Strides Pharma Science Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Strides Pharma Science Bundle

What is included in the product

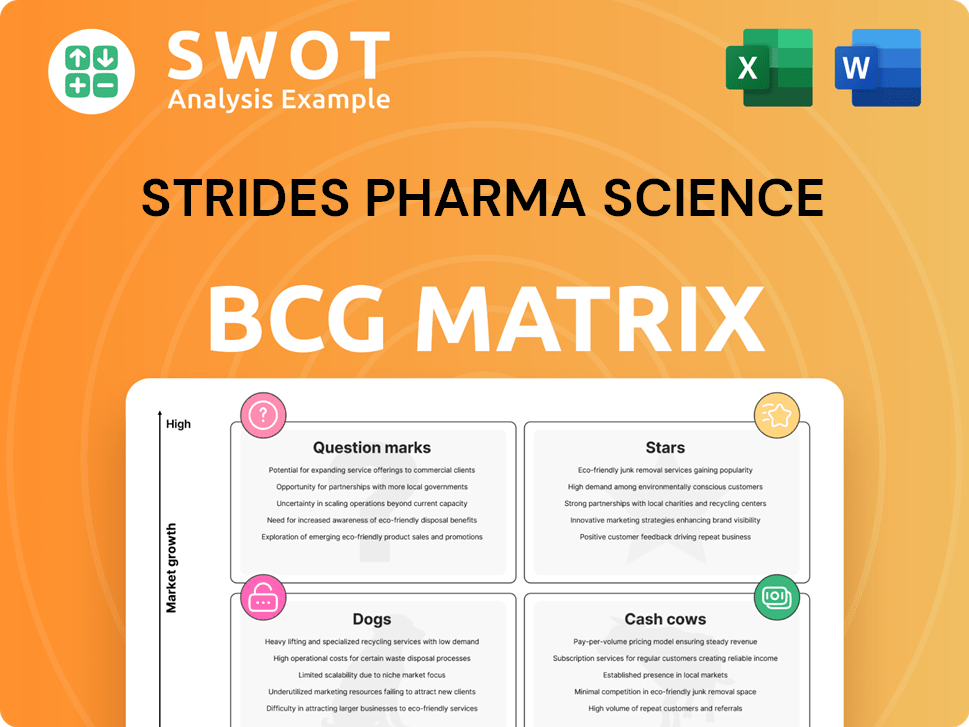

This BCG Matrix analysis outlines Strides Pharma's portfolio in four quadrants, with strategic recommendations.

Clean, distraction-free view optimized for C-level presentation of Strides' portfolio.

Full Transparency, Always

Strides Pharma Science BCG Matrix

The BCG Matrix you're viewing mirrors the final product you'll receive after purchase. This complete, ready-to-download document offers a clear strategic analysis of Strides Pharma Science, optimized for your business needs. No hidden content, this is the final, professionally crafted report.

BCG Matrix Template

Strides Pharma Science's BCG Matrix offers a snapshot of its diverse product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. Analyzing these placements is vital to understanding resource allocation and future growth potential. See which products are driving revenue and which ones need a strategic overhaul.

This is just a brief overview! Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Strides Pharma Science shines as a "Star" in the US market, achieving $75 million in Q2 FY25 revenue. This robust performance supports the FY25 outlook of $275-$290 million post-demerger. The company's high market share in this expanding sector solidifies its status. Ranking #1 in 19 US products, often without Indian competition, further boosts their star power.

Strides Pharma Science prioritizes "difficult to manufacture" pharmaceutical products, offering a strong competitive advantage. This specialized focus allows for a greater market share in specific areas. They sell these products in over 100 countries, indicating a leading position. In 2024, this strategy contributed to a revenue of $700 million, reflecting their market leadership.

Strides Pharma's "Stars" include new product launches, vital for expansion. They have a robust pipeline with over 100 approved products. The company aims to launch about 60 products in the next 36 months. Strides intends to increase the average launch size to $15-20 million, up from the previous $4-5 million.

Strong Financial Performance

Strides Pharma Science's robust financial health positions it as a "Star" in its BCG Matrix. The company demonstrated strong performance in Q3 FY25. Revenue grew by 14.6% year-over-year, and EBITDA surged by 46.9% YoY. This financial strength supports investments in high-growth areas, driving future success.

- Q3 FY25 Revenue Growth: 14.6% YoY

- Q3 FY25 EBITDA Growth: 46.9% YoY

- Strategic Product Launches: Key for market share

- Focus: Sustaining growth through strategic initiatives

ESG Leadership

Strides Pharma Science shines as an ESG leader. They scored 76/100 in S&P Global's CSA 2024, outperforming competitors. This boosts their appeal to ethical investors and bolsters their brand. In the environmental area, they reached the 87th percentile, showcasing strong sustainability efforts.

- ESG score of 76/100 in 2024.

- Environmental dimension at the 87th percentile.

- Attracts socially conscious investors.

- Enhances brand reputation.

Strides Pharma Science is a "Star" due to its strong US market presence, exemplified by $75 million in Q2 FY25 revenue.

Their focus on "difficult to manufacture" products and a robust pipeline with over 100 approved products ensures market leadership and expansion.

The company’s financial health, with 14.6% YoY revenue growth and 46.9% YoY EBITDA growth in Q3 FY25, further solidifies its "Star" status.

| Metric | Value |

|---|---|

| Q2 FY25 US Revenue | $75 million |

| Q3 FY25 Revenue Growth (YoY) | 14.6% |

| Q3 FY25 EBITDA Growth (YoY) | 46.9% |

Cash Cows

Strides Pharma's regulated markets business, primarily in the US, Europe, and Australia, is a cash cow. These regions ensure steady revenue due to strict regulations and high demand for generics. In FY24, the regulated markets contributed significantly to Strides' revenue. For instance, the US market alone accounted for a substantial portion of sales.

Strides Pharma's generics portfolio is a substantial cash cow, offering a steady revenue stream. The company boasts a diverse portfolio of over 70 generic products. In Q3 2024, Strides Pharma Science Ltd. reported a revenue of ₹1,160.24Cr. This broad portfolio ensures stable financial performance.

Strides Pharma's "In Africa for Africa" strategy targets the African market with essential medicines, generating a steady revenue stream. This segment, focusing on regulated markets, provides consistent demand, crucial for stability. In 2024, Strides saw approximately $100 million in revenue from Africa. This strategy ensures predictable cash flow, classifying it as a cash cow within the BCG matrix.

Manufacturing Capabilities

Strides Pharma Science boasts strong manufacturing capabilities, operating seven facilities across four continents, with four approved by the US FDA. This global footprint supports efficient production and high capacity utilization, key drivers for cash generation. These facilities are crucial for producing a wide range of pharmaceutical products. This operational efficiency directly contributes to its financial performance.

- Seven manufacturing facilities worldwide.

- Four US FDA-approved facilities.

- High capacity utilization.

- Efficient production processes.

Institutional Business

Strides' Institutional Business, a cash cow, serves donor-funded markets with pharmaceuticals. This segment generates stable cash flows, benefiting from long-term contracts and consistent demand. Strides has a strong operational track record, serving reputable clients. This is supported by accredited facilities. In 2024, this segment contributed significantly to overall revenue.

- Stable Revenue: Predictable cash flow from long-term contracts.

- Consistent Demand: Steady need for pharmaceuticals in donor-funded markets.

- Operational Excellence: Demonstrated track record with reputable clients.

- Low Risk: Low product concentration risks.

Strides Pharma's cash cows include regulated markets, generics, and its "In Africa for Africa" strategy, ensuring steady revenue. These segments benefit from stable demand and efficient operations. Institutional Business, with donor-funded contracts, also contributes to predictable cash flow. Manufacturing efficiency further supports financial performance.

| Cash Cow Segment | Key Features | 2024 Data Highlights |

|---|---|---|

| Regulated Markets (US, Europe, Australia) | Strict regulations, high demand. | Significant revenue contribution; US market a key driver. |

| Generics Portfolio | Diverse portfolio of over 70 products. | Q3 2024 Revenue: ₹1,160.24Cr. |

| "In Africa for Africa" | Essential medicines, steady demand. | Approx. $100 million revenue in 2024. |

Dogs

Some of Strides Pharma's older generic products may encounter price erosion due to rising competition. These products, possibly exhibiting low growth and market share, align with the 'dog' category. The company's diverse product portfolio allows it to shift focus if certain products face such pressures. In 2024, generics faced price declines, impacting profitability. Strides reported a revenue decline in specific generic segments.

In the pharmaceutical industry, capital-intensive operations can be a challenge. Some business units might need substantial investment without matching returns, potentially becoming 'dogs.' Strides Pharma's capital structure showed a gearing of 1.63x as of March 31, 2024. The total debt to PBILDT was 3.36x, indicating its financial health.

In the BCG matrix, underperforming emerging market ventures at Strides Pharma Science could be categorized as 'dogs'. These ventures would exhibit both low market share and low growth potential, potentially impacting overall profitability. Strides operates with 8 manufacturing units globally, including 6 in regulated markets.

Products with Regulatory Issues

Products encountering regulatory challenges are categorized as 'dogs' in the BCG matrix. These issues often result in low growth and reduced market share. Strides Pharma Science faces regulatory risks due to its focus on pharmaceutical formulations and injectables. The company must navigate these hurdles to improve its market position.

- In 2024, regulatory actions, including warning letters, have impacted several pharmaceutical companies.

- Strides' manufacturing facilities have faced inspections and compliance reviews.

- Compliance failures can lead to product recalls and financial penalties.

- Addressing regulatory issues is crucial for sustaining long-term growth.

Inefficiently Managed Product Lines

Inefficiently managed product lines, or "dogs," at Strides Pharma Science, have high operational costs relative to revenue. These lines drain resources without substantial returns. Strides' focus on cost optimization and maximizing sales involves a long working capital cycle. Production primarily occurs in India, with exports to overseas subsidiaries for sales in regulated, growth, and access markets.

- High operational costs impact profitability.

- Inefficiency consumes valuable resources.

- Working capital tied up in export-oriented production.

- Focus on optimizing cost and maximizing sale

Older generics facing price erosion, regulatory hurdles, and high operational costs at Strides Pharma Science are categorized as Dogs, indicating low growth and market share. These products may struggle to generate returns, consuming resources without substantial gains. In 2024, generics faced price declines and compliance issues. Strides reported revenue decline in generic segments.

| Aspect | Description | Impact |

|---|---|---|

| Price Erosion | Increased competition. | Reduced profitability in 2024. |

| Regulatory Issues | Warning letters & inspections. | Product recalls & penalties. |

| Inefficiency | High operational costs. | Resource drain. |

Question Marks

OneSource, post-demerger, is a high-growth CDMO business with lower market share. It needs major investments to expand and become a leader. In September 2023, Strides planned to integrate SSPL and OneSource to build an integrated CDMO company. Strides Pharma's revenue was about ₹3,600 crore in FY24.

Biosimilars could be Stars in Strides' BCG Matrix if they're a high-growth area. They might start with low market share, but require big investments. Strides, founded in 1990 by Mr. Arun Kumar, is known for successful business turnarounds. In 2024, the biosimilars market is estimated to reach $45B, with significant growth potential.

New therapeutic categories for Strides Pharma Science are considered "question marks" within a BCG matrix due to their high growth potential, yet uncertain prospects. This requires significant upfront investment. Strides Pharma Science, a specialty and generic drug manufacturer, focuses on niche pharmaceutical products. In 2024, the company aimed to expand its portfolio in these areas. The success will depend on market penetration and product adoption.

505(b)(2) Products

Strides Pharma Science strategically invested in 505(b)(2) products. This segment is part of their growth strategy. They aimed to relaunch 60 dormant ANDAs, targeting $400 million in generics revenue. This expansion included new areas like Control Substances Nasal Sprays.

- 505(b)(2) products allow for faster approvals.

- Focus on niche markets with fewer competitors.

- Strides aimed to leverage this for revenue growth.

- The strategy included expanding into new product types.

Strategic Acquisitions

Strategic acquisitions for Strides Pharma Science, like Amexel, fit the "Question Mark" category in a BCG Matrix. These ventures show high growth potential but face uncertain market share. They demand significant investment and effective integration to succeed. Strides Pharma Global (SPG) aims to boost collaborations in the pharmaceutical sector.

- Amexel acquisition represents a high-potential, high-investment venture.

- SPG's platform seeks to facilitate global pharmaceutical partnerships.

- Question Marks need careful management to become Stars.

Question Marks in Strides' BCG Matrix include new therapeutic areas and acquisitions. They have high growth potential but uncertain market share. These require substantial investments and strategic management to succeed.

| Category | Characteristics | Strides' Actions |

|---|---|---|

| New Therapeutics | High growth, uncertain market share | Portfolio expansion, niche focus |

| Strategic Acquisitions | High-potential ventures, high investment | Amexel acquisition, SPG collaborations |

| Investment Needs | Significant upfront investment | Aim to relaunch 60 ANDAs, $400M generics revenue |

BCG Matrix Data Sources

The Strides Pharma Science BCG Matrix is derived from financial data, market analysis, industry reports, and expert commentary for trustworthy insights.