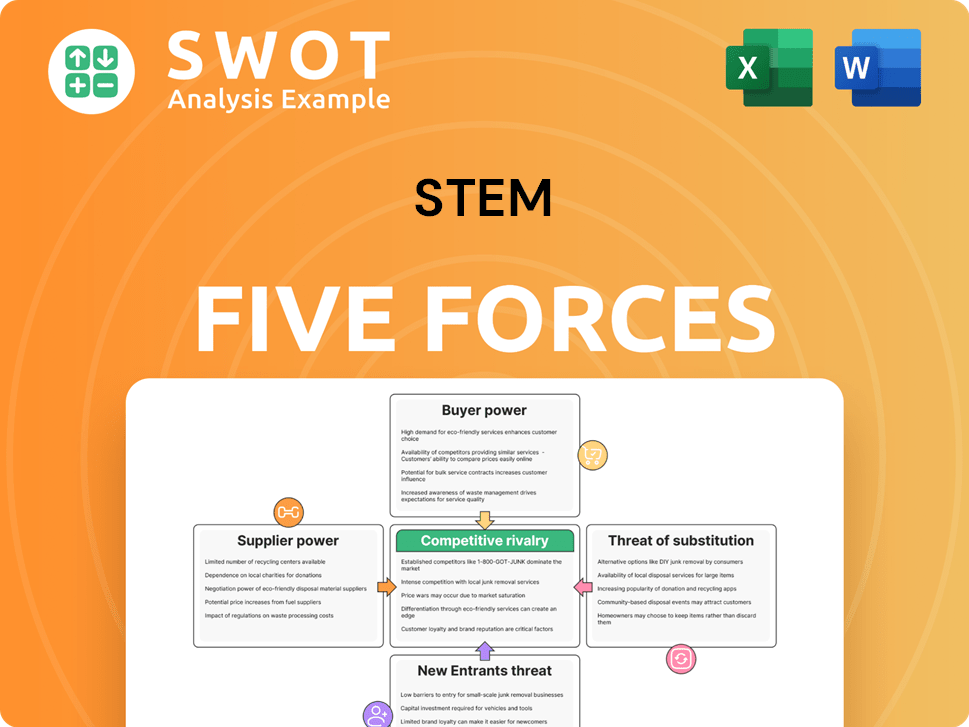

Stem Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stem Bundle

What is included in the product

Analyzes Stem's competitive forces, including market entry, supplier power, and rivalry within its landscape.

Easily visualize competitive landscapes with interactive graphs, perfect for strategic pivots.

Same Document Delivered

Stem Porter's Five Forces Analysis

You're seeing the complete Porter's Five Forces analysis. This preview reflects the identical document you'll instantly download upon purchase. It's a fully prepared analysis, professionally formatted and ready. There are no revisions or extra steps to get it ready for immediate use. The document you see here is your deliverable.

Porter's Five Forces Analysis Template

Stem faces competitive pressures influenced by five key forces. Supplier bargaining power affects cost management and innovation. Buyer power, driven by client options, shapes pricing dynamics. The threat of new entrants impacts market share, while substitutes challenge revenue streams. Industry rivalry, intensified by competition, influences profitability. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Stem’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Stem's reliance on specialized tech suppliers grants them some bargaining power. High switching costs for niche providers, like advanced AI analytics, could lock Stem in. This dependence allows suppliers to negotiate better terms. In 2024, tech companies saw supplier price increases of 5-10%.

Stem's reliance on standard software infrastructure, including cloud services, diminishes supplier power. The availability of numerous alternative providers for essential services like cloud storage and basic software mitigates the risk of supplier control. In 2024, the cloud computing market was valued at over $670 billion, and is projected to reach $1.6 trillion by 2030, offering ample choices. This allows Stem to switch providers, if needed.

Suppliers of music industry data have moderate power. Accurate royalty tracking needs reliable sources. If Stem depends on one provider, it may impact pricing or service terms. In 2024, the global music market was valued at $28.6 billion, indicating the stakes involved.

Talent acquisition platforms

Talent acquisition platforms can wield some bargaining power, especially when Stem seeks specific skills. The company needs skilled developers and music industry experts to function. In a tight labor market, these platforms might raise fees or dictate unfavorable terms. For instance, the global talent acquisition market was valued at $20.5 billion in 2023. This figure is projected to reach $30.8 billion by 2028, showing potential cost pressures.

- Market size: The talent acquisition market's growth indicates potential cost increases.

- Specialized skills: Demand for developers and music experts enhances platform leverage.

- Labor market: A tight labor market empowers platforms to set terms.

Partnerships with financial institutions

Financial institutions, crucial for payment processing, impact Stem's costs significantly. Stem depends on these institutions for revenue splitting and payouts, making their influence substantial. Building robust partnerships and diversifying financial partners is key to reducing this power. For example, in 2024, payment processing fees averaged between 1.5% and 3.5% of transaction value. This can significantly impact profitability.

- Payment processing fees range between 1.5% and 3.5%

- Strong partnerships are essential for mitigating costs

- Diversification of financial partners is key

- Efficient revenue splitting and payouts depend on institutions

Stem faces varied supplier power across its operations. Specialized tech providers and talent acquisition platforms have moderate to high influence, especially given niche skills. Cloud services suppliers have less power due to ample market choices. The global music market was worth $28.6 billion in 2024.

| Supplier Type | Bargaining Power | 2024 Data/Impact |

|---|---|---|

| Specialized Tech | Moderate-High | Tech supplier price increases of 5-10% |

| Cloud Services | Low | Cloud market: $670B+ (growing) |

| Music Data | Moderate | Global music market: $28.6B |

| Talent Acquisition | Moderate | Market: $20.5B (2023) to $30.8B (2028) |

| Financial Institutions | High | Payment fees: 1.5%-3.5% |

Customers Bargaining Power

Individual musicians and independent artists are highly price-sensitive, often working with limited budgets. To stay competitive, Stem must offer attractive pricing or unparalleled value. In 2024, the music streaming market saw over $20 billion in revenue, highlighting the importance of cost-effective solutions for artists. Stem's pricing strategy directly impacts its ability to secure and keep artists using its platform.

Switching costs for artists on platforms like Stem are a key factor. Data portability is crucial; if moving data is difficult, artists are less likely to switch. Streamlined migration and clear revenue splits enhance loyalty. Stem can boost customer retention by simplifying these processes.

The bargaining power of Stem's customers is heightened by the availability of alternative platforms. Services like DistroKid and TuneCore offer similar distribution solutions, providing artists with viable options. This competition necessitates that Stem distinguishes itself through better features, customer support, or competitive pricing. In 2024, DistroKid reported distributing over 20 million songs, highlighting the strong presence of alternatives.

Negotiating power of larger labels

Larger independent labels wield significant negotiating power due to their substantial revenue streams and multi-artist management. This allows them to secure favorable terms, such as lower prices or customized services, from companies like Stem. In 2024, the music industry saw independent labels account for approximately 30% of the market share, highlighting their influence. Stem must adapt its offerings to accommodate these key accounts to stay competitive.

- Independent labels collectively generated over $8 billion in revenue in 2024.

- Approximately 30% of the music market share is controlled by independent labels in 2024.

- Customized pricing and solutions are essential for attracting larger labels.

- Negotiation leverage comes from managing multiple artists and revenue streams.

Demand for transparent revenue tracking

Customers in today's market demand transparent revenue tracking, a key factor in their bargaining power. Lack of transparency can damage trust, potentially leading customers to seek alternatives. Stem must prioritize accuracy and openness in financial reporting to maintain customer loyalty. This is vital, especially in competitive sectors.

- In 2024, studies showed that 70% of consumers would switch brands due to a lack of trust.

- Companies with high transparency often see a 15% increase in customer retention rates.

- Poor financial reporting has caused a 20% drop in stock value for some firms in 2024.

- Openness builds customer confidence, improving brand perception by up to 25%.

Customer bargaining power is high due to platform alternatives like DistroKid and TuneCore, with DistroKid distributing over 20 million songs by 2024. Large independent labels, controlling about 30% of the market in 2024, wield substantial negotiating strength, necessitating customized services. Transparent revenue tracking is crucial, as 70% of consumers may switch brands over trust issues.

| Factor | Impact | Data (2024) |

|---|---|---|

| Platform Alternatives | Increased customer choice | DistroKid distributed over 20M songs |

| Independent Labels | Negotiating power | ~30% market share |

| Transparency | Customer loyalty | 70% switch due to lack of trust |

Rivalry Among Competitors

The music tech sector is fiercely competitive, with many firms providing comparable services. DistroKid, TuneCore, and CD Baby directly challenge Stem. This rivalry leads to pressure on pricing and features, impacting profit margins. In 2024, the digital music distribution market was valued at approximately $3.5 billion, highlighting the stakes.

Companies compete by offering unique features. Stem, for example, might differentiate itself with advanced analytics or integrated financial tools. In 2024, the fintech market saw a 15% increase in demand for such features. Superior features and user experience are critical for Stem. Continuous innovation is essential for staying ahead in this competitive landscape.

Effective marketing and strong brand building are key in competitive markets. Stem must cultivate a solid brand reputation to attract customers. Positive word-of-mouth and a robust online presence are essential. In 2024, companies spent billions on digital ads. For example, Meta's ad revenue in Q3 2024 was $36.5 billion, showing marketing's impact.

Pricing strategies

Aggressive pricing strategies can significantly heighten competitive rivalry, as businesses vie for customer attention. Competitors often engage in price wars to capture market share, which can squeeze profit margins. Stem must carefully balance competitive pricing with the need to maintain profitability and financial health.

- Price wars can decrease profitability for all competitors, as seen in the airline industry in 2024.

- Companies like Amazon frequently adjust prices to stay competitive, reflecting the dynamic nature of pricing in e-commerce.

- In 2024, the average profit margin in the retail sector was around 3.5%, highlighting the importance of efficient pricing.

- Stem needs to analyze competitor pricing to ensure they remain competitive without sacrificing financial stability.

Acquisitions and consolidation

The competitive landscape in the energy storage industry is evolving rapidly, marked by significant acquisitions and consolidation. Larger companies often acquire smaller ones to boost market share, gain access to new technologies, or diversify their portfolios. This trend intensifies rivalry, as the remaining players must compete more fiercely for market dominance. Stem needs to stay informed about potential acquisition targets and opportunities to navigate this dynamic environment effectively.

- In 2024, the global energy storage market saw several acquisitions, with deals totaling billions of dollars.

- Companies like Fluence and Tesla have been actively involved in strategic acquisitions.

- These acquisitions often involve innovative battery technologies or project development capabilities.

- This consolidation increases the competitive pressure on all industry participants.

Competitive rivalry in the music tech sector is intense, impacting pricing and profitability. Differentiation through unique features and user experience is crucial. Marketing and brand building are vital for customer attraction. Aggressive pricing strategies can heighten competition.

| Aspect | Impact | Data (2024) |

|---|---|---|

| Market Value | Competition Intensity | Digital music distribution: ~$3.5B |

| Marketing Spend | Brand Visibility | Meta ad revenue: $36.5B (Q3) |

| Retail Profit | Pricing Pressure | Avg. profit margin: ~3.5% |

SSubstitutes Threaten

Artists could opt for DIY spreadsheets or manual tracking, a low-tech substitute for Stem. This method might appeal to those preferring manual control or with simple revenue streams. In 2024, the adoption of DIY financial tools remained significant, with around 30% of small businesses still using spreadsheets. Stem must highlight its time-saving and accuracy advantages.

Traditional accounting software, such as QuickBooks, poses a threat as a substitute for some financial management tasks. These tools, while lacking music-specific features, can handle basic accounting needs. For instance, in 2024, QuickBooks reported over 30 million users globally. Stem must emphasize its specialized features tailored for the music industry to differentiate itself. This differentiation is key in a market where basic financial software is widely accessible and affordable.

The threat of substitutes in Stem's landscape arises from artists blending financial tools. Some artists currently use distributors for royalties and separate accounting software, creating a fragmented financial management approach. In 2024, the usage of multiple financial tools among artists has been observed to be around 35%. Stem must deliver an all-encompassing solution, simplifying finances and reducing the need for these alternative services.

In-house financial teams

Larger independent labels often use in-house financial teams to manage revenue and artist payouts, posing a substitution threat to Stem. These teams provide detailed control and customization over financial operations. Stem should focus on smaller artists and labels that lack these internal resources to maintain its market share. The global music market was valued at $26.2 billion in 2023, a 10.2% increase from 2022, highlighting the potential for Stem to serve those without in-house capabilities.

- In 2023, the recorded music revenue reached $26.2 billion globally.

- Major labels account for roughly 65% of the global market share.

- Independent labels and artists make up about 35% of the market.

Bartering and direct deals

Artists occasionally opt for bartering or direct deals, sidestepping conventional revenue channels. These informal transactions decrease the reliance on platforms like Stem. This poses a threat because Stem's value diminishes if artists frequently choose alternatives. To counter this, Stem must concentrate on formalizing and meticulously tracking all revenue sources to capture a comprehensive financial picture.

- Direct deals can cut into Stem's potential earnings.

- Informal arrangements bypass Stem's fee structure.

- Stem needs to offer more value to compete.

- Focusing on tracking all revenue streams is crucial.

Substitutes like DIY tools and traditional software challenge Stem's position. Artists may use spreadsheets, with 30% of small businesses still using them in 2024. Fragmentation, with 35% using multiple tools, also poses a threat.

In-house financial teams at labels offer alternatives. Stem must highlight its advantages to compete effectively.

| Substitute | Impact | Countermeasure |

|---|---|---|

| DIY Spreadsheets | Direct Control | Emphasize Time-saving |

| Accounting Software | Handles Basics | Specialize in Music |

| Multiple Tools | Fragmented | Provide All-in-One |

Entrants Threaten

The music tech sector faces a low barrier to entry. Creating basic platforms for revenue splitting and analytics is affordable. The cost to launch a music streaming service can range from $5,000 to $50,000. This accessibility attracts new competitors. In 2024, the music streaming market generated over $20 billion in revenue.

Incumbent platforms, such as Stem, benefit from brand recognition and a loyal customer base. These established players already have a strong foundation, making it harder for newcomers to gain traction. To compete, new entrants must present a superior offering. For example, in 2024, a new platform would need to demonstrate a 20% better value proposition to attract customers from established firms.

Technological advancements pose a significant threat. Blockchain, for example, could revolutionize royalty tracking, offering enhanced transparency and security. Such innovations could empower new entrants to challenge established players. Stem must proactively adopt these technologies to maintain a competitive edge. In 2024, blockchain's market size reached $16 billion, showing its growing importance.

Access to funding

New music tech entrants face the challenge of securing funding to build and promote their platforms. Venture capital and angel investors are showing increasing interest in music technology startups. Access to capital can enable new entrants to rapidly scale their operations and compete effectively. In 2024, the music tech industry saw approximately $1.2 billion in funding, demonstrating strong investor confidence.

- Funding is vital for new entrants to develop and market their platforms.

- Venture capital and angel investors are increasingly interested in music tech.

- Securing funding enables new entrants to scale operations quickly.

- In 2024, music tech received about $1.2 billion in funding.

Partnerships and integrations

Strategic partnerships and integrations significantly affect the threat of new entrants in the music industry. These collaborations can lower the hurdles for new players. For example, integrating with major streaming services provides instant access to a large audience. New entrants can quickly gain traction by leveraging such partnerships.

- Digital music distribution is a competitive space, with platforms like DistroKid and TuneCore offering services to artists.

- In 2024, the music industry saw significant growth, with digital music revenues continuing to rise.

- Partnerships with established platforms allow new entrants to bypass the need to build their own infrastructure.

- These integrations can include distribution, marketing, and royalty management, crucial for attracting artists.

The music tech sector's low barrier to entry increases the threat of new entrants. Established players like Stem face competition from innovative platforms. New entrants need substantial funding, with $1.2B invested in 2024, to gain traction.

| Factor | Impact | 2024 Data |

|---|---|---|

| Barriers to Entry | Low | Launch Cost: $5K-$50K |

| Competitive Advantage | Brand Loyalty | Market Revenue: $20B |

| Funding | Essential | Investment: $1.2B |

Porter's Five Forces Analysis Data Sources

We use diverse data, including scientific publications, patent databases, funding reports, and company statements, for a robust STEM Five Forces analysis.