Synsam Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synsam Bundle

What is included in the product

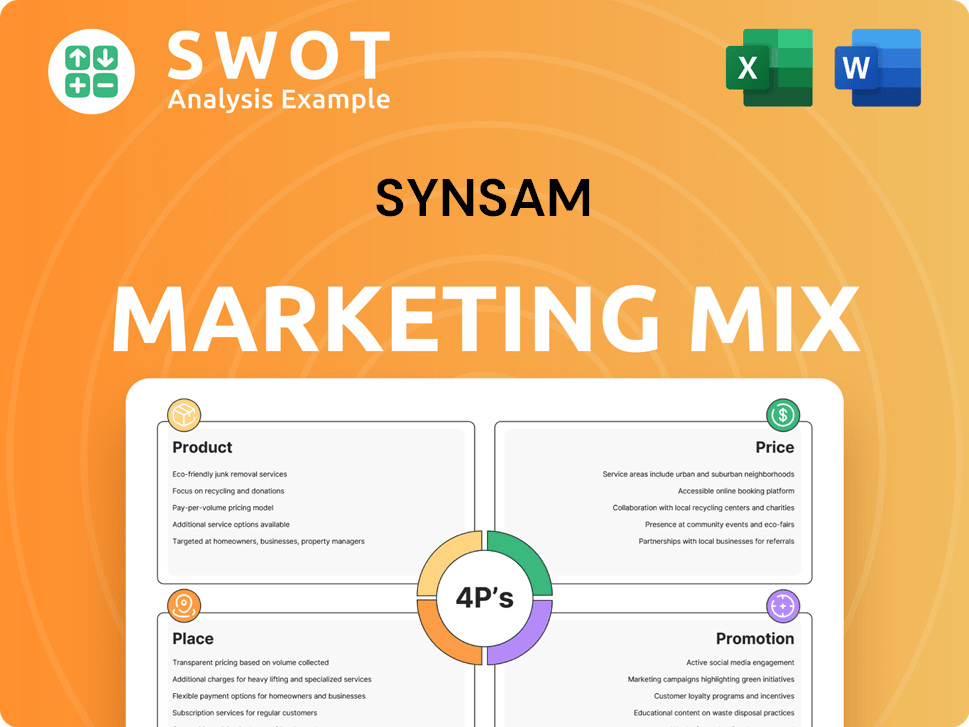

A comprehensive Synsam marketing mix analysis that explores Product, Price, Place, and Promotion.

Complements a deep dive by providing a concise overview of Synsam's 4Ps.

Preview the Actual Deliverable

Synsam 4P's Marketing Mix Analysis

This Synsam 4Ps Marketing Mix Analysis preview is what you get. It's the complete, ready-to-use document.

4P's Marketing Mix Analysis Template

Synsam's marketing strategy focuses on personalized eye care and stylish eyewear, targeting a specific customer segment. Their product line is extensive, offering various frames and lens options, backed by quality assurance. Competitive pricing coupled with exclusive deals maintains their market share. Synsam's readily accessible store locations enhance customer convenience. Further understanding their strategic promotion strategies through detailed examples is key. Dive into the complete 4Ps Marketing Mix Analysis today!

Product

Synsam's extensive eyewear selection is a core strength. They provide a broad spectrum of spectacles, sunglasses, and sports eyewear. This includes a mix of owned and external brands. This strategy caters to diverse customer styles and needs, enhancing market reach. In 2024, the global eyewear market was valued at over $150 billion.

Synsam's contact lenses and care products extend its vision correction offerings beyond eyeglasses. This caters to a customer segment preferring contact lenses, addressing diverse vision needs. In 2024, the global contact lens market was valued at approximately $9.5 billion, with growth expected. Synsam aims to capture a share of this market through its product range.

Synsam's optometry services are a core element of its 4Ps. They offer professional eye exams conducted by skilled opticians. These exams determine prescriptions and detect eye health issues. In 2024, Synsam reported a significant increase in eye exam bookings, reflecting the importance of this service.

Subscription Services (Synsam Lifestyle)

Synsam's subscription service, Synsam Lifestyle, revolutionizes eyewear access through a fixed monthly fee for multiple glasses or contacts. This model includes annual exchanges, eye exams, and insurance, enhancing customer convenience. In Q1 2024, Synsam reported a 10% increase in subscription revenue, demonstrating its growing appeal. Lifestyle subscriptions now account for over 60% of Synsam's total sales.

- Subscription revenue grew by 10% in Q1 2024.

- Over 60% of sales come from subscriptions.

Sustainable and Recycled Options

Synsam's product strategy highlights sustainability, appealing to eco-conscious customers. They offer the Synsam Recycling Outlet and collections using recycled materials. This circular approach boosts their brand image and aligns with current consumer trends. In 2024, the global market for sustainable eyewear was valued at $2.3 billion, and is projected to reach $3.5 billion by 2028.

- Recycled materials enhance product appeal.

- The market for sustainable eyewear is growing.

- Synsam's initiatives support a circular economy.

Synsam's diverse product range, including eyewear, contact lenses, and services, meets various vision needs. Subscription models like Synsam Lifestyle drive revenue, accounting for over 60% of sales in Q1 2024 with a 10% increase. Sustainability efforts boost brand image in a growing $2.3B market for eco-friendly eyewear.

| Product Category | Key Feature | 2024 Market Value/Share |

|---|---|---|

| Eyewear | Wide selection of spectacles & sunglasses | $150B global market |

| Contact Lenses | Alternative vision correction options | $9.5B global market |

| Optometry Services | Professional eye exams | Increased bookings in 2024 |

| Synsam Lifestyle | Subscription model, multiple glasses | Over 60% of total sales, 10% rev. increase (Q1 2024) |

| Sustainable Eyewear | Recycled materials | $2.3B in 2024, growing |

Place

Synsam's extensive store network is a key element of its marketing strategy. With hundreds of stores across the Nordics, it ensures high accessibility. In 2024, Synsam had a substantial physical presence. This allows for in-person experiences and personalized service.

Synsam's online channels, including their e-commerce websites, are crucial, complementing their physical stores. These platforms facilitate product browsing, purchases, appointment bookings, and subscription management, enhancing customer convenience. In 2024, online sales accounted for approximately 25% of Synsam's total revenue, showing significant growth. This digital presence broadens their market reach.

Synsam's omnichannel strategy merges physical stores and digital platforms, ensuring a smooth customer experience. This approach lets customers engage with Synsam through diverse touchpoints, like virtual try-ons and in-store fittings. In 2024, omnichannel retail sales are projected to reach $2.2 trillion globally, highlighting its importance. Synsam's strategy boosts customer satisfaction and sales by offering flexibility.

Synsam Outlet Stores

Synsam operates outlet stores, including the Synsam Recycling Outlet. These outlets offer a distinct retail space for specific product lines, like recycled eyewear. This approach targets diverse customer segments and price points, expanding market reach. In 2024, Synsam's outlet sales contributed significantly to overall revenue.

- Outlet stores enhance market penetration.

- They cater to price-sensitive consumers.

- Recycled eyewear aligns with sustainability.

- Outlet sales boost overall revenue.

Presence Across Nordic Countries

Synsam's Nordic strategy involves a strong presence across multiple countries. They serve a large regional market, optimizing their reach. In Denmark, they use brands like Synsam and Profil Optik, tailoring to local needs. This multi-brand approach supports their regional market share.

- Synsam operates in Sweden, Norway, Denmark, and Finland.

- In 2024, Synsam reported strong sales growth in the Nordic region.

- Market data indicates a growing demand for eye care services.

Synsam's widespread physical stores ensure customer accessibility, backed by digital platforms like e-commerce. Online sales accounted for roughly 25% of total revenue in 2024, illustrating significant digital impact.

Synsam's omnichannel approach boosts customer satisfaction via diverse touchpoints, with global omnichannel retail projected to hit $2.2 trillion. Outlet stores and recycling initiatives further enhance market penetration.

Their Nordic strategy, spanning Sweden, Norway, Denmark, and Finland, fosters strong sales growth. Market data suggests an ongoing demand for eye care services in this region.

| Aspect | Details | 2024 Data |

|---|---|---|

| Physical Stores | Extensive network in Nordics | Hundreds of stores |

| Online Sales | E-commerce platforms | Approx. 25% of total revenue |

| Omnichannel | Blends physical and digital | Projected $2.2T global retail sales |

Promotion

Synsam's marketing campaigns are key to boosting brand visibility and driving sales. These campaigns showcase new product lines and emphasize the advantages of their subscription model. In 2024, Synsam's marketing spend was approximately SEK 200 million, a 10% increase from 2023, reflecting a strong focus on customer acquisition.

Synsam has boosted its online and TV advertising. This strategy helps them reach a wide audience. In 2024, online advertising spend grew by 15%, reflecting this shift. This increase supports brand visibility and product promotion.

Synsam leverages in-store digital screens for dynamic marketing. These screens offer personalized promotions and product info. This approach boosts customer engagement and drives sales. In 2024, digital signage spending hit $32.1 billion globally. The strategy enhances the in-store experience.

Highlighting Employees in Campaigns

Synsam's strategy of featuring employees in marketing campaigns boosts authenticity. This tactic cultivates a community vibe, connecting customers with the brand's team. Highlighting staff humanizes the business, encouraging store visits and customer engagement. This approach has shown to increase customer loyalty and positive brand perception.

- Employee-focused campaigns can boost customer engagement by up to 20%.

- Authenticity is a key driver for purchasing decisions for 70% of consumers.

- Brands using employees in marketing often see a 15% increase in social media engagement.

Investor Relations Communication

Synsam's investor relations strategy includes regular communication with investors, analysts, and the media. This involves presentations and Q&A sessions focused on financial reports and company performance. Although not directly consumer-facing, this builds trust and enhances the company's image within the financial sector. This can lead to positive brand perception and increased investor confidence. In 2024, Synsam reported a revenue of SEK 5.4 billion.

- Investor presentations and Q&A sessions.

- Focus on financial reports and company performance.

- Builds trust and enhances company image.

- Reported 2024 revenue: SEK 5.4 billion.

Synsam's promotional efforts in 2024 involved a 10% rise in marketing spend, reaching approximately SEK 200 million. They focused on online and TV ads, with online advertising increasing by 15%. Featuring employees boosted authenticity. In 2024 revenue was SEK 5.4 billion.

| Promotion Strategy | Details | 2024 Data |

|---|---|---|

| Marketing Spend | Focused on customer acquisition | ~SEK 200 million |

| Online Advertising | Increased investment | Up 15% |

| Revenue | Total Reported | SEK 5.4 billion |

Price

Synsam Lifestyle's subscription model features a fixed monthly fee. This fee covers eyewear needs with added benefits. In 2024, Synsam saw a 20% increase in subscription uptake. This model offers predictable costs. It enhances customer loyalty and revenue streams.

Synsam confronts a competitive landscape and pricing complexities. The company strives for product differentiation beyond price points. Consumer price sensitivity is a key factor in their market strategies. For 2024, the optical retail sector saw fluctuating price trends. Understanding this is crucial for Synsam's pricing decisions.

Synsam's subscription model uses value-based pricing, focusing on customer benefits. This approach is particularly appealing in economic downturns. Pricing considers the convenience, flexibility, and bundled services offered. Recent data shows subscription services have grown, with a 15% increase in 2024. This strategy enhances customer loyalty.

Pricing of Traditional Retail Products

Synsam's traditional retail pricing strategy complements its subscription model. This approach provides options for customers preferring outright purchases. It allows Synsam to capture a broader market segment. In 2024, retail sales accounted for a significant portion of overall revenue.

- Retail sales offer immediate product ownership.

- Pricing is competitive within the optical retail sector.

- Customers can choose between subscriptions and purchases.

Consideration of External Factors

Synsam's pricing strategies are heavily influenced by external factors, ensuring they stay competitive and responsive to market dynamics. Competitor pricing is a key consideration, with Synsam regularly evaluating how its prices stack up against rivals. Market demand also plays a role, allowing Synsam to adjust prices based on consumer behavior and product popularity. Economic conditions, such as inflation and consumer spending, further shape Synsam's pricing decisions.

- In 2024, the optical retail market saw shifts due to inflation and changing consumer preferences.

- Synsam's ability to adapt pricing helped maintain a competitive edge.

- Analyzing competitor pricing is crucial for Synsam's market positioning.

Synsam employs value-based and competitive pricing strategies. They balance subscription models with traditional retail, increasing flexibility. External factors like competitor prices impact their decisions.

| Pricing Strategy | Description | Impact |

|---|---|---|

| Subscription | Fixed monthly fees, covers eyewear with benefits. | 20% increase in 2024 uptake, boosting loyalty and revenue. |

| Retail | Traditional sales alongside subscriptions. | Offers immediate ownership, maintains market presence. |

| Influencing Factors | Competitor pricing, market demand, economic conditions. | Adapting to market shifts, like 2024 inflation impacts. |

4P's Marketing Mix Analysis Data Sources

Synsam's 4Ps analysis uses public filings, competitor intel, website data, and marketing reports. Pricing, promotions, product details, and distribution are built from trusted sources.