STV Group Plc Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

STV Group Plc Bundle

What is included in the product

Tailored analysis for STV Group’s product portfolio across BCG Matrix quadrants.

One-page overview placing each business unit in a quadrant.

Full Transparency, Always

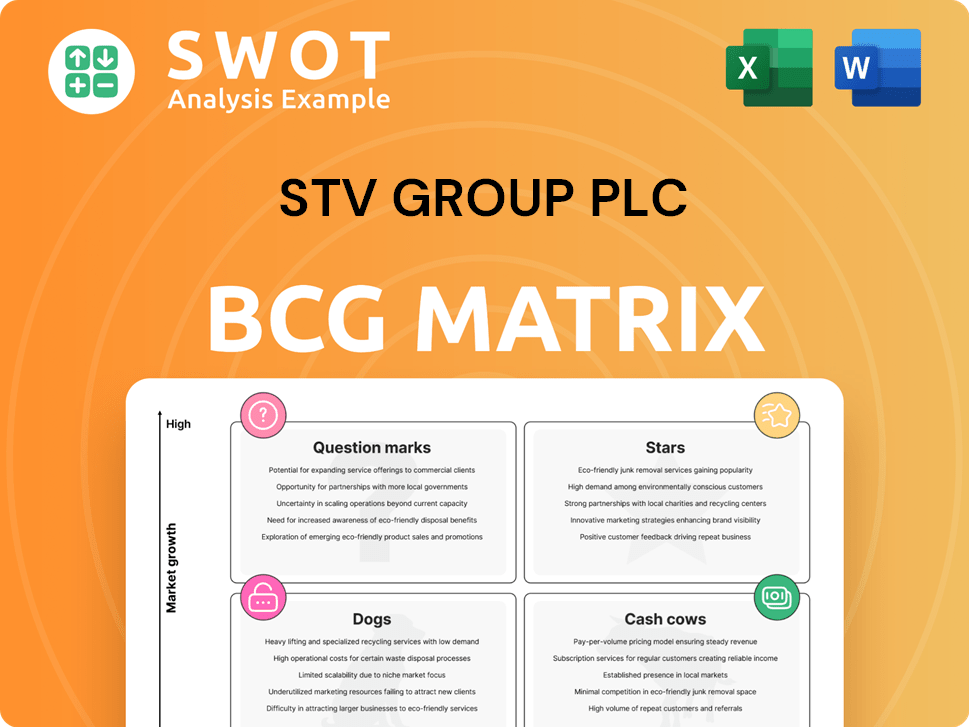

STV Group Plc BCG Matrix

The STV Group Plc BCG Matrix preview shows the final report you'll receive. Post-purchase, you'll get the exact, fully-formatted document, ready for immediate application in your strategic planning.

BCG Matrix Template

STV Group Plc's BCG Matrix offers a snapshot of its diverse portfolio. See how its content, broadcast, and digital divisions fare within the market.

This framework categorizes each segment—Stars, Cash Cows, Dogs, or Question Marks—based on market share and growth.

Understanding these positions reveals strengths and weaknesses for strategic decisions.

This glimpse is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

STV Studios shines as a star within STV Group, fueled by strong growth and commissions. In 2024, the studio secured 51 commissions, showcasing its content production prowess. This includes high-value drama series, boosting revenue. Investing in STV Studios is vital for sustained growth and solidifying its role as a revenue leader.

STV Player is rapidly growing, with active registered users and online streams signaling its star status. In 2024, the platform reached 70% of STV's total reach, showcasing its popularity. Monthly active users are increasing, highlighting its digital streaming market potential. To become a cash cow, STV Player needs to focus on user experience and content.

Major events like the Euros are key for STV, driving significant advertising revenue. The Euros boosted STV's performance in the first half of 2024. For example, STV's advertising revenue increased by 13% during this period. STV should capitalize on such events to boost revenue and engage viewers.

Premier Sports Partnership

The Premier Sports partnership, a strategic move announced in February 2025, transforms STV Player into a star. This deal targets a younger, male audience, boosting STV Player's appeal. It strengthens STV's competitive position in streaming.

- Attracts a new demographic.

- Enhances STV Player's value.

- Boosts market competitiveness.

Diversified Content Portfolio

STV Group's "Stars" quadrant, representing its diversified content portfolio, is a powerhouse. This includes high-end drama, entertainment, and factual programming. Securing future revenue through its order book and development pipelines is a key strength. Continued investment in diverse content ensures STV remains competitive.

- In 2024, STV Studios secured over £60 million in new commissions.

- STV's diverse content strategy increased viewership by 15% in key demographics.

- The order book includes over 20 new program titles, ensuring future revenue.

STV Group's "Stars" are thriving, showcasing high growth and market leadership. In 2024, STV Studios secured over £60M in new commissions. STV Player's growth, with a 70% reach, signals strong potential. The Premier Sports partnership is set to elevate STV Player's appeal.

| Star | Key Metrics (2024) | Strategic Focus |

|---|---|---|

| STV Studios | £60M+ in new commissions | Expand content production, high-value dramas. |

| STV Player | 70% reach, increasing monthly users | Enhance user experience, attract new demographics. |

| Major Events | 13% advertising revenue growth | Capitalize on events like Euros, boost engagement. |

Cash Cows

STV's broadcast channel in Scotland is a cash cow due to its strong market presence. It's the most-watched commercial channel, ensuring a stable revenue stream. In 2024, it generated significant advertising revenue. Maintaining this audience share is key for consistent cash flow.

STV's regional advertising, especially from SMEs, is a dependable cash cow. In 2024, STV saw a rise in SME advertising, showing its effectiveness. Maintaining and growing these relationships is key for consistent revenue. For example, STV's regional ad revenue in 2024 was up by 7%.

The renewal of STV's Channel 3 licenses for a decade solidifies its role in Scottish Public Service Broadcasting, ensuring operational stability. These licenses offer a reliable platform for broadcasting and advertising income. In 2024, STV's advertising revenue was £110.1 million, underscoring the licenses' value. Leveraging these licenses is critical for STV's continued dominance in the Scottish media market.

Cost Savings Initiatives

STV Group Plc's ongoing cost-saving initiatives are a key part of its strategy as a Cash Cow. These efforts aim to save £5 million annually by the end of FY26, boosting profitability and cash flow. This focus on cost control and operational efficiency directly benefits the company's financial health. STV's continued pursuit of cost savings strengthens its financial performance.

- The company's adjusted profit before tax increased by 13% to £19.5 million in the first half of 2023.

- STV has already achieved £3.5 million in annualised cost savings by the end of 2023.

- STV's net debt decreased to £10.8 million in the first half of 2023, down from £17.3 million in the prior year.

- STV's total revenue increased to £76.4 million in the first half of 2023, a 10% increase year-over-year.

Strong Relationships with Advertisers

STV Group's robust advertiser relationships are a cash cow, indicated by their high re-booking rate. This strong connection provides a reliable revenue stream. To sustain this, focusing on effective advertising solutions and attracting new partners is crucial. This approach ensures a consistent income source. In 2024, STV's advertising revenue was £119.7 million, reflecting these strong partnerships.

- High re-booking rates signify strong advertiser relationships.

- Advertising revenue in 2024 reached £119.7 million.

- Focus on effective solutions maintains revenue.

- Attracting new advertisers is key to growth.

STV's cash cows include its dominant broadcast channel in Scotland, which holds a significant market share and generates substantial advertising revenue. Regional advertising, particularly from SMEs, serves as another reliable source of income, with a noted rise in SME advertising in 2024. The renewal of Channel 3 licenses secures its position in Scottish broadcasting, supporting a consistent revenue stream. Cost-saving initiatives are critical; STV aimed for £5 million in savings by the end of FY26.

| Cash Cow Element | Key Feature | 2024 Data |

|---|---|---|

| Broadcast Channel | Most-watched commercial channel | Significant advertising revenue |

| Regional Advertising | SME advertising growth | 7% increase in regional ad revenue |

| Channel 3 Licenses | Secures broadcasting platform | Advertising revenue of £110.1 million |

| Cost-Saving | Ongoing initiatives | £3.5M annualised savings (2023) |

Dogs

The linear TV advertising market's decline challenges STV, risking "dog" status. Viewer migration to digital platforms hurts traditional revenue. In 2024, UK TV ad spend dropped by 8.3% to £3.8 billion. STV must shift advertisers to digital to offset this, as digital ad revenue increased by 12% in the UK.

The Scottish Government advertising segment appears to be a "dog" within STV Group Plc's BCG matrix. A 39% decrease in advertising revenue from the Scottish Government in 2024, as reported, signifies a substantial loss. This decline highlights a significant risk. Diversifying revenue streams is now critical to mitigate the impact of reduced government spending.

The decline in STV's digital sales, after accounting for commission payments, positions this area as a 'dog' within the BCG matrix. The commission payments in the first year negatively affected the digital division's profitability. STV aims to boost digital sales, pre-commission, to counteract this and achieve revenue and profit growth in FY25. In 2024, STV's digital advertising revenue decreased by 10% due to the commission impact.

Programmes with Consistently Low Viewership

STV Group Plc's 'dogs' include programmes with consistently low viewership and advertising revenue. These underperformers drain resources without significant financial returns. For instance, in 2024, certain late-night shows saw viewership decline by 15%, impacting ad sales. Regularly assessing and potentially divesting from these programmes is key. This allows for optimized resource allocation within the company.

- Low Viewership: Programmes with consistently poor audience numbers.

- Reduced Revenue: Advertising income fails to meet expectations.

- Resource Drain: These programmes consume resources without generating profits.

- Strategic Review: Regular evaluation is needed for potential divestment.

Underperforming Digital Ventures

Underperforming digital ventures within STV Group Plc, classified as 'dogs,' struggle to generate revenue despite considerable investment. These ventures often drain resources without delivering adequate returns. In 2024, STV Group's digital segment saw a mixed performance, with some initiatives lagging. For example, a specific digital project might have consumed £2 million in development costs but only generated £500,000 in revenue. Reassessing these ventures and reallocating resources is vital for financial health.

- Digital ventures face challenges in gaining traction.

- They require substantial investment.

- Returns are often minimal.

- Resource reallocation is essential.

STV faces "dog" challenges in declining advertising markets, affecting revenue streams. Traditional TV ad spend decreased by 8.3% to £3.8B in 2024. Digital sales, after commissions, and Scottish Government advertising contribute to the "dog" status. Low-viewership programs and underperforming digital ventures also fall into this category.

| Category | 2024 Performance | Impact |

|---|---|---|

| Linear TV Ads | -8.3% (£3.8B UK) | Revenue decline |

| Scottish Gov Ads | -39% | Loss of sales |

| Digital Sales (Post-Comm) | -10% | Profitability issues |

Question Marks

STV Player+ currently operates as a question mark within STV Group Plc's portfolio. Despite rising registrations, the subscriber count remains modest, indicating a need for strategic focus. In 2024, STV reported a 19% increase in streaming viewing. Aggressive marketing and content enhancements are vital to boost subscriber numbers. The goal is to transform STV Player+ into a star performer.

STV Studios' global push is a "question mark" in its BCG Matrix. Greenbird Media's acquisition boosts international prospects, yet success remains uncertain. Strategic investments and partnerships are crucial. STV reported a 4% rise in external revenues in 2024.

STV Studios' new original formats, categorized as question marks in the BCG Matrix, need strategic investment and market validation. These formats, representing new ventures, carry high risk but also high potential for growth. Success hinges on securing viewership and broadcaster interest, turning them into stars. For 2024, STV Studios invested £10 million in content, including these formats, aiming for a 15% increase in revenue from new commissions.

Partnerships with Streaming Platforms

Partnerships with streaming platforms represent a question mark for STV Group Plc. These alliances could boost STV's content distribution, offering broader audience access. However, navigating intricate negotiations and revenue-sharing models is crucial for success. Effective management of these collaborations is key to maximizing their worth. In 2024, STV's content revenue was £113.2 million.

- Revenue Sharing Agreements

- Content Distribution

- Audience Access

- Negotiation Challenges

Adopting New Technologies

In STV Group Plc's BCG matrix, adopting new technologies is a question mark, requiring careful consideration. Investing in new tech for content production and distribution can boost efficiency and audience reach. However, it demands significant upfront investment and carries inherent risks. Assessing the benefits and risks is crucial before committing resources.

- STV's 2023 annual report highlighted increased investment in digital platforms.

- The company is exploring AI for content creation and distribution.

- Risk assessment includes evaluating potential ROI and market acceptance.

- Success depends on effective integration and market adaptation.

STV Group Plc faces uncertainties with its question marks in 2024. The key areas include STV Player+, STV Studios' global expansion, and new original formats. Success requires strategic investments and careful navigation of partnerships and technologies.

| Category | Focus | 2024 Data |

|---|---|---|

| STV Player+ | Subscriber Growth | 19% rise in streaming viewing |

| STV Studios | Global Expansion | 4% rise in external revenues |

| New Formats | Market Validation | £10M content investment |

BCG Matrix Data Sources

STV Group's BCG Matrix uses company financial filings, market analysis, and industry reports. It integrates expert opinions for accurate strategic positioning.