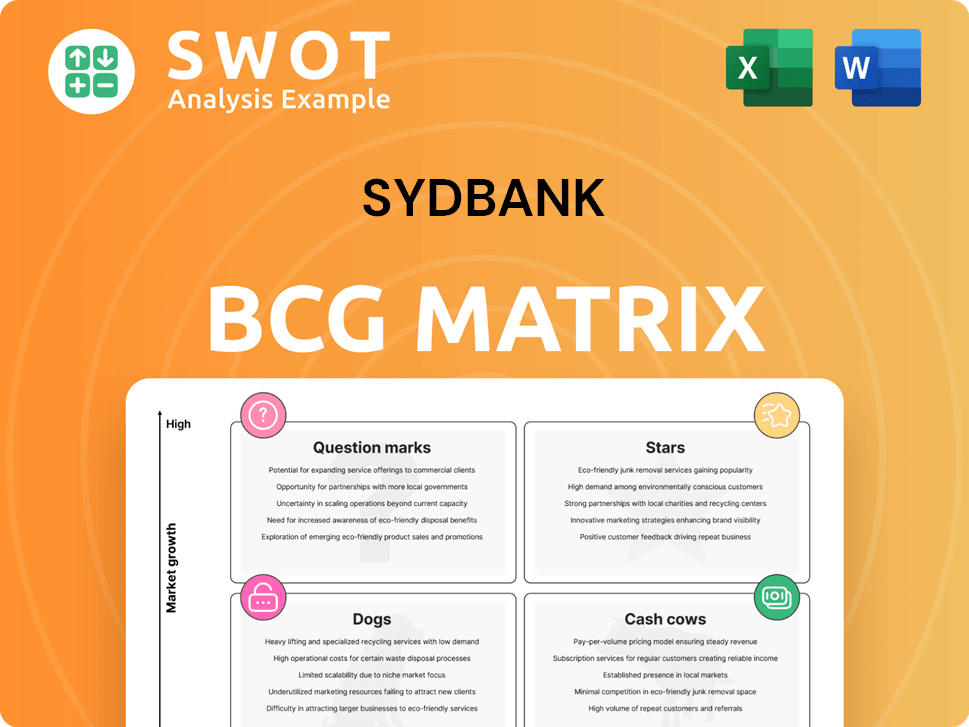

Sydbank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sydbank Bundle

What is included in the product

Tailored analysis for Sydbank's product portfolio, across all BCG Matrix quadrants.

Sydbank BCG Matrix helps streamline portfolio discussions.

Delivered as Shown

Sydbank BCG Matrix

The Sydbank BCG Matrix you see is the complete document you receive after purchase. It's a fully functional, ready-to-use strategic analysis tool, prepped for immediate integration into your planning processes.

BCG Matrix Template

Sydbank's BCG Matrix sheds light on its product portfolio's potential. Stars shine with high growth, while Cash Cows provide steady profits. Dogs struggle, and Question Marks need careful evaluation. This snapshot only scratches the surface of Sydbank's strategic landscape. Get the full BCG Matrix to unlock detailed analyses and actionable recommendations!

Stars

Sydbank's 2024 core earnings hit a record DKK 7,227 million, fueled by capital management and investment activity. This solid financial performance highlights their strength in crucial business segments. The bank's focus on savings and investments contributed to this success. Sustaining this strong earnings trend is vital for Sydbank.

Sydbank's business volume is expanding, evident from the 11% increase in bank loans and advances, reaching DKK 82.5 billion in 2024. This growth highlights the bank's ability to meet customer lending needs effectively. The focus on value-added customer advice has fueled this expansion, boosting loan volumes. This suggests a strong market position and customer loyalty.

Sydbank's Q3 2024 results showcased a remarkable 21.7% return on equity, a leading figure in the Nordic banking arena. This financial performance underscores the bank's proficiency in leveraging shareholder equity for profit generation. The bank's forecast of over 15% return on equity for its next strategic phase is a testament to its financial health.

Strategic Share Buyback

Sydbank's share buyback, a strategic move within its BCG matrix framework, involved repurchasing shares worth DKK 1,350 million. This action demonstrates confidence in the bank's financial stability and growth potential. Such buybacks often aim to boost shareholder value by improving key financial metrics.

- Share buyback programs enhance Earnings Per Share (EPS).

- The move signals strong financial health and confidence.

- It can make the company more appealing to investors.

- Buybacks optimize capital structure.

Sustainability Initiatives

Sydbank actively pursues sustainability, aiming for a positive environmental and social impact. The bank has set five key sustainability targets, including a DKK 10 billion goal for green finance by 2027. These initiatives are crucial for attracting investors and enhancing its reputation in 2024. Focusing on ESG factors is central to Sydbank’s strategy.

- DKK 10 billion green finance target by 2027.

- Integration of ESG factors into core operations.

- Supports various sustainability initiatives.

Sydbank, as a Star, shows high growth and market share. Its strong financial performance and expanding business volume support this. The bank's high return on equity further solidifies its Star status.

| Aspect | Details | Impact |

|---|---|---|

| Growth | 11% increase in loans in 2024 | Positive |

| Market Share | Strong in Nordic banking | Positive |

| Financials | 21.7% Return on Equity (Q3 2024) | Strong |

Cash Cows

Retail and corporate banking are Sydbank's cash cows, generating 88.8% of its income. This segment offers a reliable revenue stream. Focusing on customer relationships is key for sustained profitability. Sydbank's 2024 performance shows a strong reliance on this area for stability.

Sydbank's robust market presence in Denmark, boasting 54 branches, and a smaller footprint in Germany with 3 branches, solidifies its position. This extensive network enables efficient customer service and sustained profitability. Focusing on the optimization and upkeep of these branches is crucial.

Sydbank's robust financial health is evident in its strong capital base. The bank's capital ratio reached 21.4% by late 2024, with a CET1 ratio of 17.8%. This solid foundation ensures stability, allowing the bank to navigate economic challenges effectively. Consequently, Sydbank can distribute profits via dividends and share buybacks.

High Customer Satisfaction

Sydbank prioritizes high customer satisfaction to secure its "Cash Cow" status. The bank aims to be in the top 3 in customer satisfaction among Denmark's largest banks. This focus boosts loyalty, ensuring steady income. They achieve this through excellent service and personalized banking. In 2024, Sydbank's customer satisfaction scores were closely watched for these reasons.

- Customer retention rates are a key metric.

- Personalized services drive loyalty and repeat business.

- Focus on customer service is a priority.

- Stable income stream comes from loyal customers.

Experienced Leadership

Following Karen Frøsig's mid-2024 departure, Mark Luscombe has ensured Sydbank's continued positive development. The leadership transition has been smooth, maintaining operational stability. The board chairman is pleased with the bank's trajectory. This continuity is crucial for maintaining its cash cow status.

- 2024 net profit reached DKK 1,042 million, a 13% increase.

- Return on equity rose to 11.1% in 2024.

- Customer satisfaction scores remained high.

- Luscombe's strategy focuses on digital transformation.

Sydbank's retail and corporate banking, as cash cows, supply dependable income, representing 88.8% of its income in 2024. Their solid market presence, with 54 branches in Denmark and 3 in Germany, strengthens this position. Strong capital, like the 21.4% capital ratio by late 2024, supports financial stability.

| Metric | 2024 Value | Notes |

|---|---|---|

| Net Profit | DKK 1,042M | Up 13% from previous year |

| Return on Equity | 11.1% | Increased from the previous year |

| Capital Ratio | 21.4% | Solid base for stability |

Dogs

Sydbank's Dogs category highlights its limited international reach, concentrating mainly on Danish and Northern German markets. This geographic concentration exposes Sydbank to regional economic risks. In 2024, Denmark's GDP growth was approximately 1.6%, while Germany's hovered around 0.3%, signaling potential vulnerabilities. Expanding internationally could spread risk.

Sydbank's net interest income is heavily influenced by the Danish central bank's interest rate decisions. The June 2024 rate cut caused a DKK 79 million decrease in net interest income. This dependence highlights the need for Sydbank to diversify its revenue sources. Focusing on non-interest income could stabilize earnings.

Sydbank's 2024 profit suffered due to increased impairment charges, a key "Dogs" characteristic in the BCG matrix. These charges rose significantly, by DKK 622 million compared to 2023. The total expense from these charges was DKK 595 million. DKK 446 million related to Better Energy's restructuring. Managing credit risk, thus minimizing impairment, is vital for Sydbank's financial health.

Potential Economic Slowdown

Sydbank's 2025 outlook faces uncertainty, influenced by market and economic factors. Denmark's economy is projected to grow moderately. A slowdown could hurt lending and profits; in 2024, Danish GDP growth was around 1.2%. This impacts profitability.

- Uncertainty in 2025.

- Moderate Danish growth.

- Slowdown impacts profits.

- 2024 GDP at 1.2%.

Rising Costs

Sydbank's "Dogs" category reflects challenges, including rising expenses. In 2024, the bank saw a 6% increase in costs, impacting core earnings. To combat this, Sydbank is prioritizing efficiency. Improved cost control is critical for profitability.

- Cost Increase: 6% rise in 2024.

- Strategic Focus: Enhance efficiency.

- Key Goal: Improve cost control.

Sydbank's "Dogs" show limited international presence and regional economic risks. The bank's profitability in 2024 was hurt by increased impairment charges and rising costs. A 6% cost increase was seen in 2024, emphasizing the need for efficiency.

| Aspect | 2024 Data | Impact |

|---|---|---|

| GDP Growth (Denmark) | 1.2% | Moderate, affects lending |

| Cost Increase | 6% | Impacts core earnings |

| Impairment Charges | Increased by DKK 622M | Reduced profit |

Question Marks

Sydbank's strategy leverages digitalization and AI to boost efficiency and customer service. Investments in these technologies could unlock growth and sharpen its competitive edge. The bank is focused on digital tools to increase customer value while cutting costs. In 2024, digital banking adoption rose, with 70% of customers using online services.

Sydbank aims to boost wealth management funds, signaling asset management expansion. This area offers strong growth, potentially boosting profitability. In 2024, the wealth management sector saw a 7% increase. Customer focus remains crucial for success.

Sydbank is embedding Environmental, Social, and Governance (ESG) factors into its operations. This approach aims to draw in socially conscious investors, potentially opening new business avenues. The bank has set a green finance target of DKK 10 billion by 2027. Promoting green finance strengthens Sydbank’s reputation.

New Lending Opportunities

Sydbank's agreement with the EIB to provide up to €400 million for Danish Mid-Caps is a major opportunity. This allows Sydbank to offer more favorable financing terms. Managing this new loan portfolio effectively is key to success. This initiative aligns with the bank's strategic goals for growth.

- €400 million financing available for Danish Mid-Caps.

- Improved financing terms for clients.

- Focus on effective loan portfolio management.

- Strategic alignment with growth objectives.

Strategic Partnerships

Sydbank strategically partners to boost its corporate services, exemplified by its collaboration with Swedbank in Denmark. These alliances open doors to new markets and specialized knowledge. Identifying and utilizing strategic partnerships can significantly foster both growth and innovation. Such moves are crucial for Sydbank's competitive edge. These partnerships are pivotal to Sydbank's strategic initiatives.

- In 2023, Swedbank reported a net profit of SEK 27.4 billion, showcasing the financial strength of its partnerships.

- Sydbank's partnerships aim to increase its market share, which was approximately 5% in Denmark in 2024.

- Strategic partnerships are vital in the evolving financial landscape of 2024, with fintech collaborations on the rise.

- These alliances enable Sydbank to offer more comprehensive services, crucial in a competitive market.

Question Marks represent business units with low market share in high-growth markets, like new fintech ventures. Sydbank must decide whether to invest in or divest these units. These require careful evaluation of their growth potential and resource needs. They can either become Stars or become Dogs.

| Category | Description | Sydbank Example |

|---|---|---|

| Market Growth | High (e.g., Fintech) | Expansion into digital payment solutions |

| Market Share | Low | New wealth management services |

| Strategic Decisions | Invest, divest, or hold | Considering further digital banking services |

BCG Matrix Data Sources

The Sydbank BCG Matrix utilizes comprehensive data from financial statements, market analyses, industry reports, and expert opinions for insightful quadrant assessments.