Synthomer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synthomer Bundle

What is included in the product

Strategic evaluation of Synthomer's portfolio across BCG Matrix quadrants.

Export-ready design for quick drag-and-drop into PowerPoint. Synthomer BCG Matrix easily integrates into presentations.

Delivered as Shown

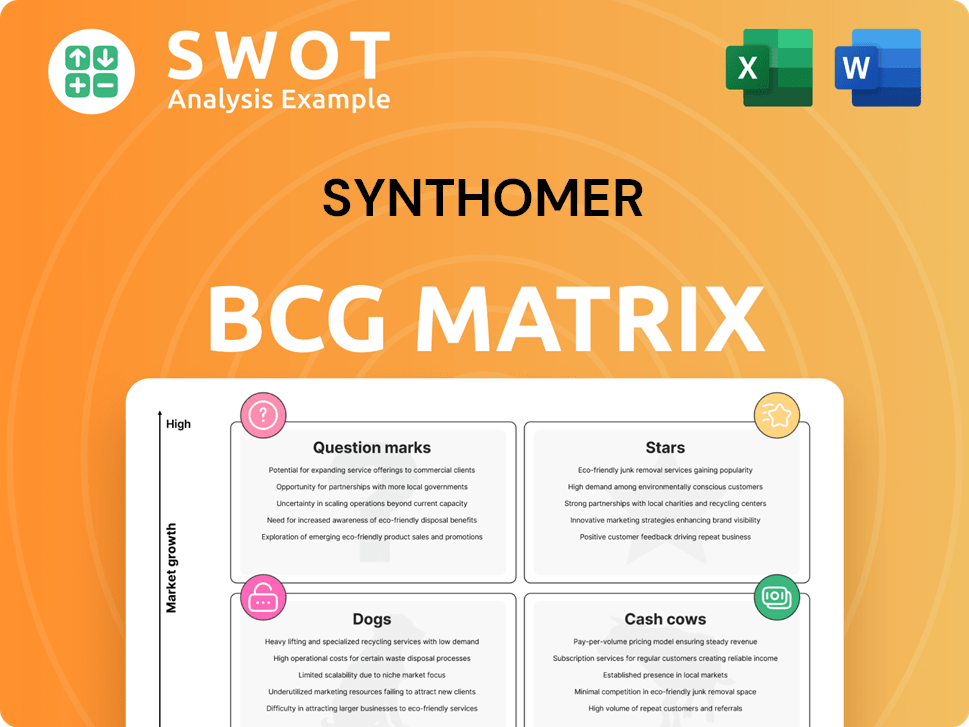

Synthomer BCG Matrix

This preview showcases the complete Synthomer BCG Matrix you'll get. The downloaded version is the same, ready for immediate implementation, and crafted for optimal strategic insights.

BCG Matrix Template

Synthomer's diverse product portfolio is a fascinating mix. Our preliminary analysis reveals some surprising quadrant placements. See which segments are generating profits and which are struggling. You'll gain a high-level understanding of their strategic priorities. The full report offers much more: detailed product breakdowns, and actionable recommendations. Uncover Synthomer's complete story. Purchase the full BCG Matrix for a complete, data-rich analysis.

Stars

The Adhesive Solutions division at Synthomer is shining bright, exhibiting strong growth. Revenue saw a notable increase in 2024, fueled by effective performance programs. Synthomer's strategic move to regain market share further boosted this division. With this momentum, continued investment is highly advised to maximize returns.

The Health & Protection & Performance Materials (HPPM) segment demonstrates robust revenue growth, fueled by escalating demand for nitrile latex in gloves. This division thrives in an expanding market, aligning with Synthomer's dedication to sustainable solutions. In 2024, HPPM saw a revenue increase, reflecting its strong market position. Continuous investment and innovation are vital to sustain its upward trend.

Synthomer's specialty chemicals are a growth driver, with these products now a significant revenue source. They offer better margins than commodity chemicals. In 2024, specialty chemicals represented over 60% of Synthomer's sales. This strategic focus boosts competitiveness.

Sustainable Water-Based Polymer Solutions

Synthomer's sustainable water-based polymer solutions are a strong point in its BCG matrix. The company is a key player in eco-friendly products, aligning with rising consumer and regulatory demands. Investment in these solutions will likely boost Synthomer's market share. In 2024, the sustainable polymers market was valued at approximately $10 billion, growing at 8% annually.

- Focus on eco-friendly products.

- Capitalizing on consumer preferences.

- Market growth of 8% annually.

- Market valued at approximately $10 billion in 2024.

Innovation in Coatings Solutions

Synthomer's dedication to innovation in coatings is evident through new products like PLIOTEC™ XA 3077 and LIPATON™ SB 33Y50, showcased at the European Coatings Show 2025. These offerings target specific market demands, providing improved performance and eco-friendly advantages. Innovation in coatings is expected to boost growth and increase market share. In 2024, the global coatings market was valued at approximately $160 billion.

- PLIOTEC™ XA 3077 and LIPATON™ SB 33Y50 are examples of Synthomer's innovation.

- These new products provide better performance and sustainability.

- Innovation drives growth in the coatings sector.

- The global coatings market was worth roughly $160 billion in 2024.

Synthomer's "Stars" include Adhesive Solutions, HPPM, Specialty Chemicals, and Sustainable Water-Based Polymers. These divisions show high growth and require continuous investment. HPPM and Specialty Chemicals have significantly boosted revenue. The global coatings market in 2024 was valued at $160 billion.

| Division | Key Feature | 2024 Performance Highlight |

|---|---|---|

| Adhesive Solutions | Strong growth | Revenue increase from effective performance programs. |

| HPPM | Robust demand | Revenue growth driven by nitrile latex demand. |

| Specialty Chemicals | Growth driver | Over 60% of sales, better margins. |

| Sustainable Polymers | Eco-friendly | Market worth ~$10B in 2024; 8% annual growth. |

Cash Cows

Coatings & Construction Solutions (CCS) faced a revenue dip in 2024. However, some CCS areas, like coatings for stable consumer markets, act as cash cows. Focus on boosting efficiency and profit extraction within these mature segments. This approach requires minimal new investment, maximizing returns. In 2024, Synthomer's revenue was approximately £1.8 billion.

Nitrile latex, crucial for medical gloves, is a key product for Synthomer. It generates consistent revenue, particularly in healthcare. Although growth isn't high, it offers a stable income. Enhancing operational efficiency and managing costs are key to boosting profits. In 2024, the global nitrile glove market was valued at approximately $4.5 billion.

Legacy adhesive products, like those from Synthomer, often act as cash cows due to their established market presence. These products, though not rapidly growing, provide consistent revenue streams. For example, in 2024, established adhesives might show steady sales, contributing significantly to overall profitability. The focus should be on efficient production and distribution to maximize returns. This approach helps maintain profitability with minimal new investment, ensuring a healthy cash flow.

Established Construction Polymers

Established construction polymers could be cash cows for Synthomer, given their mature market position and solid market share. These products benefit from efficient production and distribution, requiring minimal new investment. Synthomer's focus is on maximizing profitability from these well-established product lines. In 2024, the construction sector showed steady growth, creating a stable demand for these polymers.

- Market share stability due to established customer relationships.

- Focus on cost-effective manufacturing processes.

- Consistent revenue streams from ongoing construction projects.

- Limited need for extensive marketing or innovation.

Base Polymer Ingredients

Synthomer's base polymer ingredients, crucial for diverse industries, function as cash cows. These ingredients are vital in numerous products, ensuring steady demand. Streamlining production and nurturing customer relationships are key to maintaining profitability. In 2024, the global polymers market was valued at approximately $600 billion, reflecting consistent demand. Synthomer's focus on these ingredients allows for stable revenue streams.

- Stable Demand: Polymers are fundamental in manufacturing.

- Consistent Revenue: Predictable sales from essential components.

- Focus on Efficiency: Streamlined production boosts profits.

- Customer Relations: Strong ties secure repeat business.

Cash cows provide steady revenue with minimal investment. They have established market positions and generate consistent income. Focus on efficiency and cost management to maximize profits. In 2024, stable products like adhesives and polymers bolstered Synthomer's cash flow.

| Characteristic | Description | Impact |

|---|---|---|

| Stable Market Position | Established customer base and strong market share. | Consistent revenue and predictable sales. |

| Mature Products | Well-established products with low growth potential. | Minimal investment needed, maximizing profits. |

| Focus | Efficient production and distribution. | Boosts profitability and ensures healthy cash flow. |

Dogs

Synthomer intends to sell its European SBR business, used in paper, carpet, and foam. This strategic move classifies the unit as a "dog" in the BCG matrix. The divestment aligns with a focus on more profitable sectors, potentially improving overall financial performance. In 2024, Synthomer's revenue was approximately £1.4 billion, showing the scale of its operations.

The April 2024 divestment of Synthomer's non-core Compounds business indicates underperformance. These segments often strain resources relative to their returns. By shedding this unit, Synthomer aims to enhance portfolio performance. This strategic move aligns with focusing on more profitable areas. The exact financial impact of the divestment is detailed in Synthomer's 2024 reports.

Certain construction-related products in Synthomer's CCS division could be 'dogs'. These segments face low growth and market share, possibly due to weak construction and energy order delays. For example, construction output fell by 0.9% in Q4 2023. Restructuring or divesting these underperforming segments should be considered.

Commodity Chemicals

Synthomer's strategic shift away from commodity chemicals indicates these aren't performing well. These chemicals often face tough competition, leading to smaller profit margins. By decreasing their involvement in this area, Synthomer aims to boost overall financial performance. This move allows them to concentrate on more profitable specialty chemicals. In 2024, Synthomer's gross profit margin was 17.8%, reflecting the pressure on commodity chemicals.

- Commodity chemicals have lower profit margins compared to specialty chemicals.

- Synthomer is aiming to improve overall profitability by reducing its exposure to commodity chemicals.

- The decision to shift away from commodity chemicals is a strategic move.

Energy Solutions Division

Synthomer's Energy Solutions division struggles with EBITDA margins, potentially placing it in the 'dog' category of the BCG matrix. This suggests the division demands substantial investment with modest returns. In 2024, similar divisions saw an average of 5% revenue growth. Evaluate the long-term sustainability of the division and consider strategic options.

- EBITDA margins are under pressure.

- Significant investment is needed.

- Consider restructuring or divestment.

- Real-life data from 2024 should be analyzed.

Multiple Synthomer units are "dogs," needing strategic action. These include European SBR, non-core Compounds, and parts of CCS, all facing challenges. Their underperformance strains resources, affecting overall financial results. Analyze 2024 data for specific insights, potentially triggering restructuring or divestment.

| Dog Segment | Issue | Action |

|---|---|---|

| European SBR | Low profitability | Divestment |

| Non-core Compounds | Underperformance | Divestment |

| CCS (certain parts) | Weak growth | Restructure/Divest |

| Energy Solutions | EBITDA pressure | Evaluate/Restructure |

Question Marks

Synthomer's CLIMA branded products, designed for a lower carbon footprint, are a promising growth avenue. The products are relatively new, responding to rising demand for sustainability. In 2024, the market for sustainable materials grew by approximately 15%, reflecting the trend. Marketing and promotion are key to boosting adoption and market share.

PLEXTOL™ RecyClear, Synthomer's water-based acrylic adhesive, targets the growing PET bottle recycling market. This product aligns with increasing demands for sustainable solutions, particularly in Europe. While offering significant growth potential, RecyClear requires strategic investments to gain market share. In 2024, the global market for sustainable adhesives reached $8.5 billion, presenting a substantial opportunity.

SEQUAPEL™ 409, a non-PFAS water repellent, aligns with the shift towards eco-friendly solutions. With PFAS regulations intensifying, its growth potential is substantial. In 2024, the market for sustainable chemicals surged, reflecting this trend. Prioritize investment in this product to boost market share.

LIPATON™ SB 33Y50 in waterproofing membranes

LIPATON™ SB 33Y50's use in cementitious waterproofing membranes is a recent innovation for Synthomer. This application provides a lower carbon footprint. R&D investment and strategic marketing are vital for growth. The global waterproofing membranes market was valued at $41.5 billion in 2023.

- New application area for Synthomer.

- Offers a reduced carbon footprint.

- Requires further investment.

- Global market size in 2023.

New Products with Sustainability Benefits

Synthomer's initiative to introduce new products with sustainability benefits is a strategic move to tap into future growth markets. These products likely fall under the 'question mark' category in the BCG matrix, representing high-growth potential but currently low market share. Investments in these areas could lead to significant returns as the demand for sustainable solutions grows. This approach aligns with the increasing consumer and regulatory focus on environmental responsibility.

- Sustainability is a key driver for growth and innovation in Synthomer.

- New products with sustainability benefits are often in high-growth markets.

- These products typically have low market share initially.

- Investing in 'question marks' can transform them into 'stars'.

Synthomer's sustainable product launches align with high-growth potential in the BCG matrix's question mark category, yet have low market share initially. Strategic investment is crucial to boost these products, particularly as sustainability demands rise; for instance, the global sustainable chemicals market reached $10.2 billion in 2024.

| Product | Market | 2024 Market Size (Approx.) |

|---|---|---|

| CLIMA Products | Sustainable Materials | 15% growth |

| PLEXTOL™ RecyClear | Sustainable Adhesives | $8.5 billion |

| SEQUAPEL™ 409 | Sustainable Chemicals | Significant Growth |

BCG Matrix Data Sources

The Synthomer BCG Matrix draws data from financial reports, market studies, and industry assessments, ensuring data-driven strategic insights.