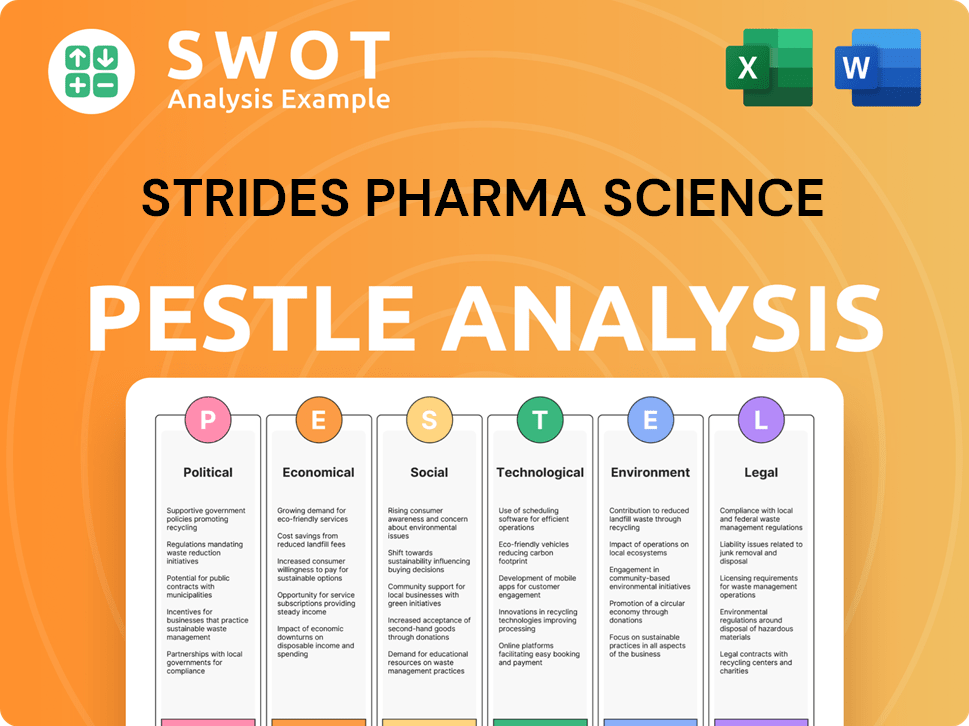

Strides Pharma Science PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Strides Pharma Science Bundle

What is included in the product

Examines the macro-environmental forces shaping Strides Pharma Science across key areas: PESTLE. The analysis supports identifying opportunities and risks.

Helps support discussions on external risk during planning sessions.

Same Document Delivered

Strides Pharma Science PESTLE Analysis

The preview is identical to the Strides Pharma Science PESTLE Analysis you'll get. This file is fully formatted and ready for immediate use.

PESTLE Analysis Template

Discover the external forces impacting Strides Pharma Science with our in-depth PESTLE Analysis. Explore the political, economic, social, technological, legal, and environmental factors at play. Understand how these forces shape the company's strategic landscape. This ready-to-use analysis offers valuable insights for investors and strategists alike. Buy the full version to gain a competitive edge and make informed decisions.

Political factors

Government regulations significantly affect Strides Pharma Science. The company must comply with drug approval processes, manufacturing standards, and pricing policies across various markets. For example, in 2024, regulatory changes in India, where Strides has a significant presence, led to adjustments in production costs. These adjustments influenced the company's profitability.

Strides Pharma Science faces political risks in regulated and emerging markets. Changes in government or trade policies can disrupt supply chains and distribution. For example, political instability in countries like Venezuela (2024) could affect operations. In 2023, global political risk was at a moderate level, but changes can be fast.

Government healthcare reforms significantly impact Strides Pharma. Changes in reimbursement policies, like those under the US Inflation Reduction Act, affect profitability. For instance, the Act's drug price negotiation could lower revenues. Healthcare spending priorities, with an estimated $4.1 trillion spent in 2024, also shape demand. Access to medicines, influenced by policies, impacts sales volumes.

International Trade Agreements and Tariffs

Strides Pharma Science's international operations are significantly influenced by global trade agreements and tariffs. For instance, the company's ability to export to the US, its largest market, could be affected by trade policies. A 2024 report indicated that the US-India trade relationship, including pharmaceuticals, was valued at over $19 billion. Changes in tariffs, like those on pharmaceutical ingredients, can directly affect Strides' manufacturing costs and pricing strategies.

- Impact on Raw Material Costs: Tariffs on imported ingredients can raise production costs.

- Market Competitiveness: Trade barriers can affect the pricing and market access of Strides' products.

- Export and Import Activities: Changes in trade policies directly influence Strides' global supply chain.

Political Influence on Drug Pricing

Political factors significantly shape drug pricing, with governments globally implementing measures to manage healthcare costs. Recent trends show increased scrutiny and legislation aimed at curbing pharmaceutical expenses. For instance, in 2024, the US Inflation Reduction Act allowed Medicare to negotiate drug prices, impacting industry revenues. These policies directly affect the profitability of companies like Strides Pharma Science.

- US Inflation Reduction Act impact on drug prices.

- Government regulations influence on revenue.

- Price control policies effect on Strides Pharma.

Political elements heavily influence Strides Pharma Science's operational landscape. Compliance with drug regulations and global trade agreements significantly impact costs and market access. Government policies, like drug price negotiations in the US, affect revenues, with the Inflation Reduction Act of 2024 having direct effects.

| Political Factor | Impact on Strides Pharma | Data/Examples (2024-2025) |

|---|---|---|

| Drug Approval Regulations | Affects product launches & market entry | Stringent requirements in India and US. |

| Trade Policies & Tariffs | Influence costs and supply chain | US-India pharma trade valued ~$19B. |

| Healthcare Reforms | Impact pricing and revenue | US Inflation Reduction Act impacts pricing. |

Economic factors

Global economic conditions significantly influence Strides Pharma Science. Inflation, such as the 3.1% US CPI in January 2024, affects operational costs. Economic growth, e.g., India's robust 7.6% GDP in Q2 FY24, boosts healthcare spending. Currency fluctuations, like the INR/USD rate, impact export revenues and profitability for the company. These factors collectively shape consumer and government healthcare expenditures.

Healthcare spending significantly impacts the pharmaceutical market. Governments and insurers' budget allocations and patient out-of-pocket expenses are key. In 2024, global healthcare spending reached approximately $10.5 trillion, with projections exceeding $11 trillion by 2025. This affects drug demand and Strides' revenue.

As an international pharmaceutical company, Strides Pharma Science faces currency exchange rate risks. These fluctuations impact the cost of importing materials and the revenue from exports. For instance, a weaker INR against the USD can increase costs. In 2024, the INR/USD exchange rate fluctuated, affecting profitability.

Inflation and Cost of Goods

Rising inflation presents a significant challenge for Strides Pharma Science, potentially increasing the costs of raw materials, manufacturing, and overall operations. This can squeeze profit margins, especially if the company cannot fully pass these increased costs to consumers or healthcare systems. The Indian inflation rate was 4.83% in April 2024, a slight increase from 4.85% in March 2024, indicating continued inflationary pressures. These pressures can affect the pricing and profitability of pharmaceutical products.

- Indian inflation rate: 4.83% (April 2024)

- Raw material cost increases can impact profit margins.

- Pricing strategies are crucial to mitigate inflation effects.

- Operational efficiency becomes more critical.

Market Competition and Pricing Pressure

The pharmaceutical market is fiercely competitive, with many companies selling similar generics. This intense competition creates pricing pressure, especially affecting companies like Strides Pharma Science. In 2024, generic drug prices decreased by about 5-7% on average. This pressure can significantly impact Strides' revenue and profitability, particularly in the generics segment.

- Generic drug price erosion can be 5-7% annually.

- Competition from numerous players.

- Pricing pressure impacts revenue.

- Focus on cost-saving measures.

Economic factors, like inflation (4.83% in India, April 2024), affect Strides Pharma's costs and pricing. Healthcare spending globally, about $10.5 trillion in 2024, is crucial for its revenue. Currency fluctuations (INR/USD) impact export profits, with generic drug price erosion around 5-7% annually.

| Economic Indicator | Impact on Strides | Data (2024) |

|---|---|---|

| Inflation | Increased costs; margin pressure | India: 4.83% (April) |

| Healthcare Spending | Revenue Driver | Global: ~$10.5T |

| Currency Fluctuations | Affects export revenue | INR/USD volatility |

Sociological factors

Changing demographics, including an aging global population, drive shifts in disease prevalence and pharmaceutical demand. The World Health Organization projects a significant rise in chronic diseases by 2030. Strides Pharma Science must adapt its portfolio to address these evolving healthcare needs, focusing on areas like geriatric care and chronic disease management. In 2024, the global market for chronic disease treatments was valued at $1.2 trillion, a sector in which Strides has opportunities.

Growing health awareness and lifestyle shifts influence demand for medicines and wellness products. Strides Pharma can capitalize on this, with the global wellness market projected to reach $7 trillion by 2025. This trend presents chances for preventative care and lifestyle disease treatments.

Sociological factors such as income levels significantly impact patient access to healthcare. In India, approximately 21.9% of the population lives below the poverty line, influencing affordability. Inadequate healthcare infrastructure, especially in rural areas, further restricts access. Social inequalities also play a role, affecting the demand for specific medicines and services. For example, in 2024, healthcare expenditure per capita was around $70, highlighting accessibility challenges.

Cultural Beliefs and Attitudes towards Medicine

Cultural beliefs significantly influence healthcare choices. Attitudes toward modern medicine and generic drugs differ globally; in India, traditional medicine coexists with modern practices. Strides Pharma Science must tailor its strategies to respect these beliefs, ensuring effective product acceptance. For example, in 2024, the Indian pharmaceutical market reached $55 billion, reflecting the importance of understanding local preferences.

- In 2024, India's generic drug market was valued at $25 billion.

- Around 60% of Indians use both traditional and modern medicine.

- Strides Pharma's revenue in FY24 was approximately $600 million.

Influence of Patient Advocacy Groups

Patient advocacy groups significantly shape the pharmaceutical landscape by boosting awareness of specific illnesses and pushing for better treatment accessibility. These groups often lobby for policy changes, directly affecting drug markets and the public's perception of pharmaceutical firms. For example, the National Organization for Rare Disorders (NORD) advocates for patients with rare diseases, influencing research priorities and regulatory pathways. Their efforts can drive demand for specialized medications and impact a company's brand.

- NORD's advocacy has influenced the FDA's orphan drug designation process, which provides incentives for developing treatments for rare diseases.

- In 2024, patient advocacy groups spent over $1 billion on lobbying efforts in the U.S. related to healthcare.

- Groups like the American Cancer Society actively support research and patient services, impacting the market for oncology drugs.

Income disparities in India affect healthcare accessibility; about 21.9% live below the poverty line. Cultural attitudes, like India's blend of traditional and modern medicine (60%), shape pharmaceutical choices. Patient advocacy, vital, influences policies and market dynamics, spending over $1 billion on lobbying in 2024.

| Factor | Impact on Strides Pharma | Data Point (2024) |

|---|---|---|

| Income Levels | Influences affordability and demand. | Healthcare spend per capita ~$70 in India. |

| Cultural Beliefs | Dictates product acceptance & market approach. | Indian pharma market value $55B; generic drugs $25B. |

| Patient Advocacy | Shapes demand, influences policy. | Advocacy groups spent $1B+ on lobbying. |

Technological factors

Strides Pharma Science benefits from tech advancements in drug discovery, development, and manufacturing. AI and machine learning accelerate drug creation, enhancing efficacy and cutting costs. For example, the global AI in drug discovery market is projected to reach $4.05B by 2029. This tech-driven approach boosts efficiency and innovation.

Strides Pharma Science is investing in advanced manufacturing tech and automation. This boosts production capacity and cuts costs. In 2024, automation helped reduce manufacturing costs by 10%. This also sped up product launches. The company's R&D spending grew to $45 million in Q4 2024, reflecting this tech focus.

Digitalization is transforming healthcare, influencing pharma. The rise of electronic health records (EHRs) and telemedicine affects how drugs are prescribed and used. In 2024, the global digital health market was valued at $280 billion. Strides Pharma Science must adapt to these tech shifts to stay competitive. This includes using digital platforms for drug monitoring.

Biotechnology and Gene Therapy

Strides Pharma Science must navigate the rapid evolution of biotechnology, especially in gene therapy and personalized medicine. These advancements are reshaping the pharmaceutical industry, creating both opportunities and challenges. To stay relevant, Strides needs to strategically invest in or partner with entities developing these technologies. Gene therapy market is projected to reach $13.4 billion by 2025, according to recent reports.

- Market for gene therapy is expected to reach $13.4 billion by 2025.

- Investment in R&D or partnerships is critical for long-term competitiveness.

Supply Chain Technology and Traceability

Technological advancements are pivotal for Strides Pharma Science's supply chain, particularly in product traceability and anti-counterfeiting measures. Effective supply chain technology ensures quality control and adherence to regulatory standards. The pharmaceutical industry invests heavily in these technologies; for example, global spending on supply chain software reached $20.9 billion in 2024. This investment is crucial for maintaining compliance and operational efficiency.

- Supply chain software market is projected to reach $35.9 billion by 2029.

- Blockchain technology is increasingly used for tracking and tracing pharmaceuticals.

- Serialization technologies are essential for preventing counterfeit drugs.

Strides Pharma Science leverages tech in drug development, including AI, with the AI in drug discovery market projected to hit $4.05 billion by 2029. The company invests heavily in manufacturing tech, leading to automation that decreased costs by 10% in 2024 and increased R&D spending to $45 million in Q4 2024. Moreover, adapting to digitalization, like electronic health records and the $280 billion digital health market in 2024, and advancing biotechnology are vital.

| Technology Aspect | Impact | Data |

|---|---|---|

| AI in Drug Discovery | Accelerates drug creation and cuts costs | Market projected to $4.05B by 2029 |

| Manufacturing Automation | Boosts production and lowers costs | Cost reduction of 10% in 2024 |

| Digital Health | Influences drug use via EHRs, telemedicine | $280B market value in 2024 |

Legal factors

Strides Pharma Science faces legal hurdles tied to drug approval and regulatory compliance. They must navigate approvals from bodies like the USFDA before launching products. Non-compliance can result in penalties. In 2024, regulatory actions impacted several pharmaceutical firms. Data indicates that regulatory hurdles significantly affect launch timelines.

Patent laws are crucial for Strides Pharma Science, safeguarding its drug formulations and technologies with exclusivity. The company heavily relies on patent expirations of innovator drugs. In 2024, the global generics market was valued at approximately $400 billion, presenting significant opportunities. This market is projected to reach $500 billion by 2027.

Strides Pharma Science, like all pharmaceutical firms, is exposed to product liability and litigation risks concerning its products' safety and effectiveness. Stringent adherence to quality control and regulatory standards is vital to minimize these risks. In 2024, the pharmaceutical industry faced over $5 billion in settlements and verdicts related to product liability. For example, a major pharmaceutical company settled a product liability lawsuit for $600 million in Q1 2024.

Antitrust Laws and Market Competition Regulations

Antitrust laws are crucial for maintaining fair market competition. Strides Pharma Science must adhere to these laws to avoid anti-competitive behaviors. Compliance includes scrutiny of pricing strategies and distribution models, which can impact market share. Failure to comply can result in hefty fines and legal battles, as seen with other pharma companies. In 2024, the U.S. Federal Trade Commission (FTC) and Department of Justice (DOJ) have increased scrutiny of pharmaceutical mergers and acquisitions.

- FTC and DOJ have blocked several pharmaceutical mergers in 2024.

- Increased focus on generic drug pricing practices.

- Potential for lawsuits if anti-competitive practices are suspected.

Labor Laws and Employment Regulations

Strides Pharma Science must adhere to diverse labor laws across its global operations, impacting employment practices. These regulations cover areas like wages, working hours, and employee benefits, varying significantly by region. Non-compliance can lead to significant financial penalties and reputational damage, as seen in cases involving similar pharmaceutical companies. For example, in 2024, labor law violations resulted in an average of $150,000 in fines for companies in the pharmaceutical sector.

- Compliance costs can constitute up to 5% of operational expenses.

- Legal disputes related to labor issues have increased by 10% in the last year.

- Companies face an average of 3-4 audits per year to ensure labor law adherence.

Legal challenges for Strides include navigating regulatory approvals and compliance with patent, antitrust, and labor laws. In 2024, the pharmaceutical industry faced over $5 billion in settlements related to product liability, underscoring the risks involved. Antitrust scrutiny has increased, with agencies blocking mergers.

| Area | Challenge | 2024 Data |

|---|---|---|

| Regulatory | Drug approval delays, compliance | Avg. 6-12 month FDA review time |

| Product Liability | Lawsuits for product safety | >$5B in settlements |

| Antitrust | Fair market competition | FTC/DOJ blocked mergers |

Environmental factors

Strides Pharma Science faces environmental challenges from its manufacturing processes. Waste disposal, emissions, and water usage are key concerns. Compliance with environmental regulations is crucial. In 2024, the pharmaceutical industry faced increased scrutiny regarding waste management and pollution control. The company must invest in sustainable practices.

Strides Pharma Science faces growing pressure to adopt environmental, social, and governance (ESG) principles. This is driven by investor demands and regulatory changes. Companies are increasingly assessed on their ESG performance. In 2024, ESG-focused investments surged globally, reflecting this trend. Strides' ESG rating directly impacts its valuation.

Climate change poses significant risks to Strides Pharma's supply chain. Extreme weather, like the 2024 floods in India, can disrupt manufacturing and distribution. Reduced water availability, crucial for drug production, is a growing concern. The World Bank estimates climate change could push 100 million people into poverty by 2030, impacting drug access.

Waste Management and Recycling

Waste management and recycling are vital for Strides Pharma Science due to environmental and regulatory demands. Proper disposal of pharmaceutical waste, including hazardous materials, is essential for compliance. Effective waste reduction and recycling programs are key to sustainability. The pharmaceutical industry faces increasing scrutiny, with environmental concerns influencing operational strategies. Strides Pharma needs to align with global standards to manage waste effectively.

- In 2024, the global pharmaceutical waste management market was valued at approximately $8.5 billion.

- Recycling rates in the pharmaceutical sector are increasing, with some companies aiming for 75% recycling of certain materials by 2025.

- Regulatory fines for improper waste disposal in the pharmaceutical industry can range from $100,000 to several million dollars.

Responsible Sourcing of Raw Materials

Responsible sourcing of raw materials is increasingly crucial for pharmaceutical companies like Strides Pharma Science. The environmental impact of suppliers is now a key consideration, influencing procurement decisions. This includes assessing the sustainability of extraction processes and supply chain practices. Companies are under pressure to ensure ethical sourcing and minimize environmental damage. In 2024, the global market for sustainable raw materials in pharmaceuticals was valued at approximately $8 billion, projected to reach $12 billion by 2025.

- Focus on sustainable sourcing reduces environmental impact.

- Demand for eco-friendly practices is rising among consumers and regulators.

- Compliance with environmental regulations is essential to avoid penalties.

- Sustainable sourcing can enhance brand reputation and investor appeal.

Strides Pharma Science navigates environmental pressures. Waste, emissions, and water usage demand attention. ESG principles and sustainable practices are vital. The company must invest in reducing its environmental footprint and aligning with global standards.

| Aspect | Details | 2024/2025 Data |

|---|---|---|

| Waste Management Market | Global value. | $8.5B (2024), projected $9.2B (2025) |

| Recycling Goals | Some companies target. | 75% recycling by 2025 (specific materials) |

| Regulatory Fines | Improper disposal costs. | $100K - millions (depending on violation) |

| Sustainable Raw Materials | Market Value | $8B (2024), projected to $12B by 2025 |

PESTLE Analysis Data Sources

Our analysis uses data from financial reports, healthcare publications, government agencies, and market research. Economic, legal, and societal trends are examined.