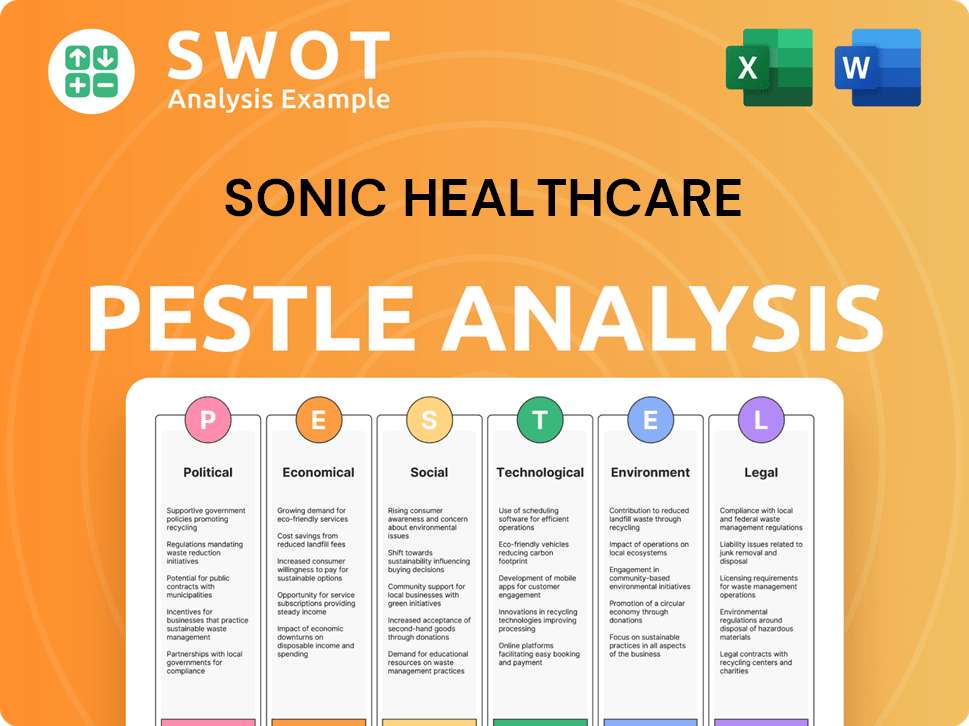

Sonic Healthcare PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sonic Healthcare Bundle

What is included in the product

Explores Sonic Healthcare's external factors: Political, Economic, Social, Technological, Environmental, and Legal.

Helps support discussions on external risk and market positioning during planning sessions.

Preview the Actual Deliverable

Sonic Healthcare PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This Sonic Healthcare PESTLE analysis provides a comprehensive look at key external factors. It examines the political, economic, social, technological, legal, and environmental aspects. Download this exact, insightful document immediately.

PESTLE Analysis Template

Sonic Healthcare operates in a dynamic environment, constantly shaped by external forces. Our PESTLE analysis breaks down these influences, from regulatory changes to social shifts. Discover the economic pressures and technological advancements impacting their strategies. Analyze the competitive landscape with a clear understanding of their opportunities and threats. Don't miss out on vital intelligence; purchase the full PESTLE analysis now.

Political factors

Government healthcare policies heavily influence Sonic Healthcare. Changes in funding, reimbursement, and regulations directly impact revenue and costs. For instance, potential fee cuts in the USA could affect earnings. The US healthcare spending reached $4.5 trillion in 2022, showing policy's financial scope. Regulatory shifts also affect compliance costs.

Sonic Healthcare's success hinges on political stability across its operational regions. Predictable regulations and healthcare funding are essential for its business model. For example, Australia, a key market, saw political stability in 2024, supporting consistent healthcare spending. Conversely, instability can disrupt operations and investment, as seen in some emerging markets. In 2024, Sonic Healthcare's revenue from Australia was approximately AUD 8.2 billion.

Healthcare system structures significantly shape Sonic Healthcare's global footprint. The NHS's influence in the UK creates opportunities for outsourcing, with recent contracts worth millions. Sonic's ability to adapt to varying healthcare models, from public to private systems, is crucial. This adaptability is evident in its diverse revenue streams across different countries. The company's expansion strategy is heavily influenced by these political landscapes.

Government Initiatives in Healthcare

Government healthcare initiatives significantly shape Sonic Healthcare's operational landscape. Policies focused on enhancing healthcare access, quality, and efficiency are key. For example, in 2024, the Australian government increased healthcare spending by 6.2%, impacting diagnostic service demand. Changes in referral systems and preventative medicine programs influence test volumes. These shifts can create both opportunities and challenges for Sonic Healthcare.

- Increased government healthcare spending.

- Changes in referral systems.

- Focus on preventative medicine.

International Relations and Trade Policies

International relations and trade policies significantly affect Sonic Healthcare, a multinational entity. Changes in diplomatic ties or trade agreements can disrupt supply chains, particularly for medical equipment and pharmaceuticals. For instance, recent trade tensions between major economies have increased import costs. These shifts may affect Sonic Healthcare's profitability and operational efficiency.

- Global trade in pharmaceuticals is projected to reach $1.7 trillion by 2025.

- Tariff increases can raise the cost of imported medical devices by up to 15%.

- Changes in visa policies may impact the mobility of healthcare professionals.

Government policies, such as healthcare funding and regulations, are critical. These factors directly impact Sonic Healthcare's financial performance. Political stability is essential for predictable operations, with Australia contributing AUD 8.2 billion in revenue in 2024.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Healthcare Spending | Affects service demand | Australia's healthcare spending increased 6.2% in 2024. |

| Trade Policies | Impacts supply chains | Global pharmaceutical trade projected to reach $1.7T by 2025. |

| Regulatory Changes | Influences operational costs | Tariff increases could raise medical device costs up to 15%. |

Economic factors

The level of healthcare spending significantly impacts Sonic Healthcare. Increased healthcare spending, especially in developed markets, boosts demand for diagnostic services. Stable healthcare funding, whether through government or private insurance, is crucial. For example, in Australia, healthcare spending reached $240.6 billion in 2023-24.

Inflation, especially in labor costs, could affect Sonic's profits by raising operating expenses. Recent reports show inflation pressures are easing in some major markets. For example, the consumer price index rose by 3.3% in April 2024. This is down from 3.5% in March 2024, indicating a potential easing trend.

Currency fluctuations significantly influence Sonic Healthcare's financial results. The company's international revenue, which accounted for 65% of total revenue in FY23, is exposed to currency translation risk. For instance, a weaker AUD against the EUR or USD can boost reported earnings, as seen in the 1H24 results. Conversely, a stronger AUD can reduce the value of foreign earnings when converted.

Economic Growth and Disposable Income

Economic growth and disposable income are key for Sonic Healthcare. Higher disposable income often leads to increased demand for private healthcare and diagnostic services. For example, in Australia, private health insurance membership rose to 45.6% in December 2023. Economic downturns could decrease this demand.

- Australia's GDP growth in 2023 was around 2.2%.

- US disposable income increased by 3.7% in Q4 2023.

- UK healthcare spending reached £264.6 billion in 2022-23.

Acquisition and Investment Costs

Sonic Healthcare's growth strategy heavily relies on acquisitions and investments in advanced diagnostic technologies. The economic impact of these moves is substantial, involving considerable upfront costs and the expectation of future financial benefits. These investments are critical for expanding its market presence and enhancing its service offerings.

- In FY23, Sonic Healthcare invested $427.4 million in acquisitions.

- These acquisitions are expected to generate significant revenue synergies.

- Technology investments aim to improve operational efficiency and service quality.

Economic conditions are pivotal for Sonic Healthcare, affecting spending and demand for services. Healthcare expenditure in Australia hit $240.6B in 2023-24. Inflation pressures ease, with CPI at 3.3% in April 2024. Currency impacts profits due to global operations.

| Factor | Impact | Data |

|---|---|---|

| Healthcare Spending | Increases demand | AUS $240.6B (2023-24) |

| Inflation | Raises costs | CPI 3.3% (Apr 2024) |

| Currency Fluctuations | Affects earnings | 65% Revenue (FY23) |

Sociological factors

Aging populations and overall population growth in Sonic Healthcare's key markets, such as Australia, the US, and Germany, are significant drivers for increased demand for diagnostic services. For instance, Australia's population is projected to reach 26.9 million by 2025, with an aging demographic. This demographic shift fuels a favorable long-term outlook for Sonic Healthcare, as older populations typically require more healthcare. These trends are expected to increase demand for the company's services.

A rising emphasis on preventative medicine boosts demand for diagnostic testing. Public health awareness also drives this trend. Sonic Healthcare benefits from this increased demand. Revenue increased by 10.3% to $9.6 billion in FY24. This growth reflects the importance of early detection.

Lifestyle shifts significantly affect healthcare demands. Rising chronic disease rates, like diabetes and heart disease, boost diagnostic test needs. For example, in 2024, the CDC reported over 37 million Americans have diabetes, increasing testing volumes. This trend continues to shape healthcare service demands.

Healthcare Accessibility and Health Equity

Societal focus on healthcare accessibility and health equity shapes diagnostic service delivery. Increased demand for convenient, equitable access could drive Sonic Healthcare to broaden service locations and offer mobile testing options. This aligns with growing calls for healthcare that reaches underserved populations. For instance, in 2024, the U.S. spent over $4.8 trillion on healthcare.

- Healthcare spending in the U.S. in 2024 exceeded $4.8 trillion.

- The push for health equity is increasing demand for accessible healthcare services.

- Mobile testing services are becoming more prevalent.

Workforce Availability and Skill Shortages

The availability of skilled healthcare professionals significantly impacts Sonic Healthcare's operations. Labor shortages, especially in areas like pathology and radiology, can strain resources. These shortages often drive up salary costs, influencing the company's financial performance. Addressing workforce stability is crucial for sustained growth and service delivery.

- The U.S. Bureau of Labor Statistics projects a 13% growth in employment for medical scientists, including pathologists, from 2022 to 2032.

- In 2024, the average salary for a radiologist in Australia, where Sonic Healthcare has a significant presence, is around AUD 400,000.

- Sonic Healthcare's workforce includes approximately 38,000 employees globally as of 2024.

Increased emphasis on health equity drives demand for accessible healthcare. This leads to mobile testing options expansion. Healthcare spending in the U.S. exceeded $4.8 trillion in 2024.

| Aspect | Impact | Data |

|---|---|---|

| Health Equity | Boosts demand for accessible services. | U.S. healthcare spending in 2024: over $4.8T. |

| Mobile Testing | Becomes more prevalent. | Expected growth in mobile healthcare services. |

| Public Awareness | Promotes preventive medicine. | Increasing chronic disease rates impact diagnostic test needs. |

Technological factors

Sonic Healthcare benefits significantly from tech advancements in lab medicine and imaging. AI and new tests boost efficiency and accuracy. In FY23, R&D spending was $166.7M, reflecting commitment to innovation. These tech enhancements expand service offerings, driving growth. For example, in 2024, adoption of AI in radiology increased diagnostic speed by 20%.

The healthcare sector's digital transformation, including digital pathology, affects Sonic. In 2024, the global digital pathology market was valued at $630 million, projected to reach $1.2 billion by 2029. Enhanced revenue systems and digital health tools also reshape service delivery. This shift drives efficiency and new service models for Sonic. The increasing use of AI in diagnostics is also important.

Artificial Intelligence (AI) and Machine Learning (ML) are transforming healthcare, particularly in diagnostics. Sonic Healthcare is actively investing in AI, with potential to enhance diagnostic accuracy and efficiency. In 2024, the global AI in healthcare market was valued at $28.2 billion and is projected to reach $194.4 billion by 2032. This growth underscores the increasing importance of AI in the sector.

Data Management and Cybersecurity

Data management and cybersecurity are paramount for Sonic Healthcare. The surge in digital patient data necessitates strong security. Protecting patient information is crucial for maintaining trust and operational integrity. Cybersecurity breaches can lead to significant financial and reputational damage. For example, in 2024, healthcare data breaches cost an average of $10.9 million per incident.

- Data breaches cost the healthcare industry an average of $10.9 million per incident in 2024.

- Cybersecurity is a top priority to safeguard sensitive patient data.

- Sonic Healthcare invests in robust systems to protect patient information.

- Compliance with data protection regulations like GDPR is essential.

Telehealth and Remote Monitoring

Telehealth and remote monitoring are reshaping healthcare delivery, impacting diagnostic service access and integration. These technologies offer opportunities for Sonic Healthcare to expand its reach and improve patient care. Consider that the global telehealth market is projected to reach $225.5 billion by 2025. This shift could lead to new revenue streams and operational efficiencies for Sonic Healthcare. However, it also presents challenges related to data security and integration with existing systems.

- Telehealth market expected to hit $225.5B by 2025.

- Opportunities for expanded reach and improved care.

- Challenges in data security and system integration.

Technological factors significantly impact Sonic Healthcare's operations, particularly AI's growth in diagnostics, enhancing accuracy and efficiency, supported by $166.7M R&D spending in FY23. The company addresses digital transformation by focusing on cybersecurity and data management to protect patient information; healthcare data breaches cost ~$10.9M each in 2024. Telehealth, with a projected $225.5B market by 2025, presents opportunities and challenges, focusing on expansion and integration.

| Aspect | Impact | 2024 Data |

|---|---|---|

| AI in Healthcare | Enhanced Diagnostics | $28.2B Market Value |

| Digital Pathology Market | Market Growth | $630M Value, to $1.2B by 2029 |

| Telehealth Market | Service Expansion | Projected $225.5B by 2025 |

Legal factors

Sonic Healthcare faces intricate healthcare regulations across its global operations. These include varying standards for medical testing, data privacy, and patient safety. Compliance with evolving billing policies and healthcare reforms is crucial. In 2024, the company spent approximately $150 million on regulatory compliance. Legal issues are significant ongoing considerations.

Government and insurer reimbursement policies significantly influence Sonic's financial health. For instance, changes in Medicare or private insurance fee schedules directly affect their revenue streams. Any reductions in fees or alterations to payment models pose financial risks. In Australia, where Sonic has a strong presence, healthcare reforms and regulatory changes in 2024/2025 could impact service pricing.

Sonic Healthcare must adhere to stringent data privacy and security laws globally. These include GDPR, HIPAA, and similar regulations that dictate the handling of sensitive patient information. In 2024, the healthcare industry faced approximately 460 data breaches. Non-compliance can lead to substantial fines and reputational damage.

Antitrust and Competition Laws

Sonic Healthcare's acquisition strategy is significantly affected by antitrust and competition laws, particularly in the regions where it expands. Regulatory bodies like the ACCC in Australia and similar agencies globally examine proposed acquisitions to prevent the reduction of market competition. These reviews can lead to delays, modifications, or even the rejection of deals.

- ACCC has blocked several acquisitions in the healthcare sector, highlighting the scrutiny.

- Sonic Healthcare has faced regulatory challenges in various jurisdictions due to its acquisition activities.

- The company must navigate complex legal landscapes to ensure compliance and deal approvals.

- Failure to comply can result in significant fines and operational restrictions.

Medical Liability and Litigation

Sonic Healthcare faces medical liability risks in the healthcare sector, where lawsuits are common. Maintaining high standards of quality and safety is vital to reduce legal issues. In 2024, healthcare liability claims were significant, with an estimated $4 billion in payouts. This impacts operational costs and insurance premiums.

- Medical liability is a significant risk.

- Quality and safety are key to risk management.

- High payouts are common in this sector.

Legal factors significantly influence Sonic Healthcare's operations, involving compliance with evolving healthcare regulations globally, including data privacy and medical testing standards. Government reimbursement policies directly impact revenue; changes in Medicare or private insurance significantly affect financial health. Antitrust laws and competition scrutiny also impact acquisitions. Legal compliance cost the company approximately $150 million in 2024.

| Regulatory Aspect | Impact | 2024/2025 Data |

|---|---|---|

| Compliance Costs | Financial Strain | $150M spent in 2024 |

| Data Breaches in Healthcare | Reputational damage & fines | Approx. 460 breaches in 2024 |

| Healthcare Liability | Operational costs & insurance | Approx. $4B payouts in 2024 |

Environmental factors

Medical labs produce diverse waste, including biohazardous materials. Sonic Healthcare's waste management must be environmentally sound. This involves proper disposal of infectious substances. Efficient waste handling reduces environmental impact. The global waste management market is projected to reach $2.8 trillion by 2025.

Sonic Healthcare's labs and imaging centers consume significant energy, impacting its carbon footprint. The company is actively reducing energy use to meet environmental goals. In 2024, Sonic invested $10 million in green initiatives. Renewable energy adoption is a key focus, aligning with broader sustainability trends.

Sustainable procurement involves sourcing equipment, reagents, and consumables with environmental considerations. Assessing supplier and product environmental credentials is vital. For instance, in 2024, companies saw a 15% rise in demand for eco-friendly products. This trend impacts supply chain choices, influencing operational costs and brand reputation.

Climate Change Impact and Adaptation

Climate change poses indirect risks to Sonic Healthcare, mainly through extreme weather potentially disrupting healthcare infrastructure and supply chains. While not a primary concern, the increasing frequency of severe weather events, as indicated by the UN, could affect operations and logistics. Consider the potential for increased operational costs due to climate-related disruptions. For instance, the World Bank estimates climate change could push 100 million people into poverty by 2030.

- Increased frequency of extreme weather events.

- Potential disruptions to supply chains.

- Increased operational costs.

- Long-term environmental planning considerations.

Environmental Regulations and Reporting

Sonic Healthcare faces growing scrutiny regarding its environmental impact, particularly in waste management and energy consumption. Compliance with environmental regulations is crucial, with potential fines for non-compliance increasing. The trend shows a rise in environmental reporting demands, which necessitates improved data tracking and transparency. For example, the healthcare sector saw a 15% increase in environmental audits in 2024 compared to 2023.

- Increasing regulatory pressure on healthcare waste disposal.

- Rising costs associated with carbon emissions and energy usage.

- Investor and stakeholder demands for environmental disclosures.

- Need for sustainable practices to enhance corporate reputation.

Environmental factors significantly shape Sonic Healthcare's operations. Waste management practices are crucial, with the global market projected at $2.8T by 2025. Energy consumption and carbon footprint reduction remain pivotal concerns, underlined by increasing investments in green initiatives and renewable energy adoption to boost sustainability and minimize risks from climate change. Enhanced environmental disclosures will be imperative as regulatory pressures intensify.

| Factor | Impact | Data/Trend (2024/2025) |

|---|---|---|

| Waste Management | Regulatory compliance; public health | Market to $2.8T by 2025 |

| Energy Consumption | Carbon footprint; operational costs | $10M investment in green initiatives (2024) |

| Climate Change | Infrastructure disruption; cost increases | Healthcare audits rose 15% in 2024 vs. 2023 |

PESTLE Analysis Data Sources

Sonic Healthcare's PESTLE relies on market research, government publications, and financial reports. We use data from healthcare-specific sources and international bodies for a robust analysis.