Superior Energy Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Superior Energy Services Bundle

What is included in the product

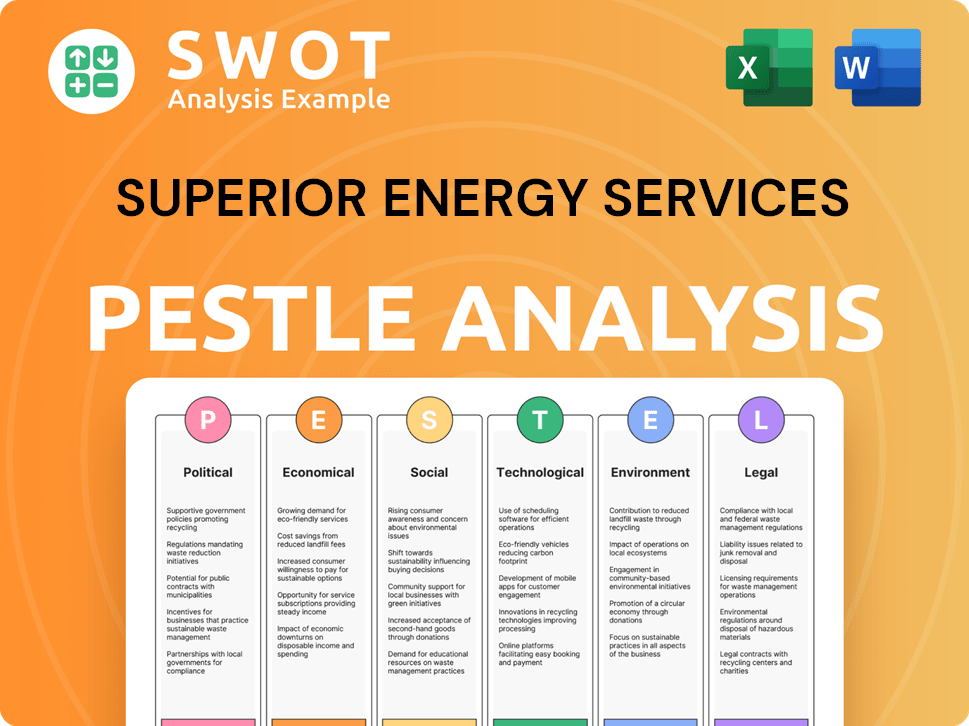

It analyzes Superior Energy Services through Political, Economic, Social, Technological, Environmental, and Legal lenses.

Provides a concise version to quickly grasp key points before crucial Superior Energy Services meetings.

What You See Is What You Get

Superior Energy Services PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured for Superior Energy Services. This PESTLE analysis explores crucial factors. You'll examine Political, Economic, Social, Technological, Legal, and Environmental impacts. The complete analysis, exactly as shown, will be ready to download after purchase.

PESTLE Analysis Template

Navigate Superior Energy Services's market with confidence! Our PESTLE Analysis reveals crucial external factors impacting its performance. We examine political, economic, social, technological, legal, and environmental forces. Understand regulatory hurdles, economic fluctuations, and technological disruptions affecting them. Spot opportunities, mitigate risks, and stay ahead of the curve. Get the full analysis now for immediate insights!

Political factors

Government regulations are crucial for Superior Energy Services. Policies on drilling permits and environmental rules affect the company. Tax law changes impact production costs. Political stability in operating regions is also a key factor. For example, in 2024, new environmental rules could increase operational costs by 10-15%.

Geopolitical events, military actions, and terrorism introduce market volatility. Superior Energy Services faces operational disruptions in international locations. Socio-political unrest and instability are key concerns. Global oil prices are influenced by political instability, impacting service demand. For instance, the 2024/2025 period saw fluctuations tied to conflicts.

Trade policies and international relations significantly impact Superior Energy Services' operations. Their global presence in roughly 47 countries means they must navigate diverse regulations. For example, in 2024, changes in trade agreements could alter the cost of imported equipment. These policies can also create operational risks.

Government Incentives and Subsidies

Government incentives and subsidies significantly affect Superior Energy Services. These policies influence the demand for oilfield services and alternative energy projects. For example, the U.S. government offers tax credits for renewable energy, impacting the energy landscape. Such incentives can boost or diminish the need for the company's services. Consider the Inflation Reduction Act of 2022, which allocated billions to clean energy.

- The Inflation Reduction Act of 2022 included $369 billion for energy security and climate change programs.

- Tax credits for renewable energy projects can decrease demand for traditional oilfield services.

- Subsidies for electric vehicles may indirectly affect oil demand.

Political Stability in Operating Regions

Superior Energy Services' operations are significantly influenced by political stability in its operating regions. Political instability can disrupt operations, raising security risks and potentially altering regulations. These changes can negatively impact the company's financial performance. For instance, political turmoil in key oil-producing nations could severely affect Superior Energy Services' projects.

- Political risks: geopolitical tensions, policy changes, and regulatory shifts.

- Operational impact: disruption, increased security costs, and compliance challenges.

- Financial implications: reduced revenue, higher expenses, and potential asset impairments.

- Mitigation strategies: diversification, risk management, and stakeholder engagement.

Government actions profoundly affect Superior Energy. Regulations, taxes, and incentives can reshape costs. Political events such as the Russia-Ukraine war heavily influenced oil prices in 2024-2025. Consider the implications of the Inflation Reduction Act.

| Political Factor | Impact | 2024/2025 Data |

|---|---|---|

| Regulations | Increased costs | Environmental rules up operational costs 10-15% (2024) |

| Geopolitics | Market volatility | Oil price fluctuations due to global conflicts (2024) |

| Incentives | Shift in demand | IRA: $369B for energy, climate. |

Economic factors

Fluctuations in oil and natural gas prices significantly impact Superior Energy Services. Low prices can curb customer spending and exploration. High prices generally boost activity. In Q1 2024, WTI crude averaged $76/barrel. Natural gas prices also influence profitability.

Worldwide economic activity is a key driver for energy demand, directly impacting Superior Energy Services. Global growth forecasts for 2024-2025 show moderate expansion, with the IMF projecting roughly 3.2% growth. A slowdown could significantly reduce demand for oilfield services. Negative economic outlooks can curb investment and activity, affecting Superior's revenue.

Superior Energy Services' operations hinge on financing availability within the oil and gas sector. A 2024 report by the Federal Reserve indicates fluctuating interest rates, impacting borrowing costs for exploration and production firms. This directly influences their budgets for services like those offered by Superior Energy. Reduced access to capital can curtail projects, affecting the company's revenue streams. Conversely, robust financing environments, like those seen in early 2024, can boost demand for services.

Inflation and Interest Rates

Inflation and interest rates significantly affect Superior Energy Services. Rising interest rates can increase borrowing costs, impacting project profitability and customer investment. Elevated inflation may also drive up operational expenses, squeezing profit margins. Supply chain issues, often linked to economic instability, further complicate matters. These factors necessitate careful financial planning and risk management.

- The U.S. inflation rate in March 2024 was 3.5%, according to the Bureau of Labor Statistics.

- The Federal Reserve maintained the federal funds rate between 5.25% and 5.50% as of May 2024.

- Supply chain disruptions continue to affect various industries, including energy services.

Competitive Pricing Pressures

The oilfield services sector is fiercely competitive, with pricing being a key differentiator. Intense rivalry can spark significant price wars, potentially eroding Superior Energy Services' financial performance. This could negatively impact its operating cash flow and profitability. In 2024, the average day rate for drilling rigs decreased by about 5-10% due to oversupply.

- Price wars are more likely during periods of oversupply.

- Lower prices can decrease profit margins.

- Competition affects revenue and investment returns.

- Market share can fluctuate due to price changes.

Economic conditions heavily affect Superior Energy Services' performance. Global growth influences energy demand; the IMF predicted 3.2% growth in 2024. Interest rate fluctuations impact borrowing costs, and inflation can increase expenses. The U.S. inflation rate was 3.5% in March 2024.

| Factor | Impact on Superior Energy Services | Relevant Data (2024) |

|---|---|---|

| Global Economic Growth | Drives energy demand | IMF projected 3.2% growth |

| Interest Rates | Influence borrowing costs for customers | Federal Reserve rate 5.25%-5.50% |

| Inflation | Affects operational costs and project profitability | U.S. inflation 3.5% (March) |

Sociological factors

Public perception significantly shapes the oil and gas industry's trajectory. Concerns about environmental impact and climate change are growing. This impacts regulatory frameworks and investment decisions. For instance, in 2024, over 60% of the public expressed worries about climate change. A negative image can lead to stricter regulations and operational constraints, affecting companies like Superior Energy Services.

Superior Energy Services relies on skilled labor. The oilfield services sector faces potential labor shortages. In 2024, the industry saw increased competition for experienced workers. Labor costs rose, affecting operational efficiency. High employee turnover rates pose a challenge.

Superior Energy Services' success hinges on strong community ties. A company's social license to operate is vital. Community concerns about environmental effects, safety, and jobs affect support and regulations. For instance, Shell's 2023 report highlights community engagement as a key risk factor. Positive community relations reduce operational risks, and promote long-term sustainability.

Health and Safety Standards and Culture

Health and safety regulations significantly influence Superior Energy Services' operations and expenses. The industry's and regulatory bodies' focus on safety mandates rigorous practices, impacting project timelines and budgets. Superior's safety performance directly affects its competitiveness and reputation. A robust safety culture is essential to minimize operational risks and ensure worker well-being. In 2024, the oil and gas industry saw a 10% increase in safety-related training costs due to stricter regulatory demands.

- Regulatory compliance costs are expected to increase by 15% in 2025.

- Superior's injury rate improved by 8% in 2024 due to enhanced safety protocols.

- Employee surveys show a 90% satisfaction rate with the company's safety measures in 2024.

Changing Energy Consumption Patterns

Societal shifts significantly impact energy consumption patterns, directly affecting Superior Energy Services. Growing consumer preference for fuel efficiency and renewable energy sources like solar and wind is reshaping demand. This trend potentially reduces long-term reliance on oil and natural gas, impacting the services Superior Energy Services provides.

- In 2024, global renewable energy capacity is projected to increase by over 30%.

- Electric vehicle sales continue to surge, with a 35% increase in 2023.

- Consumer spending on green energy products is expected to reach $1 trillion by 2025.

Societal values strongly affect energy consumption. Growing demand for fuel efficiency and renewable energy shapes the market. Superior Energy faces reduced reliance on oil and gas services. This impacts future strategies.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Consumer Preference | Demand shift towards renewables. | Renewable energy capacity up 30% (2024). EV sales +35% (2023). |

| Public Opinion | Environmental impact scrutiny. | Over 60% concerned about climate change (2024). |

| Community Relations | Support, regulations impact. | Shell cites community engagement as key risk. |

Technological factors

Technological advancements in oil and gas exploration, production, and consumption significantly impact the demand for oilfield services. Innovations like advanced drilling techniques and automation are changing service requirements. For example, in 2024, the adoption of digital technologies in the oil and gas sector increased operational efficiency by 15%. These changes influence Superior Energy Services' service portfolio and market positioning.

Superior Energy Services' competitive edge hinges on its capacity to innovate and integrate new technologies. Specifically, advancements in 'rigless' services, coiled tubing, and pressure control are vital. In 2024, the company invested $35 million in R&D, showing its dedication to staying ahead. This technological prowess directly impacts its market share and profitability, with a projected 8% increase in revenue from new tech by late 2025.

Automation and digitalization are transforming oilfield operations, enhancing efficiency and cutting costs. For instance, in 2024, the adoption of digital solutions led to a 15% reduction in operational expenses for some energy companies. Superior Energy Services must embrace these technologies to stay competitive.

Technology Related to Environmental Performance

Technological advancements significantly impact environmental performance. Superior Energy Services must leverage technologies like advanced containment and waste management. The market for environmental remediation technologies is growing, with an estimated value of $18.8 billion in 2024. Superior's services directly address these needs.

- Containment services are crucial for preventing spills, with containment system sales reaching $2.5 billion in 2024.

- Site cleanup technologies are vital, with the global market expected to reach $25 billion by 2025.

Cybersecurity Risks

As Superior Energy Services integrates technology, cybersecurity risks escalate. Cyber threats can disrupt services and compromise data. Data breaches in the energy sector rose by 40% in 2024. The average cost of a data breach in the US energy sector is $4.8 million. Protecting against these threats is essential.

- Data breaches in the energy sector rose by 40% in 2024.

- The average cost of a data breach in the US energy sector is $4.8 million.

Technological factors heavily influence Superior Energy Services' operations, market position, and profitability. Investments in new technologies, like the 2024 R&D investment of $35 million, directly affect revenue, with an expected 8% increase by late 2025. Automation and digital solutions cut costs.

| Technology Aspect | Impact | Data (2024) |

|---|---|---|

| Digitalization Adoption | Increased efficiency | 15% efficiency gain |

| Cybersecurity Risks | Service disruption | 40% rise in breaches |

| Environmental Tech | Market growth | $18.8B market value |

Legal factors

Superior Energy Services faces stringent compliance with oil and gas regulations. These include laws on drilling, production, and transportation, both nationally and internationally. In 2024, the global oil and gas regulations saw updates, affecting operational costs. For example, the US Environmental Protection Agency (EPA) finalized regulations on methane emissions. These regulatory shifts can significantly impact the company's operational strategies and financial planning.

Superior Energy Services faces stringent environmental laws. Regulations on emissions, waste, and spill remediation are critical. Compliance costs and potential liabilities can be substantial. The EPA's 2024 budget allocated billions for environmental enforcement. Increased regulations could impact operational expenses significantly.

Worker health and safety regulations are paramount for Superior Energy Services, given the high-risk nature of oilfield operations. Adherence to these rules is a must to prevent accidents and ensure worker well-being. A strong safety record is crucial, as it protects the workforce and reduces potential liabilities. For example, in 2024, the industry saw a 15% increase in safety incidents due to non-compliance, highlighting the importance of strict adherence.

Trade and Export Control Laws

Superior Energy Services, operating globally, must comply with trade and export control laws. These regulations impact the movement of equipment and services across international borders. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) enforces export controls. Changes to these laws, like updates to the Export Administration Regulations (EAR), can create operational challenges.

- BIS implemented new export controls on specific technologies to Russia and Belarus in 2024.

- The EAR regulations are constantly evolving, with updates occurring several times a year.

- Companies face penalties for non-compliance, including fines and restrictions on exports.

Contractual and Litigation Risks

Superior Energy Services faces contractual and litigation risks tied to its operations. These risks include claims for personal injury, property damage, or environmental incidents. The legal landscape for these claims and the potential for substantial judgments are critical legal factors. For instance, in 2024, the oil and gas industry saw a 15% increase in environmental litigation cases. Understanding these legal obligations is crucial.

- Claims may include personal injury, property damage, or environmental incidents.

- The potential for large judgments is a significant concern.

- Oil and gas industry saw a 15% increase in environmental litigation cases in 2024.

Legal factors significantly influence Superior Energy Services' operations, covering compliance with regulations across drilling, production, and transportation, affecting costs. Environmental laws pose substantial risks through emissions, waste management, and potential liabilities, with increased enforcement. Furthermore, trade and export controls impact international operations, alongside risks from contracts, litigation, and potential environmental claims.

| Legal Aspect | Impact | Data |

|---|---|---|

| Regulations Compliance | High operational costs | US EPA's 2024 budget allocated billions for environmental enforcement |

| Environmental Laws | Increased Liabilities | 2024: The industry saw a 15% increase in environmental litigation |

| Trade and Export Control | Operational Challenges | BIS implemented new export controls in 2024 |

Environmental factors

Stringent environmental regulations significantly affect Superior Energy Services, especially regarding emissions, waste, and spill response. Compliance requires substantial investment in technologies and processes. Recent data shows that environmental compliance costs have increased by 15% in the oil and gas sector. Superior must adapt to maintain operations.

Growing climate change worries push for less fossil fuels. Policies like carbon pricing and emissions caps are emerging. The transition affects oil/gas demand, maybe raising costs. For instance, the EU's ETS saw carbon prices hit over €100/ton in 2024, influencing energy firms.

Oilfield services inherently pose environmental risks, including spills and ecosystem impacts. Superior Energy Services must minimize its footprint. In 2024, the global oil and gas industry faced over $1 billion in environmental fines. Addressing these issues is essential for operational and financial sustainability.

Waste Management and Disposal

Superior Energy Services must adhere to stringent regulations regarding waste management. Proper handling and disposal of hazardous substances are critical, with environmental impact assessments playing a key role. In 2024, the global waste management market was valued at approximately $2.1 trillion, indicating the industry's significance. Superior's waste management practices face ongoing scrutiny to ensure compliance and minimize environmental impact.

- Compliance with regulations is essential to avoid penalties.

- Focus on reducing waste generation and promoting recycling.

- Investment in sustainable waste management technologies.

- Regular audits and monitoring of waste disposal practices.

Site Remediation and Reclamation

Superior Energy Services faces environmental liabilities, including site remediation and reclamation. Regulations mandate restoring land after operations, potentially incurring significant costs. Historical operations may lead to substantial financial burdens for environmental cleanup. For instance, the US EPA's Superfund program costs billions annually.

- Remediation costs can vary widely, from thousands to millions per site.

- Companies must comply with federal and state environmental laws.

- Failure to comply can result in significant fines and legal action.

- Proper planning for these costs is crucial for financial stability.

Environmental factors heavily impact Superior Energy Services. Stricter regulations raise compliance expenses and operational adaptations. Climate concerns and carbon pricing, with the EU ETS exceeding €100/ton, influence demand.

Oilfield risks necessitate strong waste and spill management, avoiding substantial fines. Companies face liabilities for site cleanup, impacting finances significantly. In 2024, environmental fines in the oil/gas industry exceeded $1B.

| Regulation Area | Impact | Financial Data (2024) |

|---|---|---|

| Emissions Compliance | Investment in tech & processes | Compliance cost rise: 15% in oil/gas |

| Carbon Pricing | Potential cost increase/demand shift | EU ETS carbon price: Over €100/ton |

| Waste Management | Stringent handling and disposal | Waste mngmt market: $2.1T globally |

PESTLE Analysis Data Sources

The analysis uses data from energy sector reports, government statistics, and financial publications to cover key areas.