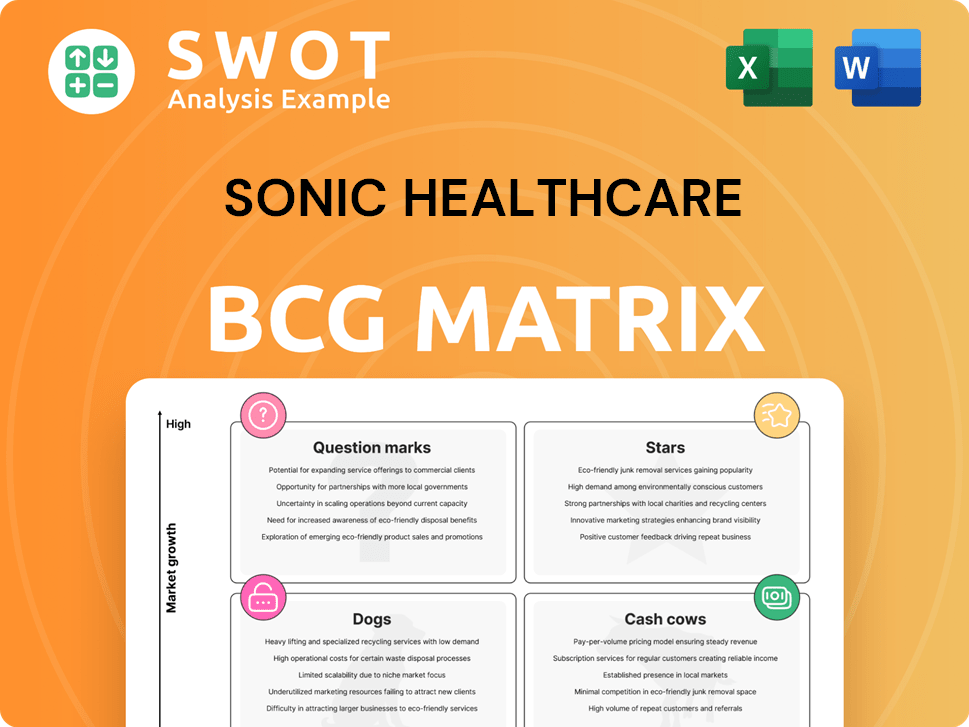

Sonic Healthcare Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sonic Healthcare Bundle

What is included in the product

Clear descriptions and strategic insights for each BCG Matrix quadrant.

Printable summary optimized for A4 and mobile PDFs. Sharing and alignment made simple!

Delivered as Shown

Sonic Healthcare BCG Matrix

The Sonic Healthcare BCG Matrix preview showcases the final product. This document is the same comprehensive report you'll receive upon purchase, optimized for strategic insights. It's immediately ready for your analysis and presentation.

BCG Matrix Template

Sonic Healthcare operates in a complex healthcare market. This preview offers a glimpse into its product portfolio through a BCG Matrix lens. We analyze its products, categorizing them as Stars, Cash Cows, Dogs, and Question Marks. Understanding these classifications reveals crucial strategic insights into resource allocation. This overview barely scratches the surface. Purchase the full BCG Matrix for a complete breakdown and actionable strategic recommendations.

Stars

Sonic Healthcare demonstrates strong organic revenue growth in key markets. Australia, Germany, and the UK lead this growth, fueled by Medical Leadership and expertise in specialty testing. In 2024, the company's revenue reached approximately $9.5 billion, reflecting a solid increase. This expansion is supported by rising testing rates and an aging population.

Sonic Healthcare's strategic acquisitions are key to its revenue. Recent purchases like Medisyn, Dr. Risch Group, PathologyWatch, and LADR Lab Group have boosted revenue. These moves expand its global reach and boost earnings. In FY24, Sonic reported a 7.4% revenue increase, showing the impact of these acquisitions.

Sonic Healthcare's radiology division shows impressive growth. It benefits from high-value modalities and strategic investments in AI. The division's organic revenue and EBITDA are growing strongly. New greenfield site openings boost its growth trajectory. In 2024, the division's revenue reached $2.5 billion, a 12% increase.

Strong Balance Sheet Enables Growth

Sonic Healthcare's robust financial health, reflected in gearing below pre-pandemic levels, is a key strength. This financial stability allows for strategic investments, acquisitions, and technological advancements. The company’s strong balance sheet provides a competitive edge in the market, supporting its growth trajectory. Sonic Healthcare's focus on financial prudence is evident in its capacity to seize new market opportunities.

- Gearing below pre-pandemic averages.

- Strategic investments in technology and acquisitions.

- Competitive advantage in the market.

- Financial prudence.

Expansion of Anatomical Pathology Services

Sonic Healthcare is broadening its anatomical pathology services, targeting the private market for growth. This expansion is a strategic response to the rising need for specialized diagnostics. In fiscal year 2024, Sonic Healthcare's revenue reached $9.8 billion, reflecting its robust market position. This move capitalizes on the growing demand for advanced medical diagnostics.

- Sonic Healthcare's FY24 revenue: $9.8B.

- Focus on private market expansion.

- Responding to increased diagnostic demand.

- Strategic growth initiative.

Sonic Healthcare's "Stars" include its radiology and anatomical pathology divisions, exhibiting high growth and market share. These divisions benefit from strategic investments and acquisitions, boosting their expansion. In 2024, radiology revenue was up by 12% reaching $2.5B, fueled by AI and new sites.

| Feature | Details |

|---|---|

| Key Divisions | Radiology, Anatomical Pathology |

| Growth Drivers | AI, Acquisitions, New Sites |

| FY24 Radiology Revenue | $2.5B, up 12% |

Cash Cows

Sonic Healthcare leads the Australian pathology market. This mature market provides significant cash flow. In 2024, pathology revenue in Australia was approximately $2.5 billion. It needs little reinvestment, a true cash cow for Sonic.

Sonic Healthcare has a strong foothold in Europe, particularly in Germany, Switzerland, and the UK. These areas generate reliable income, with potential for boosted efficiency and profit. In 2024, European operations accounted for a significant portion of Sonic Healthcare's revenue, around 40%.

Sonic Healthcare's core lab services are cash cows. They provide steady cash due to high testing volumes. The company has a strong network of labs. Minimal investment is needed in marketing. In FY2024, revenue from lab services was substantial.

Economies of Scale

Sonic Healthcare's extensive global footprint provides substantial economies of scale. Their centralized executive support, group purchasing, and IT infrastructure boost profit margins. These operational efficiencies solidify their status as a cash cow within the BCG matrix. In 2024, Sonic Healthcare's revenue reached approximately $9.5 billion, driven by these strategies.

- Centralized support reduces operational costs.

- Group purchasing lowers procurement expenses.

- Efficient IT systems streamline operations.

- High-margin outcomes are a direct result.

Medical Leadership Culture

Sonic Healthcare's Medical Leadership culture is a key differentiator. It fosters strong professional medical practice, boosting market share. This approach ensures customer loyalty and stable revenue. In 2024, Sonic's revenue reached $10.1 billion, reflecting its success. This leadership model is central to their "Cash Cow" status.

- Competitive Advantage: Drives market share growth.

- Customer Loyalty: Maintains a loyal customer base.

- Revenue Stream: Ensures a consistent revenue stream.

- Financial Performance: Contributed to $10.1B revenue in 2024.

Sonic Healthcare excels as a "Cash Cow" due to its consistent revenue streams, particularly in its core lab services and established European operations. The company's robust market presence and efficient operational strategies generate substantial profits with minimal reinvestment needs. For 2024, their global revenue reached approximately $10.1 billion, a strong indicator of its financial stability.

| Characteristic | Description | Impact |

|---|---|---|

| Core Services | High-volume lab testing | Steady Cash Flow |

| Geographic Footprint | Extensive global presence | Economies of Scale |

| Financials (2024) | Revenue of $10.1B | Strong Profitability |

Dogs

Sonic Healthcare's COVID-19 testing revenue faced a steep decline, impacting overall profitability. This shift, anticipated as the pandemic eased, now requires strategic cost adjustments. In 2024, COVID-19 testing contributed significantly less to their revenue. The focus is now on core services to maintain profitability.

In 2024, Sonic Healthcare's Belgian operations saw a slight revenue dip. This was mainly due to government fee reductions in the healthcare sector. Despite this, underlying growth signals potential. Strategic moves are needed to offset fee impacts and boost results. The 2024 revenue decline was approximately 2%.

Sonic Clinical Services confronts primary care hurdles, notably a GP shortage. This restricts expansion, demanding novel staffing solutions. In 2024, Australia faced a significant GP deficit, impacting healthcare access. Innovative strategies are essential to navigate these market dynamics effectively.

Underperforming US Anatomical Pathology

The US anatomical pathology segment within Sonic Healthcare's portfolio showed slower revenue growth compared to competitors. This underperformance necessitates focused strategic actions to improve its market position. The US market for anatomical pathology is substantial, with an estimated value exceeding $10 billion in 2024. Sonic Healthcare's revenue from this segment in the US was approximately $1.5 billion in 2024, indicating a need for growth strategies.

- Slower growth compared to peers.

- US anatomical pathology market exceeds $10 billion.

- Sonic Healthcare's US revenue: ~$1.5B (2024).

- Strategic initiatives needed to boost market share.

Initial Losses from New Contracts

New contracts, like the UK Hertfordshire & West Essex NHS deal, can initially cause losses due to setup costs and integration difficulties. These contracts require time to generate profits and positively impact the company's financials. The UK pathology market is competitive, with Sonic Healthcare facing challenges. In 2024, Sonic Healthcare's revenue from the UK market was around $1.3 billion.

- Initial losses occur from new contracts due to upfront costs.

- Integration challenges impact profitability in the short term.

- Contracts need time to become profitable and contribute positively.

- The UK pathology market is highly competitive.

Dogs within Sonic Healthcare represent underperforming segments with low market share in a slow-growth market.

These areas require strategic attention to improve profitability or consider divestment. The company's goal is to reallocate resources from these areas.

Examples include segments with slower growth and new contracts struggling initially.

| Segment | Market Share | Growth Rate (2024) |

|---|---|---|

| US Anatomical Pathology | Moderate | Slower than Peers |

| UK Contracts (Initial) | Variable | Negative (Setup Costs) |

| COVID-19 Testing | Decreasing | Significant Decline |

Question Marks

Investments in AI and digital pathology by Sonic Healthcare are classified as "Question Marks" within the BCG matrix, indicating high growth potential but uncertain returns. These ventures necessitate substantial capital, with market analysis forecasting a global digital pathology market size of $774.2 million in 2024. The adoption of AI in diagnostics could boost efficiency and accuracy, but the technology is still in early stages. Sonic Healthcare must carefully assess risks and rewards before committing significant resources, as the market is expected to reach $1.3 billion by 2029.

Specialty Diagnostics and Genetics are question marks in Sonic Healthcare's BCG matrix. Growth in microbiome sequencing and forensic toxicology offer high potential. These areas need substantial investment. Sonic Healthcare's 2024 revenue was AUD 9.7 billion. The company spends heavily on R&D.

Sonic Healthcare's expansion into new geographic regions offers growth potential, yet it's risky. Careful planning and investment are crucial for success. For example, in 2024, Sonic Healthcare expanded its presence in several international markets. This strategic move aims to capitalize on healthcare demands.

Telehealth Services

Telehealth services are a question mark for Sonic Healthcare, demanding investments in tech and infrastructure. The telehealth market is expanding; however, Sonic Healthcare must gain a substantial share to become a star. The global telehealth market was valued at $61.4 billion in 2023 and is expected to reach $352.7 billion by 2030. This growth presents both opportunities and risks. Sonic Healthcare needs to carefully evaluate its strategy.

- Market Growth: The telehealth market is projected to grow significantly.

- Investment Needs: Requires substantial investment in technology and infrastructure.

- Strategic Focus: Needs a clear strategy to capture market share.

- Risk vs. Reward: Balancing the risks and rewards of market expansion.

Primary HPV Testing

The shift to primary HPV testing in cervical cancer screening creates both chances and difficulties for Sonic Healthcare. To succeed in this changing market, Sonic Healthcare needs to invest in the needed technology and infrastructure. This strategic move is essential for capturing a larger market share in the coming years. The company's ability to adapt and invest will determine its success.

- Primary HPV testing adoption varies; some countries already use it.

- Investment involves buying advanced diagnostic equipment.

- Infrastructure includes training staff and setting up efficient labs.

- Market share gains rely on strategic planning and execution.

Sonic Healthcare faces "Question Marks" in AI, telehealth, and new diagnostic areas. These require significant investments with uncertain outcomes. The digital pathology market was $774.2M in 2024. Strategic planning and market share capture are critical.

| Area | Description | Challenge |

|---|---|---|

| AI/Digital Pathology | High growth potential. | Requires large capital, early-stage tech. |

| Telehealth | Expanding market. | Needs tech and infrastructure investments. |

| HPV Testing | Changes in screening. | Adaptation and equipment. |

BCG Matrix Data Sources

Sonic's BCG Matrix leverages financial reports, market analysis, competitor data, and expert opinions for dependable, actionable results.