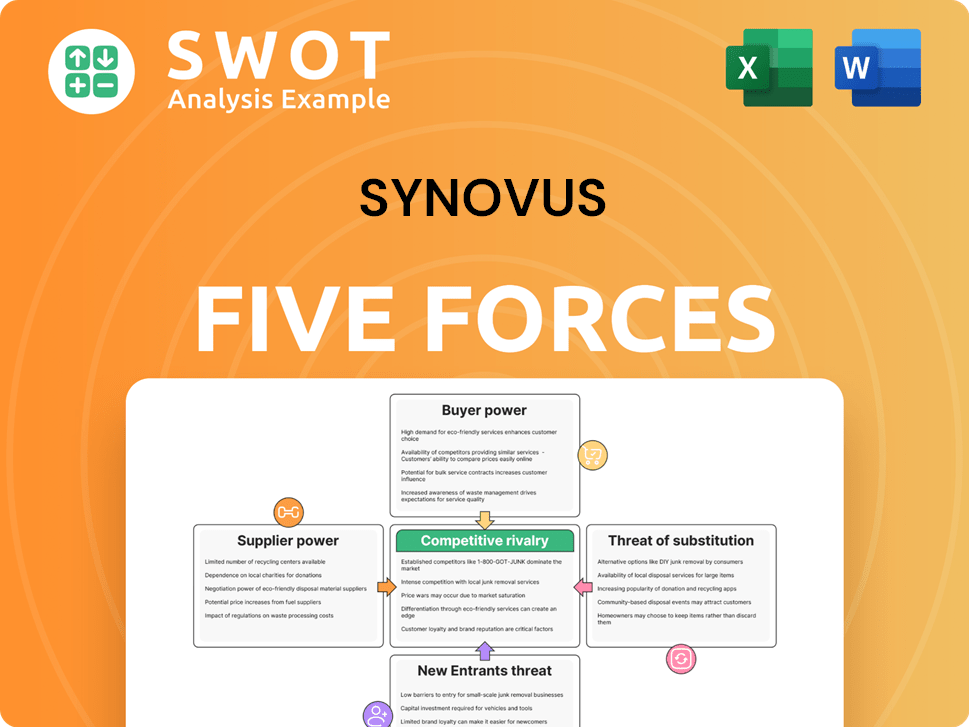

Synovus Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synovus Bundle

What is included in the product

Tailored exclusively for Synovus, analyzing its position within its competitive landscape.

Customize pressure levels based on new data or evolving market trends.

Preview the Actual Deliverable

Synovus Porter's Five Forces Analysis

This is the complete Porter's Five Forces analysis of Synovus. The detailed analysis you see here is the very same document you'll receive immediately after your purchase is complete. It's fully formatted and ready for your instant use and review. No hidden content or additional steps, this is your deliverable!

Porter's Five Forces Analysis Template

Synovus faces competitive pressures from various angles, including established rivals and the evolving financial landscape. Buyer power, driven by customer choices and loyalty, significantly impacts Synovus's market position. Understanding the threat of new entrants, particularly fintech companies, is crucial for sustained success. Analyzing substitute products, such as online banking, reveals evolving competitive dynamics.

Our full Porter's Five Forces report goes deeper—offering a data-driven framework to understand Synovus's real business risks and market opportunities.

Suppliers Bargaining Power

FinTech competition intensifies, offering alternative banking technologies. This rise reduces Synovus's dependence on traditional suppliers. Suppliers face pressure to provide competitive pricing and innovative solutions. The market saw over $100 billion in FinTech investments in 2024, fueling this shift. To remain relevant, suppliers must adapt.

Synovus depends heavily on technology suppliers for its digital banking infrastructure, which is essential for operations. The dependability and availability of these systems are vital for customer service and financial transactions. This dependence can give tech suppliers significant bargaining power, especially if they offer unique or critical services. For instance, in 2024, banks spent an average of 35% of their IT budget on external vendors.

Data service providers are essential for financial institutions due to the increasing need for advanced data analytics and robust security measures. These suppliers wield significant bargaining power, especially considering the stringent compliance requirements and the constant threat of cyberattacks. For instance, in 2024, the cybersecurity market is projected to reach $262.4 billion, reflecting the high demand for these services. The necessity for data protection further amplifies this power, as financial institutions rely heavily on these providers to safeguard sensitive information.

Specialized banking software vendors

Synovus relies heavily on core banking systems and specialized software, making these vendors crucial to its operations. The limited number of vendors offering such sophisticated solutions significantly boosts their bargaining power. This situation means Synovus could face considerable challenges and expenses if it decides to switch providers, due to the complexity and high costs associated with such transitions.

- In 2024, the global banking software market was estimated at $76 billion, with a few major players dominating.

- Switching core banking systems can cost banks millions and take several years to implement.

- Specialized software vendors often charge premium prices due to the critical nature of their products.

- The concentration of vendors allows them to dictate terms, impacting Synovus’s cost structure.

Economic conditions influence

Economic conditions significantly influence supplier dynamics, especially during downturns. Suppliers may become more flexible in negotiations to maintain business relationships. This shift allows Synovus to potentially secure more favorable terms and pricing agreements. For example, in 2024, the Federal Reserve's actions influenced borrowing costs, impacting supplier pricing strategies.

- Economic downturns increase supplier competition.

- Suppliers may offer discounts to retain clients.

- Synovus can negotiate better deals.

- Market conditions impact pricing.

Synovus faces supplier power challenges due to tech dependence and market concentration. Core banking and software vendors hold significant power, especially given the high switching costs; in 2024, switching core systems cost millions. Economic conditions also play a role, influencing negotiation dynamics.

| Supplier Type | Impact on Synovus | 2024 Data |

|---|---|---|

| Tech Suppliers | High dependency for digital infrastructure | Banks spent ~35% IT budget on vendors. |

| Data Service Providers | Critical for analytics and security | Cybersecurity market projected to $262.4B. |

| Core Banking/Software | High bargaining power | Global banking software market $76B. |

Customers Bargaining Power

Customers of Synovus have many choices because switching banks is simple. With online and mobile banking, access to different financial institutions has become easier. This ease of switching makes Synovus work hard to offer good rates and services to keep customers. For instance, in 2024, the mobile banking user rate increased by 15%.

Customers of Synovus are notably sensitive to interest rates and fees. They are likely to switch to banks providing more attractive terms. This sensitivity compels Synovus to balance profitability with customer satisfaction. In 2024, the Federal Reserve's actions significantly impacted interest rates, affecting customer behavior. To retain deposits and loan business, Synovus must offer competitive rates.

Customers increasingly demand personalized financial advice and tailored solutions. Banks unable to meet these expectations face the risk of customer attrition. Synovus's community bank model is designed to provide personalized services. For 2024, Synovus reported a customer satisfaction score of 85% due to personalized services. This focus helps retain customers.

Loan product competition intense

The loan market is intensely competitive, giving customers significant bargaining power. Borrowers can easily compare offers from various institutions, driving down rates and terms. Synovus faces pressure to provide attractive loan products to stay competitive. This impacts profitability as they must offer competitive deals.

- In 2024, the average interest rate on a 60-month new car loan was 6.62%.

- Customers can compare loan rates through online platforms.

- Synovus's net interest margin was 3.08% in 2023.

- Competition forces Synovus to manage costs.

Wealth management alternatives

Customers in wealth management have significant bargaining power due to numerous alternatives. High-net-worth individuals can choose from independent advisors and robo-advisors. These options provide services similar to traditional banks like Synovus. Synovus must highlight its value proposition to retain clients, especially in a competitive market.

- Independent advisors manage roughly $7 trillion in assets.

- Robo-advisors manage over $1 trillion.

- Synovus's wealth management services are a key revenue stream.

- Client retention rates are crucial for profitability.

Synovus customers have strong bargaining power. They can easily switch banks and compare rates, increasing their influence.

Competitive pressures force Synovus to offer attractive terms on loans and deposits to retain customers. This impacts profitability due to rate sensitivity and the availability of alternatives.

Wealth management clients have numerous options. To compete, Synovus must highlight its value.

| Customer Behavior | Impact on Synovus | 2024 Data |

|---|---|---|

| Rate Sensitivity | Pressure on margins | Average auto loan rate: 6.62% |

| Ease of Switching | Need for competitive offers | Mobile banking user increase: 15% |

| Demand for personalization | Need for tailored services | Customer satisfaction: 85% |

Rivalry Among Competitors

Synovus faces fierce competition in the Southeastern U.S. banking market. The region sees strong competition from national and regional banks. This rivalry impacts pricing and service strategies. In 2024, several banks, like Truist and Regions, are key competitors. This competitive landscape could affect Synovus' profitability.

FinTech companies are significantly disrupting traditional banking. They provide innovative services, frequently at lower prices, intensifying competition. For instance, the FinTech market is projected to reach $324 billion by 2026. Synovus needs to adapt to compete effectively.

Banks actively optimize branch networks to cut costs, a trend Synovus must navigate. This competitive pressure pushes Synovus to streamline operations. The challenge involves balancing cost reductions with maintaining customer service. In 2024, many banks closed branches, so Synovus needs a strategic approach. They must adapt to changing consumer behaviors.

Mergers and acquisitions common

The banking sector sees frequent mergers and acquisitions, intensifying competition. Synovus, like other banks, must evaluate strategic partnerships or acquisitions. These moves are critical to boost its competitive standing. In 2024, the total value of announced bank mergers and acquisitions was over $20 billion.

- Consolidation is a key trend in the banking industry.

- Synovus needs to adapt to survive.

- Partnerships can improve market position.

- Acquisitions can expand market share.

Digital banking capabilities crucial

Digital banking capabilities are now essential for attracting and retaining customers. Banks that fail to provide user-friendly and feature-rich digital platforms risk losing customers to competitors. Synovus must prioritize investments in its digital infrastructure to stay competitive. According to a 2024 survey, 70% of banking customers prefer digital banking for everyday transactions.

- Customer Expectations: Customers increasingly expect seamless digital experiences.

- Market Share Risk: Lagging in technology can lead to significant market share loss.

- Investment Priority: Synovus must enhance digital offerings to remain competitive.

- Data Point: Digital banking usage has increased by 20% since 2020.

Competitive rivalry is intense in the Southeastern banking sector where Synovus operates. Banks are aggressively competing on pricing, services, and digital offerings to gain market share. This pressure forces Synovus to continuously innovate and adapt. In 2024, the banking sector saw over $20 billion in mergers, intensifying competition.

| Aspect | Description | Data |

|---|---|---|

| Market Competition | High intensity due to numerous national and regional banks. | Truist, Regions, FinTechs. |

| Digital Banking | Critical for customer retention and acquisition. | 70% customers prefer digital banking. |

| Mergers & Acquisitions | Consolidation increases competitive pressure. | $20B+ in 2024. |

SSubstitutes Threaten

Online-only banks, offering services sans physical branches, pose a threat. They lure customers with lower fees and higher interest rates. Synovus, like other traditional banks, must enhance its digital offerings. In 2024, digital banking users grew, with mobile banking transactions up by 20%.

Credit unions pose a threat to Synovus, offering comparable financial services. These institutions often prioritize member benefits, translating into lower fees and potentially better interest rates. In 2024, credit unions held over $2 trillion in assets, demonstrating their significant market presence. Synovus counters this threat by highlighting its community bank model, focusing on local engagement and personalized customer service.

Peer-to-peer lending platforms, like LendingClub, pose a threat to traditional lenders like Synovus by offering alternative financing. These platforms often provide quicker loan approvals and more flexible terms, attracting borrowers. In 2024, the P2P lending market was valued at approximately $2.4 billion. Synovus needs to innovate and adapt to remain competitive in this evolving financial landscape.

Payment apps gain traction

The rise of mobile payment apps poses a threat. Platforms like PayPal and Venmo are increasingly used for transactions. This shift could impact Synovus's traditional payment methods, potentially affecting revenue. To stay competitive, Synovus needs to integrate these platforms.

- In 2024, mobile payment transactions reached $1.5 trillion.

- Venmo reported 85 million active users in 2024.

- PayPal processed $354 billion in payments in Q4 2024.

- Synovus's Q4 2024 revenue was $650 million.

Alternative investments expand

The rise of alternative investments presents a threat to Synovus. Real estate and cryptocurrencies are attracting investors. These options can pull funds from traditional bank deposits, affecting Synovus's core business. To stay competitive, Synovus needs to provide appealing investment choices.

- Real estate investment grew by 8.7% in 2024.

- Cryptocurrency market capitalization reached $2.6 trillion in December 2024.

- Synovus's total deposits were $48.9 billion at the end of 2024.

- The shift to alternatives could impact Synovus's deposit base.

Alternative investments such as real estate and cryptocurrency attract investors, potentially diverting funds from traditional bank deposits, thus impacting Synovus. In 2024, real estate investment grew by 8.7%, and the cryptocurrency market reached $2.6 trillion in capitalization. To compete, Synovus must offer appealing investment options.

| Threat | Impact | 2024 Data |

|---|---|---|

| Alternative Investments | Diversion of Funds | Real Estate Growth: 8.7%Cryptocurrency Market Cap: $2.6T |

| Synovus Response | Offer Appealing Investments | Total Deposits: $48.9B |

| Strategic Need | Adapt and Innovate | Q4 Revenue: $650M |

Entrants Threaten

The banking sector is heavily regulated, posing a significant challenge for new entrants. Starting a new bank demands substantial capital and a team with deep compliance knowledge. These regulatory requirements, including those set by the Federal Reserve and FDIC, significantly reduce the likelihood of new competitors entering the market. In 2024, the average cost to establish a new bank could easily exceed $20 million, highlighting the financial barrier.

Building a strong brand reputation requires significant time and financial investment. Customers tend to trust and prefer established banks that have a solid history. Synovus leverages its long-standing presence and strong community ties to its advantage. As of 2024, Synovus's brand value is estimated to be in the billions, reflecting its market position.

New banks face a significant hurdle: substantial technology investment. Building digital banking platforms and robust cybersecurity requires considerable upfront capital. These costs include software, hardware, and IT staff, representing a major barrier to entry. For example, in 2024, cybersecurity spending by financial institutions reached $18.5 billion, highlighting the ongoing investment needed.

Economies of scale favor incumbents

Established banks, like Synovus, hold a significant advantage due to economies of scale. These banks can distribute their operational costs, such as technology and marketing, across a vast customer base, making them more efficient. New entrants often find it challenging to match the pricing and operational efficiency of these established institutions. This makes it difficult for new competitors to gain a foothold in the market.

- Synovus's efficiency ratio (operating expenses/revenue) in 2023 was around 58%, reflecting their cost management.

- New banks typically have higher initial costs, impacting their profitability.

- Larger banks can offer more competitive interest rates on loans and savings.

- Economies of scale also apply to risk management and compliance.

Access to capital is challenging

The banking industry faces a substantial barrier from new competitors due to the difficulty in securing capital. Launching a new bank requires significant financial resources, making it a challenging endeavor. Investors typically favor established banks with a history of success and profitability. This preference significantly reduces the likelihood of new banks entering the market.

- Startup costs for a new bank can run into the millions, covering regulatory compliance, technology infrastructure, and initial operating expenses.

- Established banks often have lower funding costs due to their access to a wider range of funding sources.

- The FDIC reported total assets of $23.7 trillion for all U.S. banks in Q4 2023, highlighting the scale of existing institutions.

The banking sector's high barriers to entry significantly limit new competitors. Regulatory hurdles and substantial capital requirements make it tough to launch a new bank. Existing institutions, like Synovus, benefit from brand strength, technology advantages, and economies of scale.

| Factor | Impact on New Entrants | 2024 Data Points |

|---|---|---|

| Regulatory Compliance | High costs and complexity | Compliance costs can exceed $5M. |

| Capital Requirements | Substantial financial investment | New banks need over $20M to start. |

| Brand Reputation | Time and investment needed | Synovus's brand value in billions. |

Porter's Five Forces Analysis Data Sources

The Synovus analysis uses annual reports, financial databases, and industry news from reputable sources for data. This helps to assess competitive forces and inform strategy.