Starbucks SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Starbucks Bundle

What is included in the product

Analyzes Starbucks’s competitive position through key internal and external factors

Provides a simple, high-level SWOT template for fast decision-making.

What You See Is What You Get

Starbucks SWOT Analysis

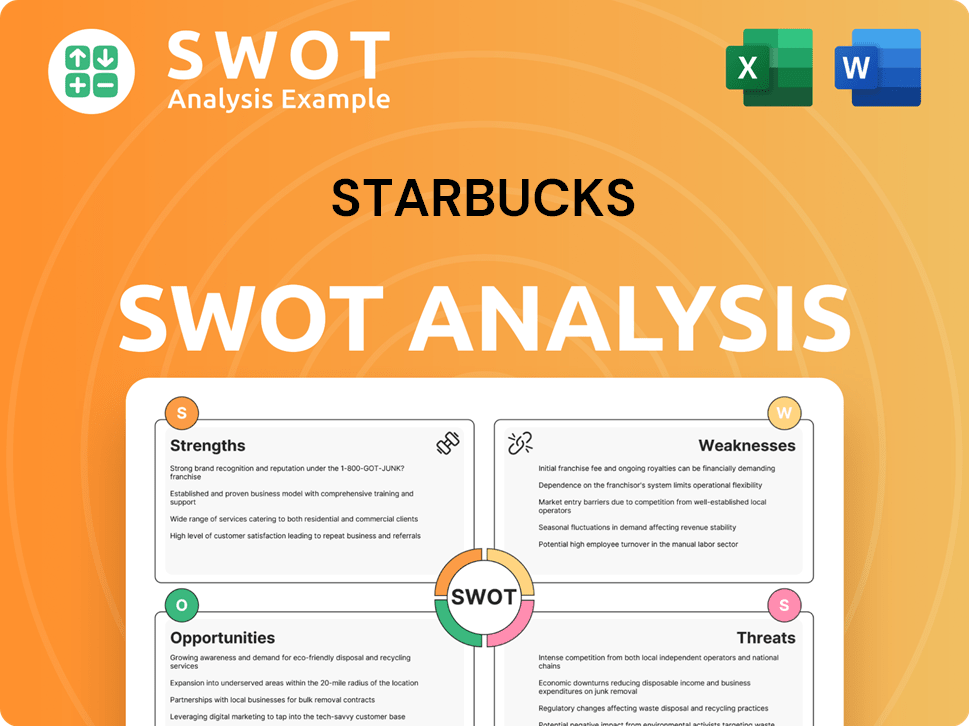

See what you'll get! This preview showcases the authentic Starbucks SWOT analysis you’ll download. Post-purchase, you'll have complete access to this detailed, professional document.

SWOT Analysis Template

Starbucks faces both fierce competition and exciting opportunities. This brief overview only scratches the surface of its strengths, like brand recognition. We've also touched upon weaknesses such as vulnerability to market changes. The analysis highlights threats such as changing consumer tastes and opportunities like international expansion.

Want the full story behind Starbucks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Starbucks benefits from strong brand recognition, a key strength in its SWOT analysis. Its brand is globally recognized, linked with premium coffee and unique customer experiences. This brand equity, cultivated through marketing and consistent store design, boosts loyalty and market differentiation. In 2024, Starbucks' brand value reached approximately $59.3 billion, reflecting its strong market position.

Starbucks boasts a vast global footprint, with over 38,000 stores worldwide as of early 2024. This expansive presence allows for strong brand recognition across diverse markets. Their global reach boosts market penetration and leverages economies of scale, driving operational efficiencies. Starbucks' international strategy generated $8.3 billion in revenue in fiscal year 2023.

Starbucks' dedication to quality starts with sourcing premium coffee beans globally, ensuring a consistent, high-quality product. They continuously innovate, introducing new beverages and food items to stay ahead. This focus on quality and innovation is reflected in their financial performance. In Q1 2024, global comparable sales increased by 5%, showcasing strong customer appeal.

Strong Loyalty Program and Digital Integration

Starbucks excels with its robust loyalty program and digital integration. The Starbucks Rewards program is a major strength, attracting a large and engaged customer base. Digital tools, including mobile ordering and payment, enhance the customer experience and boost sales. Data analytics also play a key role in personalizing offers and improving operations.

- In Q1 2024, Starbucks Rewards members accounted for 58% of U.S. company-operated store sales.

- Mobile Order & Pay represented 25% of U.S. company-operated store transactions in Q1 2024.

- Starbucks' active Rewards membership in the U.S. reached 32.4 million in Q1 2024.

Sustainability Initiatives

Starbucks has a strong focus on sustainability. They've launched the 'Greener Stores' program, which is designed to lessen the environmental footprint. This includes energy efficiency, waste reduction, and water conservation efforts. These initiatives boost brand image and appeal to eco-minded customers. Starbucks aims for 50% waste diversion by 2025.

- 'Greener Stores' program focuses on energy efficiency.

- Waste reduction and water conservation are key goals.

- Positive brand image enhanced by sustainability.

- Appeals to environmentally conscious consumers.

Starbucks' solid brand recognition boosts loyalty, supported by a 2024 brand value of $59.3B. The vast global presence, with 38,000+ stores, drives strong market penetration. Quality coffee sourcing and innovation, with Q1 2024's 5% global sales growth, showcase strong customer appeal. A robust Rewards program with 32.4M members in Q1 2024 and digital tools enhance customer experience.

| Strength | Details | Data |

|---|---|---|

| Brand Recognition | Globally recognized brand, linked with premium experiences. | $59.3B Brand Value (2024) |

| Global Footprint | Vast presence in diverse markets. | 38,000+ stores globally (early 2024) |

| Quality & Innovation | Premium coffee sourcing; new beverages. | 5% Global Comp Sales (Q1 2024) |

| Loyalty Program & Digital | Starbucks Rewards; mobile ordering. | 32.4M US Rewards members (Q1 2024) |

Weaknesses

Starbucks' premium pricing strategy can be a weakness. This pricing might deter budget-conscious customers. During economic slowdowns, cheaper options become more attractive. For example, in 2024, Starbucks' comparable sales growth slowed to 3% in the US. This shows potential vulnerability to price-sensitive consumers.

Starbucks heavily relies on the U.S. market for revenue, which poses a risk. Around 67% of Starbucks' global revenue comes from the Americas, with the U.S. being the dominant player. Economic downturns in the U.S. directly impact Starbucks' financial performance. This dependence makes Starbucks vulnerable to U.S. market-specific challenges.

Starbucks faces product imitability challenges. Competitors can replicate popular drinks and food items. This erosion of uniqueness impacts market share. In 2024, Starbucks' revenue was $36 billion, facing pressure from copycat offerings. This makes it hard to keep a strong brand identity.

Labor Relations Challenges

Starbucks confronts labor relation issues, especially with unionization. These challenges can spark disputes and decrease employee morale, potentially disrupting operations and damaging its brand. According to a 2024 report, unionization efforts have increased by 50% in the past year. This increase has led to several strikes and protests.

- Increased unionization efforts.

- Potential for strikes and protests.

- Impact on employee morale.

- Risk to brand image.

Vulnerability to Supply Chain Disruptions

Starbucks faces supply chain vulnerabilities due to its global sourcing of coffee beans. Climate change, political instability, and commodity price fluctuations pose significant risks. For example, coffee prices surged in 2023, impacting profitability. Starbucks' dependence on specific regions makes it susceptible to disruptions. This could affect its ability to maintain consistent product availability and pricing.

- Coffee prices increased by 15% in 2023.

- Starbucks sources coffee from over 30 countries.

- Climate change impacts are expected to reduce coffee yields by 10-15% by 2030.

Starbucks' premium pricing can alienate budget-conscious consumers, evident in slower 2024 sales growth. Dependence on the U.S. market, accounting for around 67% of global revenue, makes it vulnerable. Product imitability and rising labor costs from increased unionization pose ongoing challenges. Supply chain vulnerabilities, especially in sourcing coffee beans, adds to these weaknesses.

| Weakness | Description | Impact |

|---|---|---|

| Premium Pricing | Prices can be a barrier to entry. | Slowed comparable sales growth to 3% in 2024 |

| U.S. Market Dependence | Majority of revenue from the U.S. | Vulnerable to U.S. economic downturns. |

| Product Imitability | Competitors copy popular products. | Revenue impacted; faced $36B pressure in 2024 |

| Labor Issues | Increased unionization efforts | Potential disruptions. |

| Supply Chain | Global coffee sourcing; climate change | Price fluctuations, disruptions, impacting consistency. |

Opportunities

Starbucks can unlock substantial growth by expanding into emerging markets. These regions, including Africa, the Middle East, India, and Southeast Asia, offer high growth potential. Starbucks’ current presence is limited, creating ample room to establish a larger footprint and capture new consumers. For instance, Starbucks aims to double its store count in India by 2028, showcasing its commitment to these markets.

Starbucks can introduce new products to stay relevant. Exploring coffee subscriptions and focusing on trends like cold brew can attract new customers. Diversifying the menu caters to evolving consumer preferences. Starbucks reported a 7% increase in global comparable store sales in Q1 2024. This included a 5% increase in North America.

Starbucks can boost customer experience via tech. Mobile ordering and AI-driven suggestions can streamline operations. In 2024, mobile orders made up over 30% of sales. Data analytics offers personalized offerings. Digital transformation boosts efficiency and customer satisfaction.

Enhancing the Starbucks Rewards Program

Starbucks can boost customer loyalty by enhancing its rewards program. Expanding the program and offering more relevant rewards can improve customer retention and encourage repeat visits. This strategy can leverage Starbucks' substantial existing member base, potentially increasing sales. The Starbucks Rewards program has over 31 million active members in the U.S. as of late 2024.

- Enhance rewards to boost customer loyalty.

- Increase repeat business by offering relevant incentives.

- Capitalize on the large existing member base.

Focus on Sustainability and Ethical Sourcing

Starbucks can capitalize on the growing consumer demand for sustainable and ethically sourced products. Investing further in these areas can significantly boost its brand image, drawing in customers who prioritize social responsibility. This approach can also protect Starbucks from supply chain disruptions and reputational damage. Starbucks' commitment to ethical sourcing is evident in its goal to source 100% of its coffee responsibly, with 99% currently verified as ethically sourced.

- Enhance brand reputation.

- Attract socially conscious consumers.

- Mitigate supply chain risks.

- 99% ethically sourced coffee.

Starbucks sees major chances in new markets and can expand its presence by targeting growth regions. New products like coffee subscriptions help keep them relevant to consumers. Enhancing their tech, from mobile ordering to AI-driven features, can boost customer satisfaction and efficiency. Improving its loyalty program with better rewards could also help retain existing customers. Finally, sustainable practices offer opportunities to attract ethical consumers and improve their brand.

| Opportunity | Details | Impact |

|---|---|---|

| Market Expansion | Focus on India, Africa, and the Middle East. | Increased sales; expanded footprint. |

| New Products | Introduce cold brew, and subscriptions. | Attract new customers. |

| Tech Enhancements | AI and mobile orders. | Improved customer satisfaction and efficiency. |

| Loyalty Program | Improve rewards to boost repeat visits. | Enhanced customer retention. |

| Sustainability | Ethically sourced coffee. | Enhanced brand reputation. |

Threats

Intense competition is a major threat to Starbucks. The coffee giant battles rivals like McDonald's McCafé and Dunkin', impacting sales. Starbucks also faces pressure from local coffee shops. In 2024, the global coffee market was valued at over $460 billion, with intense competition expected to increase.

Shifting consumer tastes, like more health-conscious choices or price sensitivity, could hurt Starbucks. Economic downturns, as seen in late 2023 and early 2024, can lead to less spending. This impacts sales and customer visits. Starbucks reported a 4% drop in same-store sales in the U.S. in Q1 2024.

Starbucks faces supply chain vulnerabilities, including climate change's impact on coffee production. Price volatility of raw materials, like coffee, tea, and dairy, threatens profitability. In 2024, coffee prices saw fluctuations, impacting costs. These factors challenge Starbucks' ability to maintain quality and margins.

Reputational Damage and Sociocultural Movements

Starbucks faces reputational threats from controversies and negative media coverage, potentially harming its brand image. Sociocultural movements or boycotts also pose risks, impacting customer goodwill and sales. For example, in 2024, a single negative social media campaign could cause a 5-10% drop in store visits. Starbucks' brand value could decrease by 3-7% due to reputational issues.

- In 2024, social media-driven boycotts have caused up to a 12% decrease in sales in specific regions.

- Negative press coverage has led to a 5% decline in customer satisfaction scores.

- Controversies related to labor practices reduced store traffic by 8% in Q1 2024.

Challenges in the China Market

Starbucks confronts significant challenges in China, its second-biggest market, marked by fierce competition and a slowdown in growth. Comparable store sales and transaction volumes have been declining, signaling potential market saturation and changing consumer preferences. In Q1 2024, Starbucks China saw a 10% decrease in comparable store sales. This downturn is compounded by the rise of local competitors and economic uncertainties.

- Intense Competition: Local coffee chains are expanding rapidly.

- Slowing Growth: Declining comparable store sales indicate market saturation.

- Economic Uncertainties: China's economic shifts affect consumer spending.

- Changing Preferences: Adapting to evolving consumer tastes is crucial.

Starbucks battles intense competition and shifting consumer preferences, impacting sales and requiring adaptation. Economic downturns and cost volatility from raw materials like coffee and dairy threaten profitability. The brand faces reputational risks, particularly from controversies, social media, and labor practices.

| Threat | Impact | Data |

|---|---|---|

| Competition | Sales decline | Global coffee market worth over $460B in 2024. |

| Consumer Shifts | Reduced visits | 4% drop in U.S. same-store sales in Q1 2024. |

| Reputation | Brand value drop | Negative campaigns can reduce visits by 5-12%. |

SWOT Analysis Data Sources

Starbucks' SWOT relies on financial statements, market analyses, and industry reports, for precise insights.