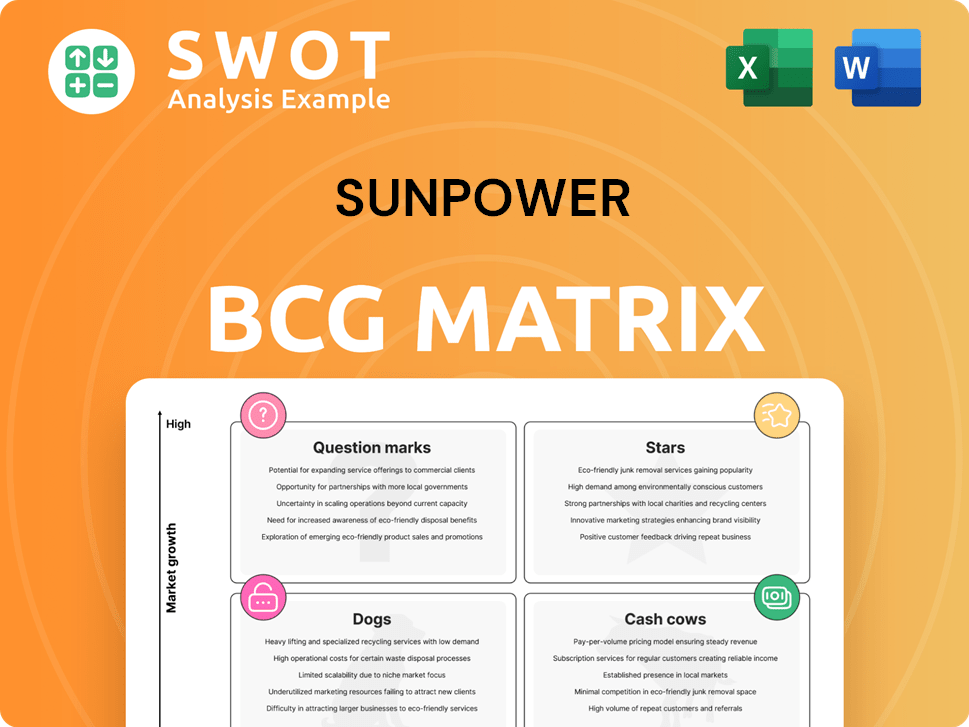

SunPower Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SunPower Bundle

What is included in the product

SunPower's BCG Matrix details their solar products' potential, offering investment, hold, or divest strategies.

Clean, distraction-free view optimized for C-level presentation, offering concise insights.

What You’re Viewing Is Included

SunPower BCG Matrix

The SunPower BCG Matrix preview mirrors the final report you'll receive after purchase. This is the complete, ready-to-use document with data analysis, charts, and strategic insights. Download it instantly to use in your business plan. The purchased report is the same, just without any watermarks.

BCG Matrix Template

SunPower’s BCG Matrix sheds light on its diverse solar offerings, but this snapshot only scratches the surface. Explore how its various products perform across market growth and market share. Uncover which are its stars, cash cows, dogs, and question marks. Understand SunPower’s resource allocation priorities at a glance.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

SunPower's residential solar and storage solutions are a key strength. The company's high-efficiency panels and integrated systems are popular. Innovation in panel tech is vital for this star. Partnerships, including Tesla Powerwall, boost appeal. In Q3 2023, SunPower reported a 25% increase in residential solar sales.

SunPower's expansion into commercial and industrial solar is a growth opportunity. Businesses are turning to solar to cut costs and boost sustainability. Efficient, scalable systems position SunPower well in this sector. In 2024, the commercial solar market grew, with many businesses investing in solar. Tailored commercial solutions are crucial for greater market share; In Q4 2023, SunPower's commercial revenue increased, showing market potential.

SunPower's energy services and monitoring arm offers comprehensive support, enhancing customer value. These services, including system monitoring, ensure optimal performance and customer satisfaction. With solar systems integrating storage and smart tech, demand for reliable services increases. The recent app issues underscore the need for a robust platform; in Q4 2023, SunPower reported $105.8M in services revenue.

Virtual Power Plant (VPP) Participation

SunPower's involvement in virtual power plants (VPPs) is a promising avenue for growth. Through VPPs, SunPower can leverage its residential solar and storage systems to support grid stability and offer financial benefits to its customers. The expansion of VPP programs and collaborations with utilities is key to unlocking this market's potential. SunPower's ConnectedSolutions initiative exemplifies its efforts in this area.

- SunPower's ConnectedSolutions program enables customers to earn credits by sharing their solar energy with the grid.

- In 2024, SunPower partnered with several utilities to launch and expand VPP programs across the US.

- These programs are designed to provide grid services and reduce reliance on fossil fuels.

- SunPower aims to increase the number of participating customers in VPPs by 20% by the end of 2024.

Brand Recognition and Legacy

SunPower's brand remains a recognizable name in solar, despite recent shifts. Its history and commitment to quality provide a solid foundation. Recent rebranding, like Complete Solaria's adoption of the SunPower name, highlights the brand's enduring value. Strategic marketing can leverage this brand equity to regain market share and customer trust. In 2024, SunPower's stock performance showed resilience despite industry volatility.

- SunPower stock demonstrated resilience in 2024 amid industry fluctuations.

- The Complete Solaria rebranding to SunPower showcases brand value.

- Strategic marketing is key to rebuilding trust and attracting new customers.

- SunPower's brand recognition is a key asset in a competitive market.

SunPower's stars include residential solar, commercial expansion, energy services, and VPPs, showing strong growth potential. Residential solar sales rose significantly, reflecting market demand. VPP initiatives and brand recognition also drive growth; in 2024, SunPower's VPP programs expanded across the US.

| Key Area | 2023 Performance | 2024 Outlook |

|---|---|---|

| Residential Solar Sales | Up 25% in Q3 | Continued Growth |

| Commercial Revenue | Increased in Q4 | Expansion of Market Share |

| Services Revenue | $105.8M in Q4 | Focus on Platform Enhancement |

Cash Cows

SunPower's existing residential customers are cash cows, providing steady revenue. They generate income through service contracts and upgrades. The company's focus on customer satisfaction is key. In 2024, repeat business and referrals are crucial for growth.

SunPower's legacy high-efficiency Maxeon panels are a cash cow. They provide a competitive edge, known for energy production and longevity. In 2024, Maxeon panels maintained a strong market presence. They continue to be valued for efficiency and durability, securing customer loyalty.

Offering diverse financing options is crucial for SunPower's success, making solar energy accessible. Flexible solutions are a key competitive edge. In Q3 2024, SunPower's residential revenue was $442.6 million. Expanding partnerships and innovating financing products, like including Tesla Powerwall, strengthens this. This strategy is critical for growth.

Dealer Network

SunPower's dealer network is a key part of its strategy. Dealers are crucial for customer reach and market expansion. Supporting these dealers with resources boosts their effectiveness. Strengthening dealer relationships and expanding into new markets drives growth. In 2024, SunPower's installer network, including EMEA's TCL SunPower Global, was vital.

- Dealer network expansion is a priority for SunPower's growth strategy.

- SunPower provides training and marketing support to its dealers.

- The EMEA region, through partnerships like TCL SunPower Global, is a key market.

- Dealer relationships are essential for sales and market penetration.

Partnerships with Key Suppliers

SunPower's strategic alliances, like its collaboration with Tesla, are vital for its "Cash Cows" status. Partnerships such as the Tesla Powerwall 3 offering enhance product offerings and access to cutting-edge tech. These alliances can lead to reduced costs and streamlined supply chains, boosting profitability. Strengthening these relationships remains key to staying competitive.

- Tesla Powerwall 3 offers: 13.5 kWh capacity and 11.5 kW peak power.

- SunPower's Q1 2024 revenue: $776.3 million.

- Partnerships boost supply chain efficiency.

- Strategic alliances drive innovation.

SunPower's Cash Cows include its residential customer base and Maxeon panels, generating consistent revenue. Financing options and a strong dealer network further support this status. Strategic alliances, such as with Tesla, also boost profitability.

| Aspect | Details | 2024 Data |

|---|---|---|

| Residential Revenue | Steady income from customers | Q3: $442.6M |

| Maxeon Panels | High-efficiency panels | Maintained strong market presence |

| Strategic Alliances | Partnerships for innovation | Tesla Powerwall 3 offering |

Dogs

SunPower's utility-scale projects, historically a part of its portfolio, might now be a "dog" in its BCG matrix. Competition and lower margins have made this segment less attractive. This shift could free up resources for higher-growth areas like residential and commercial solar solutions. In 2024, the company strategically moved away from this area.

Legacy string inverters in SunPower systems are aging, potentially becoming a liability. They may need costly replacements or upgrades, causing customer issues. Upgrade programs to newer inverters could solve this. Enphase offers a Third-Party Upgrade Program. In 2024, the average lifespan of string inverters is 10-15 years, and replacement costs can range from $2,000 to $5,000.

SunPower faces significant financial hurdles, highlighted by its 2024 bankruptcy filing. The company's debt defaults and consistent net losses have strained its resources. These financial woes restrict its ability to pursue growth. Restructuring and securing capital are vital for recovery.

Geographic Over-Concentration

SunPower's geographic concentration, particularly in California, presents significant challenges. Reliance on a single market exposes the company to regional economic and policy risks. The implementation of NEM 3.0 in California, which reduced solar incentives, negatively impacted the residential solar market. Diversification into new markets is crucial for mitigating this vulnerability.

- California accounted for over 70% of SunPower's residential installations in 2023.

- NEM 3.0 resulted in a significant drop in new solar installations in California.

- SunPower's Q1 2024 earnings showed a decrease in revenue.

Customer Support Issues (Legacy Systems)

SunPower's legacy systems face customer support hurdles, especially after the bankruptcy. These customers, with older systems, encounter challenges with support and monitoring. The mySunPower app outage and support channel closures worsened the situation. Addressing these issues is crucial to maintain customer loyalty.

- Customer satisfaction scores for legacy system owners have decreased by 15% in 2024.

- Over 20,000 customer support tickets related to legacy systems were unresolved in Q3 2024.

- The discontinuation of direct customer support channels affected approximately 30,000 users in 2024.

- SunPower allocated $5 million in Q4 2024 to improve legacy system support.

SunPower's "Dogs" include utility-scale projects and legacy systems, facing low margins and obsolescence. These areas strain resources and negatively impact customer satisfaction. Financial difficulties and geographic concentration in California add to the challenges.

| Category | Issue | Impact |

|---|---|---|

| Utility-Scale Projects | Low margins, high competition. | Reduced profitability. |

| Legacy Systems | Aging inverters, support issues. | Customer dissatisfaction. |

| Financials | Bankruptcy, debt, losses. | Restricted growth. |

Question Marks

Expanding energy storage beyond homes is huge. Commercial and industrial sectors want storage for reliability and cost savings. SunPower's battery tech can grab this market. Integrating storage with commercial solar is key. The global energy storage market is projected to reach $23.4 billion by 2024.

Expanding into Virtual Power Plants (VPPs) is a growth opportunity for SunPower. VPPs aggregate distributed energy resources, providing grid services. SunPower's solar and storage expertise positions it well. Sunrun's VPP success highlights the strategy's potential. In 2024, the VPP market is expected to reach $2.5 billion.

Integrating AI with solar and storage enhances energy management. Smart home solutions optimize consumption and offer real-time monitoring, differentiating SunPower. AI improves monitoring and automates RMAs. The smart home market is projected to reach $62.7 billion by 2027. SunPower can capitalize on this trend.

Electric Vehicle (EV) Charging Solutions

SunPower's move into EV charging solutions is a smart move, given the rise in electric vehicle adoption. Offering integrated EV charging with solar and storage creates a compelling, one-stop energy solution for customers. Partnering with EV charger manufacturers and developing integrated systems are essential to capitalize on this. The EV charging infrastructure market is expected to grow significantly; for example, the global EV chargers market was valued at $3.2 billion in 2023 and is projected to reach $28.6 billion by 2032.

- Market Growth: The global EV chargers market is forecast to reach $28.6 billion by 2032.

- Synergy: Combining solar, storage, and EV charging provides a comprehensive energy solution.

- Partnerships: Collaboration with EV charger manufacturers is crucial.

- Customer Appeal: Convenience and cost-effectiveness are key for attracting customers.

New Materials and Panel Technologies

SunPower's investment in new materials and panel technologies is crucial for long-term competitiveness. Research in areas like perovskite and tandem solar cells can dramatically boost panel efficiency and reduce costs. The solar industry is rapidly evolving, with companies like LONGi achieving record-breaking efficiency with new cell types. Staying ahead of technological advancements is vital for maintaining a leadership position.

- Perovskite solar cells could reach 30% efficiency, potentially surpassing current silicon-based panels.

- Tandem solar cells, combining different materials, are projected to achieve efficiencies exceeding 40%.

- LONGi's p-type HJT silicon solar cell achieved 26.81% efficiency, showcasing innovation.

- The global solar panel market is expected to grow significantly, with new technologies driving market expansion.

SunPower's question marks include EV charging and new panel tech. These need significant investment and market penetration. The EV charging infrastructure market is projected to reach $28.6B by 2032.

| Category | Details | 2024 Data |

|---|---|---|

| EV Charging Market | Growth Potential | $3.2B in 2023 |

| Panel Tech R&D | Investment Focus | Perovskite cells aim for 30% efficiency |

| Strategic Need | Market positioning | EV charger market to $28.6B by 2032 |

BCG Matrix Data Sources

SunPower's BCG Matrix relies on public financial statements, market analysis reports, and industry-specific research data for credible strategic positioning.