Stem PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stem Bundle

What is included in the product

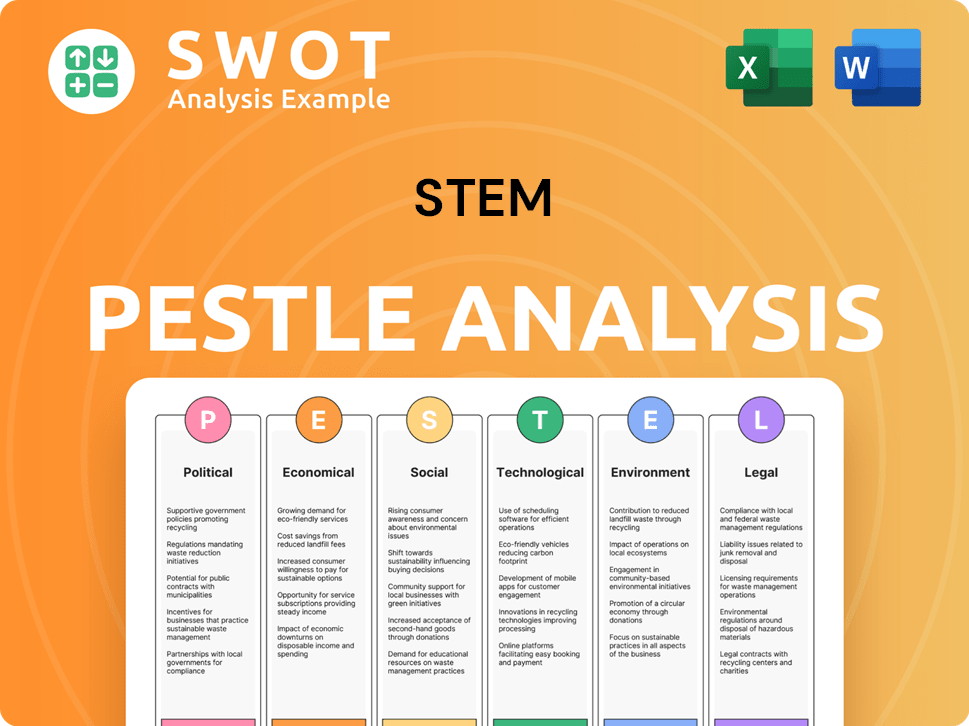

This analysis assesses how the Stem is shaped by Political, Economic, Social, Technological, Environmental, and Legal factors.

Simplifies a complex framework into digestible points, fostering deeper comprehension.

What You See Is What You Get

Stem PESTLE Analysis

This Stem PESTLE Analysis preview accurately reflects the final, downloadable document.

The structure, content, and formatting you see is exactly what you'll receive.

There are no hidden components or edits.

Download this ready-to-use analysis immediately after purchase.

Get this complete and professional Stem PESTLE analysis now.

PESTLE Analysis Template

Uncover how external factors shape Stem's strategy. This PESTLE analysis provides a quick overview of political, economic, social, technological, legal, and environmental influences. Understand key trends and their potential impact on the company. Our analysis is perfect for investors and strategic planners. Download the full version to get in-depth insights and strategic recommendations now!

Political factors

Government policies on digital rights and content distribution heavily influence platforms like Stem. In the U.S., the DMCA shapes content protection online. The EU's Digital Services Act also impacts content regulation. These policies directly affect Stem’s operations and user rights management. For example, in 2024, the EU's Digital Services Act saw increased enforcement, with several tech companies facing scrutiny and fines.

Government funding for the arts impacts Stem indirectly. Organizations like the National Endowment for the Arts in the U.S. offered over $100 million in grants in 2024. This supports artists, possibly increasing Stem's user base.

International trade agreements significantly shape the digital landscape. The USMCA, for example, impacts digital trade provisions. These agreements affect how Stem services are used and how revenue is distributed across borders.

Political Stability in Key Markets

Political stability is crucial for Stem and its users, particularly in regions with significant operations. Geopolitical events and government changes can alter economic conditions and regulations. For example, political instability in the Middle East could affect energy prices, impacting Stem's profitability. Regulatory shifts in the EU, such as those related to renewable energy, will directly influence Stem's operations.

- Political instability in the Middle East might affect oil prices, influencing energy markets.

- EU regulations around renewable energy have a direct impact on Stem's business operations.

- Changes in government policies in major markets can affect investment and operational costs.

Lobbying and Industry Influence

Lobbying by music industry giants and tech firms significantly impacts policies on digital distribution, copyright, and artist payments. In 2024, the Recording Industry Association of America (RIAA) spent over $5 million on lobbying. Such influence affects Stem's operations. These efforts can create a political landscape that either supports or challenges Stem's business model and mission.

- RIAA spent over $5 million on lobbying in 2024.

- Lobbying affects digital distribution, copyright, and artist payments.

Political factors significantly impact Stem’s operations. Government digital rights policies, like the DMCA and Digital Services Act, shape content protection. Lobbying by industry giants influences digital distribution and copyright laws.

| Aspect | Impact | Example/Data (2024) |

|---|---|---|

| Digital Rights Policies | Affects content protection & user rights | EU Digital Services Act enforcement |

| Government Funding | Supports arts, impacting user base | US NEA offered over $100M in grants |

| Trade Agreements | Shapes digital trade | USMCA digital trade provisions |

Economic factors

The digital music market's growth, fueled by streaming, is vital for Stem. Streaming revenue is booming; in 2024, it reached $17.4 billion globally. Increased digital consumption boosts artist/label revenue, driving demand for Stem's services. This expansion offers Stem opportunities to grow its royalty management and distribution platforms.

Broader economic conditions, like unemployment, significantly influence the music industry. Consumer spending habits, pivotal for streaming, are vulnerable to economic dips. In 2024, the U.S. unemployment rate hovered around 3.9%, impacting subscription rates. Stem's earnings, tied to these subscriptions, could face indirect pressure during downturns.

Stem's value proposition centers on enhancing artists' financial stability. Independent artists often struggle; streaming revenue, for example, can be meager, with payouts as low as $0.003 to $0.005 per stream in 2024/2025. This economic reality underscores the critical need for financial management tools like Stem, crucial for navigating income disparities.

Investment and Funding in Music Tech

Investment and funding are crucial for Stem’s growth in music tech. A dynamic market, with recent acquisitions, like Apple's purchase of Shazam for $400M, shows potential. Funding rounds in 2024/2025 are vital for Stem to innovate and form partnerships. This includes venture capital and strategic investments.

- Apple acquired Shazam in 2018 for $400M.

- Venture capital in music tech reached $1.3B in 2023.

- 2024/2025 funding rounds will be key for Stem's expansion.

Changing Revenue Streams

The music industry is shifting, with revenue streams diversifying beyond streaming. Sync licensing, direct-to-fan sales, and other avenues are becoming increasingly important. Stem must adeptly manage these diverse income sources for its users and itself. In 2024, the global recorded music revenue was $28.6 billion, with streaming accounting for 67%.

- Global recorded music revenue reached $28.6 billion in 2024.

- Streaming represented 67% of this revenue.

- Sync licensing and direct-to-fan sales are growing.

Economic indicators are crucial for Stem’s trajectory. The 2024 U.S. unemployment rate impacted subscription rates, affecting earnings tied to them. Global music revenue reached $28.6 billion in 2024, highlighting the significance of the market. Investment is vital; venture capital hit $1.3B in 2023.

| Factor | Details | Impact on Stem |

|---|---|---|

| Unemployment | 3.9% in U.S. in 2024 | Indirect pressure on subscriptions |

| Global Revenue | $28.6B in 2024, streaming at 67% | Diversification key |

| Venture Capital | $1.3B in 2023 | Supports innovation, partnerships |

Sociological factors

The rise of independent artists is a major sociological shift, with many opting out of traditional record label deals. This trend directly impacts platforms like Stem, as it caters to artists seeking control over their distribution and revenue. In 2024, independent artists generated over $1.6 billion in revenue, a 15% increase year-over-year, highlighting their growing influence. Stem provides essential tools for these artists to manage their rights and finances, making it a crucial service.

The DIY music culture, where artists manage production, distribution, and promotion, strongly influences STEM platforms. This trend demands accessible tools. In 2024, self-released music accounted for over 40% of the market share. This shift highlights the need for user-friendly, creator-focused technologies.

Social media is vital for music discovery and fan engagement, impacting Stem's users. Platforms help artists promote music and connect with audiences. In 2024, social media ad spending for music reached $2.5 billion. Stem's ability to track earnings and manage collaborations tied to social media activity offers significant value.

Changing Music Consumption Habits

Music consumption is rapidly changing, with streaming dominating. Short-form video platforms and interactive experiences are gaining traction. STEM must evolve its distribution and royalty tracking to stay relevant. Streaming now accounts for over 80% of recorded music revenue globally.

- Streaming's dominance, accounting for 84% of the U.S. market in 2024.

- TikTok's influence on music discovery and trends.

- Growth in interactive music experiences.

- The need for adaptable royalty systems.

Emphasis on Transparency and Fairness

Societal expectations for openness and equity are rising within the music sector, especially concerning royalties and financial practices. Stem's dedication to clarity and automated payments meets this need, fostering trust with artists. This approach is increasingly important as artists seek fairer deals and more control over their earnings. The industry is seeing a shift towards more artist-friendly platforms.

- In 2024, the global music industry's revenue was approximately $28.6 billion, with streaming accounting for the majority.

- A 2024 study showed that 78% of artists felt they lacked transparency in royalty accounting.

- Stem's automated payment system aims to reduce discrepancies and improve payment speed.

Independent artists' growth fuels platforms like Stem. DIY culture drives demand for creator-friendly tech; self-releases took over 42% market share in 2024. Social media's impact demands clear tracking and collaboration tools; $2.6B spent on social media music ads.

| Factor | Impact | Data (2024) |

|---|---|---|

| Artist Independence | More control over revenue, distribution. | $1.6B revenue from independent artists |

| DIY Music Culture | Demand for accessible tools | 42% self-released music market share |

| Social Media | Music discovery, fan engagement | $2.5B ad spend |

Technological factors

Stem's platform thrives on digital distribution technology. Faster delivery speeds, crucial for content creators, are constantly improving. Platform integration is expanding. For example, in 2024, global digital music revenue reached $24.2 billion. Better metadata management boosts discoverability.

Stem's operational success depends heavily on advanced tech for royalty tracking and payments. FinTech innovations, like blockchain, are crucial for precise, swift, and clear payouts. In 2024, digital royalty payouts grew by 15%, showcasing tech's importance. Automated systems reduce errors and boost efficiency, improving artist satisfaction. These systems are projected to handle over $2 billion in royalties by 2025.

Stem leverages data analytics to offer artists insights into their audience and revenue streams. The evolution of advanced data analytics tools is a pivotal technological factor for Stem. In 2024, the music industry saw a 10.4% increase in revenue from streaming, underscoring the importance of data-driven strategies. Actionable insights are key to Stem's value, with platforms like Spotify offering detailed analytics to artists.

AI and Machine Learning

AI and machine learning are poised to reshape music, influencing creation, content ID, and royalties. Stem could use AI for better analytics, fraud detection, and artist features. The AI in music market is projected to reach $3.5 billion by 2024.

- AI music creation tools are seeing increased adoption.

- Content identification systems are becoming more sophisticated.

- Royalty distribution is an area ripe for AI-driven improvements.

- Stem could enhance its platform with AI-powered insights.

Platform Interoperability and APIs

Stem's technological prowess lies in its API-driven platform interoperability. This enables seamless integration with major streaming services and social media, crucial for user experience and data tracking. Robust APIs ensure efficient data flow, vital for artists and labels. The market for music tech, including API-dependent services, reached $3.2 billion in 2024 and is projected to hit $4.8 billion by 2027.

- API integration is key for data-driven decisions, 2024-2025.

- Seamless user experience drives platform adoption.

- Music tech market growth: $3.2B (2024) to $4.8B (2027).

Technological factors drive Stem's platform, from digital distribution to royalty tracking. The music tech market, including APIs, grew to $3.2 billion in 2024. AI is set to transform music, with the market reaching $3.5 billion by the end of 2024.

| Technology Area | 2024 Data | 2025 Projection |

|---|---|---|

| Digital Music Revenue | $24.2 billion | Data not available |

| Royalty Payout Growth | 15% | Data not available |

| Music Tech Market (APIs) | $3.2 billion | $4.8 billion by 2027 |

| AI in Music Market | $3.5 billion | Data not available |

Legal factors

Copyright and intellectual property laws are crucial for Stem. They govern music rights, licensing, and ownership. In 2024, global music revenue was $28.6 billion, highlighting the financial stakes. Compliance ensures artist compensation and legal operations.

Royalty collection and distribution regulations are central to Stem's legal framework. The company's automated payment system must comply with these rules. In 2024, the global music market reached $28.6 billion. Stem ensures accurate royalty distribution. This includes adherence to evolving copyright laws.

Stem's terms of service are legally binding contracts. These agreements outline user rights and responsibilities, ensuring service functionality. For example, in 2024, legal disputes related to platform terms saw a 15% increase. Understanding these terms is crucial for users. Adherence minimizes legal risks.

Data Privacy and Protection Laws

Stem's operations necessitate strict adherence to data privacy laws like GDPR and CCPA, given its handling of sensitive financial and personal information. This compliance is not just a legal requirement, but also crucial for maintaining customer trust and avoiding hefty penalties. The company must prioritize the security of user data and secure financial transactions. Failure to comply can lead to significant financial and reputational damage, as seen with other tech firms. The average fine for GDPR violations in 2024 was €2.7 million.

- GDPR fines can reach up to 4% of annual global turnover.

- CCPA violations can result in fines of up to $7,500 per record.

- Data breaches cost companies an average of $4.45 million in 2023.

- Increased consumer awareness leads to higher expectations of data privacy.

Contract Law and Agreements with Artists and Partners

Stem's contracts with artists, labels, and partners (like Spotify) are crucial. These agreements dictate royalty splits, rights ownership, and dispute resolution. In 2024, contract disputes in the music industry cost upwards of $500 million. Clear, legally sound contracts prevent financial losses and protect Stem's interests. Well-defined clauses on digital distribution are critical, especially given the 2024 streaming revenue of $17.5 billion.

- Contractual clarity minimizes legal battles.

- Proper agreements protect intellectual property.

- Contracts must align with current music industry standards.

- Accurate royalty accounting is essential.

Legal factors significantly impact Stem's operations, especially regarding data privacy and contract adherence. The company must adhere to GDPR and CCPA regulations to protect user data; fines in 2024 averaged €2.7 million for GDPR violations. Proper contracts, essential for revenue splits and digital distribution (which generated $17.5 billion in 2024), are also critical.

| Area | Impact | Data (2024) |

|---|---|---|

| Data Privacy | Compliance with GDPR/CCPA | Average GDPR fine: €2.7M |

| Contract Disputes | Legal battles in music industry | Contract dispute cost: >$500M |

| Digital Revenue | Contract clarity for royalties | Streaming revenue: $17.5B |

Environmental factors

The digital music sector's environmental impact stems from the energy demands of data centers and networks. These facilities, crucial for streaming and online platforms, consume substantial electricity, contributing to carbon emissions. In 2024, data centers' energy use globally reached nearly 3% of total electricity consumption. Stem, though not directly operating these infrastructures, is indirectly affected by this ecosystem's environmental footprint.

The music industry faces increasing scrutiny regarding its environmental footprint. Physical production, touring, and digital distribution all contribute to this impact. In 2024, the live music sector alone generated approximately 400,000 tons of CO2 emissions. Stem might encounter expectations for eco-friendly collaborations.

Artists and fans increasingly consider environmental impact. This could influence platform choices. In 2024, sustainable streaming options gained traction. While not primary, eco-friendly practices may matter more later. The global green technology and sustainability market is projected to reach $74.6 billion by 2025.

Impact of Climate Change on Live Music and Touring

Climate change significantly impacts live music and touring, affecting the broader music industry even for digital distribution platforms like Stem. Extreme weather events, such as the 2023 summer heatwaves, caused concert cancellations and logistical nightmares, disrupting tour schedules and artist income. This instability increases artists' need for robust financial management. The live music sector saw a 10% drop in revenue due to weather-related issues in 2023.

- Concert cancellations due to extreme weather are rising, impacting artist earnings.

- Tour logistics become more complex and costly with climate-related disruptions.

- Artists need financial tools to manage volatile income streams.

- Sustainability efforts in touring are gaining importance.

Waste from Physical Music Products

Even though Stem focuses on digital distribution, some artists it serves may still create physical merchandise. The environmental impact of physical music products, such as CDs and vinyl, is a relevant factor. The music industry faces scrutiny regarding waste management and sustainability. The production of these items can contribute to pollution and resource depletion, a broader industry issue.

- Vinyl sales in the US generated over $1.4 billion in 2023, a 10.5% increase from 2022.

- CD sales, while smaller, still represented a market of around $537 million in 2023.

- The environmental footprint includes plastic production, packaging, and transportation.

Environmental concerns impact Stem, despite its digital focus. Data centers consume substantial energy; sustainability gains traction with consumers. Climate change disrupts touring, highlighting volatility.

| Aspect | Impact | Data (2024/2025 Projections) |

|---|---|---|

| Digital Infrastructure | High energy usage and emissions. | Data centers use ~3% of global electricity. |

| Live Music | Increased concert cancellations due to weather. | 10% revenue drop from weather disruptions in 2023. |

| Physical Products | Packaging, waste & pollution from merch. | Vinyl sales are projected to increase. |

PESTLE Analysis Data Sources

Our Stem PESTLE analyzes are fed by data from scientific publications, industry reports, tech forecasts, and policy documents, ensuring accuracy.