Sprouts Farmers Market Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sprouts Farmers Market Bundle

What is included in the product

Analyzes Sprouts' competitive position, including rivals, buyers, suppliers, and entry barriers.

Swap in your own data for competitive analysis that reflects your current Sprouts business.

Preview Before You Purchase

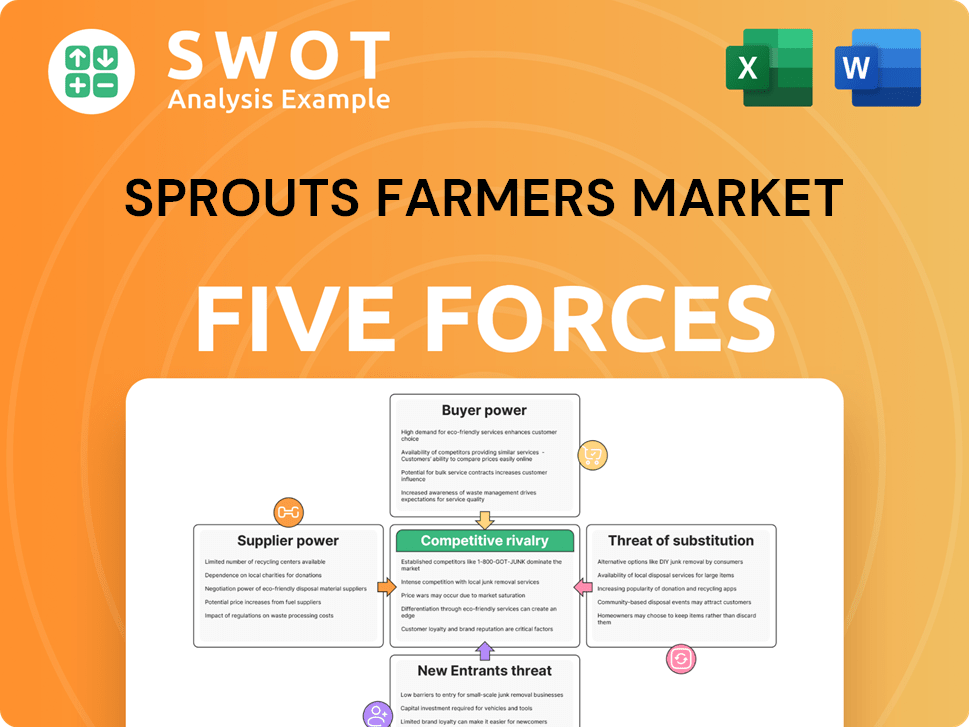

Sprouts Farmers Market Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Sprouts Farmers Market Porter's Five Forces Analysis analyzes industry competition. It covers threats of new entrants and substitutes. Also, buyer and supplier power, and competitive rivalry are thoroughly assessed. This analysis is ready to download and use.

Porter's Five Forces Analysis Template

Sprouts Farmers Market faces moderate rivalry in the competitive grocery sector. Buyer power is significant due to consumer choice and price sensitivity. Supplier power, especially from produce providers, presents challenges. The threat of new entrants is moderate, influenced by capital needs. Substitute products, like online grocery services, pose a growing threat.

Unlock key insights into Sprouts Farmers Market’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Sprouts Farmers Market benefits from limited supplier concentration. The company sources from various suppliers, reducing dependence on any single one. This strategy enables Sprouts to negotiate better terms. In 2024, Sprouts' diverse sourcing helped manage costs effectively. This diversification is crucial in the fresh produce sector.

Sprouts Farmers Market sources many standardized agricultural goods, like produce. Because these products are widely available, suppliers have limited power. This setup enables Sprouts to negotiate favorable prices and maintain a steady supply. In 2024, Sprouts reported a gross profit margin of approximately 33% due to effective cost management, including supplier negotiations.

Sprouts' strong brand reputation for quality and natural foods provides some negotiating power with suppliers. Suppliers often want to align with reputable brands, making them more likely to accept Sprouts' terms. This helps in controlling costs and maintaining high-quality standards. For instance, in 2024, Sprouts reported a gross profit margin of around 30%, showing their ability to manage supplier relationships effectively.

Contract Negotiation

Sprouts Farmers Market likely uses strong contract negotiation skills to get good deals with its suppliers. These negotiations could mean lower prices for buying in bulk, making sure the quality is good, and setting up payment plans that help Sprouts. Good contract management is key to keeping suppliers from having too much power. For example, in 2024, Sprouts' cost of goods sold was a significant portion of its revenue.

- Volume discounts help lower costs.

- Quality control protects brand reputation.

- Payment terms affect cash flow.

- Effective contract management is a core competency.

Vertical Integration Potential

Sprouts Farmers Market could consider limited vertical integration to boost bargaining power, though it's not a core strategy. This could involve building its own distribution centers or investing in certain farming operations, reducing reliance on suppliers. Such moves would require significant capital and add operational complexity, which Sprouts must carefully evaluate. In 2023, Sprouts' total assets were about $1.88 billion, highlighting the scale of potential investments.

- 2023 total assets: ~$1.88 billion.

- Vertical integration: Could include distribution centers or farm investments.

- Impact: Reduce supplier dependence; increase bargaining power.

- Consideration: Requires substantial capital and operational adjustments.

Sprouts Farmers Market generally has strong bargaining power with suppliers due to its diverse sourcing and brand reputation. They source from various suppliers, reducing reliance on any single entity. In 2024, Sprouts' sourcing strategy helped maintain a gross profit margin of about 30-33%.

| Factor | Impact | 2024 Data |

|---|---|---|

| Supplier Diversity | Reduces Dependence | Gross Margin: 30-33% |

| Brand Reputation | Attracts Suppliers | Maintains Quality |

| Contract Negotiation | Cost Control | Cost of Goods Sold: Significant |

Customers Bargaining Power

Customers are highly price-sensitive when shopping for groceries. Sprouts faces competition from conventional supermarkets and discount retailers. In 2024, grocery price inflation varied, influencing customer choices. This price sensitivity forces Sprouts to use competitive pricing. For example, in Q3 2024, overall grocery inflation in the U.S. was around 3%.

Sprouts Farmers Market faces significant customer bargaining power due to the availability of substitutes. Many products, like produce and packaged goods, have alternatives at other grocers. This includes conventional options, offering consumers price flexibility. In 2024, the grocery market saw intense price competition, impacting Sprouts' ability to maintain its premium pricing strategy.

Sprouts Farmers Market faces informed customers, primarily health-conscious consumers. These shoppers actively compare prices, seeking the best deals, and are less brand-loyal. This increases their bargaining power, influencing pricing strategies. In 2024, consumer spending on health foods continues to be strong, emphasizing the need for Sprouts to focus on value perception.

Low Switching Costs

Customers of Sprouts Farmers Market face low switching costs, able to easily shift to competitors without significant financial or logistical burdens. This ease of switching significantly strengthens customer bargaining power, as they can readily choose alternatives. Convenience and accessibility are key factors influencing customer decisions. According to a 2024 report, the average shopper visits about 2.7 different grocery stores monthly.

- Ease of Switching: Customers can easily switch to other grocery stores.

- Empowered Customers: Low switching costs empower customers.

- Convenience and Accessibility: Key factors in customer decisions.

- Market Data: Average shopper visits 2.7 stores monthly (2024 data).

Promotion Sensitivity

Customers' strong reaction to promotions and discounts highlights their focus on saving money when grocery shopping. This sensitivity shows they might switch stores for better deals. Sprouts must use promotions strategically to keep and gain customers. For instance, in 2024, grocery stores saw a 5-10% increase in sales during major promotional events.

- Promotion-driven sales boosts are common.

- Customers actively seek cost savings.

- Strategic promotions are key for retention.

- Competitors' offers influence customer choices.

Customers have considerable bargaining power because of easy switching and strong price sensitivity, which are influenced by promotions. This power is increased by health-conscious consumers. In 2024, the average shopper visited about 2.7 grocery stores monthly. Promotions are key for customer retention.

| Factor | Impact | 2024 Data |

|---|---|---|

| Switching Costs | Low | 2.7 stores visited monthly |

| Price Sensitivity | High | Grocery inflation ~3% Q3 |

| Promotions | Key | Sales up 5-10% during events |

Rivalry Among Competitors

The grocery sector is extremely competitive, hosting many national and regional entities all fighting for a slice of the market. This competition pushes Sprouts to stand out and keep its prices attractive. In 2024, the grocery industry's revenue reached approximately $850 billion, reflecting its scale. Key competitors are Kroger, Whole Foods Market, and Trader Joe's.

Sprouts faces intense competition as traditional supermarkets like Kroger and Whole Foods Market increase their organic and natural food selections. This trend erodes Sprouts' differentiation, making it harder to stand out. To maintain a competitive edge, Sprouts needs continuous innovation in product offerings and marketing strategies. In 2024, the organic food market grew, with mainstream grocers capturing a larger share. This intensified rivalry requires Sprouts to adapt quickly.

Sprouts faces price wars, especially on common grocery items. This can squeeze profits across the board. In Q3 2023, Sprouts' gross profit margin was 33.3%. Sprouts must balance competitive pricing and profitability. They need strategies to protect margins.

Market Saturation

The grocery market's saturation, especially in certain areas, intensifies competition, making it tough for Sprouts to gain ground. Overcrowding of stores means more rivals vying for the same shoppers. Strategic location planning is vital for Sprouts to stand out in these packed markets. In 2024, the grocery industry saw increased competition with new entrants and expansion by existing players.

- Market saturation increases competition.

- Strategic location is crucial for Sprouts.

- Grocery industry saw increased competition in 2024.

- More rivals compete for the same customers.

Consolidation Trends

The grocery market is consolidating, intensifying competition for Sprouts. Major chains are merging or acquiring smaller ones, creating giants. This consolidation gives these larger competitors more resources and market power. Sprouts must adjust its strategies to stay competitive.

- Kroger and Albertsons' proposed merger, valued at $24.6 billion, would significantly reshape the market.

- In 2024, the top five grocery retailers controlled over 50% of the market share.

- Sprouts' revenue in 2024 was approximately $6.6 billion, a fraction of the largest players.

- Increased competition could lead to price wars and margin pressure for Sprouts.

The grocery market is highly competitive due to numerous players and industry consolidation, intensifying pressure on Sprouts. Strategic location and product innovation are vital for Sprouts to differentiate itself. In 2024, Kroger and Albertsons' proposed merger highlighted the market's consolidation.

| Factor | Impact on Sprouts | 2024 Data |

|---|---|---|

| Market Saturation | Intensifies competition, affects growth | Increased competition with new entrants |

| Consolidation | Creates stronger rivals | Top 5 retailers controlled over 50% share |

| Price Wars | Squeezes profits | Sprouts' revenue approx. $6.6B |

SSubstitutes Threaten

Traditional supermarkets, such as Kroger and Safeway, pose a threat due to their extensive product ranges and competitive pricing strategies. They directly compete with Sprouts by offering similar groceries, yet often at lower costs, making them attractive to budget-conscious consumers. Data from 2024 shows that conventional grocery stores still hold a larger market share compared to specialty grocers. Sprouts must emphasize its focus on quality and selection to maintain customer loyalty and justify its premium pricing.

Discount retailers, such as Walmart and Aldi, pose a threat to Sprouts. These retailers now offer competitive pricing on grocery staples. In 2024, Walmart's grocery sales grew, showing the impact of this competition. Sprouts must highlight its unique natural and organic offerings to retain customers. This differentiation is key.

Meal kit services pose a threat as convenient substitutes. They offer pre-portioned ingredients and recipes, appealing to busy consumers. The meal kit market was valued at $9.6 billion in 2023. Sprouts must innovate to compete with this convenience. This could include offering its own meal kits or partnering with existing services.

Restaurant Meals

Restaurant meals pose a threat to Sprouts as consumers can opt for dining out instead of buying groceries. The appeal of convenience and diverse options makes eating out attractive, particularly for those with busy schedules. To counter this, Sprouts should highlight the advantages of home cooking, such as health benefits and cost savings. In 2024, the National Restaurant Association projected total U.S. restaurant sales to reach $1.1 trillion.

- Restaurant sales in the U.S. are projected to reach $1.1 trillion in 2024.

- Convenience is a key factor driving consumer choices between cooking at home and dining out.

- Sprouts can emphasize the health and cost benefits of home-cooked meals.

- Takeout and delivery services further intensify competition in the food market.

Fast Food

Fast food represents a significant threat to Sprouts Farmers Market due to its convenience and affordability. Quick service restaurants provide immediate meal solutions, competing directly with the need for grocery shopping. These alternatives often lack the nutritional value of fresh produce, a key selling point for Sprouts. Sprouts needs to highlight the health advantages of its offerings to counter this threat. For example, in 2024, the fast food industry's revenue was approximately $300 billion, demonstrating its market dominance.

- Fast food's convenience attracts time-pressed consumers.

- Fast food prices are generally lower than those of Sprouts.

- Sprouts must emphasize health benefits to compete.

- The fast food market is a multi-billion dollar industry.

Sprouts faces substitution threats from various sources. These include traditional supermarkets, discount retailers, and meal kit services, all vying for consumer spending. Restaurant meals and fast food also offer convenient alternatives, impacting Sprouts' market position.

| Threat | Description | 2024 Data/Impact |

|---|---|---|

| Supermarkets | Large selection, competitive pricing | Conventional stores still hold larger market share |

| Discount Retailers | Offers cheap grocery staples | Walmart grocery sales grew in 2024 |

| Meal Kits | Convenient, pre-portioned | Meal kit market valued at $9.6B in 2023 |

Entrants Threaten

Establishing a grocery chain like Sprouts demands substantial capital for real estate, equipment, and inventory. This high initial investment acts as a significant deterrent to new competitors. Securing funding poses a major challenge, especially for smaller entities. For example, in 2024, the average cost to launch a new supermarket could easily exceed $10 million, making it difficult for new entrants to compete. This financial hurdle protects existing players like Sprouts.

Established grocery chains like Kroger and Albertsons have strong brand loyalty. New entrants, including Sprouts, struggle to compete. Building trust and attracting customers requires significant marketing and excellent customer service. In 2024, Kroger's revenue reached $150 billion, showcasing their brand strength.

Managing a complex supply chain presents a major hurdle for new grocery store entrants, especially when dealing with perishable items like fresh produce. New businesses must cultivate dependable supplier relationships, which takes time and resources. Efficient distribution networks and logistics, including inventory management, are key to success. In 2024, supply chain disruptions and inflation continue to impact the grocery industry, adding to the challenge.

Regulatory Hurdles

Sprouts Farmers Market faces regulatory hurdles in the grocery industry, including food safety, labeling, and zoning laws. New entrants must comply, which can be expensive and time-intensive, increasing barriers to entry. Compliance costs can significantly impact profitability, especially for smaller companies. For example, food safety regulations alone can cost a new grocery chain millions.

- Food safety regulations compliance costs can range from $500,000 to $5,000,000+ for a new chain.

- Zoning laws may restrict where a new store can be built.

- Labeling requirements necessitate investments in packaging and supply chain adjustments.

Intense Competition

The grocery industry is fiercely competitive, posing a significant challenge for new entrants. Established companies, such as Kroger and Whole Foods, are well-entrenched and actively protect their market positions. Newcomers must offer something unique to succeed. Differentiation and innovation are critical for surviving and thriving in this environment.

- Sprouts Farmers Market's revenue in 2023 was approximately $6.7 billion.

- The company has over 400 stores across the United States.

- Sprouts faces competition from conventional supermarkets and specialty grocers.

- To compete, Sprouts focuses on fresh, natural, and organic products.

New grocery stores face considerable barriers due to high startup costs and established brand loyalty. Complex supply chains and strict regulations further hinder entry into the market. Intense competition, especially from major players, makes it difficult for new entrants to gain traction.

| Barrier | Impact | Data (2024) |

|---|---|---|

| Capital Requirements | High initial investment | New supermarket launch: $10M+ |

| Brand Loyalty | Established customer base | Kroger's 2024 revenue: $150B |

| Supply Chain | Complex logistics | Disruptions & inflation |

| Regulations | Compliance costs | Food safety costs: $500k-$5M+ |

| Competition | Market dominance | Sprouts' 2023 Revenue: $6.7B |

Porter's Five Forces Analysis Data Sources

The Sprouts analysis is based on financial reports, market research, industry publications, and competitive intelligence data. It includes details from company filings and trade data.