TAQA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TAQA Bundle

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Clear visualization simplifies strategic decisions.

Delivered as Shown

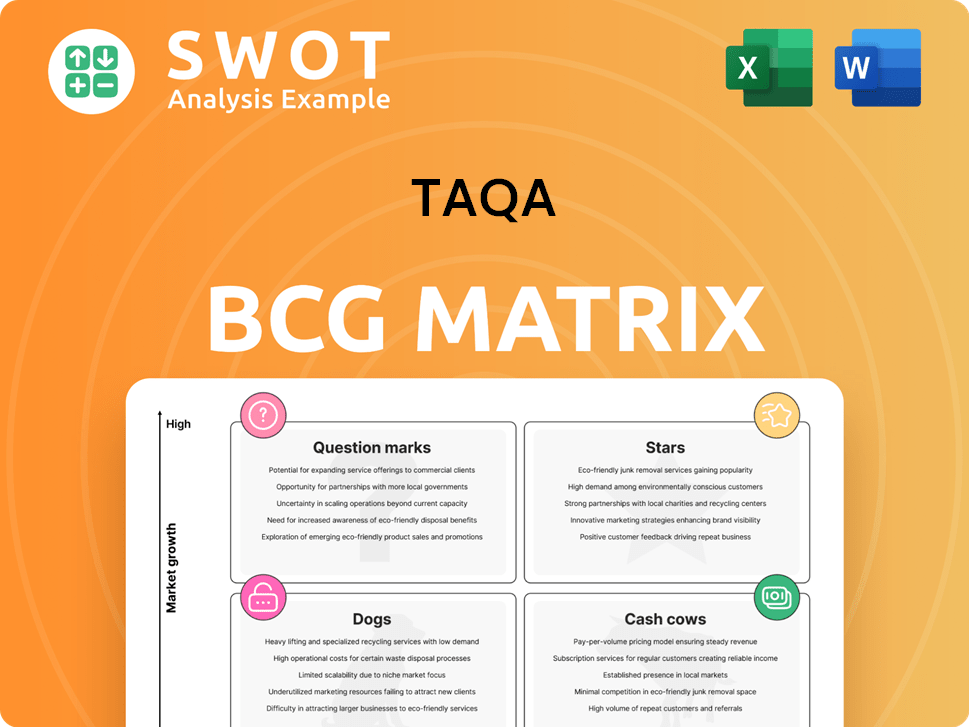

TAQA BCG Matrix

The preview shows the complete TAQA BCG Matrix you'll get. It's the final document, ready for strategic planning, with no hidden content or watermarks. Download instantly after purchase for immediate use in your business analysis.

BCG Matrix Template

The TAQA BCG Matrix provides a snapshot of the company's strategic business units. It categorizes them as Stars, Cash Cows, Dogs, and Question Marks. This simplified view helps assess growth potential and resource allocation needs. Understanding each quadrant's implications is crucial for strategic planning and informed decision-making. Dive deeper into the complete TAQA BCG Matrix to uncover the detailed quadrant assignments, actionable insights, and make smart moves.

Stars

TAQA, via Masdar, is significantly growing its renewable energy assets worldwide. This strategy involves key acquisitions, such as Terra-Gen in the US and Terna Energy in Europe. These moves are part of a broader plan to increase its renewable energy capacity. In 2024, Masdar's global portfolio exceeded 20 GW, with plans to reach 100 GW by 2030. Such expansion firmly establishes TAQA in rapidly growing renewable energy sectors.

TAQA strategically acquires to boost its capabilities and market reach. The TI acquisition in the UK gives TAQA a strong position in offshore electricity transmission. These moves fuel TAQA's growth. In 2024, TAQA saw a 12% increase in assets, highlighting its expansion through acquisitions.

TAQA Water Solutions, formed post-SWS Holding acquisition, leads Abu Dhabi's wastewater and recycled water sectors. This strategic move solidifies TAQA's leadership in integrated water solutions. The integration boosts regulated asset value, expanding TAQA's service portfolio. In 2024, the water and wastewater segment saw growth.

Saudi Arabian Projects

TAQA is shining brightly in Saudi Arabia, focusing on crucial water and power initiatives. Key projects like the Juranah Strategic Water Reservoir and the Najim Cogeneration Plant boost its standing. These moves highlight TAQA's commitment to regional expansion within a vital international market.

- TAQA's Q1 2024 revenue increased by 11% YoY, driven by strong performance in its international assets.

- The Juranah Strategic Water Reservoir has a storage capacity of 2 million cubic meters.

- Najim Cogeneration Plant provides power and steam to industrial customers.

- Saudi Arabia's energy demand is projected to grow by 3-4% annually through 2030.

Financial Strength & ESG Focus

TAQA's financial prowess and ESG dedication are pillars of its success, as highlighted in the BCG Matrix. The company's strong financial standing is underscored by a credit rating upgrade from Fitch in 2024. TAQA's commitment to sustainability is further evidenced by its improved MSCI ESG rating. Green bond issuances of $1.5 billion in 2024 help fund eco-friendly initiatives.

- Fitch credit rating upgrade in 2024.

- Improved MSCI ESG rating.

- $1.5 billion in green bond issuances in 2024.

TAQA's "Stars" in the BCG Matrix represent high-growth, high-market-share business units. These include renewable energy projects and strategic acquisitions driving expansion. Investments in projects like Juranah and Najim boost this star status. Strong revenue growth, such as the 11% increase in Q1 2024, fuels their success.

| Metric | Value | Year |

|---|---|---|

| Q1 Revenue Growth | 11% YoY | 2024 |

| Masdar Renewable Capacity | 20+ GW | 2024 |

| Green Bond Issuance | $1.5B | 2024 |

Cash Cows

TAQA's Transmission & Distribution (T&D) segment is a reliable revenue source. Network availability remains high, ensuring efficient power and water delivery. The T&D sector's growth supports TAQA's financials. In 2024, TAQA's T&D revenue was approximately $1.5 billion. This sector's stable performance is key.

TAQA's desalination ventures, exemplified by the Taweelah RO plant, are major cash generators. These projects ensure water security and provide a stable income stream. TAQA is increasing its desalination capacity with projects like Mirfa 2 RO and Shuweihat 4 RO. In 2024, the Taweelah plant produced 909,200 cubic meters of water daily. These projects are a core part of TAQA's strategy.

TAQA's UAE utilities are a cash cow, generating consistent revenue. The merger of Abu Dhabi and Al Ain Distribution boosts efficiency. This enhances TAQA's market position. TAQA's Q3 2024 net profit rose to AED 2.7 billion. The company's focus on utilities solidifies its financial health.

Cogeneration Plants

TAQA's cogeneration plants, including the Najim Cogeneration Plant in Jubail, are key cash cows. These plants generate consistent revenue by providing power and steam to industrial clients. Long-term Power Purchase Agreements (PPAs) secure a steady income stream. In 2024, TAQA's power and water revenue grew, demonstrating the stability of these assets.

- Najim Cogeneration Plant in Jubail contributes significantly to TAQA's revenue.

- Long-term PPAs ensure stable income for TAQA.

- TAQA's power and water revenue increased in 2024.

- Cogeneration plants offer reliable services to industrial clients.

Operational Efficiency

TAQA's dedication to operational efficiency and cost optimization solidifies its cash cow position. Predictive and preventive maintenance boosts power and water asset availability. Continuous process improvements drive profitability and cash flow. These efforts are crucial for sustained financial health.

- In 2024, TAQA's operational expenditure decreased, reflecting improved efficiency.

- Availability rates for key assets exceeded 98% due to effective maintenance strategies.

- Operational enhancements led to a 5% increase in net profit margins.

- Cost-saving initiatives generated an additional $100 million in cash flow.

TAQA's cash cows, including T&D and desalination, provide reliable income. These assets are key contributors to TAQA's financial stability. In 2024, the T&D segment generated about $1.5 billion in revenue, showcasing its significance.

| Cash Cow Asset | 2024 Revenue/Production | Key Performance Indicator (KPI) |

|---|---|---|

| T&D | $1.5 billion | Network Availability >99% |

| Taweelah RO Plant | 909,200 cubic meters/day | Capacity Utilization >98% |

| Cogeneration Plants | Steady Revenue from PPAs | Efficiency Rate >95% |

Dogs

TAQA's legacy oil and gas assets, especially in the UK, face declining production due to natural declines and decommissioning. These assets, with low growth and market share, might be considered "Dogs" in a BCG matrix. The company is shifting focus to safe and efficient decommissioning. In 2024, TAQA's UK production decreased, reflecting these trends.

TAQA's sale of its Atrush oil field stake signals a strategic shift. This move away from oil and gas assets aligns with a focus on sustainable energy. The divestment suggests the asset has limited growth potential. In 2024, TAQA's net profit increased by 10% compared to 2023, highlighting its strategic adjustments. Atrush's sale contributes to this restructuring.

The Netherlands' onshore gas production ceased after five decades, impacting TAQA. This shift signifies a decline in its established energy domain. The asset now fits the "Dog" category, with minimal revenue contribution. TAQA's focus is now on responsible decommissioning. In 2024, the Dutch government finalized plans for the Groningen gas field closure.

Declining Oil & Gas Production

In 2024, TAQA's oil and gas production saw a downturn, with a 5.9% year-on-year decrease, primarily due to natural field declines and asset decommissioning. This decline signifies a contraction in market share within the oil and gas segment. The company is strategically reallocating resources, prioritizing investments in low-carbon power and water solutions. This shift reflects a strategic pivot towards sustainable energy sources and infrastructure.

- Production Decrease: A 5.9% year-on-year drop in oil and gas output.

- Strategic Shift: Focus on low-carbon power and water solutions.

Assets Under Decommissioning

Assets under decommissioning, like North Cormorant and Tern platforms, are classified as "Dogs." These assets demand substantial decommissioning investments without yielding returns. In 2024, decommissioning costs for similar projects were significant. TAQA is managing this process efficiently, aiming to minimize financial impacts.

- Decommissioning costs often run into the hundreds of millions of dollars per platform.

- The North Cormorant platform began decommissioning in 2023.

- TAQA aims to streamline the decommissioning process to control costs.

TAQA categorizes declining oil and gas assets, like those in the UK and Netherlands, as "Dogs" within its BCG matrix. These assets show low growth and market share. In 2024, the company's oil and gas production fell, indicating a strategic shift towards sustainable energy, and efficient decommissioning. Atrush's sale, and Groningen closure, reflect these changes.

| Asset Type | Category | 2024 Performance |

|---|---|---|

| UK Oil & Gas | Dog | 5.9% production decrease |

| Atrush Oil Field | Dog (Divested) | Strategic sale |

| Dutch Onshore Gas | Dog (Decommissioning) | Groningen closure plan |

Question Marks

TAQA's green hydrogen projects, like the Morocco venture with Moeve, are Question Marks. They have high growth potential, yet low market share currently. Scaling these projects demands substantial investment. Successful execution could shift them into Stars. The global green hydrogen market is projected to reach $144.3 billion by 2030.

Venturing into new international markets like Tanzania and Mozambique under the TAQA BCG Matrix signifies a "Question Mark" scenario. High growth potential exists, yet significant risks accompany these expansions. These projects demand considerable upfront investment to build a market presence and achieve profitability. Successful penetration could boost growth and market share, potentially transforming into a "Star" in the future. For example, in 2024, the energy sector in Tanzania saw a 7% growth, indicating possible opportunities.

Advanced grid infrastructure investments are a question mark for TAQA in its BCG matrix. These projects, vital for AI and renewables, demand substantial capital. Success could establish TAQA as a smart grid leader, but returns are currently uncertain. In 2024, global smart grid investments are projected at $40 billion, highlighting the market's potential.

AI-Powered SCADA System

TAQA Water Solutions' AI-powered SCADA system signifies a high-growth opportunity within the BCG Matrix. This innovation aims to improve operational efficiency and environmental sustainability in water management. The project's success hinges on its effective implementation and widespread adoption in the market. The global smart water management market is projected to reach $36.8 billion by 2028.

- Market growth: The smart water management market is set to reach $36.8 billion by 2028.

- Efficiency: AI integration could reduce operational costs by up to 20%.

- Sustainability: Smart systems can decrease water loss by up to 15%.

- Adoption: Successful implementation relies on strategic partnerships and user training.

New Power Projects

New power projects, like the gas plants in Rumah and Al Nairyah, are considered Question Marks in TAQA's BCG Matrix because they operate in growing markets but have a low initial market share.

These projects require aggressive market penetration and efficient execution to become Stars, which could significantly boost TAQA's revenue.

Success hinges on securing long-term power purchase agreements and achieving high operational efficiency to ensure profitability.

In 2024, the global power generation market is estimated at over $2 trillion, offering substantial growth potential for successful projects.

- Market share increase is crucial for these projects to evolve.

- Long-term contracts provide revenue stability.

- Operational efficiency is key to profitability.

- These projects aim to capitalize on market growth.

Question Marks represent high-growth, low-share ventures for TAQA, demanding significant investment. These projects, like green hydrogen and international expansions, carry inherent risks but offer substantial upside. Successful execution can transform them into Stars, boosting market share and profitability.

| Project Type | Market Growth (2024 est.) | Investment Needs |

|---|---|---|

| Green Hydrogen | $144.3B (by 2030) | High, scaling infrastructure |

| Int'l Expansions | Sector growth (e.g., Tanzania: 7%) | Significant upfront capital |

| Smart Grid | $40B (global, 2024 proj.) | Substantial, tech-intensive |

BCG Matrix Data Sources

The TAQA BCG Matrix leverages public financial statements, market share data, industry reports, and expert analysis for precise strategic insights.