Superior Energy Services SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Superior Energy Services Bundle

What is included in the product

Analyzes Superior Energy Services’s competitive position through key internal and external factors

Simplifies complex analyses with a ready-to-use framework.

What You See Is What You Get

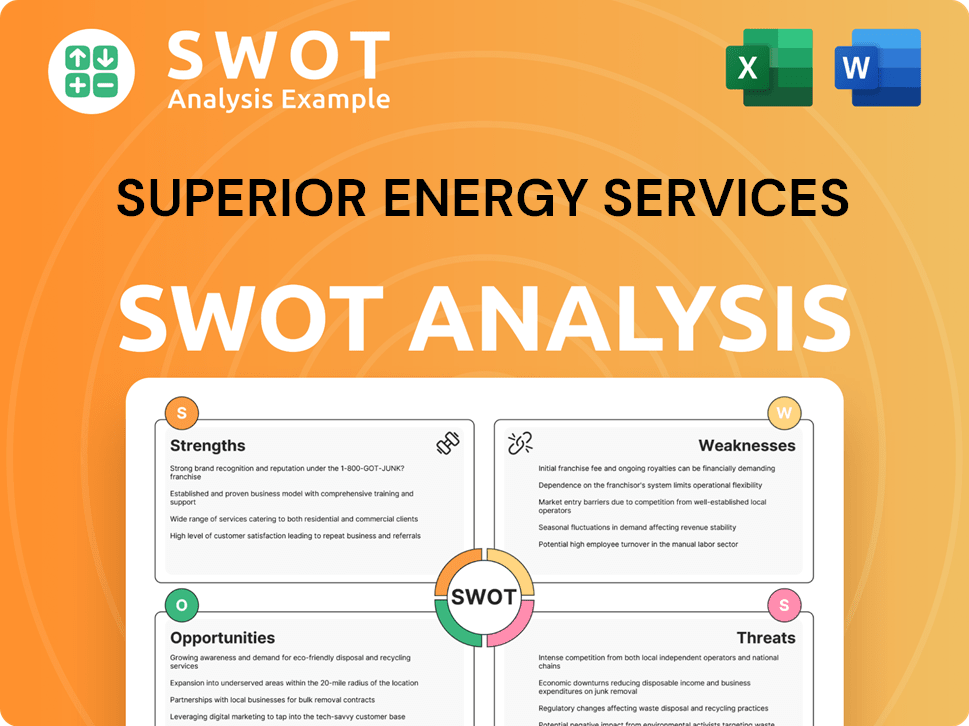

Superior Energy Services SWOT Analysis

You're looking at the real Superior Energy Services SWOT analysis! The document you see now is exactly what you’ll receive after purchase.

Get immediate access to the complete, in-depth report. All the SWOT insights are already within.

No changes, just the full, professional-quality analysis awaiting download.

Purchase today to unlock this document and its valuable insights.

SWOT Analysis Template

Superior Energy Services faces both opportunities and hurdles, but navigating them requires a deeper understanding. This snippet touches upon core aspects—yet it's just a glimpse of the full picture. Want to unlock a detailed, editable breakdown of the company’s position?

Purchase the complete SWOT analysis and get a dual-format package: a detailed Word report and a high-level Excel matrix. Built for clarity, speed, and strategic action.

Strengths

Superior Energy Services' strength lies in its diversified service portfolio. It provides specialized oilfield services and equipment across the entire well lifecycle, from drilling to abandonment. This broad scope helps to spread risk. For example, in 2024, diversified firms showed more stable revenues compared to those focused on a single service.

Superior Energy Services benefits from a robust presence in vital North American shale plays. This includes key areas like the Permian Basin and the U.S. Gulf Coast. This strategic positioning offers access to active markets and established client relationships. In 2024, the Permian Basin's oil production reached approximately 6 million barrels per day. This solid base supports sustained operational success.

Superior Energy Services excels in production-focused services. This strategic focus on production, intervention, workover, and abandonment offers a stable revenue stream. In 2024, the global market for these services was estimated at $45 billion. This approach is less volatile than new drilling services, benefiting from consistent demand. The company's focus aligns with the industry's shift towards maximizing existing assets.

Technological Capabilities and Innovation

Superior Energy Services demonstrates strengths in technological capabilities and innovation. The company uses advanced tools like SiteCatalyst, Power BI, and Azure SQL, highlighting a tech-driven approach. This technological integration supports operational efficiency and data analysis. They also launched innovative products, such as RestoreCem, which shows their dedication to product development. This focus on technology and innovation positions them well in the market.

Strategic Acquisitions to Enhance Offerings

Superior Energy Services has strategically acquired companies to broaden its service offerings. This includes firms like Rival Downhole Tools, which enhances their technology in downhole drilling. Such acquisitions strengthen their market position and open new opportunities. In 2024, acquisitions represented a significant part of growth.

- Rival Downhole Tools acquisition improved technological capabilities.

- This strategy helps to tap into new markets.

- Acquisitions contributed substantially to revenue growth in 2024.

Superior Energy Services' strengths encompass its diversified services, vital North American presence, and focus on production-focused services. Their technological capabilities are advanced with recent tech-driven integration for operational efficiency. The company also expands through strategic acquisitions, as shown by Rival Downhole Tools.

| Strength | Details | 2024/2025 Data |

|---|---|---|

| Diversified Services | Offers broad oilfield services | Stable revenues. |

| Strategic Presence | Key North American shale plays. | Permian Basin production approx. 6M barrels/day. |

| Production Focus | Production & abandonment services | Global market estimated at $45B. |

Weaknesses

Superior Energy Services faces challenges due to oil and gas price swings. Lower prices cut exploration and production spending. This impacts demand for their services, affecting revenue. In 2024, oil prices fluctuated, showing this vulnerability. This volatility can lead to financial instability.

Superior Energy Services faces vulnerabilities due to global market and economic conditions. Inflation, interest rates, and supply chain issues pose financial risks. Geopolitical uncertainties further complicate operations. Operating internationally exposes them to country-specific challenges. For instance, in 2024, supply chain disruptions increased operational costs by 7%.

The oilfield services market is highly competitive. Superior Energy Services contends with giants like Schlumberger and Halliburton. Smaller firms specializing in niche services also pose a challenge. For instance, Halliburton reported revenue of $5.6 billion in Q1 2024.

Potential Negative Impact of Rig Count Shifts

Changes in rig operations, like shifting from completion to drilling in the U.S. Gulf of Mexico, can hurt Superior Energy Services. This operational shift can affect their revenue mix and profit margins. They are vulnerable to changes in customer activities. This can lead to financial instability.

- U.S. Gulf of Mexico rig count: 2024 saw fluctuations, impacting service demand.

- Shift impact: Drilling-focused activities may reduce demand for completion services.

- Margin pressure: Changes could lead to lower-margin service mixes.

Integration Risks from Acquisitions

Integration challenges pose a significant weakness for Superior Energy Services, especially following acquisitions like Rival Downhole Tools. Combining different operational structures and corporate cultures can be difficult. Failure to integrate effectively can lead to financial losses and operational inefficiencies. According to a 2024 study, 70-90% of mergers and acquisitions fail to achieve their projected synergies.

- Operational disruptions are common during integration.

- Cultural clashes can lead to employee attrition.

- Technology integration can be complex and costly.

- Synergy realization may take longer than anticipated.

Superior Energy Services struggles with volatile oil and gas prices and fluctuating market conditions, as seen in the 2024 price swings. Competition from giants and smaller firms intensifies market pressures. Additionally, integration issues, like after Rival Downhole Tools acquisition, bring operational challenges.

| Weakness | Description | Impact |

|---|---|---|

| Market Volatility | Oil and gas price fluctuations and economic changes. | Financial instability and reduced demand for services. |

| Intense Competition | Competition with large and niche firms. | Pressure on margins and market share. |

| Integration Challenges | Difficulties merging operations post-acquisition. | Operational inefficiencies and potential financial losses. |

Opportunities

The escalating global energy demand, fueled by urbanization and industrialization in emerging economies, provides Superior Energy Services with avenues for expansion. This surge translates to more exploration and production projects, benefiting oilfield service providers. In 2024, global energy consumption is projected to increase by 2%, with Asia leading the growth. This creates substantial opportunities for companies that can meet the rising demand efficiently.

Significant opportunities exist by embracing tech and digital transformation. Superior Energy Services can boost efficiency and cut costs using IoT, AI, and data analytics. For example, the global oil and gas IoT market is projected to reach $44.4 billion by 2025. This growth highlights the potential for innovative solutions. These advancements can offer customers new, data-driven services.

Superior Energy Services can capitalize on the redevelopment of aging oil and gas reservoirs. There's a growing need to boost production from existing, older fields. This plays directly into Superior's strengths in intervention and production services. The global market for these services is projected to reach $45 billion by 2025.

Expansion in Renewable and Lower Carbon Energy Services

Superior Energy Services could tap into the expanding renewable and lower-carbon energy markets. This could involve using current infrastructure or extending services to support renewable projects. Companies like Baker Hughes and Schlumberger are already active in this space. The global renewable energy market is projected to reach $1.977 trillion by 2030.

- Market growth: The global renewable energy market is expected to reach $1.977 trillion by 2030.

- Industry involvement: Companies like Baker Hughes and Schlumberger are active in renewable energy.

- Service expansion: Opportunities exist for services related to lower-carbon fuels like CNG and hydrogen.

Potential for Further Strategic Acquisitions and Partnerships

Superior Energy Services may pursue strategic acquisitions to boost shareholder value. This could broaden their services, expand geographically, and improve tech. For example, in 2024, the oil and gas sector saw a 10% increase in M&A activity. This indicates potential for growth via acquisitions.

- Increased market share through acquiring competitors.

- Access to new technologies or specialized services.

- Enhanced geographic footprint and customer base.

- Improved operational efficiencies and cost synergies.

Superior Energy Services can leverage growing energy demands. This is amplified by tech advancements, projected at $44.4B by 2025. Expansion into renewable markets, valued at $1.977T by 2030, and strategic M&A are viable pathways.

| Opportunity | Description | 2024/2025 Data |

|---|---|---|

| Market Growth | Capitalize on increasing energy demands. | Global energy consumption projected +2% in 2024. |

| Tech Integration | Utilize IoT, AI, and data analytics to enhance efficiency and services. | Oil & Gas IoT market projected to reach $44.4B by 2025. |

| Strategic Actions | Expand operations through acquisitions and market penetration. | Oil & Gas sector M&A activity increased by 10% in 2024. |

Threats

The growing emphasis on renewable energy and sustainability presents a significant challenge. Reduced investment in oil and gas exploration is expected. In 2024, renewable energy investments hit $366 billion globally. This trend could decrease demand for Superior Energy Services' services.

Stringent environmental regulations pose a threat, potentially hiking Superior Energy Services' operational costs. Compliance with evolving rules for oil and gas activities is costly. These regulations might limit operational flexibility, affecting project timelines. For instance, in 2024, the EPA proposed stricter methane emission standards. This could reduce demand for some services.

Oil and gas E&P companies' capital spending significantly impacts Superior Energy Services. Reduced investments due to market changes or strategic shifts pose a direct threat. In 2024, capital expenditures in the oil and gas sector are projected to be around $300 billion, a slight increase from 2023's $280 billion, according to the Energy Information Administration (EIA).

Supply Chain Disruptions and Increased Costs

Supply chain disruptions pose a significant threat to Superior Energy Services, potentially impacting profitability. Material shortages and rising costs of raw materials, labor, and energy can hinder efficient service delivery. According to the U.S. Bureau of Labor Statistics, the Producer Price Index for oil and gas extraction rose by 6.7% in 2024, reflecting increased input costs. These factors could lead to project delays and reduced margins.

- Increased input costs could squeeze profit margins.

- Supply chain issues may lead to project delays.

- Material shortages could limit service capacity.

Geopolitical Risks and Instability

Geopolitical risks and instability pose significant threats to Superior Energy Services, potentially disrupting its international operations. These uncertainties can affect demand for its services and expose the company to political and economic risks. For instance, political instability in key oil-producing regions could lead to supply chain disruptions. The Russia-Ukraine conflict, ongoing since 2022, has already impacted energy markets globally.

- Increased operational costs due to security measures.

- Potential for asset nationalization or expropriation.

- Fluctuations in currency exchange rates.

- Difficulty in securing contracts and projects.

Superior Energy Services faces threats from renewable energy trends, as global investments hit $366B in 2024, potentially lowering demand for their services. Stringent environmental regulations increase operational costs and limit flexibility, impacting project timelines, exemplified by the EPA's stricter methane standards proposed in 2024. Geopolitical instability and supply chain issues, which increased the Producer Price Index by 6.7% in 2024, also pose significant risks, affecting international operations and profitability.

| Threats | Impact | 2024 Data |

|---|---|---|

| Renewable Energy Shift | Decreased demand | $366B in investments |

| Environmental Regulations | Increased costs/limited flexibility | EPA proposed methane standards |

| Geopolitical/Supply Chain | Disrupted operations | PPI for oil/gas +6.7% |

SWOT Analysis Data Sources

This SWOT analysis uses financial reports, market analysis, and expert assessments, ensuring reliable, data-driven insights for strategic clarity.