Synthomer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Synthomer Bundle

What is included in the product

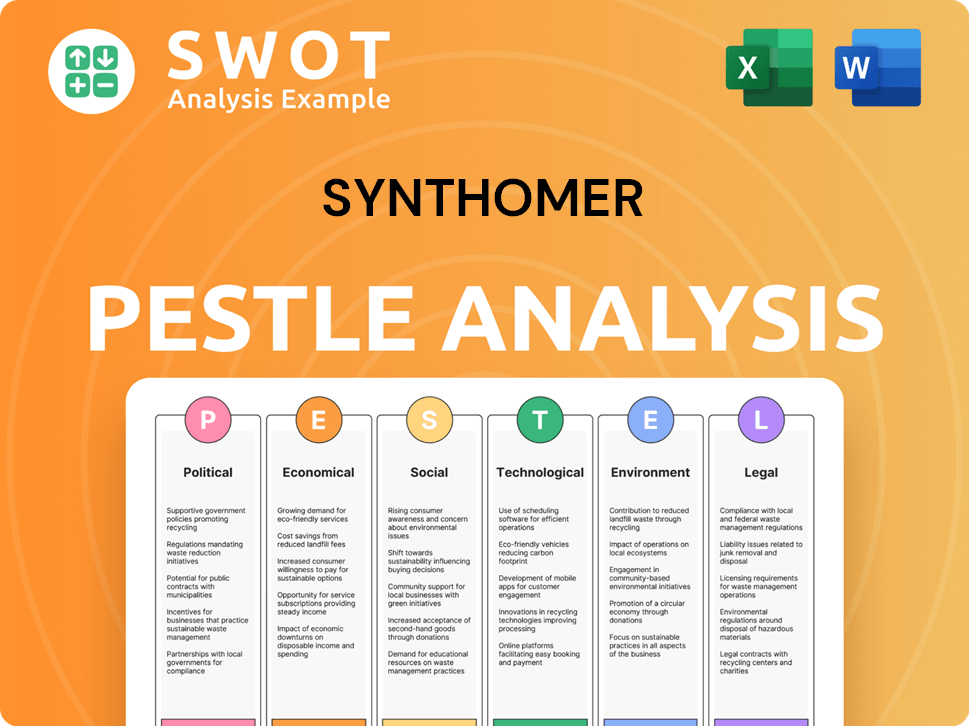

Evaluates Synthomer through Political, Economic, Social, Tech, Environmental, & Legal lenses. Highlights threats and opportunities.

Helps support discussions on external risk during planning sessions.

Full Version Awaits

Synthomer PESTLE Analysis

Preview the Synthomer PESTLE Analysis! The content shown is exactly what you’ll receive post-purchase.

It's fully formatted and ready for use; this is the final product.

Download immediately after buying to access the same well-structured report.

No guesswork – this is the real, complete analysis file.

PESTLE Analysis Template

Navigate the complexities shaping Synthomer with our in-depth PESTLE analysis. Uncover the political, economic, social, technological, legal, and environmental factors influencing their business. We break down each element, revealing crucial impacts on Synthomer's strategy. Get a competitive edge by understanding the external forces driving the company's performance. Download the full PESTLE analysis now and unlock valuable insights for your strategic advantage!

Political factors

Changes in regulations for chemical manufacturing, safety, and environmental protection can greatly affect Synthomer's costs. Trade policies like tariffs and agreements influence raw material imports and exports. In 2024, the EU's REACH regulation continues to impact the chemical industry, driving compliance costs. The UK's new trade deals post-Brexit have altered import/export dynamics. Synthomer must adapt to stay competitive.

Synthomer's global operations are exposed to political risks. Political instability, such as the 2023 Sudanese conflict impacting supply chains, can disrupt operations. Changes in government policies or trade regulations in key markets, like those in China (Synthomer's largest market), can also affect performance. For example, in 2024, regulatory shifts in China influenced chemical imports. These factors directly impact production costs and market access.

Geopolitical instability can significantly affect Synthomer. Recent conflicts and tensions, like those observed in Eastern Europe, can disrupt supply chains. This may affect the availability of raw materials, potentially increasing costs. Synthomer's operations might face demand fluctuations in affected regions.

Government Support for Green Initiatives

Government backing for green initiatives provides Synthomer with growth prospects. Incentives for sustainable products and manufacturing can boost demand for its specialized polymers. Policies supporting green building and eco-friendly products create market opportunities. For instance, the EU's Green Deal and similar initiatives globally are driving the shift towards sustainable materials. In 2024, the global green building materials market was valued at $367.3 billion.

- EU Green Deal: Aims to make Europe climate-neutral by 2050.

- US Inflation Reduction Act: Includes significant investments in clean energy.

- Global Green Building Materials Market: Valued at $367.3 billion in 2024.

- Increased adoption of sustainable practices across various industries.

Political Influence on Industry Standards

Political factors significantly shape industry standards, especially for chemical companies like Synthomer. Governments worldwide, including those in Europe and North America, are increasingly focused on environmental protection and public health. This leads to stricter regulations and standards for chemical product safety and waste management. Synthomer must proactively adjust its product formulations and manufacturing processes to meet these evolving requirements.

- EU's REACH regulation impacts chemical registration and use.

- US EPA sets standards for air and water quality.

- Global initiatives drive sustainable practices.

- Political stability affects long-term investment.

Political elements significantly influence Synthomer's operations. Regulatory shifts and trade policies, such as those stemming from Brexit and China's chemical import regulations in 2024, directly affect the company. Geopolitical events, including regional conflicts, can disrupt supply chains, as observed in Eastern Europe, influencing material costs.

Government support for sustainable practices, like the EU's Green Deal and the US Inflation Reduction Act, drives demand for sustainable polymers and expands market opportunities, with the global green building materials market reaching $367.3 billion in 2024.

| Political Factor | Impact | 2024/2025 Data |

|---|---|---|

| Trade Policies | Affects import/export dynamics, costs | Brexit's impact continues; China's regulatory shifts in chemical imports. |

| Political Instability | Disrupts supply chains | Conflicts in Eastern Europe; Sudanese conflict in 2023 affecting supply chains. |

| Green Initiatives | Boosts demand for sustainable polymers | Global Green Building Materials Market at $367.3B in 2024; EU Green Deal; US Inflation Reduction Act. |

Economic factors

Synthomer's success hinges on worldwide economic health. Robust growth boosts demand in sectors like construction and autos. Conversely, downturns hurt sales and profits; for instance, the IMF projects 3.2% global growth in 2024 and 3.2% in 2025, impacting Synthomer's performance.

Synthomer's profitability heavily relies on raw material costs. Global supply, geopolitical events, and energy prices significantly impact these costs. For instance, in 2024, raw material costs represented a substantial portion of Synthomer's total expenses. Price volatility directly affects profit margins, necessitating careful risk management strategies.

Synthomer faces currency risks due to its global operations. Fluctuating exchange rates impact raw material costs and export competitiveness. For example, in 2024, GBP/EUR volatility affected profit margins. Currency shifts also influence the translation of international earnings. These factors require careful financial risk management strategies.

Inflation and Interest Rates

Inflation significantly affects Synthomer's operational costs, potentially squeezing profit margins. Interest rate fluctuations influence borrowing expenses and investment strategies. Elevated inflation and high interest rates might curb demand from consumers and businesses, impacting Synthomer's sales. In the UK, inflation was 3.2% in March 2024. The Bank of England's base rate is at 5.25% as of May 2024.

- UK inflation at 3.2% (March 2024)

- Bank of England base rate at 5.25% (May 2024)

Market Demand and Competition

Synthomer faces intense competition in its diverse markets. Demand varies across sectors like coatings and healthcare, impacting pricing and volumes. For instance, the global adhesives market, a key segment, was valued at $60.7 billion in 2024 and is projected to reach $81.2 billion by 2029. Competition affects Synthomer's ability to maintain or grow its market share, especially with rivals like BASF and Dow.

- Global Adhesives Market: $60.7B (2024)

- Projected Adhesives Market: $81.2B (2029)

- Key Competitors: BASF, Dow

Global economic health critically influences Synthomer's sales, with projections of 3.2% growth in both 2024 and 2025. Raw material costs are a major factor, significantly impacting profit margins, as seen in 2024's expense structure. Currency fluctuations and inflation further add to the financial complexities faced by the company, necessitating robust risk management strategies.

| Economic Factor | Impact | Example/Data (2024) |

|---|---|---|

| Global Growth | Influences Demand | IMF: 3.2% growth |

| Raw Material Costs | Impacts Profit | Significant Portion of Expenses |

| Inflation | Raises Operational Costs | UK: 3.2% (March) |

Sociological factors

Consumer preferences are shifting towards sustainable products. This trend impacts industries Synthomer serves. In 2024, the market for sustainable products grew. Companies like Synthomer can capitalize by offering eco-friendly polymers. The global green chemicals market is projected to reach $136.6 billion by 2025.

Growing public awareness of health and safety significantly impacts the chemical industry. Stricter regulations are emerging, particularly for products with volatile organic compound (VOC) emissions. In 2024, the global market for low-VOC coatings was valued at $10.5 billion. Synthomer's specialty chemicals are well-positioned to meet these changing demands. This focus helps address societal health and safety concerns.

Demographic shifts and urbanization impact Synthomer. Urbanization boosts construction and coatings demand. Global population growth and urban development increase infrastructure needs. In 2024, global urbanization reached 57%. Increased demand for Synthomer's products is expected.

Lifestyle Trends and Product Innovation

Lifestyle shifts significantly influence polymer demand. Healthcare trends, like increased demand for medical devices, boost polymer use; the global medical polymers market is projected to reach $18.8 billion by 2025. Personal care trends, such as sustainable packaging, drive innovation, impacting Synthomer's portfolio. Changing consumer preferences necessitate product adjustments.

- Medical polymer market value: $18.8 billion by 2025.

- Focus on sustainable packaging is growing.

- Consumer preferences drive product innovation.

Workforce Availability and Skills

Workforce availability and skills significantly influence Synthomer's operations. Access to skilled labor in chemical manufacturing, R&D, and technical sales is critical. The chemical industry faces a skills gap, with 44% of UK chemical companies reporting difficulties in recruiting skilled workers in 2024. Synthomer must adapt to attract and retain talent, especially with increasing automation and digitalization.

- Skills shortages in the chemical industry affect innovation and production.

- Investments in training and development programs are crucial.

- Competition for skilled workers is intense.

- The UK chemical industry employs over 500,000 people.

Societal factors influence Synthomer's market dynamics, including consumer shifts toward sustainable products. This impacts industries the company serves, with the global green chemicals market anticipated at $136.6 billion by 2025. Demographic trends, urbanization (57% in 2024), and healthcare preferences further drive polymer demand.

| Factor | Impact | Data |

|---|---|---|

| Sustainability | Growing demand for eco-friendly products. | Green chemicals market: $136.6B (2025) |

| Demographics | Urbanization and population growth boost construction and coatings. | Global urbanization: 57% (2024) |

| Healthcare | Increased demand for medical devices, enhancing polymer use. | Medical polymer market: $18.8B (2025) |

Technological factors

Advancements in polymer science fuel innovation. Synthomer's R&D is key to new polymers. In 2024, R&D spending was ~$60 million. This investment supports high-performance and sustainable products, vital for competitive advantage, as seen in the 2024 annual report.

Technological advancements in sustainable manufacturing are crucial for Synthomer. These include reducing energy use, waste, and emissions. Cleaner tech improves their environmental standing. For example, in 2024, the company invested £15 million in eco-friendly production.

Digitalization and automation are transforming manufacturing. Adoption of these technologies boosts efficiency, cuts costs, and improves quality. Synthomer can optimize its operations using these advancements. In 2024, the global automation market was valued at $180 billion, growing annually by 8%. This growth shows the importance of embracing tech.

Development of New Applications for Polymers

Technological advancements across sectors drive new polymer applications. Synthomer can leverage these innovations, creating market opportunities. Recent data shows that the global market for advanced polymers is projected to reach $120 billion by 2025. Identifying and adapting to these technological shifts is critical for Synthomer's growth.

- Increasing demand for lightweight materials in automotive and aerospace.

- Development of bio-based polymers to meet sustainability demands.

- Growing use of polymers in 3D printing and additive manufacturing.

Intellectual Property and Patents

Intellectual property protection, particularly through patents, is critical for companies like Synthomer in the specialty chemicals sector. Synthomer's substantial R&D investments are directly linked to its ability to secure and defend patents for its cutting-edge polymer technologies, ensuring a competitive edge. In 2024, Synthomer reported spending £50 million on R&D, reflecting its commitment to innovation and IP protection. This strategic focus allows Synthomer to maintain its market position and capitalize on its proprietary technologies.

- R&D spending in 2024 was £50 million.

- Patents protect innovative polymer technologies.

- IP is crucial for maintaining market position.

Synthomer leverages technological advancements to innovate and gain competitive advantages. Their R&D expenditure, around $60 million in 2024, boosts product performance. Embracing digitalization and sustainable practices improves efficiency. Anticipated polymer market growth ($120B by 2025) presents further opportunities.

| Technological Aspect | Details | 2024/2025 Data |

|---|---|---|

| R&D Investment | Focuses on innovation & new products. | $60M in R&D spending in 2024 |

| Sustainable Manufacturing | Eco-friendly practices to cut emissions. | £15 million invested in eco-friendly production in 2024 |

| Digitalization & Automation | Increases efficiency, cuts costs. | Automation market: $180B in 2024, growing 8% annually |

| Market Growth | Growth in advanced polymer markets. | Advanced polymers market: $120B by 2025 |

| Intellectual Property | Securing & defending patents | £50M on R&D in 2024 to protect IP |

Legal factors

Synthomer faces environmental regulations globally, impacting operations. Costs arise from emission controls, waste management, and chemical handling. In 2024, environmental fines for non-compliance could reach millions, impacting profitability. Specifically, a plant in Germany faced €1.2 million in penalties due to waste disposal issues.

Chemical safety regulations are critical for Synthomer. Compliance ensures market access and minimizes risks. Regulations cover production, transport, and use of chemicals. In 2024, companies faced increasing scrutiny. Non-compliance can lead to hefty fines, impacting profitability.

Synthomer faces product liability risks. These laws may lead to claims if products cause harm. In 2024, product liability insurance costs rose by 8%. Quality control and clear user instructions are key. This helps reduce potential legal issues.

Competition Law and Anti-Trust Regulations

Synthomer must comply with competition law to avoid anti-competitive actions. These laws influence pricing, market conduct, and M&A activities. In 2024, the UK's Competition and Markets Authority (CMA) fined companies £16.5 million for anti-competitive agreements. This highlights the importance of compliance. Any mergers require regulatory approval, impacting growth strategies.

- Compliance ensures fair market practices.

- Laws affect pricing and market strategies.

- Mergers require regulatory approval.

- Fines for non-compliance can be substantial.

Labor Laws and Employment Regulations

Synthomer operates globally, necessitating strict adherence to diverse labor laws and employment regulations. These regulations, varying by country, dictate working conditions, employee rights, and industrial relations. Non-compliance can result in significant legal and financial repercussions, impacting operational costs and potentially damaging the company's reputation. In 2024, labor disputes cost UK businesses an estimated £2.5 billion.

- Compliance costs include wages, benefits, and training.

- Employment regulations cover contracts, discrimination, and health and safety.

- Industrial relations involve unions and collective bargaining.

- Failure to comply may lead to fines, lawsuits, and operational disruptions.

Legal factors significantly impact Synthomer's operations worldwide, driving the need for strict regulatory compliance. In 2024, penalties for non-compliance with environmental, chemical safety, and labor laws could total tens of millions globally, underscoring the critical need for adherence. Competition laws, like those that led to £16.5 million in fines in the UK, further influence pricing and market strategies. Any non-compliance, especially regarding labor or safety, results in increased operating expenses and reputational risks.

| Legal Aspect | Impact | 2024 Financial Data |

|---|---|---|

| Environmental Regulations | Emission controls and waste management costs | €1.2M fine in Germany |

| Chemical Safety | Compliance ensuring market access | Increased scrutiny on chemical use |

| Product Liability | Risk of claims, product insurance | 8% increase in product liability insurance costs |

| Competition Law | Influences pricing, mergers | £16.5M fines for anti-competitive agreements in the UK |

| Labor Laws | Compliance covering working conditions | £2.5B cost of labor disputes in the UK |

Environmental factors

Climate change and carbon emissions are major environmental concerns. Synthomer is actively cutting its Scope 1 and 2 emissions. In 2023, Synthomer reported a 10% reduction in Scope 1 and 2 emissions. They are also engaging suppliers to address Scope 3 emissions. The company aims for further reductions in the coming years.

The environmental impact of sourcing raw materials is a major concern. Synthomer is increasingly focused on using bio-based and circular feedstocks. In 2024, they invested significantly in sustainable sourcing initiatives. This shift aims to reduce fossil fuel dependence and improve product sustainability. The company's efforts align with growing consumer and regulatory demands.

Water scarcity and strict wastewater regulations are key environmental concerns for chemical companies like Synthomer. Synthomer must efficiently manage water usage across its operations. For example, in 2024, the chemical industry faced increased scrutiny regarding water pollution. Proper wastewater treatment is critical to avoid environmental fines.

Waste Management and Circular Economy

Synthomer faces increasing scrutiny regarding its waste management practices, driven by stricter regulations and societal demands for sustainability. The company must adapt to these changes to minimize environmental impact and adhere to circular economy principles. For example, the global waste management market is projected to reach $438.4 billion by 2029. Synthomer's ability to incorporate recycled materials is crucial for reducing waste and aligning with environmental goals.

- Regulatory Compliance: Meeting evolving waste disposal and recycling mandates.

- Circular Economy Integration: Utilizing recycled content and reducing waste generation.

- Market Trends: Capitalizing on the growing demand for sustainable products.

- Financial Implications: Costs associated with waste management and potential revenue from recycled materials.

Biodiversity and Land Use

Synthomer's environmental impact includes its influence on biodiversity and land use, primarily through its manufacturing sites and raw material sourcing. The company's manufacturing footprint, encompassing facilities worldwide, can affect local ecosystems. Sourcing raw materials, like natural rubber, may lead to deforestation or habitat loss, thus affecting biodiversity. Synthomer is under pressure to reduce its environmental footprint and improve sustainability.

- In 2024, Synthomer reported a 10% increase in the use of sustainable raw materials.

- The company aims to reduce its land use impact by 15% by 2026.

Synthomer confronts environmental pressures like carbon emissions and waste, aiming for sustainable practices. In 2023, a 10% reduction in Scope 1 and 2 emissions was reported. Water management and raw material sourcing are other crucial points.

| Factor | Details | Data |

|---|---|---|

| Emissions Reduction | Scope 1 & 2 cuts | 10% reduction (2023) |

| Sustainable Materials | Use of sustainable sources | 10% increase (2024) |

| Waste Management Market | Projected Market | $438.4B by 2029 |

PESTLE Analysis Data Sources

Our Synthomer PESTLE Analysis is informed by industry reports, economic forecasts, and governmental publications to ensure accurate market insights.