Target Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Target Bundle

What is included in the product

Analyzes Target's competitive forces, exploring supplier/buyer power, and threats of new entrants/substitutes.

Customize pressure levels based on new data or evolving market trends.

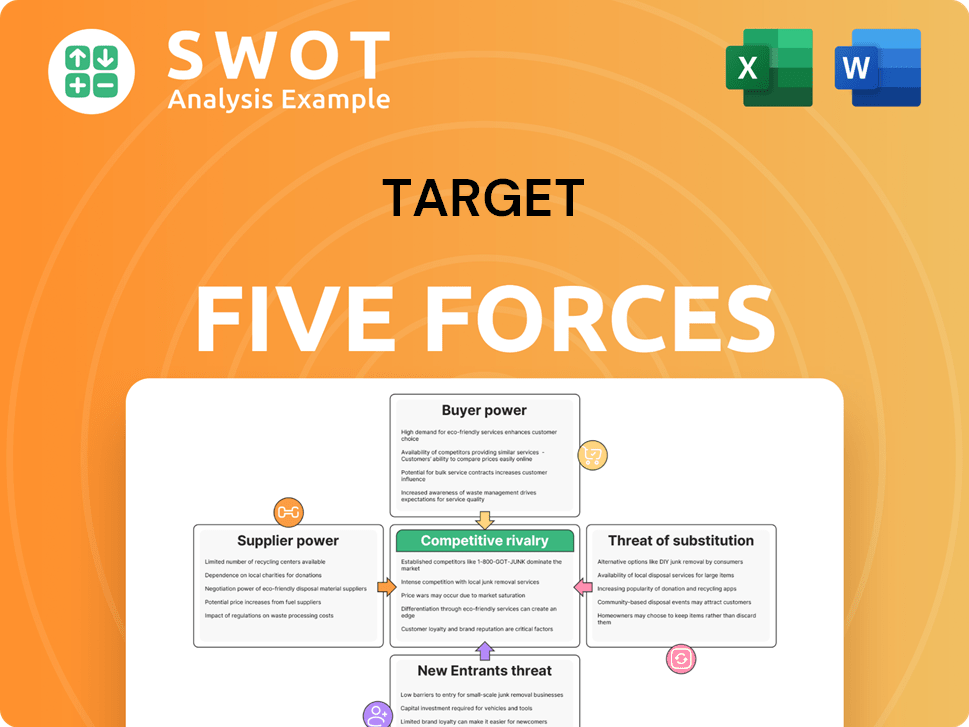

Preview the Actual Deliverable

Target Porter's Five Forces Analysis

This preview showcases the complete Target Porter's Five Forces analysis. You'll receive the exact document after purchase—fully formatted and insightful.

Porter's Five Forces Analysis Template

Target faces competition from established retailers and online giants, increasing the rivalry among existing competitors. The bargaining power of suppliers is moderate, as Target sources from a diverse range of vendors. Buyer power is significant, influenced by consumer choice and pricing sensitivity. The threat of new entrants remains moderate due to capital requirements and brand recognition. The threat of substitutes is present, with consumers having various retail options.

Ready to move beyond the basics? Get a full strategic breakdown of Target’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Target's extensive supplier network, with no single dominant player, dilutes supplier power. The fragmented supply base reduces the impact of any single supplier's actions. Target's ability to switch suppliers easily curbs their influence. In 2024, Target sourced goods from thousands of vendors, maintaining strong negotiating leverage.

Target benefits from the standardization of many inputs. This standardization provides flexibility in sourcing. For example, as of 2024, Target sources apparel from various suppliers, mitigating reliance on any single one. This reduces supplier bargaining power, ensuring competitive pricing.

Switching costs for Target are generally low because finding new suppliers is straightforward. Target's ability to switch suppliers easily boosts its negotiating power. This flexibility allows Target to seek better prices and terms. In 2024, Target's cost of goods sold was around $70 billion, showing its reliance on suppliers.

Forward Integration Threat

The threat of suppliers integrating forward into retail, affecting Target, is generally low. Most of Target's suppliers are manufacturers. They specialize in production rather than retail. These manufacturers often lack the retail expertise needed to compete effectively.

- Target's revenue in 2024 was approximately $107 billion.

- Target operates thousands of stores across the U.S.

- Target's established supply chain and logistics are a significant barrier.

Impact of Inputs on Target's Products

The quality and cost of supplier inputs significantly influence Target's profitability and brand reputation. Target can change suppliers, but ensuring consistent quality is vital for maintaining customer trust. Hence, Target focuses on building strong supplier relationships to secure dependable sourcing and competitive pricing. Target's cost of goods sold (COGS) in 2023 was approximately $71.9 billion. This highlights the importance of managing supplier costs effectively.

- Supplier costs directly impact Target's financial performance.

- Quality consistency is essential for brand integrity.

- Strong supplier relationships are a strategic priority.

- Effective sourcing helps manage COGS.

Target's supplier power is diluted due to a fragmented supplier base. The ability to switch suppliers easily further diminishes their influence. In 2024, Target's extensive network helped maintain strong negotiating leverage.

| Factor | Impact | Data |

|---|---|---|

| Supplier Concentration | Low | Thousands of vendors |

| Switching Costs | Low | Easily sourced alternatives |

| Forward Integration Threat | Low | Focus on manufacturing |

Customers Bargaining Power

Target's customer base is incredibly diverse, with no single customer or small group wielding substantial power. This fragmentation limits the influence any one customer can exert on pricing or terms. In 2024, Target's sales were spread across millions of shoppers, preventing any single entity from dictating terms. This dispersed customer base strengthens Target's negotiating position.

Customers show moderate price sensitivity, particularly for basic goods. Target's "cheap chic" strategy appeals to shoppers mindful of costs. In 2024, Target's gross margin was about 28.9%, indicating pricing pressure. Balancing brand image and competitive pricing is crucial for Target to keep customers.

Customers' access to price and product details is unprecedented, thanks to the internet and mobile tech. This enables easy price comparisons across various retailers. In 2024, online retail sales reached $1.1 trillion in the U.S. alone, showing the power of informed consumers. Target must be transparent to compete effectively.

Switching Costs for Customers

Switching costs for Target's customers are generally low, making it easy for them to choose competitors like Walmart or Amazon. This ease of switching means Target's pricing and service offerings must be highly competitive. To retain customers, Target focuses on creating a unique shopping experience and strong loyalty programs.

- Walmart's revenue in fiscal year 2024 reached $648.1 billion, highlighting the intense competition.

- Amazon's net sales in 2023 were $574.8 billion, showcasing its significant market presence.

- Target's loyalty program, Target Circle, has millions of members, indicating the importance of customer retention strategies.

Brand Loyalty

Target's brand loyalty provides some protection against customer bargaining power, yet it's not impenetrable. Customers enjoy Target's exclusive brands and shopping experience, but price remains a key factor in their decisions. In 2024, Target's same-day services grew, showing customer willingness to engage with the brand. Maintaining customer loyalty requires consistent value delivery.

- Target's same-day services grew in 2024.

- Price sensitivity influences customer choices.

- Brand value must be continually reinforced.

- Exclusive brands help maintain loyalty.

Target faces moderate customer bargaining power due to diverse and informed shoppers. Price sensitivity and easy switching to competitors like Walmart and Amazon pressure Target. Customer access to online pricing data intensifies competition. However, brand loyalty and exclusive products offer Target some defense.

| Factor | Impact | Data (2024) |

|---|---|---|

| Customer Base | Fragmented | Millions of shoppers |

| Price Sensitivity | Moderate | Gross margin ~28.9% |

| Switching Costs | Low | Walmart's revenue $648.1B |

Rivalry Among Competitors

The retail sector is fiercely competitive, hosting many national and regional competitors. Target contends with giants like Walmart and Amazon. The high competition squeezes margins; for example, Target's gross profit margin was about 27.8% in 2024. This environment demands strategic agility.

The retail industry's growth rate is moderate. A slower growth environment intensifies competition, forcing companies to vie for market share. Target must innovate and differentiate itself to succeed in this mature market. For instance, in 2024, the US retail sales grew by approximately 3.6%, indicating moderate expansion.

Product differentiation at Target is moderate. Target has exclusive brands and designer collaborations. However, many products are similar to competitors'. To stay competitive, Target must innovate and refresh offerings. In 2024, Target's private-label brands accounted for nearly 30% of sales, showing differentiation efforts.

Switching Costs Between Retailers

Switching costs between retailers are generally low for consumers, intensifying competition. Shoppers can easily change where they buy based on price, product variety, or convenience. This flexibility puts pressure on retailers like Target to compete effectively. According to recent data, the average consumer visits 2.7 different grocery stores per month.

- Price sensitivity drives consumer behavior, impacting retailer competition.

- Product assortment and store layout are key differentiators.

- Convenience factors, like location and online shopping, influence choices.

- Promotional offers and loyalty programs attempt to retain customers.

Exit Barriers

Exit barriers significantly influence competitive dynamics. High exit barriers, stemming from long-term leases and infrastructure investments, make it difficult for underperforming retailers to leave. This can lead to overcapacity within the market, intensifying competitive pressure among rivals like Walmart and Amazon. The persistent presence of competitors, even when struggling, directly impacts Target's ability to improve its market position.

- Target's lease obligations totaled $17.7 billion in 2024.

- The U.S. retail market saw a 2.3% increase in overcapacity in 2024.

- Walmart's net sales reached $648.1 billion in fiscal year 2024.

Competitive rivalry in retail is intense, with Target facing giants like Walmart and Amazon. This environment demands innovation and strategic agility. Factors such as moderate growth and low switching costs amplify competition. High exit barriers further intensify pressure.

| Aspect | Impact on Target | 2024 Data |

|---|---|---|

| Gross Margin | Pressure to maintain profitability | Target's gross profit margin: ~27.8% |

| Market Growth | Increased competition for market share | US retail sales growth: ~3.6% |

| Private Label Sales | Differentiation efforts | Target's private-label sales: ~30% |

SSubstitutes Threaten

Target faces competition from numerous substitutes. Consumers can choose from various retailers, online platforms, and specialty shops. In 2024, the retail sector saw a shift, with online sales growing and brick-and-mortar stores adapting. For example, Amazon's retail sales grew, while Target's comparable sales experienced fluctuations. To mitigate this, Target must focus on unique products and experiences.

Substitutes often present a similar price-performance ratio, making them attractive alternatives. For instance, in 2024, the rise of online retailers like Amazon, offering competitive pricing and convenience, posed a threat to Target. Customers might switch if a substitute provides comparable value, such as lower prices or greater convenience. Target must continually enhance its value proposition to deter substitution, focusing on factors like unique products and superior customer service. In 2024, Target's efforts included expanding its private-label brands and investing in in-store experiences.

Switching costs to substitutes are generally low in the retail sector. Consumers can easily switch between retailers like Walmart and Amazon. Target faces the risk of losing customers if they find better prices or experiences elsewhere. In 2024, the average consumer spent $6,500 annually on retail purchases, making it crucial for Target to retain its share.

Customer Propensity to Substitute

Customers show a moderate tendency to switch from Target. Many stay loyal, but others seek better value elsewhere. Target faces competition from various retailers, including online platforms. To retain customers, Target needs to focus on value and convenience. The company must adapt to changing customer preferences.

- Target's online sales grew by 1.4% in Q4 2023, showing some customer shift to online alternatives.

- Walmart's comparable sales increased by 4.0% in Q4 2023, indicating the willingness of customers to switch.

- Amazon's market share in the U.S. e-commerce market was about 37.6% in 2023, highlighting the impact of online substitutes.

Technological Advancements

Technological advancements are rapidly spawning substitutes, intensifying competition. Online shopping and delivery services provide convenient alternatives to traditional stores. Target faces pressure to enhance its e-commerce and omnichannel capabilities to stay competitive. Investing in digital infrastructure is crucial to mitigate the threat of substitutes and maintain market share. This strategic focus aligns with the evolving consumer preferences driven by technology.

- E-commerce sales in the U.S. reached $1.1 trillion in 2023, indicating strong growth.

- Target's digital sales grew, but it faces competition from Amazon and Walmart.

- Target's omnichannel investments include same-day delivery options.

- Consumers increasingly value convenience and diverse shopping experiences.

Target faces significant substitution threats from online retailers and other stores. In 2024, the ease of switching between options and competitive pricing from Amazon and Walmart continue to challenge Target. This forces Target to focus on unique offerings and excellent service to retain customers.

| Key Factor | Impact on Target | 2024 Data/Context |

|---|---|---|

| Online Retail Growth | Increased competition | Amazon's U.S. e-commerce share was ~38% in 2024 |

| Price Sensitivity | Customers seek value | Average consumer retail spend ~$6,700 annually |

| Switching Costs | Low customer loyalty | Target's comparable sales saw fluctuations |

Entrants Threaten

Barriers to entry for new competitors are moderately high. New entrants face substantial capital investment needs, established supply chains, and the challenge of building brand recognition. Target's extensive network of nearly 2,000 stores and over $100 billion in annual revenue create a significant advantage. This established presence and scale act as a deterrent to potential new entrants.

High capital requirements significantly hinder new entrants. Building a national retail chain demands substantial investments. Newcomers face hefty costs for real estate, inventory, and tech. This upfront financial burden acts as a major barrier. For example, in 2024, establishing a large retail presence could require hundreds of millions of dollars.

Economies of scale protect Target from new competitors. Target leverages its size to secure better supplier prices and streamline operations. For instance, Target's revenue in 2024 reached approximately $107 billion, showcasing its operational efficiency. New entrants face difficulties in matching this cost advantage. This makes it harder for them to compete effectively.

Brand Recognition

Brand recognition acts as a significant barrier for new entrants in the retail sector, and Target's established reputation is a key advantage. Target has cultivated strong brand equity over many years, which is tough for newcomers to replicate quickly. New retailers face substantial marketing and advertising costs to build brand awareness and gain market share. This financial burden makes it difficult to compete directly with established brands like Target.

- Target's brand value was estimated at $25.9 billion in 2023.

- Marketing and advertising spending by Target in 2023 was approximately $2.4 billion.

- New entrants often require several years to reach comparable brand recognition levels.

- High brand recognition leads to customer loyalty and repeat business.

Government Regulations

Government regulations present a moderate obstacle for new entrants in the retail sector. Businesses, including Target, must adhere to various zoning laws, environmental regulations, and labor standards. Compliance with these regulations can significantly raise the initial costs and operational complexities for new market participants. This can act as a deterrent, particularly for smaller businesses or startups with limited resources. These requirements often necessitate legal expertise and specialized compliance procedures, which can be costly.

- Zoning laws dictate where a business can operate, impacting location choices and potentially increasing real estate costs.

- Environmental regulations require businesses to manage waste, emissions, and other environmental impacts, adding to operational expenses.

- Labor laws mandate fair wages, working conditions, and benefits, influencing staffing costs and operational efficiency.

- Compliance with these regulations often requires significant upfront investment and ongoing operational costs.

The threat of new entrants to Target is moderate, largely due to significant barriers. High capital requirements, like those needed to establish a large retail presence, pose a challenge. Target's established brand, valued at $25.9 billion in 2023, and extensive operational scale further deter newcomers.

| Barrier | Impact | Example |

|---|---|---|

| Capital Needs | High Entry Costs | Hundreds of millions in 2024. |

| Economies of Scale | Cost Advantage | $107B revenue in 2024. |

| Brand Recognition | Customer Loyalty | $2.4B marketing in 2023. |

Porter's Five Forces Analysis Data Sources

This analysis leverages SEC filings, market research, financial reports, and industry news to build a comprehensive competitive assessment.