Starbucks Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Starbucks Bundle

What is included in the product

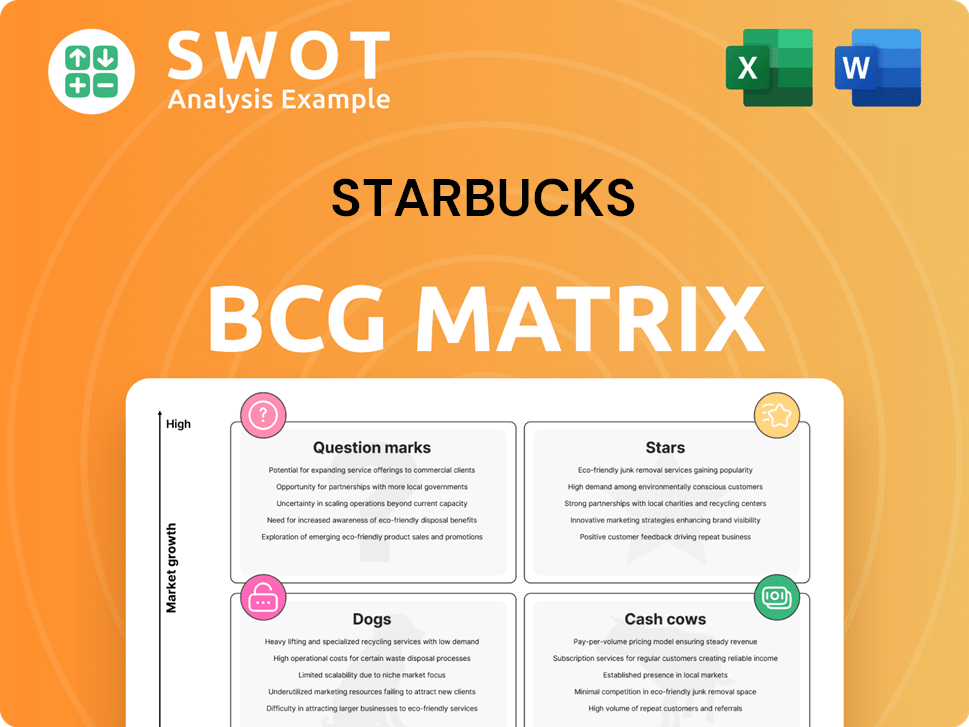

Starbucks' BCG Matrix explores its diverse offerings, classifying them to aid strategic decisions. It highlights units to invest, hold, or divest.

Clean, distraction-free view for crucial Starbucks decisions, eliminating the fluff.

Full Transparency, Always

Starbucks BCG Matrix

The Starbucks BCG Matrix previewed here is identical to the purchased report. This is the fully formatted, ready-to-use strategic analysis you'll receive immediately, offering clarity on Starbucks' portfolio. No hidden elements—just the complete document for your strategic insights.

BCG Matrix Template

Starbucks' diverse offerings, from coffee to food, present a fascinating landscape when viewed through a BCG Matrix. Certain beverages, like the Frappuccino, might be "Stars," while core coffee could be a "Cash Cow." Limited-time seasonal drinks? Perhaps "Question Marks" needing strategic attention. Understanding these placements is key to understanding Starbucks' resource allocation. This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Starbucks Rewards is a Star in the BCG Matrix, boosting loyalty. It offers personalized deals and mobile ordering, driving repeat sales. The program's success is due to its adaptability and data use. In 2024, rewards members drove 58% of U.S. sales.

Starbucks Reserve Roasteries are a "Star" in the BCG matrix, representing high growth and market share. These premium locations offer unique coffee experiences, attracting a dedicated customer base. In 2024, the Roasteries continue to boost Starbucks' brand image, focusing on innovation. The Roasteries contribute to Starbucks' overall revenue, even if the direct financial impact is small.

Starbucks strategically targets emerging markets, especially in Asia, for expansion. These regions present substantial growth prospects, fueled by increasing disposable incomes and a burgeoning coffee culture. In 2024, Starbucks' revenue in the Asia Pacific region reached $8.4 billion, demonstrating strong growth. Adapting offerings to local preferences while preserving brand values is vital for success. Starbucks plans to open about 3,000 stores globally in 2024, with a significant portion in emerging markets.

Digital Innovation

Starbucks excels in digital innovation, enhancing customer experience and operations. The mobile app, crucial for ordering and payment, is key. Investments in AI and machine learning further optimize store functions and personalize interactions. Starbucks' digital sales grew to 36% of total sales in 2023, a significant portion.

- Digital sales represented 36% of total sales in 2023.

- The Starbucks app has over 30 million active users.

- Starbucks invested over $1 billion in technology in 2023.

- Mobile order and pay accounted for 25% of transactions.

Sustainability Initiatives

Starbucks' sustainability efforts are a key part of its brand. This appeals to customers who care about the environment. Their ethical sourcing, waste reduction, and community support boost their reputation. Starbucks aims to be resource positive, giving back more than they take.

- In 2024, Starbucks sourced 99% of its coffee ethically.

- Starbucks is working towards reducing waste sent to landfills by 50% by 2030.

- The company invested $40 million in farmer loans by 2024.

Starbucks' digital initiatives and sustainability efforts are "Stars" in the BCG Matrix. These strategies have boosted customer engagement and brand value, leading to increased revenue and market share. Starbucks' digital sales grew to 36% of total sales in 2023. The company invested $1 billion in technology in 2023.

| Strategy | Key Metric | 2023 Data |

|---|---|---|

| Digital Sales | % of Total Sales | 36% |

| Technology Investment | Total Investment | $1 Billion |

| Ethically Sourced Coffee | Percentage | 99% in 2024 |

Cash Cows

Starbucks' core coffee products, including brewed coffee and Frappuccinos, are its cash cows. These items hold a significant market share in the established coffee market. In 2024, brewed coffee and espresso beverages generated substantial revenue, with Frappuccinos contributing a notable portion. Maintaining quality and consistent offerings is key to stable cash flow.

Starbucks boasts a robust presence in North America, especially in the U.S., with over 16,000 stores as of late 2024. This established market generates significant revenue; in fiscal year 2024, North America accounted for over 70% of Starbucks' global revenue. Maintaining customer loyalty and operational efficiency is key to sustaining profitability in this crucial region.

In mature markets like the US, Starbucks Rewards is a Cash Cow. The program boasts a huge membership, fueling steady sales and offering key customer insights. Despite upkeep costs, the program's return is high. In 2024, Starbucks' active Rewards members in the U.S. reached approximately 32.4 million.

Packaged Coffee and Merchandise

Starbucks' packaged coffee and merchandise represent a stable cash cow. They benefit from high brand recognition and generate revenue with lower marketing expenses. This segment includes items like coffee beans, VIA instant coffee, and branded merchandise sold outside Starbucks stores. In 2024, this category contributed significantly to overall revenue, showcasing its importance. Optimizing distribution is key to boosting cash flow.

- Low marketing costs due to brand recognition.

- Includes packaged coffee, instant coffee, and merchandise.

- Contributed significantly to 2024 revenue.

- Focus on distribution and product mix optimization.

Drive-Thru Locations

Starbucks' drive-thru locations are a reliable source of revenue, fitting the "Cash Cow" category in its BCG Matrix. These locations provide quick service, attracting busy customers and ensuring consistent sales. In 2024, drive-thrus contributed significantly to Starbucks' overall revenue, due to their high traffic and operational efficiency. Expanding and optimizing these locations is a key strategy for maintaining strong cash flow.

- Drive-thrus boost revenue through convenience.

- High traffic volumes at drive-thru locations.

- Efficiency improvements enhance cash flow.

- Drive-thrus are crucial for Starbucks' financial health.

Starbucks' Cash Cows, like core coffee, generate stable revenue. These products hold substantial market share, contributing significantly to overall sales. In 2024, beverages and North America led in revenue. Continuous quality and customer loyalty are crucial for maintaining profitability.

| Category | Description | 2024 Revenue Contribution |

|---|---|---|

| Core Coffee | Brewed coffee, Frappuccinos | Significant |

| North America | US stores, Rewards | Over 70% |

| Packaged Goods | Coffee beans, merchandise | Notably High |

Dogs

Starbucks labels some international markets as "Dogs" due to underperformance. These regions struggle with low market share and profitability. Turning these around demands heavy investment, potentially with weak returns. Considering divestment or strategic shifts is a viable option. In 2024, some international stores saw lower sales growth compared to the U.S.

Starbucks' "Dogs" include older lines facing low growth. Sales might be down due to changing tastes. These products struggle against newer rivals. Discontinuing them can boost better ventures. In 2024, underperforming items saw 5% sales drop.

Starbucks may have stores in bad locations, facing high rent or demographic shifts, leading to low profits. These locations can hurt overall financial performance.

Closing or relocating underperforming stores could be needed to boost earnings. In 2024, Starbucks's global store count was around 38,000, and they regularly evaluate store performance.

Underperforming stores drag down profits, impacting the company's financial health. Starbucks’s net revenue for fiscal year 2023 was $36 billion.

Analyzing each store's profitability is key to making smart decisions. Starbucks aims to optimize its portfolio for better results.

In 2024, Starbucks's strategic decisions will likely involve closing or relocating some underperforming stores to stay competitive.

Traditional Coffee Shop Format (in some areas)

In certain areas, Starbucks' traditional coffee shop format might be seen as a Dog, especially where consumers prefer quicker services. These locations could face reduced foot traffic and sales due to the shift in preferences. To stay competitive, Starbucks may need to adapt these stores or change their purpose. For example, in 2024, same-store sales growth in North America was approximately 7%, but this figure varies by location type.

- Decline in foot traffic in traditional formats.

- Need for adaptation to meet changing consumer needs.

- Potential for repurposing or closure of underperforming locations.

- Geographical variations in sales performance.

Slower-Selling Menu Items

Starbucks categorizes slower-selling items as "Dogs" in its BCG Matrix. These items, like specific pastries or less popular beverages, drag down profitability. Removing these can streamline operations and boost customer satisfaction. It also helps reduce waste and improve service times. In 2024, Starbucks aims to refine its menu to focus on high-demand, profitable offerings.

- Operational Inefficiencies: Slow-selling items create bottlenecks.

- Customer Frustration: Long wait times due to less popular items.

- Waste Reduction: Eliminating underperformers minimizes waste.

- Service Speed: A streamlined menu enhances service efficiency.

Starbucks designates underperforming international markets and products as "Dogs" in its BCG Matrix. These elements exhibit low market share and growth, often requiring significant investment with poor returns. Strategic actions include potential divestment or discontinuation to improve overall profitability. In 2024, some regions and product lines were actively evaluated for strategic realignment.

| Aspect | Description | Impact |

|---|---|---|

| Underperforming Markets | Low sales growth, profitability challenges. | Potential store closures or relocations. |

| Slow-Selling Items | Specific menu items with low demand. | Menu streamlining to reduce waste and improve efficiency. |

| Store Locations | Unfavorable locations with high rent or demographic shifts. | Optimization of store portfolio to boost earnings. |

Question Marks

Plant-based milk alternatives represent a "Question Mark" for Starbucks within the BCG Matrix. The global plant-based milk market was valued at $23.8 billion in 2023 and is expected to reach $53.8 billion by 2029, showing strong growth. Starbucks must decide whether to invest heavily in these options. Success hinges on effective marketing and strategic menu integration to capture market share, with plant-based milk accounting for 20% of all milk-based beverage sales.

Starbucks is exploring pick-up and delivery-only stores. This aligns with shifting consumer demands for convenience. The success is uncertain, requiring careful evaluation. Investments could boost growth, but failure risks exist. In 2024, digital orders made up a significant portion of sales, indicating a need for these formats.

The ready-to-drink (RTD) coffee segment presents a "question mark" for Starbucks. RTD coffee market is projected to reach $55.49 billion by 2024. Starbucks can leverage its brand, but faces competition from Coca-Cola and PepsiCo. Partnerships and innovation are key to capturing market share.

Starbucks Evenings Program (if still applicable)

The Starbucks Evenings program aimed to boost sales during slower evening hours by offering alcoholic beverages and snacks. Its performance has been inconsistent, leading to questions about its long-term viability. Starbucks must assess whether to further invest in this program or pivot to other strategies. The focus is on driving revenue outside of typical peak times.

- Launched in 2010, the program expanded to hundreds of stores.

- By 2019, Starbucks began scaling back the program.

- The program's profitability varied significantly by location.

- Starbucks has been exploring other evening offerings, such as expanded food menus.

New Menu Items (Innovative but Unproven)

Starbucks frequently introduces new menu items, fitting the "Question Marks" quadrant of the BCG matrix, representing high-growth potential but uncertain success. New items like the Iced Cherry Chai and Jalapeño Chicken Pocket aim to boost customer interest and stay current with food trends. These offerings require careful monitoring to gauge consumer acceptance and market performance. Successful products can drive substantial growth, yet there's an inherent risk of failure.

- In 2024, Starbucks's revenue reached $36 billion, a 7% increase.

- The company invested heavily in product innovation, allocating approximately $500 million for new menu development.

- New menu items have a failure rate of around 30%, requiring swift adjustments.

- Successful new products can boost quarterly sales by up to 10%.

Starbucks' new menu items are considered "Question Marks" in the BCG matrix, representing high-growth potential but uncertain success. These offerings, such as the Iced Cherry Chai and Jalapeño Chicken Pocket, aim to boost customer interest and stay relevant. Success hinges on consumer acceptance and market performance.

| Metric | Data |

|---|---|

| 2024 Revenue | $36 Billion |

| Product Innovation Investment | $500 Million |

| New Item Failure Rate | 30% |

| Successful Item Sales Boost | Up to 10% |

BCG Matrix Data Sources

The Starbucks BCG Matrix utilizes company financial data, industry analysis, and market research to assess its portfolio. This data ensures insightful positioning for each product category.