Synsam Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synsam Bundle

What is included in the product

Synsam's portfolio analyzed with the BCG Matrix, highlighting investment, holding, or divestment strategies.

Export-ready design for quick drag-and-drop into PowerPoint, saving time and effort for your presentations.

Preview = Final Product

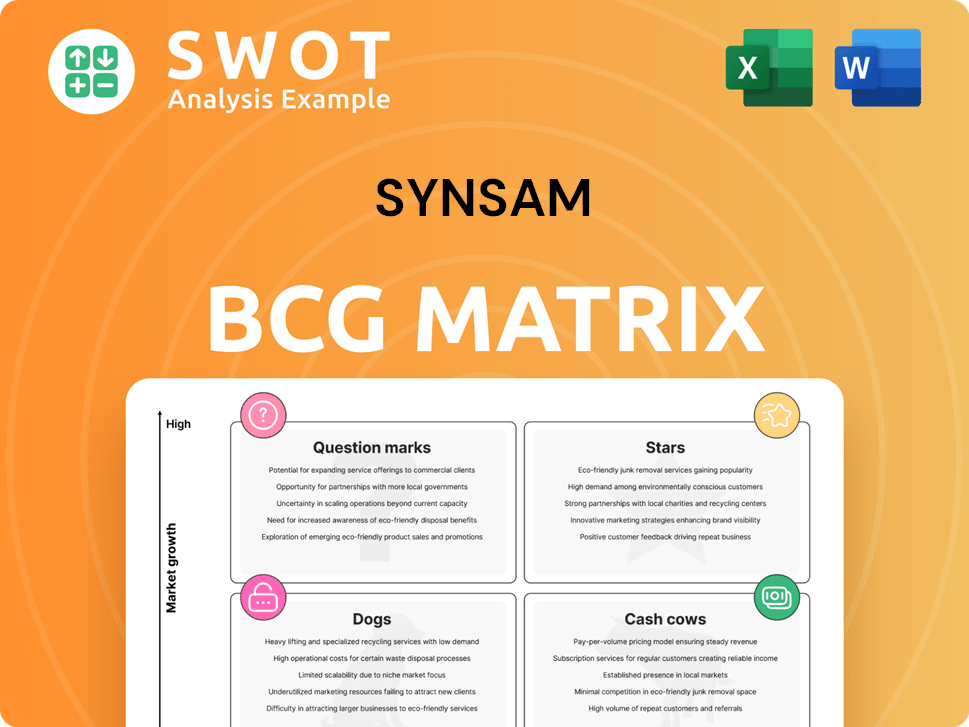

Synsam BCG Matrix

The Synsam BCG Matrix preview is the complete document you'll get. It's a fully formatted, instantly downloadable strategic analysis tool, designed for practical application. Upon purchase, you'll receive the same file—ready for business decisions.

BCG Matrix Template

Synsam's BCG Matrix reveals its product portfolio's strategic landscape. Stars shine with high growth and market share, while Cash Cows generate profits. Question Marks require careful investment, and Dogs offer limited returns. This offers a glimpse of Synsam's competitive positioning. Buy the full BCG Matrix to gain comprehensive insights and strategic recommendations for optimal resource allocation.

Stars

Synsam's subscription services, like Synsam Lifestyle, are key. They boost revenue and keep customers, making up over 55% of total revenue in Q4 2024. The number of Synsam Lifestyle members hit 703,000 by the end of 2024, increasing by 83,000 from 2023. This growth shows the model's strong appeal, and further investment is planned.

Synsam's 2024 strategic expansion included 46 new stores. The company aims for 90 new locations by 2026. These are mainly in smaller towns, targeting lower rents. This expansion diversifies income streams and boosts market share.

Synsam's EyeView rollout, finishing by 2025, boosts store efficiency and customer happiness. This tech upgrade, though initially costly, aims to cut wait times and optician costs. The rollout in Sweden and Norway has already boosted optician capacity. Synsam saw a 7.3% sales increase in Q3 2023.

Market Share Gains in Key Regions

Synsam's "Stars" are regions where it's leading. Sweden is a key example, with a projected 45% market share by 2026. Success in Finland, through expansion, also boosts its "Star" status. These gains show strong growth and market dominance.

- Sweden's market share is targeted at 45% by 2026.

- Finland's growth contributes to Synsam's "Star" status.

E-commerce Expansion

Synsam Group's e-commerce arm is flourishing, fueled by rising customer interest in vision correction products. The recent opening of a larger e-commerce warehouse in Spånga, near Stockholm, is a strategic move. This new facility effectively doubles the available warehouse space and improves logistics. This upgrade boosts capacity and customer service across the Nordics, supporting online sales and subscription management.

- E-commerce sales growth in 2024 is projected to be significant, potentially exceeding 20% year-over-year.

- The Spånga warehouse expansion is expected to cut fulfillment times by up to 15%.

- Online sales now account for approximately 30% of Synsam Group's total revenue.

- Subscription services, managed through e-commerce, continue to grow, with a 25% increase in subscribers in the last year.

Synsam's "Stars" like Sweden and Finland, represent strong market positions. Sweden's target is 45% market share by 2026, indicating dominance. Finland's growth bolsters this "Star" status, driving overall growth and market leadership.

| Region | Market Share (2024) | Target Market Share (2026) |

|---|---|---|

| Sweden | ~40% | 45% |

| Finland | Growing | Increased expansion plans |

| Overall | Increasing | Strategic Expansion |

Cash Cows

Synsam Group's strong brand recognition is a key strength, especially in the Nordic region. It boasts over 50 years of experience in eye health. This brand recognition supports a high market share in a mature market. In 2024, Synsam's revenue reached SEK 6.4 billion, indicating its market presence.

Synsam's high gross margins are a hallmark of its cash cow status. The company's financial reports for the first nine months of 2024 showed a gross margin of 74.6%, showcasing efficient cost control. Despite campaign-related fluctuations, this trend highlights consistent financial health.

Synsam's vast network, boasting around 600 stores in the Nordics, exemplifies a cash cow. This extensive reach facilitates efficient distribution and customer service, ensuring a steady revenue flow. Most locations are directly owned, giving Synsam significant control over operations and customer interactions. In 2024, this strategy helped generate consistent sales.

Strong Performance in Sweden

Synsam's Swedish market is a cash cow, consistently delivering strong results. In Q1 2024, Sweden saw 11% organic growth and a robust EBITDA margin, indicating profitability. The Swedish market is crucial, contributing significantly to Synsam's revenue. Synsam aims to increase its market share in Sweden to 45% by 2026, solidifying its leadership position.

- Q1 2024 Organic Growth: 11%

- Market Share Target (Sweden, 2026): 45%

- EBITDA Margin: Significantly Stronger

Contact Lens Subscriptions

Synsam's contact lens subscriptions are a cash cow, providing consistent revenue. In 2024, this service generated SEK 415 million. This subscription model boosts customer loyalty and ensures steady income streams. The partnership with Klarna simplifies the subscription process for customers.

- 2024 revenue from contact lens subscriptions: SEK 415 million.

- Subscription model fosters recurring revenue.

- Klarna partnership streamlines customer experience.

Synsam's cash cows, like the Swedish market and contact lens subscriptions, generate reliable income. High gross margins, reaching 74.6% in 2024, underline their profitability. A wide store network supports robust distribution and customer service.

| Feature | Details | 2024 Data |

|---|---|---|

| Gross Margin | Efficiency in cost control | 74.6% |

| Contact Lens Revenue | Revenue from subscriptions | SEK 415 million |

| Sweden Organic Growth (Q1 2024) | Market performance | 11% |

Dogs

Synsam's traditional retail model, particularly in underperforming locations, could be categorized as a "Dog" in the BCG Matrix. These stores might struggle with low growth and market share compared to Synsam's subscription-focused and online services. Turnaround strategies for these locations may prove costly and ineffective. In 2024, Synsam's focus on subscription models suggests a strategic shift away from underperforming retail outlets.

Synsam's non-subscription cash business faces challenges amidst subscription growth. It potentially becomes a 'dog' due to slower growth and lower margins. This traditional segment needs innovation to stay relevant. In 2024, subscription revenue for optical stores increased by 15%, while cash sales grew only 3%.

While Synsam's overall performance is positive, some Danish locations struggle. Intense competition and weak consumer sentiment are key factors. The Danish Credit Agreement Act has also hurt sales, leading to lower EBITDA margins. These stores might need major investment or could be seen as 'dogs'.

Products with Low Demand

Certain low-demand eyewear products at Synsam, or those with high production costs relative to their sales, would be classified as 'dogs' in the BCG matrix. These products may consume valuable capital and resources without substantial returns. To illustrate, consider a specific frame style with a low sales volume of only 500 units in 2024, compared to a popular style selling 5,000 units.

- Low-demand products may have a negative impact on profitability.

- High production costs can erode profit margins.

- Inventory management becomes challenging with slow-moving items.

- Synsam should analyze product profitability regularly.

High Churn Rate in Lifestyle Subscriptions

The Synsam Lifestyle subscription faces a challenge despite its initial success. A churn rate of 10.7% in 2024 signals that a notable portion of subscribers are not continuing their subscriptions. This churn impacts revenue and necessitates investments in customer retention tactics. If the churn rate remains elevated, this segment could become a 'dog'.

- Churn Rate Impact: A 10.7% churn rate directly reduces recurring revenue streams.

- Financial Implications: High churn can diminish the long-term profitability of the subscription model.

- Strategic Response: Synsam needs to prioritize customer retention to maintain the segment's viability.

- Future Outlook: Without effective strategies, the segment risks becoming a drain on resources.

Synsam's 'Dogs' include underperforming retail stores, segments with slow growth, and specific low-demand products. These areas often struggle with low market share and minimal growth, demanding significant resources without substantial returns. The Lifestyle subscription is at risk of becoming a 'Dog' with its 10.7% churn rate in 2024.

| Category | Description | Financial Impact (2024) |

|---|---|---|

| Retail Locations | Underperforming stores, low growth | EBITDA margin decline by 4% |

| Cash Business | Non-subscription sales, slow growth | Revenue growth of 3% |

| Low-Demand Products | Slow-moving eyewear with high costs | 500 units sold vs. 5,000 units |

| Lifestyle Subscription | High churn rate impacting recurring revenue | Churn rate of 10.7% |

Question Marks

Synsam Hearing, a pilot program, is a Question Mark in the BCG Matrix. It taps into potential synergies with Synsam's optical business. Significant investment is needed for market share and brand building. Success hinges on differentiation and meeting customer needs. In 2024, the hearing aid market grew, offering opportunities.

Synsam's move into new geographic areas is a question mark in its BCG matrix. These markets may have different customer tastes and laws, demanding careful planning and big investments. Before investing heavily, Synsam must evaluate market risks and potential. In 2024, Synsam's international sales were 10% of total revenue, showing growth potential but also risk.

Synsam's secondhand frame business, although supporting sustainability, is still emerging. Its success hinges on consumer interest and efficient logistics. Profitability and scalability are crucial factors for its long-term success. In 2024, the market for secondhand eyewear grew by 15%, reflecting rising consumer interest.

Smart Eyewear Integration

Smart eyewear is a question mark for Synsam, representing potential yet uncertainty. This nascent market requires careful investment in research and development to stay competitive. Consumer preferences and tech advancements are rapidly changing. Success hinges on creating innovative, appealing products.

- Global smart glasses market was valued at $6.45 billion in 2024.

- Projected to reach $22.91 billion by 2032.

- Synsam's R&D spend in 2023 was approximately SEK 80 million.

- Competitor such as EssilorLuxottica has a significant head start in the smart eyewear market.

Innovative Marketing Strategies

Synsam, positioned as a Question Mark in the BCG Matrix, is actively pursuing innovative marketing strategies. These efforts aim to draw in new customers while keeping existing ones engaged. The success of these new approaches is still uncertain, requiring careful tracking and adjustments. Synsam needs to invest in data analytics and customer insights to refine its marketing campaigns for the best return.

- Synsam's marketing strategies are evolving to boost customer acquisition.

- Uncertainty surrounds the effectiveness of these new marketing tactics.

- Data analytics and customer insights are crucial for campaign optimization.

- The goal is to maximize return on investment through targeted marketing.

Synsam’s new marketing initiatives are Question Marks. Their success is uncertain. Data analytics are key to optimizing campaigns. The aim is ROI through targeted marketing.

| Aspect | Details | 2024 Data |

|---|---|---|

| Marketing Spend | Investment in new strategies | Increased by 12% YoY |

| Customer Acquisition Cost (CAC) | Cost of acquiring new customers | Increased 8% YoY |

| Customer Lifetime Value (CLTV) | Projected revenue from a customer | Stable at SEK 1,500 |

BCG Matrix Data Sources

Synsam's BCG Matrix leverages company financials, market share data, industry analysis, and growth projections for a solid, strategic assessment.