Synovus PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synovus Bundle

What is included in the product

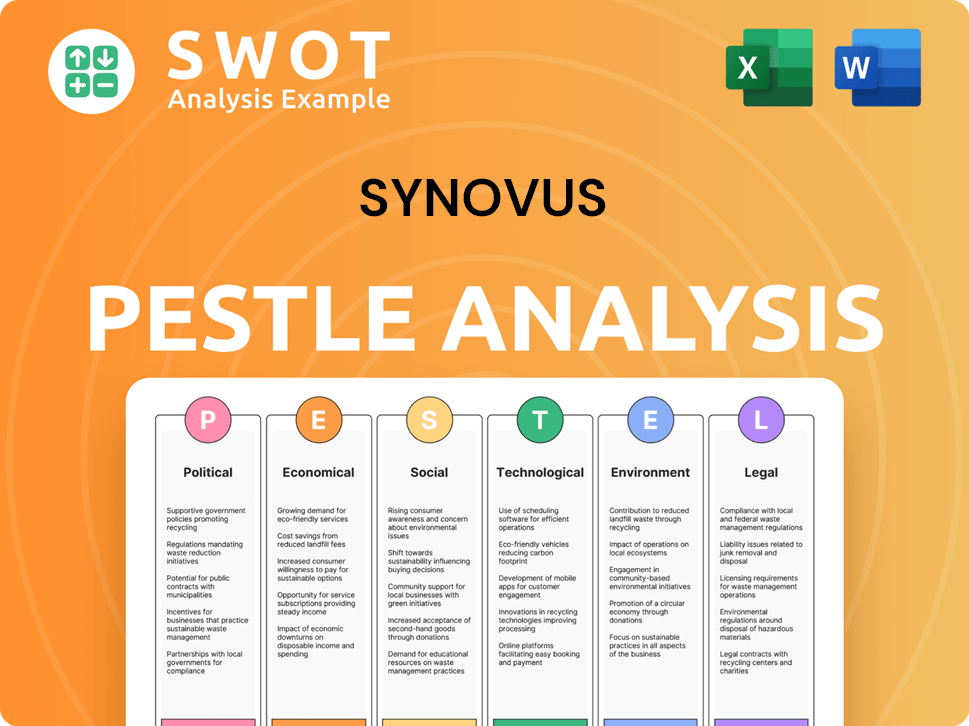

Evaluates Synovus's external environment through six factors: Political, Economic, Social, Technological, Environmental, and Legal.

Allows users to modify or add notes specific to their own context, region, or business line.

What You See Is What You Get

Synovus PESTLE Analysis

Preview the Synovus PESTLE Analysis now. The document you see is the final product.

You'll download the exact file—fully formatted and ready to use.

PESTLE Analysis Template

Uncover the forces impacting Synovus's future with our detailed PESTLE analysis. We dissect the political, economic, social, technological, legal, and environmental factors affecting their operations. This comprehensive review is perfect for strategic planning and market research. Understand risks, identify opportunities, and make informed decisions. Download the full analysis and gain a competitive edge now!

Political factors

Synovus faces a dynamic political landscape, particularly in the Southeastern U.S. where it primarily operates. Regulatory changes at both federal and state levels can influence its operations and compliance costs. For instance, the Federal Reserve's actions, like interest rate adjustments, directly affect Synovus's profitability. In 2024, the bank closely watched developments in banking regulations and the political environment to adapt its strategies.

Political stability across Alabama, Florida, Georgia, South Carolina, and Tennessee is crucial for Synovus. These states' stable political climates generally boost business confidence, supporting lending and investment. For example, Georgia's strong economic growth, with a 3.2% GDP increase in Q4 2024, reflects this stability. Stable policies encourage predictable business conditions, benefiting Synovus's operations.

Broader trade policies and geopolitical events, though seemingly remote, influence Synovus's operations. Trade tensions and conflicts can create uncertainty for businesses, affecting loan demand. Input costs might rise for commercial clients. Synovus monitors these factors for portfolio and economic outlook impacts. In 2024, international trade volume growth is projected at 2.4%.

Government Spending and Fiscal Policy

Government spending and fiscal policies significantly shape economic landscapes, directly impacting banking services demand. Infrastructure projects or tax reforms in Synovus's operational zones can boost business activities. Conversely, restrictive fiscal measures might slow economic growth, influencing Synovus's strategic plans. These factors are crucial in the bank's economic forecasts.

- U.S. government spending reached $6.13 trillion in fiscal year 2023.

- Tax revenue in the U.S. was approximately $4.4 trillion in 2023.

- Federal budget deficit for 2023 was around $1.7 trillion.

Political Contributions and Lobbying

Synovus actively participates in political contributions and lobbying, complying with all applicable laws and regulations at every level of government. Although these contributions are reported as immaterial, they demonstrate the bank's commitment to influencing the political landscape. This involvement allows Synovus to advocate for its interests and stay informed about policy changes. In 2023, the financial services sector spent $380.8 million on lobbying.

- Synovus's political activities are compliant with all laws.

- These actions help the bank stay informed on policy changes.

- Lobbying is a key part of the financial services industry.

Synovus navigates a dynamic political scene, focusing on regulatory shifts and monetary policy impacting operations. Political stability across key Southeast states like Georgia, which saw a 3.2% GDP rise in Q4 2024, is vital for business confidence and lending. Broader trade and government fiscal policies also shape demand; the U.S. federal deficit was about $1.7T in 2023.

| Factor | Impact on Synovus | Data Point (2023/2024) |

|---|---|---|

| Regulatory Changes | Influences compliance costs and operations. | Financial services sector spent $380.8M on lobbying in 2023. |

| Political Stability | Boosts business confidence, supporting lending/investment. | Georgia's Q4 2024 GDP growth: 3.2%. |

| Fiscal Policies | Shapes demand for banking services. | U.S. government spending: $6.13T (FY2023). |

Economic factors

Fluctuations in interest rates are critical for Synovus's profitability. Higher short-term rates raised funding costs, though asset yields helped. Future Federal Reserve rate cuts will influence Synovus's lending and deposit strategies. In Q1 2024, Synovus reported a net interest margin of 3.07%. The bank anticipates these factors to shape its financial performance.

Synovus's success is significantly linked to the Southeast's economic well-being. This region has experienced solid growth, with states like Florida and Georgia leading in job creation. The Southeast's GDP has been rising, indicating strong economic activity. This growth fuels demand for Synovus's financial services, supporting its performance.

Inflation significantly impacts consumer buying power and business expenses, affecting banking product demand. Though easing, geopolitical instability could reignite inflation through supply chain disruptions. Consumer spending directly drives demand for retail banking services.

Unemployment Rates and Labor Market

The Southeast region's low unemployment rates and robust labor market are key economic drivers. This stability boosts consumer confidence and spending, directly benefiting banks like Synovus. Synovus closely tracks labor market trends to assess loan repayment risks and commercial banking service demands. For example, the U.S. unemployment rate in March 2024 was 3.8%.

- Low unemployment supports consumer spending.

- Stable labor markets reduce loan risks.

- Businesses require commercial banking services.

- Synovus monitors labor trends closely.

Credit Quality and Loan Demand

Economic factors significantly shape credit quality and loan demand. A recession can increase loan defaults and reduce the need for new loans. In 2024, the Federal Reserve's actions to control inflation affected borrowing costs. Synovus must manage credit risk, especially in commercial real estate. This includes stress testing and diversification.

- In Q1 2024, Synovus reported a net charge-off ratio of 0.34%.

- Commercial real estate loans represented 25% of Synovus's total loan portfolio by Q1 2024.

- The U.S. GDP growth for 2024 is projected around 2.1%.

Economic conditions heavily influence Synovus's performance. Interest rate changes affect funding costs and lending strategies, as seen with a 3.07% net interest margin in Q1 2024. Regional economic strength in the Southeast, marked by rising GDP and job growth, boosts demand for financial services.

Inflation and labor market trends significantly affect consumer spending and loan risk. The U.S. unemployment rate stood at 3.8% in March 2024, influencing consumer confidence. Recession risks and Federal Reserve policies also shape credit quality and borrowing costs, impacting Synovus's loan portfolio.

Managing credit risk is critical, especially with commercial real estate. In Q1 2024, Synovus's net charge-off ratio was 0.34%, while commercial real estate loans made up 25% of its portfolio. The projected U.S. GDP growth for 2024 is about 2.1%, all impacting Synovus's strategic financial decisions.

| Economic Factor | Impact on Synovus | 2024 Data |

|---|---|---|

| Interest Rates | Affect funding & lending strategies | Net Interest Margin: 3.07% (Q1) |

| Regional Growth | Boosts demand for services | Southeast GDP Growth |

| Inflation/Labor | Influence consumer spending & loan risk | U.S. Unemployment: 3.8% (Mar) |

Sociological factors

The Southeast's population boom, especially in Georgia and Florida, fuels Synovus's growth. These states saw significant population increases in 2024. This demographic shift boosts demand for homes and banking services. Synovus can capitalize on this by offering mortgages and consumer banking products. Adapting to demographic changes is key for Synovus's success.

Customer preferences are shifting, with digital banking and mobile payments gaining traction. Synovus is adapting, investing heavily in digital transformation. In 2024, mobile banking users increased by 15%, reflecting this trend. This shift requires Synovus to provide convenient and accessible banking solutions to stay competitive. Synovus's digital investments align with these evolving customer needs.

Synovus actively engages in community initiatives, boosting its reputation and customer loyalty. In 2024, Synovus invested over $20 million in community programs. The bank's corporate responsibility, including environmental stewardship, aligns with societal values. This focus helps attract customers who value ethical practices. Synovus's commitment reflects a broader trend of businesses prioritizing social impact.

Workforce Diversity and Inclusion

Synovus actively promotes a diverse and inclusive workforce, understanding its importance in reflecting the communities it serves. This commitment enhances its ability to meet the needs of a diverse customer base. Efforts to increase representation align with evolving societal values, fostering a more innovative and effective environment. Synovus's approach includes various initiatives to support diversity and inclusion. In 2023, Synovus reported that 44% of its employees were from diverse backgrounds.

- 44% of Synovus employees were from diverse backgrounds in 2023.

- Synovus has employee resource groups (ERGs) to promote inclusion.

- Synovus is committed to pay equity and equal opportunities.

Financial Literacy and Education

Financial literacy significantly shapes banking product demand and lending risk. Synovus's financial education initiatives boost client relationships and encourage responsible financial habits. A 2024 study found that only 49% of U.S. adults are financially literate. Synovus's efforts directly address this need.

- Financial literacy rates vary across demographics, influencing product adoption.

- Synovus's educational programs enhance client trust and loyalty.

- Improved financial literacy reduces loan defaults and credit risk.

- These initiatives position Synovus as a community leader.

Synovus thrives in the Southeast, benefiting from rising populations in Georgia and Florida, driving demand for banking services; mobile banking grew 15% in 2024. Customer preferences are shifting digitally. Corporate social responsibility and diversity initiatives also shape customer relationships.

| Sociological Factor | Impact on Synovus | Data/Details (2024/2025) |

|---|---|---|

| Demographic Trends | Population growth boosts demand | GA/FL population increased in 2024; boosting homes/banking. |

| Customer Preferences | Digital adoption drives investments | Mobile banking up 15% in 2024. |

| Social Responsibility | Enhances brand & loyalty | >$20M invested in community in 2024 |

Technological factors

Technological advancements are reshaping banking. Synovus invests heavily in digital banking and mobile platforms. In 2024, mobile banking users grew by 15%. This enhances customer service. Synovus competes with fintech through innovation.

Cybersecurity and data protection are vital for Synovus given its tech reliance. Protecting customer data and securing online transactions are essential for trust and compliance. Synovus invests heavily in security measures, allocating a significant portion of its IT budget, approximately $75 million in 2024, to cybersecurity. In 2025, this investment is expected to increase by 10%. This is crucial considering the rising number of cyberattacks against financial institutions, with a 38% increase in 2023.

Artificial intelligence (AI) and data analytics present significant opportunities for Synovus. The bank can utilize AI for fraud detection, enhancing customer relationship management, and personalizing product offerings. According to a 2024 report, AI-driven fraud detection has reduced losses by up to 40% in the financial sector. This also drives efficiency and innovation.

Payment Technologies

Payment technologies are rapidly evolving, influencing customer transaction behaviors. Contactless payments and faster payment systems require financial institutions, such as Synovus, to adapt. The rise in digital payments is substantial; for instance, in 2024, mobile payment transaction values reached $1.5 trillion. Synovus must update its infrastructure and offerings to stay competitive. This adaptation includes enhanced security measures and user-friendly interfaces.

- Mobile payments are projected to reach $3 trillion by 2025.

- Contactless payments increased by 40% in the past year.

- Faster payment systems reduce transaction times significantly.

- Cybersecurity spending in finance is up 15%.

Operational Efficiency through Technology

Technology significantly boosts operational efficiency at Synovus. This includes process automation, data management, and internal communications, leading to cost savings and better service. For example, Synovus has invested heavily in digital banking platforms, with mobile banking users increasing by 15% in 2024. These tech investments aim to streamline operations.

- Digital Banking: Mobile banking users grew by 15% in 2024.

- Automation: Implementation of AI-driven tools for loan processing.

- Data Management: Enhanced cybersecurity measures.

- Internal Comms: Upgraded internal communication systems.

Technological factors dramatically influence Synovus. The bank focuses on digital platforms and cybersecurity, with cybersecurity spending at $75 million in 2024, expected to rise 10% by 2025. AI is crucial for fraud detection, reducing losses, and contactless/mobile payments growing exponentially.

| Tech Aspect | 2024 Data | 2025 Forecast |

|---|---|---|

| Cybersecurity Spending | $75M | 10% Increase |

| Mobile Payment Transactions | $1.5T | $3T (Projected) |

| Contactless Payments Growth | 40% Increase | Continued growth |

Legal factors

Synovus, as a financial holding company, faces stringent banking regulations. These include capital adequacy standards and consumer protection laws, crucial for operational integrity. Compliance is mandatory, affecting its risk management and strategic choices. The bank's 2024 capital ratios met regulatory requirements, ensuring financial stability. Synovus actively cultivates positive relationships with regulatory bodies.

Consumer protection laws are crucial for Synovus, especially regarding lending and deposits. The bank must align its practices with regulations to protect customer data and avoid penalties. For example, the Consumer Financial Protection Bureau (CFPB) has issued several enforcement actions in 2024, with penalties reaching millions of dollars. This compliance is vital for maintaining customer trust and ensuring legal adherence.

Synovus must adhere to anti-money laundering (AML) rules, the USA Patriot Act, and sanctions. In 2024, the Financial Crimes Enforcement Network (FinCEN) issued advisories on evolving AML risks. Synovus's programs aim to prevent financial crime, maintaining financial system integrity. For example, in Q1 2024, banks reported $1.4 billion in suspicious activity reports.

Data Privacy Regulations

Synovus faces growing pressure from data privacy regulations. These regulations at state and federal levels affect how Synovus handles customer data. The bank needs to invest in data security to comply. Failure to comply can lead to fines and reputational damage.

- GDPR and CCPA compliance costs average $200,000-$2 million annually.

- Data breach costs for financial institutions average $5.9 million.

Litigation and Legal Proceedings

Synovus faces litigation risks common to financial institutions. These risks span lending, customer issues, and compliance. Robust legal and compliance frameworks are essential. In 2024, banks faced increased regulatory scrutiny. Litigation costs can significantly impact financial performance. Synovus's ability to manage legal challenges is crucial.

- Regulatory changes impact banks' legal exposure.

- Litigation can arise from lending practices.

- Compliance failures may lead to lawsuits.

- Effective legal teams are vital for defense.

Synovus must strictly adhere to data privacy laws like GDPR and CCPA, which have compliance costs averaging $200,000-$2 million yearly. They also face litigation risks from lending and customer issues. Failure to comply with regulations, can result in high costs like $5.9 million on data breaches for financial institutions in 2024.

| Regulatory Area | Compliance Costs | Impact |

|---|---|---|

| Data Privacy (GDPR, CCPA) | $200,000 - $2 million annually | Increased security investment, potential fines. |

| Data Breaches | ~$5.9 million average | Loss of customer trust and operational disruptions |

| Litigation | Variable (millions) | Potential losses, operational adjustments, regulatory scrutiny |

Environmental factors

Environmental risks, such as those tied to climate change, are increasingly scrutinized. These risks can affect Synovus's loan portfolio, especially within sectors vulnerable to environmental rules or climate change. Synovus is integrating environmental risk assessments into its credit risk management. For example, in 2024, banks faced increased pressure to assess climate-related financial risks. This is reflected in the growing importance of ESG factors in lending decisions.

Synovus is assessing its environmental impact, focusing on Scope 1 and Scope 2 emissions. They aim to lessen their carbon footprint by boosting energy efficiency in buildings. For example, in 2024, Synovus invested $2.5 million in energy-saving upgrades. Server consolidation to the cloud is also a key part of their plan.

Synovus's shift towards digital banking and reduced physical spaces offers environmental advantages. Decreased energy use and less paper consumption are direct results of these changes. These actions support environmental responsibility and boost operational effectiveness. Digital banking adoption continues to rise; in 2024, mobile banking users in the U.S. reached approximately 180 million.

Renewable Energy and Green Lending

Synovus is actively involved in renewable energy initiatives, including exploring solar tax credits and expanding its green lending options. This strategic move aligns with the increasing demand for sustainable financial products and demonstrates a commitment to environmental responsibility. The bank's focus on renewable energy projects reflects a broader trend in the financial sector. In 2024, the renewable energy sector saw investments exceeding $300 billion globally, indicating significant growth potential.

- Solar tax credits offer financial incentives for renewable energy projects.

- Green lending supports environmentally friendly initiatives.

- The renewable energy market is experiencing substantial growth.

- Synovus aims to capitalize on opportunities in the green economy.

Climate Change Risk Management

Synovus faces climate change risks, including extreme weather events, impacting property values and operations. The bank integrates these risks into its risk management framework. According to the National Oceanic and Atmospheric Administration (NOAA), in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters. Synovus must adapt to these changes.

- Increased frequency of extreme weather events.

- Impact on property values.

- Disruption to business operations.

- Integration into risk management.

Environmental factors greatly affect Synovus's operations and strategy, particularly in terms of climate risk and sustainability. The bank manages these risks by assessing climate-related financial impacts. Moreover, Synovus is actively engaged in renewable energy projects.

Their efforts include lowering emissions, improving energy efficiency in buildings, and transitioning to digital banking. This involves incorporating environmental factors into risk management frameworks.

Synovus also faces climate change risks, like extreme weather events that can impact operations. As of early 2024, green bond issuances increased 20%, reaching over $200 billion. The U.S. saw about $92 billion invested in renewable energy in 2023.

| Aspect | Focus | Impact |

|---|---|---|

| Climate Risk | Weather events, property values | Risk assessment, adaptation |

| Sustainability | Lowering carbon footprint | Energy efficiency |

| Renewable Energy | Green lending and investments | Growth of green economy |

PESTLE Analysis Data Sources

The Synovus PESTLE Analysis uses sources like governmental data, financial reports, and industry publications. Our research incorporates economic forecasts, policy changes, and consumer trends for insightful analysis.