TAQA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

TAQA Bundle

What is included in the product

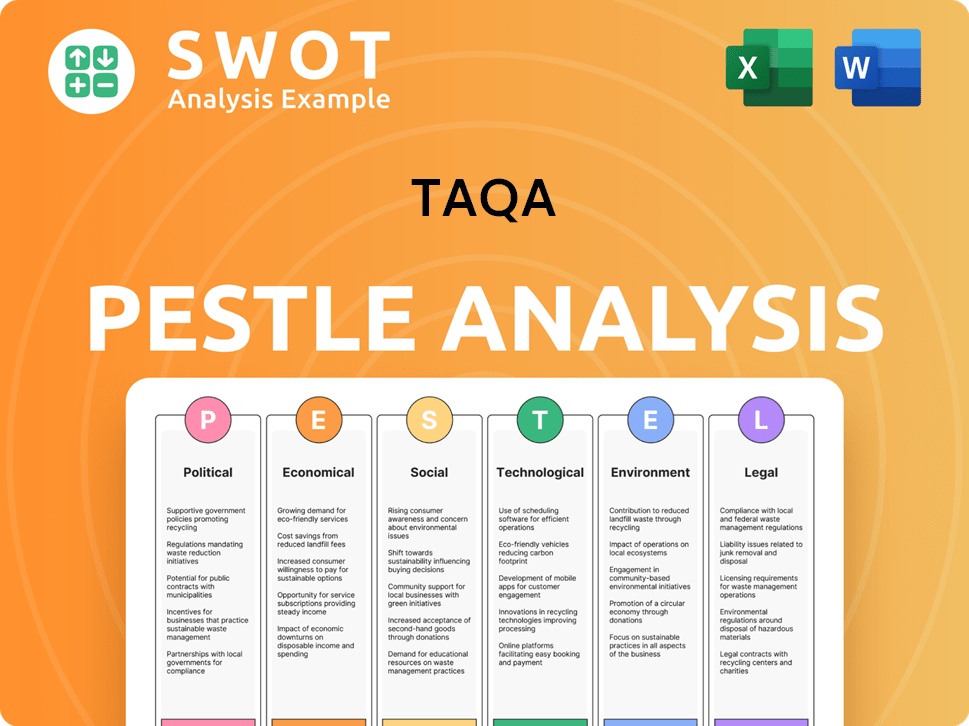

Assesses TAQA's external environment using Political, Economic, Social, etc. factors. It informs strategy.

Offers a summarized PESTLE framework, making it simple to track opportunities and threats within an easy-to-read chart.

Full Version Awaits

TAQA PESTLE Analysis

This is the TAQA PESTLE Analysis document. What you see now in the preview is identical to the file you will download after your purchase. The same detailed content, formatting, and professional structure will be available to you instantly. Rest assured, no hidden surprises! Everything displayed here is part of the final product.

PESTLE Analysis Template

Unlock a strategic edge with our focused PESTLE analysis for TAQA, examining key external influences. This concise breakdown highlights the political, economic, social, technological, legal, and environmental factors impacting the company. Understand market dynamics and the competitive landscape shaping TAQA’s trajectory. Download the full report now to leverage actionable insights for better strategic decision-making.

Political factors

TAQA, backed by the Abu Dhabi government, thrives due to state support and alignment with the UAE's 2030 Vision and Net Zero by 2050. This ensures stability and prioritizes TAQA in national projects, especially clean energy and water. The government's low-carbon energy push directly boosts TAQA's goals. In Q1 2024, TAQA's net profit rose to AED 2.9 billion.

TAQA's global presence, including operations in the UAE, Saudi Arabia, Canada, and the UK, subjects it to diverse political factors. Expanding into Saudi Arabia and the UK offers growth but introduces regulatory and political complexities. In 2023, TAQA reported a net profit of AED 12.1 billion, reflecting its international exposure.

A stable regulatory framework is key for TAQA. Abu Dhabi's clear regulations support investment and smooth operations. This predictability helps TAQA's transmission and distribution. In 2024, TAQA's revenue increased due to regulatory support.

Energy Transition Policies

Government policies supporting energy transition are vital for TAQA's strategies. The UAE's goal to boost clean energy by 2050 affects TAQA's renewable energy investments. In 2024, the UAE aimed for 14% clean energy, rising to 32% by 2030. TAQA actively invests in solar and wind projects to align with these goals.

- UAE's 2050 Net-Zero Strategy.

- TAQA's renewable energy projects.

- Policy-driven investments in renewables.

International Collaboration and Alliances

TAQA actively participates in international collaborations such as the Utilities for Net Zero Alliance (UNEZA), showcasing its commitment to global energy transition efforts. These alliances involve governments, civil society, and industry leaders, influencing large-scale infrastructure investments and policy changes, especially as seen at COP29. Such engagements are vital for navigating the political landscape of renewable energy. In 2024, UNEZA members committed to $100 billion in clean energy investments.

- UNEZA's commitment to over $100 billion in clean energy investments as of 2024.

- TAQA's active role in COP29 and similar international forums.

- Collaboration with governments and civil society to drive policy changes.

Political backing fuels TAQA's growth through UAE's vision and global collaborations. Governmental support boosts stability and clean energy projects, key to its strategy. Participation in UNEZA aids policy changes.

| Aspect | Details | Data |

|---|---|---|

| Government Support | Aligned with UAE's 2030 vision and net-zero goals. | UAE aims 32% clean energy by 2030. |

| International Alliances | Member of Utilities for Net Zero Alliance (UNEZA). | UNEZA committed to $100B+ in clean energy in 2024. |

| Regulatory Framework | Abu Dhabi’s regulations ensure operational stability. | TAQA's revenue increased due to regulatory support in 2024. |

Economic factors

TAQA's strong 2024 financial results reflect positively on its economic standing. The company's revenue and EBITDA figures, reported in 2024, showcase its financial health. This economic strength supports TAQA's investments and shareholder returns. The financial performance is crucial for future growth.

TAQA is heavily investing in capital expenditures, focusing on power and water capacity expansion and upgrading transmission and distribution assets. This strategy is evident in its financial reports, with significant allocations towards infrastructure projects. For instance, in 2024, TAQA's capital expenditure increased by 15% to support these initiatives. This investment is essential for meeting rising demand and achieving strategic goals.

TAQA faces global utilities and energy market dynamics, influenced by fluctuating energy prices. In 2024, Brent crude oil prices averaged around $83 per barrel, affecting operational costs. Inflation and rising interest rates, with the U.S. Federal Reserve maintaining rates around 5.25%-5.5% as of early 2024, also play a key role. Supply chain disruptions continue to impact project timelines and expenses.

Acquisitions and Strategic Investments

TAQA's strategic acquisitions and investments are major economic factors. The integration of TAQA Water Solutions and investments in Masdar boost growth and diversification. These actions aim to increase market share and expand capabilities. TAQA's focus is on low-carbon power and water.

- TAQA's 2023 net profit was AED 11.2 billion.

- Masdar's 2023 investments totaled $3.5 billion.

- TAQA Water Solutions integration expanded service offerings.

Dividend Policy and Shareholder Returns

TAQA's dividend policy and shareholder returns are key economic factors. The company's ability to offer consistent returns hinges on its financial health and growth. TAQA's commitment to shareholder value is reflected in its dividend strategy. As of Q1 2024, TAQA declared a dividend of AED 1.5 billion.

- Dividend yield in 2023 was approximately 6%.

- TAQA aims for sustainable dividend growth.

- Financial performance directly impacts dividend payouts.

TAQA's 2024 performance highlights economic strength, with growth in revenue and EBITDA supporting investments. Capital expenditures rose by 15% in 2024, focused on capacity expansion and infrastructure. Global market dynamics, including oil prices and interest rates, influence operations. TAQA's strategic moves like acquisitions and dividends directly shape its economic footprint.

| Economic Factor | Details | Impact |

|---|---|---|

| Financial Performance (2024) | Revenue and EBITDA growth. | Supports investments and shareholder returns. |

| Capital Expenditure (2024) | Increased by 15%. | Drives capacity expansion and infrastructure development. |

| Market Dynamics (2024) | Brent crude around $83/barrel. US Fed rates: 5.25-5.5%. | Affects operational costs and project timelines. |

Sociological factors

TAQA actively engages in corporate social responsibility (CSR), focusing on community engagement. In 2024, TAQA invested $15 million in local education and environmental projects. These initiatives aim to strengthen community ties and boost TAQA's image.

TAQA prioritizes employee health, safety, and well-being. They offer skill development programs, crucial for operational success. This emphasis on human capital supports a positive work environment.

In water-stressed areas, TAQA's desalination and water management projects are crucial. These efforts improve water sustainability, directly boosting community well-being. For example, in 2024, TAQA's water projects benefited over 2 million people. These projects are estimated to grow by 15% by 2025, showing increasing social impact.

Brand Perception and Customer Service

TAQA's rebranding and customer service focus aim to boost its brand image and align with customer needs. Reliable utility services are key to public trust and satisfaction. In 2024, customer satisfaction scores for utilities averaged 78%, indicating the importance of service quality. TAQA's investments in customer service tech reflect this priority.

- Customer satisfaction is key to brand perception and customer loyalty.

- Investments in customer service tech.

- Reliability of utility services is a must.

Alignment with Societal Values and Sustainable Development Goals

TAQA's commitment to societal values is evident in its alignment with the United Nations' Sustainable Development Goals and the UAE's community focus. This reflects a global shift towards sustainability and social responsibility, driving companies to integrate Environmental, Social, and Governance (ESG) principles. For instance, in 2024, TAQA allocated $500 million to renewable energy projects. This commitment is further demonstrated through community initiatives, with TAQA investing $10 million in local education programs.

- ESG integration enhances stakeholder trust.

- Community initiatives boost brand reputation.

- Sustainable investments yield long-term value.

- Compliance with SDG targets is crucial.

TAQA's community focus, investing $15M in education in 2024, fosters stronger ties. Employee well-being and skills training are priorities, crucial for success. Water projects benefited 2M+ in 2024, with 15% growth by 2025; reliability is key.

| Aspect | Details | 2024 Data |

|---|---|---|

| Community Investment | Education and Environment | $15M |

| Water Projects | Beneficiaries | 2M+ |

| ESG Initiatives | Renewable Energy Spend | $500M |

Technological factors

TAQA is actively integrating cutting-edge tech. This includes efficient reverse osmosis (RO) for desalination, critical for water projects. SCADA systems are also implemented for real-time network monitoring. Furthermore, AI aids predictive maintenance, optimizing asset management. These advancements boost operational efficiency and sustainability.

TAQA's energy transition strategy heavily relies on technological advancements. This includes renewable energy sources like solar and wind power. The company is also involved in CCS and green hydrogen development. In 2024, the global renewable energy capacity grew by 50% to 510 GW. TAQA's focus aligns with these industry trends.

TAQA leverages digital technologies like IoT and AI to boost operational efficiency, cut costs, and improve grid reliability. Building digital capabilities supports long-term growth. In 2024, digital transformation initiatives helped reduce operational expenses by 7%.

Development of Transmission and Distribution Network Technologies

TAQA must invest in advanced grid tech to manage energy shifts and ensure reliability. This includes phase-shifting transformers and dynamic reactive power systems. The global smart grid market is projected to reach $61.3 billion by 2025, reflecting this need. Such tech reduces outages, with smart grids decreasing outage times by 40-50%.

- Smart grid investments are crucial for grid modernization.

- These technologies improve grid efficiency and stability.

- The market's growth signals a shift towards smarter energy systems.

Technological Innovation in Oil and Gas Operations

TAQA embraces technological innovation in its oil and gas operations, even as it moves towards cleaner energy. This involves sustainable well cementing and enhanced oil recovery, minimizing environmental impact and boosting efficiency. In 2024, the global EOR market was valued at $40.2 billion, with expected growth. TAQA's focus includes digital transformation for operational excellence.

- Sustainable well cementing is a key area of innovation.

- Enhanced Oil Recovery (EOR) techniques are being used to improve efficiency.

- The digital transformation is a key focus.

- The global EOR market was valued at $40.2 billion in 2024.

TAQA’s tech focus spans desalination with efficient reverse osmosis and SCADA systems for real-time monitoring. They integrate AI for predictive maintenance and leverage digital tools like IoT to boost efficiency and cut costs. These efforts align with the smart grid market, expected to reach $61.3B by 2025, and include advanced grid tech for improved stability.

| Technology Area | Implementation | Impact/Benefit |

|---|---|---|

| Digitalization | IoT, AI, SCADA | 7% OpEx Reduction in 2024 |

| Grid Technology | Phase-shifting transformers | Reduced outage times by 40-50% |

| Renewable Energy | Solar and wind | 2024 global capacity grew by 50% to 510GW |

Legal factors

TAQA's global operations mean navigating complex legal landscapes. They must adhere to varied regulations in power, water, and oil and gas across multiple jurisdictions. For instance, in 2024, new environmental regulations in the UAE impacted their operational costs. Non-compliance risks significant financial penalties and operational disruptions, impacting the company's profitability. This necessitates robust legal teams and compliance strategies.

TAQA faces strict environmental regulations concerning emissions, water use, and waste. These legal standards influence its operations and investments. For example, in 2024, the company invested $150 million in renewable energy projects to meet environmental goals. Compliance costs, as reported in Q1 2024, totaled $25 million. TAQA aims to reduce its environmental impact, driven by these legal requirements.

TAQA adheres to robust corporate governance standards, surpassing regional requirements for accountability. This commitment enhances investor trust and supports sustainable growth. In 2024, TAQA's governance scores show a 95% compliance rate. This focus is crucial for navigating legal landscapes.

Contractual Agreements and Licenses

TAQA's financial stability greatly depends on the legal strength of its contracts and licenses. These agreements, covering power and water services, are critical for revenue generation and operational continuity. The legal framework's stability in regions where TAQA operates directly affects its long-term financial outlook.

- In 2024, TAQA's revenue from regulated activities was a significant portion of its total, highlighting the importance of these contracts.

- Any legal challenges or changes to these agreements could significantly impact TAQA's financial projections.

- The company's ability to secure and maintain these contracts is closely monitored by investors.

Legal Aspects of Acquisitions and Joint Ventures

Strategic acquisitions and joint ventures require meticulous legal navigation. This includes thorough due diligence to assess risks, and extensive negotiations to define terms. Regulatory approvals, such as those from antitrust bodies, are also essential. Failure to comply can lead to significant penalties.

- In 2024, the average time for merger clearance in the US was approximately 9 months.

- Legal fees for large acquisitions can range from 1% to 3% of the deal value.

Legal factors significantly shape TAQA's operations across diverse global regions. Adherence to regulations on emissions, water use, and waste is paramount. Contracts and licenses, crucial for revenue, directly impact financial stability, especially given that, in 2024, regulated activities comprised a substantial portion of TAQA's income. Strategic acquisitions and joint ventures need precise legal handling, including thorough due diligence and regulatory approvals.

| Legal Aspect | Impact on TAQA | 2024 Data/Example |

|---|---|---|

| Environmental Regulations | Affects operational costs and investments | $150M invested in renewables; $25M compliance cost (Q1 2024) |

| Corporate Governance | Enhances investor trust and growth | 95% compliance rate |

| Contracts & Licenses | Directly impacts revenue generation | Regulated activities a substantial portion of income |

Environmental factors

A significant environmental factor is the global shift towards energy transition and decarbonization. The UAE, including TAQA, is committed to this, aiming for Net Zero by 2050. TAQA's strategic focus includes expanding renewable energy and reducing emissions. In 2024, TAQA's renewable energy capacity is projected to increase by 30%.

TAQA's operations face water scarcity challenges, especially in arid regions. This drives a need for sustainable water management. The company invests in desalination and wastewater treatment. Water conservation is crucial, with a 2024 global water stress index at 1.85.

Climate change presents significant risks for TAQA. Rising temperatures and sea levels could damage infrastructure and disrupt operations. TAQA must integrate climate resilience into its strategies. For example, in 2024, the World Bank estimated that climate-related damages could cost the Middle East and North Africa region up to 6% of GDP by 2050.

Environmental Impact of Oil and Gas Operations

TAQA's oil and gas operations, despite its renewable energy focus, face environmental challenges. These include greenhouse gas emissions and the risk of environmental incidents, like spills. The company is actively minimizing these impacts through advanced technologies and operational improvements. For example, in 2023, TAQA reported a 10% reduction in methane emissions from its oil and gas operations. TAQA’s commitment also involves investing in carbon capture and storage projects to further mitigate its footprint.

- Greenhouse gas emissions are a key environmental concern.

- Environmental incidents, such as spills, pose risks.

- TAQA is investing in technologies to reduce its footprint.

- Methane emission reduction is a priority.

Environmental Regulations and Reporting

Compliance with environmental regulations and transparent reporting on environmental performance are critical for TAQA. The company actively pursues ESG ratings, reflecting its dedication to environmental stewardship. TAQA issues sustainability reports, demonstrating its commitment to transparency and accountability in environmental matters. In 2024, the global ESG investment market reached $40.5 trillion, underscoring the importance of these factors.

- TAQA's ESG efforts are vital for attracting investors and managing risks.

- Sustainability reports enhance stakeholder trust and showcase environmental responsibility.

- Transparent reporting aligns with increasing regulatory demands and investor expectations.

- ESG ratings provide external validation of environmental performance.

Environmental factors greatly affect TAQA's operations. The company must address water scarcity, which is especially significant, given a global water stress index of 1.85 in 2024. Climate change impacts, such as infrastructure risks and rising temperatures, require resilience strategies; damages in the MENA region could hit 6% of GDP by 2050. Furthermore, TAQA manages environmental risks related to greenhouse gas emissions, with a 10% reduction in methane emissions reported in 2023, alongside investment in carbon capture.

| Environmental Aspect | Challenge/Risk | TAQA's Response/Action |

|---|---|---|

| Energy Transition | Global Shift | Expanding renewables by 30% (2024) |

| Water Scarcity | Operational Constraints | Sustainable water management and investment |

| Climate Change | Infrastructure & Operational Disruptions | Implementing climate resilience strategies. |

| Emissions | Greenhouse Gas and Environmental Risks | Investing in new technology. |

PESTLE Analysis Data Sources

TAQA PESTLE analyses are fueled by governmental data, reputable financial reports, industry-specific databases, and policy updates. Each factor's insights come from credible sources for reliable results.