Stillfront Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Stillfront Group Bundle

What is included in the product

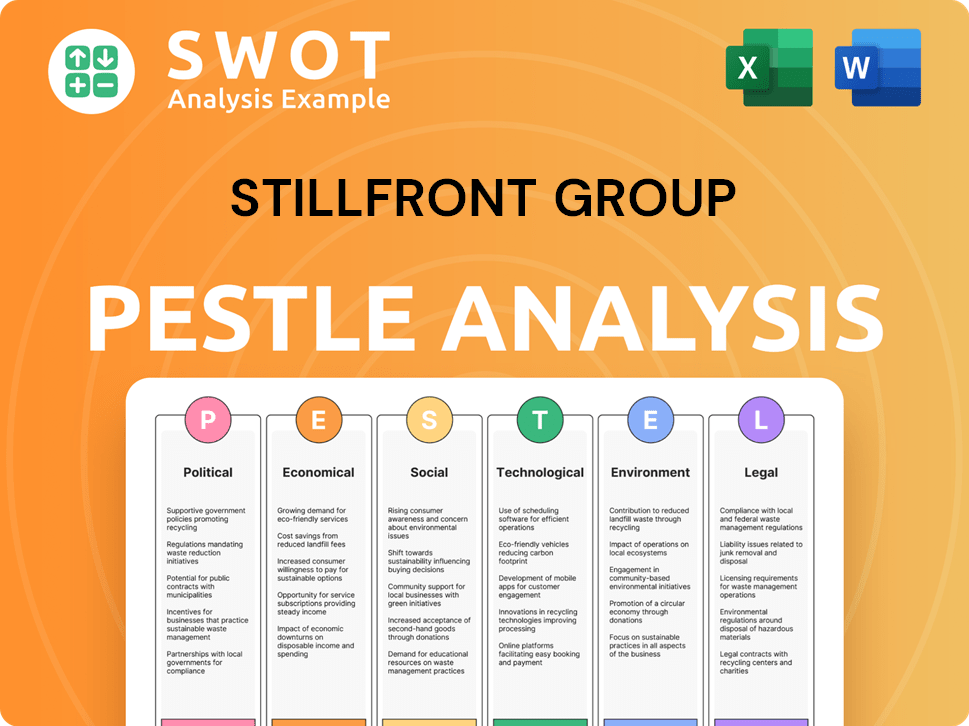

Examines Stillfront Group through PESTLE lenses: Political, Economic, Social, Tech, Environmental, and Legal. The analysis uncovers crucial market threats and opportunities.

Helps stakeholders rapidly grasp key strategic influences affecting Stillfront Group for effective decision-making.

Preview the Actual Deliverable

Stillfront Group PESTLE Analysis

Take a look at this preview of the Stillfront Group PESTLE Analysis! This preview shows you exactly what you'll receive. It is a complete, ready-to-use analysis. All data shown is included.

PESTLE Analysis Template

Navigate the complex world impacting Stillfront Group with our PESTLE analysis. We break down political factors like evolving gaming regulations. Explore economic impacts, including market volatility and consumer spending. Understand how social trends affect gaming habits and digital content consumption. Uncover legal frameworks that drive compliance. Download the full analysis now for actionable insights.

Political factors

Changes in regulations on in-game purchases, data privacy, and content affect Stillfront. Compliance across different countries is complex. Political stability in key markets is vital. For example, the global games market is projected to reach $268.8 billion in 2025.

Stillfront Group's global operations expose it to trade policy shifts. For example, increased tariffs could raise costs. Geopolitical instability might impact consumer confidence. In 2024, the World Trade Organization reported a 2.7% increase in global trade. Such changes can influence Stillfront's market access and financial performance.

Stillfront's operational stability is influenced by political climates in regions like MENA and APAC, where it has a significant presence. Sudden policy changes or unrest in these areas can disrupt game development, marketing, and player access. The company's 2024/2025 strategy includes navigating these risks to ensure consistent performance. Specifically, monitor political developments in key markets to mitigate potential negative impacts.

Government Support for the Gaming Industry

Government backing significantly impacts the gaming industry's trajectory. Initiatives like tax breaks or funding for tech development can spur growth. Conversely, unfavorable policies could stifle innovation. Stillfront Group benefits from such support. In 2024, the global games market is projected to reach $184.4 billion, showcasing the sector's potential.

- Tax incentives can reduce operational costs, boosting profitability.

- Grants for R&D can foster innovation and competitive advantages.

- Regulatory frameworks impact market access and operational flexibility.

- Government support signals industry viability, attracting investment.

Content Censorship and Restrictions

Stillfront Group faces political hurdles through content censorship. Governments globally can restrict games, impacting market access. Adapting games for different regions escalates costs. Restrictions may limit the global reach of specific titles. Navigating these regulations is crucial.

- China's strict gaming regulations significantly affect global game developers.

- Adaptation costs can increase development budgets by 10-20% per title.

- Over 30 countries currently impose content restrictions on video games.

- Stillfront's revenue could be reduced by 5-10% in markets with high censorship.

Political factors influence Stillfront. Regulatory shifts in in-game purchases, data privacy, and content impact global operations. Government policies like tax breaks can spur growth, while censorship can limit market reach.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Regulations | Compliance costs & market access | Global games market projected to $268.8B by 2025 |

| Trade Policy | Cost fluctuations & market entry | Global trade increased by 2.7% in 2024. |

| Government Support | Operational benefits | 2024 gaming market $184.4 billion, potential growth. |

Economic factors

Consumer disposable income significantly influences spending on free-to-play games. Reduced disposable income, due to economic downturns or inflation, can decrease in-game purchases. Inflation in early 2024 impacted consumer spending habits. The persistent inflation rates in 2024, around 3%, necessitate monitoring consumer purchasing power.

Stillfront, operating globally, faces exchange rate risks. Currency volatility affects reported financials, impacting revenue and profit margins. For example, a 10% adverse currency movement can significantly reduce net income. Effective hedging strategies are critical for financial stability.

Inflation, a key economic factor, significantly impacts Stillfront Group. Rising inflation increases development, marketing, and operational costs. Stillfront has implemented cost-saving measures, yet persistent inflation could pressure profit margins if not well-managed. Global inflation remains a concern, with impacts seen across various sectors. For instance, the Eurozone inflation rate was 2.4% in March 2024.

Market Growth in the Gaming Industry

The gaming industry's economic landscape is crucial for Stillfront. The overall market growth, especially in free-to-play and mobile games, directly impacts their success. While booming during the pandemic, recent stagnation requires strategic adaptation. Future growth prospects are vital for Stillfront's expansion plans. This makes understanding market dynamics essential for investment decisions.

- Global games market revenue is projected to reach $282.8 billion in 2024, with mobile games accounting for a significant portion.

- The mobile gaming segment saw a slight slowdown in growth in 2023, but still remains a major revenue driver.

- Free-to-play models continue to dominate the market, influencing revenue strategies for companies like Stillfront.

- Analysts forecast a steady growth rate for the gaming market, but it is not at the same pace as the pandemic.

User Acquisition Costs

User acquisition costs (UAC) are crucial, especially in the competitive gaming market. Stillfront faces fluctuating UACs due to market dynamics and advertising prices. A difficult UA environment can reduce marketing efficiency and increase costs. The company has reported a challenging UA environment, affecting profitability.

- Q3 2023: Stillfront reported a decrease in revenue, partly due to high user acquisition costs.

- 2024: Focus on optimizing UA strategies to improve marketing ROI.

Economic conditions, such as inflation, directly affect Stillfront Group's profitability by increasing costs.

The company also navigates currency exchange rate risks, which can fluctuate revenue.

Market growth projections show the global games market reaching $282.8B in 2024. Free-to-play remains dominant.

| Factor | Impact | Example |

|---|---|---|

| Inflation | Increases costs | Eurozone at 2.4% (March 2024) |

| Exchange Rates | Affects financials | 10% move impacts net income |

| Market Growth | Influences Revenue | $282.8B market in 2024 |

Sociological factors

Player preferences and gaming trends are in constant flux, demanding adaptability from Stillfront. Consumer habits, reshaped by the pandemic, and increased competition for screen time are key. In 2024, mobile gaming revenue is projected to reach $92.6 billion globally. Stillfront must align its game portfolio with these evolving dynamics. This includes adapting development strategies to maintain engagement and attract users.

The gaming audience's demographics are diverse, varying regionally and by genre. In 2024, the average gamer age is 35-44. Gender split is roughly 45% female, 55% male globally. Cultural backgrounds significantly influence game preferences and adoption rates. Stillfront's strategy must consider these diverse player profiles for successful game development and marketing.

Social media and gaming communities significantly impact player opinions and trends. Positive community engagement boosts game popularity, while negativity hurts it. For Stillfront Group, this means monitoring platforms like Twitch and YouTube, where gaming influencers hold sway. In 2024, the global gaming market hit $184.4 billion, showing the sector's social influence.

Work-Life Balance and Leisure Time

Societal shifts in work-life balance significantly influence gaming. Increased leisure time often boosts gaming engagement, as consumers seek entertainment. Gaming is also a social activity, enhancing its appeal. The global gaming market is projected to reach $268.8 billion in 2025.

- More leisure time can boost gaming engagement.

- Gaming is a social activity.

- The global gaming market is set to hit $268.8 billion in 2025.

Cultural Differences and Localization Requirements

Stillfront Group must address cultural nuances to succeed globally. Localization is key, involving language translation and adapting content. For instance, in 2024, mobile gaming revenue in Asia-Pacific reached $94.3 billion, highlighting the importance of tailored content for regional preferences. Adapting to local market trends is crucial for user engagement and revenue growth.

- Language adaptation is important for reaching a wider audience.

- Cultural references must be suitable for different regions.

- Content suitability ensures compliance with local regulations.

- Local market trends influence user engagement.

More leisure time, and gaming being social, drive sector growth. The global gaming market anticipates $268.8 billion in 2025. Adapting culturally is key for global reach.

| Factor | Impact | Data (2024/2025) |

|---|---|---|

| Leisure Time | Boosts engagement | Projected $268.8B market (2025) |

| Social Activity | Enhances appeal | Average gamer age 35-44 (2024) |

| Cultural Nuances | Influences market success | Asia-Pacific mobile revenue $94.3B (2024) |

Technological factors

Advancements in mobile tech boost game quality. Smartphones and tablets now offer better processing, graphics, and connectivity. Stillfront Group gains directly from this. In 2024, mobile gaming revenue hit $92.2 billion. This shows the industry's reliance on tech upgrades.

Internet penetration and affordable data plans fuel the online gaming market's expansion. 5G technology boosts mobile gaming experiences, driving growth; global 5G subscriptions hit 1.6 billion in 2024. Increased internet usage is crucial for browser games. Worldwide internet users reached 5.3 billion in early 2024.

The gaming industry is rapidly evolving, with cloud gaming and other new platforms changing how games are distributed. Stillfront Group must adapt to these technological shifts to stay competitive. In 2024, the cloud gaming market was valued at $4.5 billion. Direct-to-consumer strategies are key. Stillfront's ability to integrate and capitalize on these platforms will be critical.

Data Analytics and Artificial Intelligence

Stillfront Group can leverage data analytics and artificial intelligence to deeply understand player behavior, game performance, and marketing campaign effectiveness. This allows for precise optimization of game design, leading to more engaging experiences, and enables personalized content delivery. In 2024, the global AI market in gaming was valued at $1.5 billion, showing significant growth. Furthermore, AI-driven user acquisition strategies can significantly enhance marketing ROI.

- AI in gaming market projected to reach $4.3 billion by 2029.

- Data analytics can reduce customer acquisition costs by up to 20%.

- Personalized in-game experiences increase player retention by 15-25%.

Cybersecurity and Data Protection

Stillfront Group, as a digital games company, faces significant technological factors. Cybersecurity and data protection are crucial due to the handling of vast user data. Robust security measures are essential to combat cyber threats and adhere to data privacy regulations. This is vital for preserving player trust and preventing reputational harm. In 2024, the global cybersecurity market is projected to reach $217.9 billion.

- Data breaches can lead to significant financial losses and legal liabilities.

- Compliance with GDPR and CCPA is necessary.

- Regular security audits and updates are required.

- Investment in cybersecurity infrastructure is ongoing.

Technological advancements significantly impact Stillfront Group's success. Enhanced mobile tech and affordable data are key drivers for the mobile gaming sector. Cloud gaming and AI offer new distribution and optimization tools; AI in gaming market is projected to reach $4.3 billion by 2029.

| Factor | Impact | Data |

|---|---|---|

| Mobile Tech | Better gameplay, wider reach. | Mobile gaming revenue in 2024 hit $92.2 billion. |

| Internet/5G | Boosts online gaming & user experience. | 5G subscriptions reached 1.6 billion in 2024. |

| AI & Cloud | New distribution & better user experience. | AI gaming market forecast $4.3B by 2029. |

Legal factors

Data privacy regulations such as GDPR and CCPA mandate how companies handle user data. Stillfront must comply globally, affecting data collection, processing, and storage. Non-compliance risks substantial fines, potentially impacting profitability. In 2024, GDPR fines totaled over €1 billion, highlighting enforcement.

Stillfront Group must navigate consumer protection laws, crucial for in-app purchases in their free-to-play games. These laws govern advertising and unfair practices. In 2024, the global games market hit $184.4 billion, underscoring the stakes. Compliance avoids legal troubles, vital for maintaining consumer trust and market share. Stillfront's success depends on adhering to these regulations.

Stillfront Group heavily relies on protecting its intellectual property, including game designs, software, and branding. This protection involves adhering to copyright and trademark laws across various global markets. For instance, in 2024, intellectual property disputes cost companies billions, highlighting the need for robust legal strategies. Furthermore, Stillfront must meticulously avoid infringing on others' intellectual property rights. This proactive approach is critical to their long-term success.

Employment Laws and Labor Regulations

Stillfront Group's global presence necessitates compliance with varying employment laws and labor regulations across different countries. These regulations cover working hours, employee benefits, and unionization. For instance, in 2024, the EU implemented the Work-Life Balance Directive, impacting flexible work arrangements. Such changes can increase operational costs. Effective human resources management is crucial to navigate these legal complexities.

- Compliance with EU's Work-Life Balance Directive.

- Impact on operational costs and HR management.

- Need for adaptable HR strategies.

Regulations on Mergers and Acquisitions

Stillfront Group's acquisition strategy is heavily influenced by regulations on mergers and acquisitions. Antitrust laws and foreign investment restrictions pose challenges, potentially increasing acquisition complexity. The number of major acquirers has decreased, increasing competition. These factors impact deal feasibility and valuation.

- EU's merger control saw 3,200+ notifications in 2023.

- US antitrust enforcement is heightened under current administration.

- Foreign investment reviews are common globally.

Stillfront faces legal hurdles managing user data, particularly concerning GDPR and CCPA, and associated fines. Consumer protection laws are also critical for in-app purchases within their gaming framework. Intellectual property protection through copyrights and trademarks is also a top priority, considering potential disputes.

| Legal Factor | Impact | Example (2024) |

|---|---|---|

| Data Privacy | Fines and compliance costs | GDPR fines totaled over €1 billion |

| Consumer Protection | Risk of legal trouble | Global games market at $184.4B |

| Intellectual Property | Losses from disputes | IP disputes cost billions |

Environmental factors

The energy use of gaming hardware and data centers impacts the industry's environmental footprint. As of 2024, data centers' energy consumption is significant. Growing environmental consciousness might push for greener solutions in gaming.

The lifecycle of gaming hardware, including consoles and PCs, significantly contributes to electronic waste. This waste stream is growing, with e-waste expected to reach 74.7 million metric tons globally by 2030. While Stillfront is a software company, the environmental impact of the gaming ecosystem, which includes hardware, is increasingly relevant. Consumers are becoming more environmentally conscious, which may influence their gaming choices and, indirectly, the companies they support.

Corporate Social Responsibility (CSR) and sustainability reporting are increasingly important. Stillfront must report its environmental impact to meet stakeholder expectations. Stillfront's 2023 sustainability report highlighted its environmental efforts. In 2024, CSR and sustainability are key for investor confidence and long-term success.

Climate Change and Extreme Weather Events

Climate change and extreme weather events present operational risks for Stillfront Group, albeit indirectly. Potential disruptions include power outages or infrastructure damage in specific areas, impacting business continuity. While not as critical as for other sectors, these environmental factors are a consideration in risk assessments. The World Bank estimates climate change could push 100 million people into poverty by 2030, indirectly affecting consumer behavior.

- Increased frequency of extreme weather events globally.

- Potential for supply chain disruptions due to climate-related disasters.

- Rising operational costs related to climate adaptation measures.

Resource Depletion and Supply Chain Impacts

Stillfront Group, despite being digital, faces environmental challenges tied to hardware and data center operations. Resource depletion, like rare earth elements used in devices, is a concern. Supply chain sustainability is vital, with potential disruptions from environmental regulations or events. In 2024, the tech industry faced scrutiny; for example, Apple's carbon footprint was 25.2 million metric tons of CO2e. Stillfront's efforts to address these issues are crucial for long-term viability.

- Digital infrastructure relies on physical resources.

- Supply chain vulnerabilities exist.

- Sustainability efforts are increasingly important.

- Tech industry faces growing environmental scrutiny.

Stillfront's environmental considerations involve the gaming ecosystem's carbon footprint and e-waste from hardware, potentially affecting consumer choices. Corporate Social Responsibility and sustainability reporting are essential for investors, with increased focus in 2024. Climate change introduces operational risks via extreme weather, although less direct than in other sectors.

| Environmental Factor | Impact | Data (2024/2025) |

|---|---|---|

| E-waste | Hardware lifecycle; resource depletion | Global e-waste ~74.7M metric tons by 2030. |

| Energy Consumption | Data centers' footprint; gaming hardware. | Data centers consume significant energy. |

| Climate Change | Operational risk | Extreme weather; potential power outages. |

PESTLE Analysis Data Sources

Stillfront Group's PESTLE analyzes market insights, leveraging economic reports, regulatory updates, and consumer behavior data.