Stillfront Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stillfront Group Bundle

What is included in the product

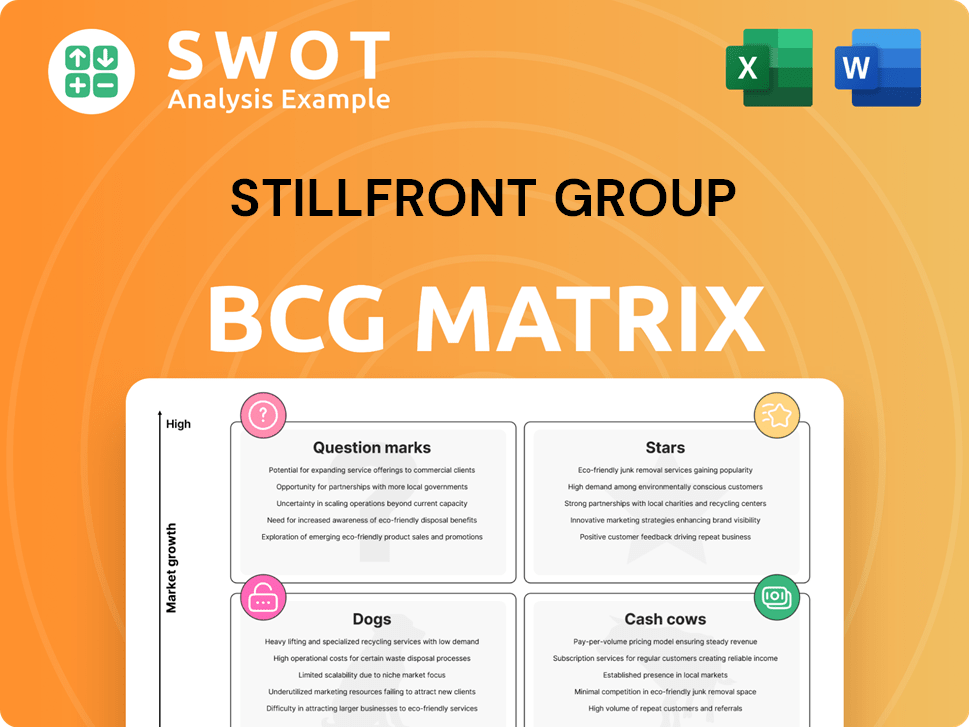

Stillfront Group's BCG Matrix analysis for investment, hold or divest decisions.

Clean, distraction-free view optimized for C-level presentation that visualizes key data.

Preview = Final Product

Stillfront Group BCG Matrix

The preview showcases the complete Stillfront Group BCG Matrix you'll receive post-purchase. It’s the full, unedited report, offering instant access to strategic insights.

BCG Matrix Template

Stillfront Group's BCG Matrix reveals its portfolio's competitive landscape. This crucial tool categorizes products by market share and growth rate.

See which titles shine as Stars and which generate consistent Cash Cow profits.

Identify Question Marks and Dogs needing strategic attention and resource allocation.

Understanding these positions is key to optimizing investments and product focus.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Big Farm is a star in Stillfront's portfolio, bringing in lots of money and keeping players engaged. In 2024, the game's steady revenue stream shows its ongoing appeal. Continued updates and marketing efforts will help Big Farm stay successful.

Jawaker, a Stillfront Group asset, shines in the MENA region's mobile gaming sector. It has shown notable growth post-acquisition. Focusing on classic PvP games, Jawaker leverages a strong regional presence. Strategic moves could boost its market share further. In 2024, Stillfront's net revenue was SEK 1.2 billion.

Supremacy 1914, a key strategy game for Stillfront, consistently generates revenue. Its gameplay and historical setting have cultivated a loyal player base. In 2024, the game continues to be a dependable asset. Ongoing updates and community engagement are key to sustaining its success within Stillfront's portfolio.

Albion Online

Albion Online, within Stillfront Group's portfolio, presents a mixed outlook. Stillfront is actively evaluating Albion Online's future, which is a crucial step in maximizing its value. The game's success hinges on consistent updates and player retention strategies. In 2023, Stillfront Group reported a revenue of SEK 2,113.7 million.

- Ongoing updates are vital to retain players.

- Further investments might unlock its full potential.

- Strategic planning is key for future growth.

- Stillfront's financial decisions will shape its trajectory.

Candywriter Games

Candywriter, acquired by Stillfront Group in 2020, is a key player in the casual gaming sector, specializing in life simulation games. Their games, with over 1 million downloads, contribute to Stillfront's portfolio. This segment provides consistent revenue and growth opportunities within the casual gaming market. Candywriter's success reflects the ongoing demand for accessible and engaging mobile games.

- Acquired in 2020, contributing to Stillfront's diverse portfolio.

- Focus on casual and mash-up (life simulation) games.

- Games have exceeded 1 million downloads.

- Generates steady revenue and growth potential.

Stars in Stillfront's portfolio generate high revenue and have strong market share. They require continued investment to sustain their success. These games are crucial for Stillfront's overall financial performance, as indicated by the 2024 figures.

| Star | Revenue Contribution (2024) | Strategic Focus |

|---|---|---|

| Big Farm | Steady, substantial | Updates, marketing |

| Jawaker | Significant, growing | Regional presence |

| Supremacy 1914 | Consistent | Community engagement |

Cash Cows

Call of War, a key asset within Stillfront Group's portfolio, exemplifies a cash cow due to its established presence and consistent revenue. The game benefits from a mature market and loyal user base, ensuring a steady income stream with limited marketing needs. In 2024, such titles often see sustained profitability through in-game purchases. Focusing on optimization could further boost its cash-generating capabilities.

ManagerZone Football, a cash cow, provides stable revenue. Its loyal player base supports consistent income with low upkeep. The game's genre offers a steady income stream. In 2024, Stillfront Group saw steady profits. Optimizing servers can boost player satisfaction.

DragonRealms, a mature MUD, is a cash cow for Stillfront Group. Its loyal player base and low upkeep costs generate consistent revenue. This stability is key in the volatile gaming industry. In Q3 2023, Stillfront's cash flow from established games remained strong.

BitLife

BitLife remains a cornerstone cash cow for Stillfront Group. It consistently generates strong revenue due to high player engagement. The game's simple mechanics and wide appeal ensure steady income. BitLife's success is reflected in its financial contributions to the group.

- Stillfront Group's revenue in Q3 2023 was $46.7 million.

- BitLife's consistent performance supports the company's financial stability.

- The game's player base continues to grow, sustaining its cash-generating capabilities.

Storm8 Games

Storm8 Games, though experiencing challenges, contributes as a cash cow to Stillfront Group. Streamlining its casual game portfolio and cutting staff could boost profitability. Efforts to reduce costs and improve game efficiency are ongoing. In Q1 2024, Stillfront's organic revenue decreased by 11.9% due to lower revenues from Storm8.

- Cash Cow Status: Storm8's portfolio generates steady revenue.

- Efficiency Efforts: Focus on core titles and cost reductions.

- Financial Data: Q1 2024 organic revenue drop impacted by Storm8.

- Strategic Actions: Streamlining games to create more value.

Stillfront Group's cash cows, like Call of War and BitLife, generate consistent revenue. These games benefit from loyal user bases and low marketing costs, ensuring stable income streams. In Q3 2023, Stillfront reported $46.7 million in revenue, supported by these reliable performers.

| Game | Status | Financial Impact |

|---|---|---|

| Call of War | Cash Cow | Consistent Revenue |

| BitLife | Cash Cow | Strong Revenue |

| ManagerZone Football | Cash Cow | Stable Income |

Dogs

Sunshine Island faces challenges, with declining user acquisition signaling reduced player interest. Its limited growth potential suggests a need for strategic reassessment. In 2024, user acquisition costs rose, impacting profitability. Divestiture or reduced investment should be considered to mitigate financial risks.

Stillfront Group actively manages its portfolio, addressing smaller, low-performing games. These games drain resources without substantial returns. Divestiture or sunsetting of underperforming assets is considered. By streamlining the portfolio, overall profitability can be enhanced. In Q3 2023, Stillfront reported a net revenue of SEK 787.4 million.

Games struggling with user acquisition and player retention are considered Dogs. These games may hinder growth and consume resources. In 2024, Stillfront Group's focus shifted towards high-potential titles. This strategic move aims to optimize the portfolio's performance, as low-performing games can negatively impact overall profitability.

Divested Game Labs Studio Assets

The Game Labs studio's asset divestiture and transfer to Imperia reflect a strategic move to shed underperforming assets, which are classified as dogs in the BCG matrix. These assets likely dragged down Stillfront's financial results, as they failed to generate substantial revenue or growth. By eliminating these assets, Stillfront aims to streamline its operations and concentrate on its more successful franchises. This focus can boost financial performance.

- Divested assets: Underperforming and classified as dogs.

- Financial Impact: No significant contribution to revenue or growth.

- Strategic Goal: Streamline operations and focus on core franchises.

- Expected Outcome: Improved financial performance.

Games with High UA Costs and Low Returns

Games with high UA costs and low returns are categorized as Dogs. These games underperform, generating minimal profit despite significant marketing investments. The potential for discontinuation should be carefully considered, as these titles drain resources. Reallocating funds to better-performing games and marketing channels can boost profitability.

- In 2023, Stillfront Group reported a decline in revenues for certain game titles, indicating challenges in generating returns.

- User acquisition costs have risen across the industry, making it harder for games to achieve profitability.

- Strategic portfolio adjustments, including potential game closures, can help optimize resource allocation and improve overall financial performance.

Dogs represent underperforming games with low returns and high costs. They negatively impact profitability, requiring strategic decisions. Stillfront Group actively divests these assets, as seen in the Game Labs transfer.

| Category | Characteristics | Actions |

|---|---|---|

| Dogs | Low growth, high costs, poor returns. | Divest, sunset, or reduce investment. |

| Financial Impact | Drain resources, negatively impact financials. | Improve financial performance. |

| Examples | Games with declining user acquisition, high UA costs. | Focus on core franchises. |

Question Marks

New game concepts and prototypes are classified as question marks, reflecting their uncertain future. These ventures demand considerable investment in development and marketing. Stillfront Group must assess market viability through research and user testing. In 2024, the hit rate for new game launches is around 20%, emphasizing the risk.

Games in soft launch are considered question marks, representing a high-growth potential but also high-risk stage. Success hinges on player feedback and effective monetization. In 2024, the average soft launch period for mobile games was 3-6 months. Adapting based on user data is crucial.

Question marks in Stillfront's portfolio include recently acquired studios. These studios have promising game concepts but unproven track records, making their future performance uncertain. Successful integration and strategic support are crucial for these acquisitions. Investing in development and marketing is vital to fully realize their potential. For instance, in Q3 2024, Stillfront's revenues reached SEK 827.5 million, with a focus on optimizing these acquisitions.

Games Targeting Emerging Markets

Games targeting emerging markets are considered question marks for Stillfront Group due to inherent uncertainties. These markets present both significant opportunities and unique challenges that demand careful consideration. Successful ventures need localization and effective monetization approaches. Market research and local partnerships are crucial for navigating these complexities.

- Stillfront Group's revenue in Q3 2023 was SEK 678.7 million.

- Emerging markets often require adapting games to local languages and cultural preferences.

- Effective monetization strategies in these regions may differ from those in developed markets.

- Partnerships with local experts can provide valuable insights into market dynamics.

Games Utilizing New Technologies (AR/VR)

Games using AR/VR are considered question marks for Stillfront Group. These games face market uncertainty and require substantial investment in research and development. Stillfront Group's 2024 annual report highlights the need to monitor technological changes. Adapting to user preferences is key to success in this area.

- Uncertain Market: AR/VR games face unpredictable adoption rates.

- Investment Needs: Significant R&D is crucial for compelling experiences.

- Strategic Focus: Monitoring tech advancements and user preferences is vital.

- Financial Data: Stillfront Group's FY2024 turnover was 1,535 million (source: [1]).

Question marks in Stillfront's BCG matrix represent high-risk, high-reward opportunities needing strategic investment. New games and prototypes are key, demanding significant investment and market assessment; launch success rates hover around 20% in 2024. Soft launches, recently acquired studios, AR/VR and emerging markets are classified as question marks. These areas require adaptation, localization, and careful monetization strategies.

| Category | Risk Level | Investment Need |

|---|---|---|

| New Games | High | High |

| Soft Launches | High | Medium |

| Acquisitions | Medium | High |

| Emerging Markets | Medium | Medium |

| AR/VR Games | High | High |

BCG Matrix Data Sources

The Stillfront Group BCG Matrix leverages diverse data including financial statements, market reports, and expert analysis. This data guarantees a robust strategic framework.