Target Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Target Bundle

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Printable summary optimized for A4 and mobile PDFs, perfect for on-the-go analysis.

Delivered as Shown

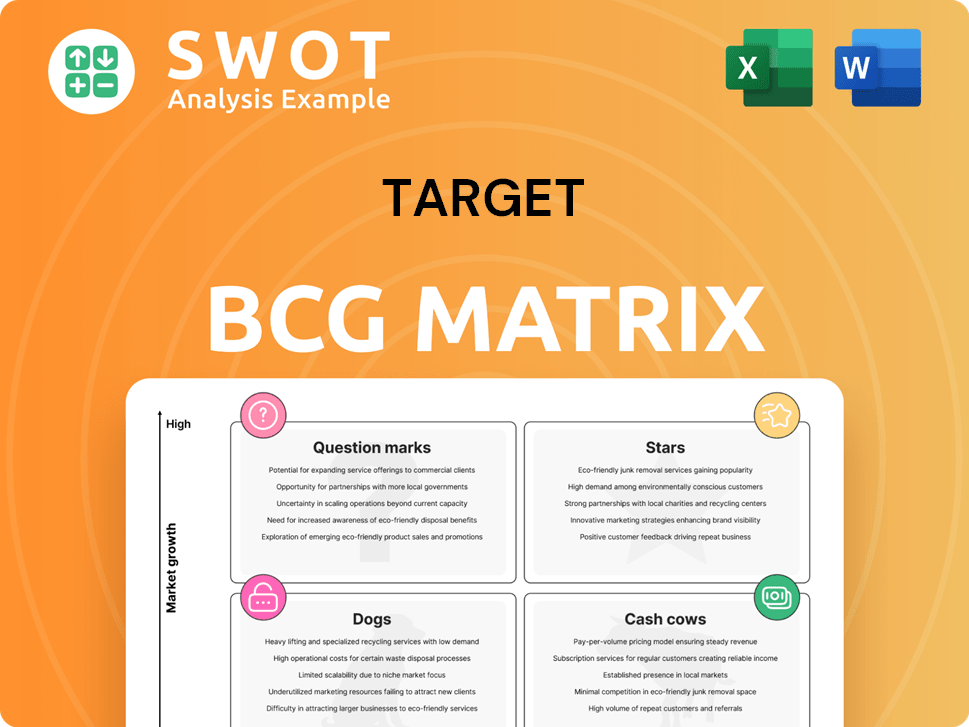

Target BCG Matrix

The displayed preview is identical to the BCG Matrix you'll obtain upon purchase. This ready-to-use report provides a strategic overview, immediately downloadable for analysis and integration.

BCG Matrix Template

Target's product portfolio presents a fascinating mix of established and emerging brands. Understanding where each product sits in the BCG Matrix—Stars, Cash Cows, Dogs, or Question Marks—is crucial. This simplified view barely scratches the surface of Target's complex market positioning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions.

Stars

Target Circle, a star in Target's BCG Matrix, fosters loyalty. The paid Target Circle 360 enhances repeat purchases. In 2024, membership grew substantially. Digital sales got a boost. Plans for 2025 aim to maximize engagement and revenue.

Target's digital sales are a shining star, especially Target.com and same-day delivery. In Q4 2024, digital comparable sales experienced strong growth, with same-day services seeing a notable boost. The company's digital investments include AI and the Target Plus marketplace. Target's digital channel sales grew by 1.9% in the first quarter of 2024, reaching $13.3 billion.

Beauty and essentials remain strong performers for Target, reflecting their "Star" status. In Q3 2024, these categories saw notable comparable sales growth. Target's strategy includes expanding beauty offerings, attracting value-seeking consumers. This expansion, with new affordable items, boosts sales and customer traffic. Beauty and essentials are a key driver of Target's overall success.

New Store Openings and Remodels

Target's strategic focus includes new store openings and renovations, crucial for sustained expansion. The company aims to open new stores and revamp existing ones, improving customer experience and broadening its reach. While the pace of new openings has adjusted, investment remains key. Target is planning over 300 new stores in the next decade.

- Investment in new stores and remodels is vital for long-term growth.

- The company plans to open new stores and remodel existing ones, enhancing the guest experience.

- Target is planning over 300 new stores in the next ten years.

Private Label Brands (e.g., Good & Gather)

Target's private-label brands are stars in its BCG matrix, excelling in popularity, quality, and value. Brands like Good & Gather have become huge successes. Good & Gather generated nearly $4 billion in sales, showcasing strong customer appeal. These brands boost Target's sales and draw in shoppers looking for budget-friendly, trendy items.

- Good & Gather sales are approaching $4 billion.

- Target's owned brands offer affordable, stylish products.

- These brands significantly contribute to overall sales.

- Target expands these brands with new products.

Target's "Stars" include digital sales, beauty, essentials, and private-label brands. Digital channels saw growth, with same-day services boosting sales in Q4 2024. Beauty and essentials experienced sales growth due to strategic expansions. These categories drive overall success.

| Category | Performance | Sales Data (2024) |

|---|---|---|

| Digital Sales | Strong Growth | $13.3B (Q1 2024) |

| Beauty & Essentials | Comparable Sales Growth | Significant increase in Q3 2024 |

| Good & Gather | Popular Private Label | Nearly $4B |

Cash Cows

Target's apparel and accessories segment is a cash cow, consistently delivering for the company. In 2024, this category contributed significantly to overall revenue, with a steady market share. Target's strategy focuses on providing fashionable, low-cost apparel, attracting a wide range of shoppers. Even amid economic shifts, apparel sales provide a reliable income stream for Target.

Home goods and décor are a major revenue driver for Target, classified as cash cows. Target leverages its brand for stylish, affordable home products. In 2024, this segment accounted for around 20% of total sales. New designs and partnerships keep Target competitive, boosting sales.

Target's REDcard is a cash cow, boosting loyalty with a 5% discount and perks. REDcard holders spend more, fueling repeat business. In 2024, the program drove substantial sales. It provides a reliable revenue stream for Target.

Strategic Partnerships

Target's strategic partnerships with renowned designers and brands are a cornerstone of its cash cow status. These collaborations lead to exclusive product lines, drawing in customers and boosting sales. By teaming up with established names, Target elevates its brand image and provides unique offerings that set it apart. In 2024, Target's collaborations, such as those with top designers, significantly increased sales.

- Partnerships generate high-profit margins.

- Exclusive products drive customer loyalty.

- Collaborations enhance brand reputation.

- Sales increase due to unique offerings.

Essential and Household Products

Essentials and household products form a stable revenue stream for Target, classifying them as cash cows. These items, including groceries and cleaning supplies, see consistent demand. Target focuses on competitive pricing and a broad product range to keep customers coming back. This strategy ensures a steady flow of income from these vital purchases.

- In 2024, Target's sales in essentials and household goods accounted for approximately 30% of total revenue.

- The company's private-label brands in these categories, such as "Up & Up," contributed significantly to profitability.

- Target's focus on in-store and online convenience drives continued sales growth.

Target's cash cows, including apparel and home goods, generate substantial revenue, ensuring financial stability. These segments consistently contribute to the company's profitability through strong market positions. Strategic initiatives like partnerships and loyalty programs further boost income.

| Segment | Revenue Contribution (2024) | Strategic Initiatives |

|---|---|---|

| Apparel & Accessories | Significant | Fashionable, low-cost offerings |

| Home Goods & Décor | ~20% of Sales | Stylish, affordable products, partnerships |

| REDcard | Substantial Sales | Loyalty program with discounts & perks |

Dogs

Target's past international ventures, like its entry into Canada in 2013, proved challenging. The Canadian expansion, costing billions, ultimately resulted in Target closing all stores there by 2015. This move highlights the difficulties of entering new markets. The Canadian failure is a stark reminder of the risks in international expansion.

Certain electronics at Target, especially those competing with online retailers, can be "dogs." These items often see low growth and struggle to keep market share. For example, in 2024, Target's electronics sales faced pressure, with some categories showing declines. Target regularly assesses its electronics to boost profitability.

Outdated inventory systems at Target could be viewed as 'dogs' in the BCG matrix, slowing down efficiency. Poor forecasting and stockouts lead to lost sales; for instance, in 2024, Target faced inventory challenges, impacting sales. The company is modernizing its inventory systems with AI. Target's 2024 investments in tech are aimed at improving inventory management.

Products with High Virgin Plastic Use

Products with packaging heavily reliant on virgin plastic are a growing concern, especially with Target's sustainability goals, and can be considered "dogs" in the BCG Matrix. Target has faced challenges in decreasing virgin plastic use in its own-brand packaging, struggling to meet its 2025 targets. The company is exploring alternative materials and packaging to address this.

- Target's 2023 Sustainability Report showed a slower-than-expected progress on reducing plastic use.

- In 2024, Target is investing more in sustainable packaging research and development.

- The company is focusing on reusable and recyclable packaging options.

- Target aims to increase the use of post-consumer recycled content in its packaging.

Categories with Declining Consumer Confidence

In the Target BCG Matrix, categories showing declining consumer confidence are often classified as "Dogs". During Q4 2024, weak sales in February reflected this trend, especially impacting discretionary items. Target aims to balance its offerings and provide value to offset economic uncertainties. This strategy is crucial for navigating market volatility.

- Target's Q4 2024 sales were affected by consumer behavior.

- Discretionary spending faced the most significant declines.

- The company focuses on offering value-driven products.

- Economic uncertainties are driving strategic adjustments.

In Target's BCG matrix, "Dogs" include underperforming categories. Electronics faced pressure in 2024, with some sales declines. Outdated inventory and unsustainable packaging practices also fit this classification.

| Category | 2024 Performance | Strategic Response |

|---|---|---|

| Electronics | Sales Declines | Assess & Optimize |

| Inventory Systems | Inefficiency | Tech Modernization |

| Unsustainable Packaging | Slow Progress | R&D, Alternatives |

Question Marks

Target Plus, a question mark in the BCG matrix, eyes significant sales growth. In 2024, Target planned to boost its online presence by expanding Target Plus. The platform aims to attract more sellers and customers, curating a selection that fits Target's brand. Success hinges on this expansion.

Target's AI-driven personalization is a question mark. Their tech investments aim to boost shopping experiences and sales. They use search, social, and data-driven personalization. The impact on customer engagement and revenue is still uncertain. In 2024, Target's digital sales grew, but the success of these AI initiatives is yet to be fully realized.

Target's wellness expansion, a question mark in its BCG Matrix, targets growing consumer interest. They're introducing new wellness products and services. Success hinges on meeting customer needs in a competitive market. In 2024, the health and wellness market is estimated to be worth over $7 trillion globally.

Sustainability Initiatives

Target's sustainability initiatives, including emissions reduction and circular design, are question marks. These initiatives aim to meet rising consumer demand for eco-friendly products. However, their effect on profitability and market share is still unclear, making them high-risk, high-reward ventures. Target's investment in sustainability needs to yield a clear return.

- Target aims to reduce its Scope 1 and 2 emissions by 50% by 2030 from a 2017 baseline.

- In 2023, Target reported that 70% of its owned brand products were made with sustainable materials.

- Target has invested over $100 million in renewable energy projects as of 2024.

- The company's sustainability efforts could boost brand image, potentially increasing sales by 5-10%.

Integration of Digital and Physical Experiences

The integration of digital and physical experiences at Target is a question mark, representing an area of potential growth. Target is investing in technology to blend social, digital, and in-store experiences to improve customer experience. Success hinges on delivering a unified and personalized shopping journey that meets evolving customer demands. This strategy aims to compete with digital-first retailers by leveraging its physical store presence.

- Target's digital sales grew 4.4% in Q4 2023, showing ongoing investment impact.

- The company aims to enhance its omnichannel capabilities.

- Customer satisfaction and loyalty are key performance indicators for this strategy.

- Target's ability to integrate these experiences seamlessly will determine its success.

Target's question marks show high-growth potential but uncertain futures.

Target Plus expansion is a key bet for online sales, needing strong growth. AI personalization targets shopping experience and revenue uplift with ongoing investment. Sustainability and digital integration represent long-term growth opportunities with high stakes.

| Initiative | Risk Level | Growth Potential |

|---|---|---|

| Target Plus Expansion | Medium | High |

| AI-Driven Personalization | High | Medium |

| Wellness Expansion | Medium | High |

| Sustainability Initiatives | High | Medium |

| Digital & Physical Integration | Medium | High |

BCG Matrix Data Sources

This BCG Matrix employs company financials, market share data, & industry forecasts to evaluate business units effectively.